Soy Protein Ingredients Market Size

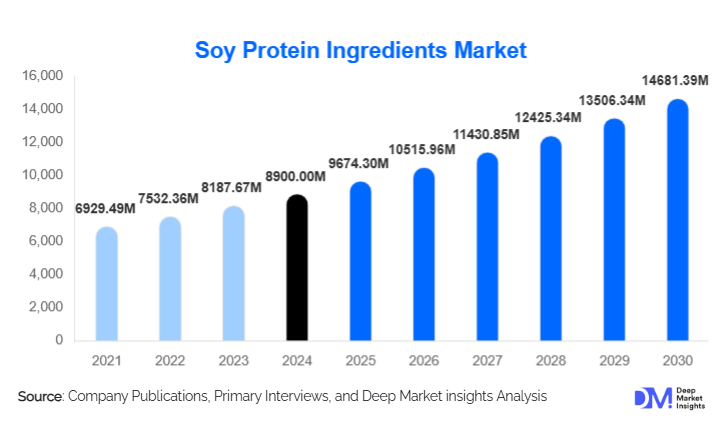

According to Deep Market Insights, the global soy protein ingredients market size was valued at USD 8,900 million in 2024 and is projected to grow from USD 9,674.3 million in 2025 to reach USD 14,681.39 million by 2030, expanding at a CAGR of 8.7% during the forecast period (2025–2030). Market growth is primarily driven by rising global demand for plant-based proteins, expansion of meat and dairy alternatives, and the rapid adoption of functional, clean-label, and high-protein food solutions across both developed and emerging markets.

Key Market Insights

- Soy protein isolates (SPIs) dominate the ingredient category, driven by high protein purity and widespread use in sports nutrition, beverages, and plant-based meat.

- Dry-form soy protein ingredients account for nearly 85–90% of market share, due to superior shelf stability and ease of formulation.

- Asia-Pacific is the largest and fastest-growing region, supported by booming processed-food sectors and government nutrition programs.

- Non-GMO and organic soy proteins are gaining strong momentum, especially in North America and Europe, where clean-label trends prevail.

- Demand for textured soy protein (TSP) is surging owing to its structural similarity to meat, making it a key component in plant-based meat products.

- Technological advancement in extrusion, protein isolation, and flavor masking is reshaping product innovation and improving sensory performance.

What are the latest trends in the soy protein ingredients market?

Functional and Clean-Label Soy Proteins Gaining Traction

Food manufacturers are increasingly adopting clean-label, non-GMO, and organic soy protein ingredients to meet consumer expectations for transparency and healthfulness. Functional soy proteins with enhanced solubility, emulsification, fat-binding, and gelation capabilities are becoming mainstream in bakery, nutrition bars, beverages, and dairy alternatives. Companies are reformulating products to reduce additives and deliver natural protein fortification, creating opportunities for specialized soy isolates, hydrolysates, and textured proteins.

Expansion of Plant-Based Meat and Dairy Alternatives

The rapid rise of plant-based diets is fueling widespread use of textured soy protein and soy protein isolates. Manufacturers are investing in advanced extrusion technologies to improve texture, juiciness, and mouthfeel in soy-based meat analogues. Plant-based yogurts, cheeses, and milk replacements increasingly rely on soy proteins for functionality and stability. This trend appeals strongly to health-conscious, flexitarian, and vegan consumers and is especially prominent in North America, Europe, and rising APAC markets.

What are the key drivers in the soy protein ingredients market?

Growing Global Shift Toward Plant-Based Nutrition

Consumers worldwide are reducing animal-protein consumption due to health, environmental, and ethical concerns. Soy protein, being cost-effective, complete in amino-acid profile, and functionally versatile, has emerged as a primary alternative. The growth of sports nutrition, ready-to-drink protein beverages, and fortified foods is further driving demand for high-quality soy protein isolates and concentrates.

Expansion of Feed, Pet Food, and Functional Food Applications

Soy protein ingredients are increasingly used in animal feed and pet food due to rising global protein requirements and preference for sustainable feed solutions. Functional foods, such as protein snacks, bars, cereals, and meal replacements, are accelerating the adoption of soy proteins for nutrition, texture, and stability. This diversification of end-use industries is a major long-term market driver.

What are the restraints for the global market?

Raw Material Price Volatility

The soy protein ingredients market faces continuous pressure from fluctuations in soybean and soymeal prices, driven by climatic conditions, geopolitical tensions, and global trade policies. Rising logistics and energy costs further affect the overall cost structure, creating challenges for manufacturers in maintaining stable pricing.

