Stress Toy Market Size

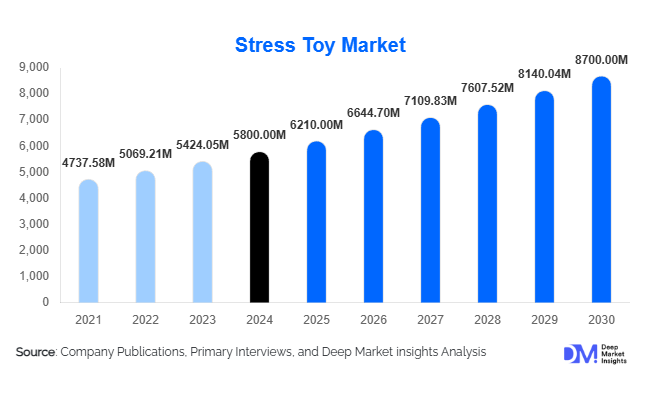

According to Deep Market Insights, the global stress toy market size was valued at USD 5,800.00 million in 2024 and is projected to grow from USD 6,210.00 million in 2025 to reach USD 8,700.00 million by 2030, expanding at a CAGR of 7.0% during the forecast period (2025–2030). The stress toy market growth is primarily driven by increasing awareness of mental wellness, integration of stress-relief products into corporate wellness programmes, and the rising popularity of affordable, sensory-based stress management solutions across all age groups.

Key Market Insights

- Stress-relief tools are evolving beyond children’s toys, with adults adopting stress toys as part of wellness routines and corporate desk kits.

- Corporate wellness and institutional procurement are growing channels, as organisations include stress toys in employee wellness and remote-work kits.

- Asia-Pacific is the fastest-growing region, supported by urbanisation, rising disposable incomes, and increased mental wellness awareness in China, India, and Southeast Asia.

- Technological integration is a rising trend, with smart stress-toys featuring sensors, app connectivity, and premium materials gaining traction.

- Foam-based stress toys hold a dominant share, thanks to low cost, ease of production, and wide appeal across demographics.

- Online retail is reshaping distribution, enabling direct-to-consumer models, rapid launches of niche variants, and global reach for stress-toy brands.

Latest Market Trends

Integration into Corporate Wellness & Employee Kits

Organisations around the world are increasingly recognising stress management and mental health as critical components of workplace productivity. As a result, stress-relief accessories like stress balls, fidget toys, and sensory desk kits are being included in employee wellness programmes, remote-worker kits, and branded corporate gifts. These products serve as low-cost, tangible well-being tools and help companies demonstrate care for mental wellness. Furthermore, branded stress toys are being used for marketing campaigns, employee onboarding kits, and conference giveaways, adding a B2B dimension to the previously retail-centric stress toy market.

Smart Sensors & Premium Materials Entering the Product Mix

While traditional stress toys (foam balls, silicone squishies) remain mainstream, a new class of premium stress toys is emerging. These include sensor-embedded devices that pair with mobile apps to monitor usage, grip strength, or stress relief frequency, and smart fidgets that provide feedback or integrate with mindfulness platforms. At the same time, manufacturers are exploring premium or eco-friendly materials (certified silicones, biodegradable foam) to differentiate offerings and command higher margins. These developments appeal to tech-savvy consumers, the adult wellness market, and corporate buyers seeking innovative stress-relief accessories.

Stress Toy Market Drivers

Rising Levels of Stress, Anxiety, and Mental Fatigue

Wellness Culture & Preventive Health Focus

The broader wellness movement emphasises self-care, mindfulness, and preventive emotional health. Stress toys align with this trend by offering affordable, portable options for stress management. Schools, therapy centres, corporate offices, and retail markets are increasingly viewing stress-toys as part of wellness toolkits. This shift has expanded market applications beyond traditional toy retail into therapy, corporate gifting, and adult wellness categories.

E-commerce Proliferation and Product Innovation

The growth of online marketplaces and direct-to-consumer (D2C) models has allowed stress toy manufacturers and brands to reach global audiences, launch customised variants quickly, and test new designs. Innovations in textures, material types (foam, silicone, gel), form factors (weighted, novelty, tactile,e), and packaging have driven refresh cycles. These factors together improve accessibility and product appeal, boosting adoption across geographies and age groups.

Market Restraints

Commoditisation, Price Pressure and Market Saturation

As the stress toy category matures, many low-cost generic products have entered the market, particularly via online marketplaces. This has led to price erosion, thinning margins for mid and premium players, and heightened competition. Differentiation becomes challenging when many products look similar and costs remain squeezed. For smaller players and new entrants, competing primarily on price may be unsustainable.

Regulatory & Safety Compliance Challenges

Stress toys are still subject to toy safety regulations (e.g., choking hazards, chemical compliance, toxicity), especially when marketed for children or therapeutic use. Manufacturers exporting globally must adhere to varied standards (ASTM, EN71, CPSIA, etc.). Any quality or safety incident can damage brand reputation and impose costly recalls. For premium or smart variants, additional electronic or sensor compliance adds complexity and cost, potentially restraining rapid scaling.

Stress Toy Market Opportunities

Corporate Wellness & B2B Customisation

Companies increasingly invest in employee mental health and productivity enhancement. Stress toys tailored for corporate wellness, branded stress balls, wellness kits for remote workers, and office desk accessories represent a growing B2B channel for manufacturers. By offering volume discounts, custom branding, and wellness-programme integration (e.g., QR codes linking to mindfulness apps), manufacturers can access recurring corporate demand and higher-value contracts.

