Steam Table Pans Market Size

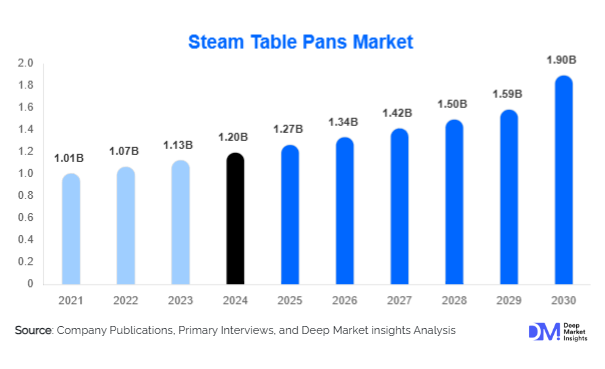

According to Deep Market Insights, the global steam table pans market size was valued at USD 1.20 billion in 2024 and is projected to grow from USD 1.27 billion in 2025 to reach USD 1.90 billion by 2030, expanding at a CAGR of 5.8% during the forecast period (2025–2030). The market growth is primarily driven by the expanding global foodservice and hospitality industry, rising demand for durable and hygienic materials, and increasing adoption of standardized and customizable pans for restaurants, hotels, institutional kitchens, and catering services.

Key Market Insights

- Stainless steel remains the leading material segment, preferred for durability, corrosion resistance, and hygiene compliance across commercial kitchens and institutional foodservice.

- Full-size pans dominate the product format segment, offering higher capacity and efficiency in large-scale operations, reducing the need for multiple smaller pans.

- Restaurants constitute the largest end-use segment, accounting for nearly 40% of the 2024 market, driven by the prevalence of buffets, catering, and high-volume service requirements.

- North America holds the largest regional market share, fueled by established foodservice infrastructure, stringent hygiene regulations, and a high density of restaurants and hotels.

- Asia-Pacific is the fastest-growing region, with strong demand in China, India, and Southeast Asia due to rising disposable incomes, urbanization, and hospitality sector expansion.

- Technological and material innovations, including antimicrobial coatings, modular designs, and improved finishing, are reshaping market dynamics and customer preferences.

What are the latest trends in the steam table pans market?

Material and Sustainability Innovations

Manufacturers are increasingly adopting eco-friendly and durable materials to meet regulatory requirements and customer demand. Stainless steel remains dominant, but the incorporation of recycled plastics, composite materials, and non-stick coatings is gaining traction. Innovations aim to reduce carbon footprint, extend product lifespan, and enhance hygiene. Some companies are exploring remanufacturing and refurbishing models for institutional clients, creating a circular economy approach that reduces waste and operational costs.

Smart and Modular Designs

Advanced design features, such as modular stackable pans, vented lids, and anti-warp edges, are becoming standard in commercial kitchens. Large-scale foodservice operations benefit from improved efficiency and hygiene, while catering and buffet setups gain flexibility. There is also a growing interest in integrating antimicrobial surfaces and heat retention technologies, enabling pans to meet higher safety and performance standards.

What are the key drivers in the steam table pans market?

Expansion of the Global Foodservice Industry

The growing number of restaurants, hotels, institutional kitchens, and catering services worldwide drives demand for steam table pans. Urbanization, increasing disposable incomes, tourism growth, and shifting dining habits encourage larger-scale foodservice operations, which in turn require high-quality, durable pans for food warming and display. Asia-Pacific shows particularly high growth, while North America maintains steady demand due to replacement cycles and premium product adoption.

Hygiene and Food Safety Regulations

Stringent hygiene and food safety standards in commercial kitchens and institutions have increased the demand for stainless steel and coated pans that are easy to clean, corrosion-resistant, and compliant with global certifications. Regulatory mandates in North America, Europe, and parts of Asia drive procurement decisions, particularly for hospitals, schools, and corporate cafeterias, where food safety is non-negotiable.

Material Innovation and Cost Efficiency

Advances in stainless steel grades, lightweight alloys, and coated plastics enhance durability and functionality while optimizing manufacturing costs. Improved heat retention, anti-corrosion treatments, and coating technologies allow manufacturers to offer products with higher performance and longer lifespan, attracting both institutional and commercial clients and supporting competitive pricing strategies.

What are the restraints for the global market?

Volatility in Raw Material Prices

Fluctuations in stainless steel, aluminum, and plastic resin costs significantly affect production expenses. Manufacturers may face pressure on margins or need to increase prices, potentially reducing demand. Tariffs, import duties, and regional supply chain constraints further exacerbate cost pressures, especially for exporters.

Competition from Substitute Equipment

Alternatives such as electric food warmers, induction heat holding equipment, chafing dishes, and insulated containers compete with traditional steam table pans. These substitutes often offer higher energy efficiency or portability, creating challenges for manufacturers of conventional pans in cost-sensitive and small-scale markets.

What are the key opportunities in the steam table pans industry?

