Soy Protein Isolate Market Size

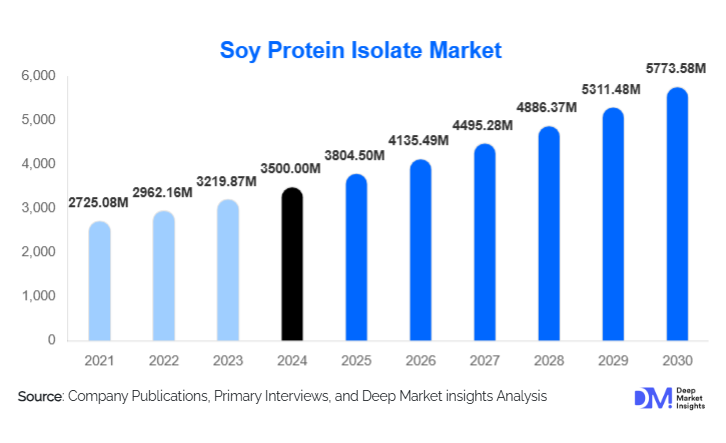

According to Deep Market Insights, the global soy protein isolate market size was valued at USD 3,500 million in 2024 and is projected to grow from USD 3,804.5 million in 2025 to reach USD 5,773.58 million by 2030, expanding at a CAGR of 8.7% during the forecast period (2025–2030). The soy protein isolate market growth is primarily driven by the rising adoption of plant-based proteins, expansion of meat and dairy alternatives, and increasing demand for high-protein functional foods and beverages across global markets.

Key Market Insights

- Soy protein isolate is becoming a preferred plant protein base for functional foods, driven by its high protein content, clean-label compatibility, and favorable amino acid profile.

- Meat and dairy alternative manufacturers remain major SPI consumers, leveraging its emulsification, gelling, and water-binding properties.

- North America dominates the global SPI market, supported by a mature food-processing sector and strong sports nutrition demand.

- Asia-Pacific is the fastest-growing region, fueled by rising disposable income, dietary modernization, and expanding local production capacity.

- Non-GMO and organic SPI demand is accelerating globally, reflecting heightened consumer interest in sustainability and clean-label formulations.

- Technological advancements such as improved isolation processes, flavor optimization, and high-solubility SPI variants are strengthening market competitiveness.

What are the latest trends in the soy protein isolate market?

Clean-Label and Non-GMO SPI Gaining Momentum

Manufacturers are increasingly shifting toward non-GMO, organic, and traceable soy sourcing to meet global clean-label demand. Brands are focusing on identity-preserved soybeans, deforestation-free certifications, and transparent supply chains. This trend is reinforced by heightened consumer awareness of ingredient purity and sustainability. Premium food and beverage brands are promoting SPI in fortified snacks, meal replacements, and wellness products, prioritizing certifications such as USDA Organic, Non-GMO Project Verified, and EU organic labels. This shift is pushing producers to invest in high-purity, low-flavor SPI grades tailored for clean-label applications.

Innovation in Functional & High-Solubility SPI Products

New SPI variants with enhanced solubility, improved texture, and better flavor profiles are reshaping product development across meat analogues, RTD beverages, and sports nutrition. Technologies such as enzymatic hydrolysis, advanced ultrafiltration, and precision milling are enabling SPI with a smoother mouthfeel and greater dispersibility. These advancements appeal to manufacturers seeking high-performance ingredients for beverages, protein bars, dairy alternatives, and plant-based meats. As demand grows for taste-optimized plant proteins, companies are accelerating R&D to differentiate on functionality and sensory attributes.

What are the key drivers in the soy protein isolate market?

Growing Global Demand for Plant-Based Proteins

The shift toward vegan, vegetarian, and flexitarian diets is significantly elevating demand for plant-based proteins. SPI stands out due to its high protein concentration (90%+), cost efficiency, and functional versatility. Food manufacturers are adopting SPI in burgers, sausages, dairy substitutes, bakery items, and snacks. Increasing concerns over animal welfare, carbon emissions, and health profiles of animal proteins are further reinforcing this trend. The proliferation of plant-based food startups and rapid innovation in meat analogues are also expanding SPI’s application base.

Rising Popularity of Functional Foods and Sports Nutrition

Consumers are increasingly seeking high-protein, clean, and nutritionally dense food and beverage products. SPI is widely used in RTD protein beverages, powders, bars, infant nutrition, and medical foods due to its digestibility, amino acid completeness, and low allergenicity relative to dairy proteins. Growing fitness culture, health awareness, and an aging global population are contributing to the strong uptake of SPI across wellness, medical, and performance nutrition sectors.

What are the restraints for the global market?

Volatility in Soybean Prices & Supply Chain Risks

Soybean price fluctuations caused by climate events, geopolitical trade tensions, and agricultural yield variability pose persistent challenges to SPI producers. Increases in raw material prices directly impact production costs, compressing margins for manufacturers and limiting pricing flexibility. Supply-chain disruptions, such as freight constraints or inconsistent crop quality, also affect SPI availability and reliability, acting as a significant restraint to market expansion.