Smart, Connected Stress-Toys & Premium Variants

Introducing tech-enabled stress toys (e.g., Bluetooth-connected fidgets, usage-tracking sensors, app integration) opens a premium sub-segment with higher margins. These products appeal to adult wellness consumers and corporate markets seeking differentiated wellness tools. Further, leveraging premium materials (eco-friendly silicones, weighted finishes) and targeting wellness-conscious demographics enhances the value proposition and positions stress toys as lifestyle accessories rather than low-cost novelty items.

Expansion into Emerging Regions and Manufacturing Localisation

Emerging markets such as India, China, Brazil, and the GCC are exhibiting rapid growth in mental wellness awareness, gift culture, and e-commerce penetration. Local manufacturing initiatives (for example, initiatives to boost domestic toy production) reduce import costs and enable competitive pricing. New entrants can target lower-penetration markets with affordable, locally-adapted stress-toy variants and leverage online distribution to scale quickly. Export-oriented production hubs in Asia also present an opportunity for global brand launches from cost-efficient bases.

Product Type Insights

Squeeze balls remain the dominant product type globally, accounting for approximately 30% of the market in 2024 ( USD 1.65 billion). Their ubiquity, low cost, ease of manufacture, and broad appeal among children, adults, and corporate gifting make them the default entry point. Meanwhile, fidget toys, squishies, and weighted plush/stress-relief variants are growing as consumers seek novelty, tactile variety, and adult-friendly designs. Premium segments (smart or eco-materials) represent smaller but fast-growing niches, enabled by product innovation and consumer willingness to pay more for differentiated stress-relief tools.

Material Insights

Foam-based materials dominate the market structure, capturing roughly 25% of the global market in 2024 ( USD 1.375 billion). Their low cost, high compressibility, ty and safety credentials make foam the material of choice for many mainstream stress toys. Silicone, rubber, and gel-filled variants are gaining traction, especially in premium adult and therapeutic niches, as consumers demand non-toxic, durable, and tactile alternatives. Hybrid and composite materials (e.g., foam plus gel core) are also appearing, catering to differentiated usage scenarios and higher price points.

Distribution Channel Insights

Online retail channels accounted for roughly 35% of global delivery in 2024 ( USD 1.925 billion). Growth in e-commerce, social-media marketing, influencer-driven fidget/novelty trends, and direct-to-consumer brand launches has significantly increased product reach and speed-to-market. Offline retail (toy/gift stores, corporate outlets) and institutional/therapeutic sales remain important for high-volume and bulk distribution, but online channels are leading growth and skewing younger and tech-savvy consumer segments.

End-User Insights

Adults (age 20–64) represent the largest end-user segment, accounting for approximately 40% of the market in 2024 ( USD 2.2 billion). Corporate wellness programmes, remote-work setups, and adult consumers seeking stress relief have driven this shift. Children and teenagers remain important users of fidget and novelty stress toys, particularly in education and gift contexts. Special-needs and therapy users (e.g., sensory toys for autism/ADHD) form a smaller but rapidly expanding niche, providing higher-margin opportunities and product diversification.

| By Product Type | By Material | By Distribution Channel | By End User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America continues to dominate the global stress-toy market with a share of approximately 38% ( USD 2.09 billion in 2024). The strong corporate wellness culture, high disposable income, robust e-commerce infrastructure, and high mental-health awareness underpin this position. The U.S. remains the single largest market in this context. Growth is steady (mid–single-digit CAGR) as the market is relatively mature but still offering opportunities in premium and adult segments.

Asia-Pacific

The Asia-Pacific region is the fastest-growing market, estimated to holda 30% share ( USD 1.65 billion in 2024) and projected to grow at a CAGR of 7–8%. The combination of rapid urbanisation, rising disposable incomes, expanding e-commerce, and increasing mental-wellness awareness in China, India, Japan, and Southeast Asia drives this momentum. Local manufacturing capacity, government-supported toy-industry initiative, and export dynamics further strengthen the region’s role.

Europe

Europe accounts for roughly 18% of the global market ( USD 0.99 billion in 2024). Demand is concentrated in the U.K., Germany, and France, where safety regulations are stringent and consumers favour design and sustainability. Growth is moderate (5–6% CAGR), supported by wellness trends, corporate gifting, and premium product uptake.

Latin America

Latin America contributes approximately 5% of the global market ( USD 0.27 billion in 2024). Key markets such as Brazil and Mexico are driving growth through youth adoption, online retail expansion, and increasing awareness of stress-management tools. While price sensitivity is high, an opportunity exists for cost-effective and culturally tuned stress toys.

Middle East & Africa

The Middle East & Africa (MEA) region accounts for about 4% of the global market ( USD 0.22 billion in 2024). Growth is strongest in Gulf Cooperation Council (GCC) countries, where corporate gifting and wellness initiatives are on the rise, and in urban African centres where youth populations and e-commerce growth are driving demand. Regulatory and distribution challenges remain, but the region represents a growing frontier for expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Stress Toy Market

- The LEGO Group

- Spin Master Corp.

- Jakks Pacific

- Hasbro Inc.

- Mattel Inc.

- Fat Brain Toys Co.

- Tangle Creations

- Toysmith

- Antsy Labs LLC

- Kikkerland Design Inc.

- Crazy Aaron’s Enterprises Inc.

- ZURU LLC

- YoYa Toys

- Schylling Inc.

- PlayMonster LLC

Recent Developments

- In May 2025, Tangle Creations announced a new line of biodegradable fidget toys designed for adult wellness and corporate gifting, emphasising eco-materials and sustainability credentials.

- In March 2025, Fat Brain Toys expanded its stress-relief range to include therapy-approved products for special-needs education, reinforcing its presence in the occupational health and sensory-toy niche.

- In January 2025, Spin Master Corp. launched its “Connected Calm” series, integrating Bluetooth-enabled stress balls that pair with mindfulness apps and usage tracking features.