Growth in Emerging Markets

Asia-Pacific, Latin America, and parts of the Middle East are witnessing rapid expansion in foodservice and hospitality. Rising urbanization, increasing disposable incomes, tourism infrastructure development, and government initiatives targeting hospitality create high demand for commercial-grade steam table pans. Localized manufacturing and cost-competitive production present opportunities for new entrants and existing players.

Eco-Friendly and Circular Economy Approaches

Manufacturers are exploring sustainable product designs, including recycled materials, longer-lasting coatings, and refurbishing models for institutional clients. These approaches reduce waste, enhance brand reputation, and cater to the growing environmentally conscious buyer base in both mature and emerging markets.

Customization and Modular Product Offerings

Flexible pan sizes, modular stackable designs, and specialized features for different cuisines or service formats are in demand. Catering services, hotels, and institutional kitchens value adaptability, which allows for more efficient space utilization, reduced labor, and optimized food presentation.

Product Type Insights

Stainless steel full-size pans dominate the market, representing approximately 60% of material share and 35–40% of product format revenue in 2024. They are preferred for durability, hygiene, and compliance with global food safety standards. Plastic pans, while lower cost, are used for lighter-duty and residential applications. Aluminum pans offer a balance of weight and heat conductivity but account for a smaller market share.

Application Insights

Restaurants remain the largest application, holding nearly 40% of the 2024 market, followed by hotels/buffets (20%), institutional foodservice (15–20%), and catering/events (10%). The fastest-growing segments are institutional kitchens and catering services, driven by outsourcing trends, growing tourism, and event-based dining. Residential and home-use applications are small but emerging, particularly with cloud kitchens and large households.

Distribution Channel Insights

Specialty restaurant supply stores, online channels, and direct sales to institutional buyers dominate distribution. E-commerce growth enables smaller buyers and remote operations to access premium products. Wholesale and institutional channels remain critical for bulk procurement, while supermarkets and hypermarkets serve residential buyers. Online and B2B marketplaces are increasingly shaping purchasing decisions.

End-Use Industry Insights

Commercial kitchens in restaurants, hotels, and catering services are the main consumers. Institutional kitchens (hospitals, schools, corporate cafeterias) are experiencing rapid growth, requiring durable, standardized, and hygienic pans. New applications include cloud kitchens, food trucks, and meal-prepping services, expanding the market beyond traditional foodservice. Export-driven demand is influenced by hospitality and tourism infrastructure investments, particularly in emerging economies.

| By Product Type | By Pan Size | By End-Use | By Distribution Channel | By Region |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds approximately 35–38% of the global market in 2024, led by the U.S. due to a dense foodservice network, premium product adoption, and regulatory compliance requirements. Canada follows with a smaller but steady demand. Replacement cycles, hygiene standards, and premium features drive stable market growth at a CAGR of ~4.5–5.5%.

Europe

Europe accounts for 18–22% of the market, with Germany, the U.K., France, Italy, and Spain as key contributors. Growth is moderate (~3.5–5%) and driven by sustainability initiatives, standardized sizes, and high-quality product demand. Eastern Europe shows faster expansion due to the emerging hospitality infrastructure.

Asia-Pacific

Asia-Pacific represents 25–30% of the market and is the fastest-growing region, led by China, India, Japan, and Southeast Asia. Rapid urbanization, rising disposable income, expansion of restaurants and hotels, and government initiatives in hospitality are the primary growth drivers. CAGR is estimated at 6–7.5% during the forecast period.

Latin America

Latin America holds 7–9% of the market, with Brazil, Mexico, and Argentina as major contributors. Demand is growing moderately, influenced by urbanization, tourism, and emerging restaurant culture. Affluent consumers drive the adoption of premium pans, while cost-sensitive buyers opt for local or lower-cost alternatives.

Middle East & Africa

MEA accounts for 5–8% of the market. GCC countries (Saudi Arabia, UAE, Qatar) are driving demand due to high disposable incomes and hospitality expansion. Africa, as a production and usage hub, sees growth from hotels, institutional kitchens, and catering services, supplemented by government investment in tourism and infrastructure.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Steam Table Pans Market

- Vollrath Company, LLC

- Cambro Manufacturing Company

- Carlisle FoodService Products

- Winco

- Thunder Group

- Browne Foodservice

- Update International

- Alegacy Foodservice Products Group

- Royal Industries

- American Metalcraft

- Advance Tabco

- Polar Ware

- Crestware

- TableCraft Products Company

- Focus Foodservice

Recent Developments

- In Q1 2025, Vollrath Company expanded production capacity for stainless steel pans with enhanced antimicrobial coatings to cater to growing institutional demand in North America.

- In Q2 2025, Cambro Manufacturing launched modular and stackable full-size pans for hotels and catering services in the Asia-Pacific, improving efficiency in high-volume kitchens.

- In Q3 2025, Thunder Group introduced eco-friendly plastic and composite pans, targeting sustainability-conscious buyers in Europe and North America.