Competition from Alternative Plant Proteins

SPI faces rising competition from pea, fava, rice, chickpea, and sunflower protein isolates, many of which appeal to consumers seeking non-allergenic or soy-free options. Pea protein in particular has gained traction due to its neutral taste profile. Additionally, some consumers still perceive soy negatively due to outdated concerns around phytoestrogens. These competitive pressures require SPI producers to invest heavily in flavor masking, functionality improvements, and targeted marketing strategies.

What are the key opportunities in the soy protein isolate industry?

Expansion in Emerging Markets

Rapid urbanization, growing middle-class populations, and increasing adoption of convenience foods in India, China, Southeast Asia, and Latin America present major opportunities for SPI manufacturers. These markets are witnessing a surge in demand for fortified foods, plant-based meats, and protein-enriched snacks. Local production capacity expansion, supported by government incentives in regions like India and China, further enhances SPI market potential.

Premium & Specialty SPI Grades

Demand for organic, non-GMO, minimally processed, and high-solubility SPI grades is rising sharply. Companies that invest in premium formulations, such as flavored isolates, enzymatically modified variants, and infant-nutrition-grade SPI, can capture higher margins and differentiate in competitive markets. As sustainability becomes a key purchase driver, specialty SPI grades with traceable, low-carbon footprints represent a strong long-term opportunity.

Product Type Insights

Dry (powder) soy protein isolate dominates the market, holding nearly 80% of global share. Powder SPI is preferred due to its long shelf life, easy transport, and compatibility with large-scale food manufacturing. Liquid SPI, though a smaller segment, is growing rapidly in beverage and RTD protein applications because of its superior solubility and ease of formulation.

Application Insights

The food segment leads SPI usage, driven by bakery, confectionery, dairy alternatives, and especially plant-based meat formulations. Beverages represent the fastest-growing segment as protein-enriched RTD drinks and nutritional beverages gain traction. The nutraceutical and medical nutrition sectors are also rising steadily due to SPI’s digestibility and amino acid profile. The animal feed segment remains stable, offering consistent demand for cost-effective protein enrichment.

Distribution Channel Insights

Direct B2B ingredient sales dominate SPI distribution, with manufacturers supplying food processors, beverage formulators, and nutrition brands. Online ingredient marketplaces and D2C bulk platforms are gaining traction among smaller manufacturers. Strategic distributor partnerships are also expanding SPI access in emerging markets, particularly across Southeast Asia, Latin America, and Africa.

End-User Insights

Food and beverage manufacturers account for the largest share of SPI consumption due to its versatility and cost efficiency. Sports nutrition brands constitute a fast-growing user segment, leveraging SPI in powders, bars, and RTD beverages. Pharmaceutical and medical nutrition companies use high-purity SPI in clinical nutrition products and infant formula. Animal feed producers represent a traditional but stable end-user base with steady growth.

| By Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America is expected to lead the global market with an approximate 30% share in 2024. The U.S. is a major consumer and manufacturer of SPI, supported by strong demand for plant-based foods, sports nutrition products, and clean-label formulations. A mature food-processing ecosystem and innovations in RTD protein beverages further drive regional growth.

Europe

Europe contributes around 25% of global SPI consumption, fueled by strong adoption of vegan diets, sustainability-focused food innovations, and robust regulations supporting plant-based ingredients. Germany, the U.K., and France lead the region with high demand for meat alternatives and functional foods.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, driven by rising health awareness, population growth, and increasing investments in soy-processing facilities. China and India dominate demand due to the expanding consumption of protein-enriched foods and beverages. Japan, South Korea, and Australia show strong uptake in specialized nutrition and food innovation sectors.

Latin America

Latin America holds around 15% of the global market, led by Brazil, Mexico, and Argentina. Growing middle-class populations and the emergence of local plant-based food brands are supporting SPI demand. Regional production capabilities are expanding, reducing reliance on imports.

Middle East & Africa

This region represents a smaller but expanding SPI market. Growth is supported by rising interest in fortified foods, infant nutrition, and sports nutrition products. GCC countries such as the UAE and Saudi Arabia are increasingly importing SPI for functional beverages and processed foods.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Soy Protein Isolate Market

- Archer Daniels Midland Company (ADM)

- Cargill Incorporated

- DuPont de Nemours, Inc.

- Fuji Oil Holdings Inc.

- Bunge Limited

- Wilmar International Limited

- The Scoular Company

- Crown Soya Protein Group

- Foodchem International Corporation

- Farbest Brands

Recent Developments

- In March 2025, ADM expanded its specialty soy protein facility in the U.S. to increase production of high-solubility and non-GMO SPI variants.

- In January 2025, Bunge announced a joint venture in India to establish a new soy isolate processing line focused on emerging markets.

- In November 2024, Fuji Oil launched a next-generation low-flavor SPI optimized for dairy alternative applications and high-protein RTD beverages.