Sous Vide Equipment Market Size

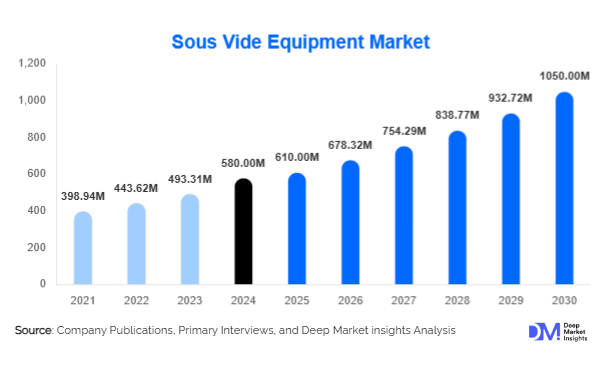

According to Deep Market Insights, the global sous vide equipment market size was valued at USD 580 million in 2024 and is projected to grow from USD 610 million in 2025 to reach USD 1,050 million by 2030, expanding at a CAGR of 11.2% during the forecast period (2025–2030). The market growth is primarily driven by increasing adoption of precision cooking techniques in professional kitchens, rising consumer demand for home-based gourmet cooking, and integration of smart and connected technologies in sous vide appliances, making them more convenient and efficient for both domestic and commercial users.

Key Market Insights

- Professional and home-based kitchens are increasingly adopting sous vide technology, driven by the need for precise temperature control and consistent food quality.

- Smart sous vide devices with Wi-Fi and Bluetooth connectivity are gaining traction, allowing users to monitor cooking remotely and integrate appliances with kitchen IoT ecosystems.

- North America dominates the market due to high disposable incomes, strong culinary culture, and widespread use in fine dining and gourmet restaurants.

- Europe is among the fastest-growing regions, fueled by increasing awareness of healthy cooking methods and the rising trend of home-based gourmet experiences.

- Asia-Pacific is emerging as a key growth market, led by expanding foodservice industries in China, India, and Japan, and rising consumer interest in modern cooking techniques.

- Technological integration, including automated sous vide machines, app-controlled cookers, and AI-assisted temperature monitoring, is reshaping user engagement and convenience.

What are the latest trends in the sous vide equipment market?

Integration of Smart Technologies

Manufacturers are increasingly embedding Wi-Fi, Bluetooth, and mobile app controls into sous vide cooking machines, enabling users to monitor and adjust cooking processes remotely. Smart devices also provide recipe databases, automated cooking programs, and integration with other kitchen appliances, appealing to tech-savvy consumers and professional chefs. This trend enhances convenience, reduces human error, and supports precision cooking, which is critical in fine dining and commercial kitchens.

Rise of Home-Based Gourmet Cooking

Post-pandemic shifts toward cooking at home have fueled demand for professional-grade kitchen appliances. Consumers increasingly seek gourmet cooking experiences, using sous vide equipment to achieve restaurant-quality meals. Recipe sharing, culinary content on social media, and streaming cooking tutorials are boosting interest in sous vide cooking among millennials and urban households. The market is seeing innovations like compact, user-friendly devices targeted at home users, complementing professional-grade offerings.

What are the key drivers in the sous vide equipment market?

Precision Cooking in Restaurants

High-end restaurants and hotels are adopting sous vide equipment for precise temperature control, improved food quality, and enhanced presentation. Chefs benefit from the ability to cook large quantities with consistent results, reducing waste and labor costs. This trend is particularly prominent in Europe and North America, where fine dining and culinary innovation are highly valued. Sous vide techniques also allow complex flavors and textures to develop, meeting consumer demand for premium dining experiences.

Health and Nutrition Awareness

Rising consumer focus on healthy cooking methods is driving sous vide adoption. The technology preserves nutrients, reduces the use of added fats, and minimizes overcooking, aligning with wellness-oriented diets. Home cooks and commercial kitchens are increasingly prioritizing low-fat, nutrient-rich meals, making sous vide an attractive solution for maintaining food quality while supporting health-conscious trends.

Growing Foodservice Industry

Expansion of hotels, restaurants, and catering services worldwide is boosting demand for sous vide equipment. Culinary schools and professional training programs are also incorporating sous vide techniques, further strengthening its adoption. Regions like Asia-Pacific and the Middle East are witnessing rapid growth in the hospitality sector, leading to higher purchases of sous vide devices for commercial use.

Restraints

High Initial Equipment Costs

Professional-grade sous vide machines and commercial water baths are expensive, limiting adoption among small restaurants and households. Even with rising interest, price remains a barrier for widespread penetration, particularly in price-sensitive emerging markets. Consumers may prefer conventional cooking appliances for cost considerations, slowing growth in certain segments.