Allergen, Regulatory, and Labeling Challenges

As soy is a major allergen, manufacturers must adhere to stringent labeling regulations, limiting its use in certain regions. Increasing demand for non-GMO and organic certification also raises compliance costs. Regulatory scrutiny on clean labeling and ingredient transparency continues to pose operational and market-entry challenges.

What are the key opportunities in the soy protein industry?

Advanced Soy-Based Meat and Dairy Innovations

The growing demand for realistic meat analogues and dairy alternatives presents an immense opportunity for companies investing in next-generation textured soy proteins and specialty isolates. Improved taste-masking technologies, fiber-infused textures, and clean-label formulations can unlock premium pricing and wider consumer acceptance.

High-Growth Potential in Emerging Markets

Asia-Pacific, Latin America, and Africa offer substantial opportunities due to rising disposable incomes, expanding packaged-food markets, and rapidly growing demand for protein-rich diets. Government-backed nutrition programs, especially in India, China, and Southeast Asia, are driving large-scale adoption of soy protein concentrates and flours in public feeding schemes and value-added food manufacturing.

Product Type Insights

Soy Protein Isolates (SPIs) lead the market owing to their high purity (>90% protein), excellent solubility, and suitability for beverages, supplements, and meat analogues. Soy Protein Concentrates (SPCs) are widely used in bakery, snacks, and feed applications due to lower cost and functional versatility. Textured Soy Protein (TSP) is rapidly gaining market share as a key ingredient in meat substitutes. Soy flour and specialty soy derivatives continue to serve bakery, confectionery, and industrial applications.

Application Insights

Meat extenders and meat alternatives dominate the application segment, driven by rising consumer adoption of plant-based diets. Functional foods and sports nutrition are rapidly expanding as soy proteins are integrated into bars, shakes, powdered supplements, and fortified foods. Infant nutrition, dairy alternatives, and clinical nutrition rely heavily on high-purity isolates. Animal feed and pet food remain high-volume segments, especially in APAC and Latin America.

Distribution Channel Insights

B2B direct supply to food, beverage, and feed manufacturers remains the dominant distribution route. Ingredient distributors and wholesalers serve smaller food processors and emerging markets. Online procurement and digital marketplaces are gaining adoption due to price transparency, technical documentation access, and streamlined vendor comparison. Major ingredient suppliers are expanding direct-to-customer digital portals to support formulation guidance and bulk purchasing.

End-User Industry Insights

Food and beverage manufacturers represent the largest end-user segment, followed by feed and pet-food manufacturers. Sports-nutrition companies and plant-based meat producers form the highest-growth customer groups. Industrial applications, including adhesives, coatings, and bioplastics, offer a small but growing niche demand for modified soy proteins.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America remains a major market driven by mature sports nutrition, plant-based meat adoption, and strong consumer preference for non-GMO and organic ingredients. The U.S. leads in R&D, innovation, and high-value soy protein isolate production, while Canada contributes significantly to non-GMO supply.

Europe

Europe shows high demand for clean-label, sustainable, and allergen-free plant proteins. Soy protein continues to gain traction in meat substitutes, bakery products, and dairy alternatives. The region’s strict regulatory environment accelerates the adoption of non-GMO and certified-organic soy proteins.

Asia-Pacific

Asia-Pacific accounts for the largest market share and is the fastest-growing region, driven by rising consumption of processed foods, expanding sports nutrition demand, and government-backed protein fortification initiatives. China and India lead consumption, while Southeast Asia shows strong growth in plant-based foods and animal feed applications.

Latin America

Latin America's market is expanding gradually as Brazil, Argentina, and Mexico adopt soy proteins in snacks, baked goods, and nutrition products. While the region is a major soybean producer, domestic utilization of high-value soy protein isolates and textured forms is rising as food processing industries modernize.

Middle East & Africa

The region shows steady growth driven by rising urbanization, increasing protein awareness, and expanding processed-food consumption. Africa’s growing feed industry also supports soy protein demand. The Middle East sees increased use of soy proteins in bakery, sports nutrition, and premium plant-based foods.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Soy Protein Ingredients Market

- Archer Daniels Midland (ADM)

- Cargill Incorporated

- Wilmar International

- Kerry Group

- DuPont (IFF Nutrition Division)

- Bunge Limited

- Ingredion Incorporated

Recent Developments

- In 2024, ADM expanded its soy protein isolate production capacity in Asia-Pacific to meet surging demand for plant-based meat and dairy alternatives.

- In 2025, Cargill introduced a new line of clean-label, non-GMO textured soy proteins targeting premium meat-alternative manufacturers.

- In early 2025, Kerry Group launched advanced functional soy isolates designed for improved solubility and flavor performance in ready-to-drink protein beverages.