Complexity and Learning Curve

Sous vide cooking requires knowledge of precise temperatures and cooking times. Lack of expertise among home users can lead to underutilization or incorrect usage, restraining market expansion. Manufacturers are addressing this with pre-programmed devices, but skill gaps remain a challenge for rapid adoption.

What are the key opportunities in the sous vide equipment market?

Expansion in Emerging Markets

Emerging economies in Asia-Pacific, Latin America, and the Middle East present untapped growth potential. Rising disposable incomes, urbanization, and increasing interest in Western culinary techniques are encouraging adoption. Government initiatives supporting food safety, hospitality growth, and modern kitchen infrastructure further enhance market opportunities in these regions.

Integration with Smart Kitchens and IoT

Smart kitchen integration is a major opportunity for sous vide devices. IoT-enabled appliances allow remote control, voice commands, and integration with other smart kitchen tools. Companies can target tech-savvy consumers and professional kitchens by offering connected solutions that improve convenience, efficiency, and personalization.

Product Innovation and Customization

There is strong potential for product innovation, including portable devices, multi-function cookers, and energy-efficient models. Customizable features, such as programmable temperature presets and recipe-sharing apps, attract home users and professional chefs. Innovations that reduce size, energy consumption, or water usage can drive adoption in space-limited and environmentally conscious markets.

Product Type Insights

Immersion circulators dominate the market, accounting for approximately 55% of the 2024 market, due to affordability, versatility, and compatibility with home and commercial setups. Water ovens follow closely, representing 30% of the market, preferred in professional kitchens for larger batch cooking and precise temperature control. Vacuum sealing machines, integral to sous vide preparation, hold 15% market share, primarily driven by demand in fine dining and foodservice applications. Trends indicate rising consumer preference for compact, smart immersion circulators, reflecting growth in home-based gourmet cooking.

Application Insights

Restaurant and foodservice applications account for the largest share, nearly 60% of 2024 demand, as precision cooking is critical for consistency and quality. Home cooking is growing rapidly, currently 25% of the market, driven by gourmet cooking trends and smart appliance adoption. Catering and institutional kitchens contribute 15%, with interest in bulk cooking and high-quality meal preparation. Emerging applications include meal kit services and culinary education, creating new revenue streams for manufacturers and distributors.

Distribution Channel Insights

Online retail channels dominate, accounting for around 45% of sales, due to direct-to-consumer convenience and availability of product reviews. Specialty kitchenware stores contribute 30%, while department stores and large-format retailers account for 25%. Increasing adoption of e-commerce platforms, subscription-based culinary kits, and smart appliance bundles is strengthening online distribution. Social media marketing and influencer partnerships also play a key role in shaping consumer preferences.

End-Use Insights

Hotels, fine dining restaurants, and culinary schools are the leading end-users, representing 60% of demand in 2024. Home cooks are a fast-growing segment due to interest in precision and gourmet cooking. Catering companies and institutional kitchens are adopting sous vide equipment for batch preparation. Export-driven demand is notable, with North America and Europe leading imports of premium devices, driven by culinary standards and luxury foodservice expansion.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds the largest share at 35% of the global market in 2024. The U.S. is the primary contributor, driven by high disposable incomes, tech adoption, and a strong culinary culture. Canada also shows significant uptake, particularly in urban centers and professional kitchens. Smart device integration and premium culinary trends sustain growth in this region.

Europe

Europe accounts for 28% of the 2024 market, led by France, Germany, and the U.K. High demand is driven by fine dining, culinary schools, and health-conscious cooking trends. The region is also adopting energy-efficient and smart sous vide devices at an increasing pace, with younger demographics driving home adoption.

Asia-Pacific

APAC is the fastest-growing region, fueled by expanding hospitality industries in China, India, Japan, and Australia. Rising urbanization, culinary awareness, and disposable income are driving both professional and consumer adoption. China is emerging as the key growth country due to growing restaurant chains and gourmet cooking interest.

Latin America

Latin America shows moderate adoption, with Brazil and Mexico leading demand. Market penetration is increasing in premium restaurants and urban households, while challenges include limited consumer awareness and price sensitivity.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, is adopting high-end sous vide devices for fine dining and luxury hospitality. Africa represents emerging adoption in select urban centers, mainly in commercial kitchens and hotels.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Sous Vide Equipment Market

- Anova Culinary

- PolyScience

- Breville

- Joule by ChefSteps

- KitchenBoss

- Gourmia

- Inkbird

- Chefman

- SEB Group

- Lavatools

- KitchenAid

- Wancle

- Nesco

- VacMaster

- Vesta Precision

Recent Developments

- In March 2025, Anova Culinary launched a new Wi-Fi-enabled immersion circulator with AI-assisted cooking programs for home chefs.

- In January 2025, Breville introduced a compact, multi-function sous vide cooker targeting urban households in Europe and North America.

- In February 2025, PolyScience expanded its professional sous vide line with energy-efficient, commercial-grade water ovens for fine dining establishments.