Sous Vide Cooking Machine Market Size

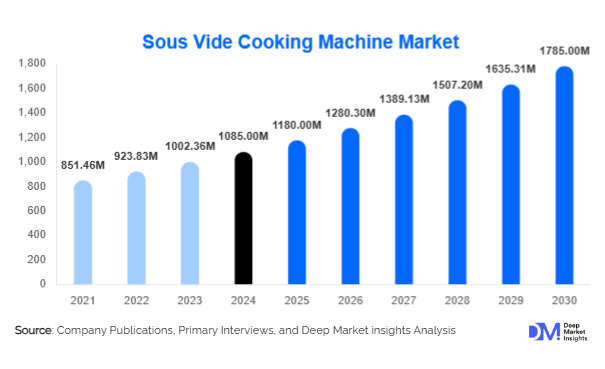

According to Deep Market Insights, the global sous vide cooking machine market size was valued at USD 1,085 million in 2024 and is projected to grow from USD 1,180 million in 2025 to reach USD 1,785 million by 2030, expanding at a CAGR of 8.5% during the forecast period (2025–2030). The sous vide cooking machine market growth is primarily driven by rising consumer demand for healthy, nutrient-preserving cooking methods, increasing adoption of smart kitchen appliances, and the growing popularity of restaurant-quality meals prepared at home.

Key Market Insights

- Immersion circulators dominate the market, accounting for more than 50% share due to affordability, portability, and ease of use in residential kitchens.

- Online retail channels lead global sales, capturing nearly 58% of the market in 2024, supported by e-commerce penetration and consumer preference for digital shopping.

- Residential users represent the largest application segment, with more than 62% of demand driven by rising culinary experimentation and home cooking trends.

- North America holds the largest regional market share (40%), led by the U.S., where disposable incomes and culinary awareness are high.

- Asia-Pacific is the fastest-growing region, expected to expand at a 10% CAGR, driven by urbanization, rising middle-class income, and growing food culture.

- Smart sous vide machines with IoT and app integration are reshaping user experience, enabling recipe sharing, remote monitoring, and predictive cooking.

Latest Market Trends

Smart and Connected Appliances Gaining Popularity

Manufacturers are integrating Wi-Fi and Bluetooth connectivity, enabling users to control cooking through mobile apps and voice assistants. These smart appliances offer guided recipes, cloud storage of cooking preferences, and real-time monitoring, appealing to younger, tech-savvy demographics. The trend is also aligned with broader smart home adoption, where consumers are building connected kitchen ecosystems.

Commercial Kitchens Increasing Adoption

Restaurants, hotels, and catering services are increasingly investing in sous vide equipment to ensure consistency, precision, and operational efficiency. Industrial-grade sous vide machines designed for high-capacity usage are being introduced, offering features such as multi-batch cooking and advanced temperature controls. This trend expands market potential beyond residential use and contributes to stable long-term demand.

Sous Vide Cooking Machine Market Drivers

Rising Health and Wellness Awareness

Consumers are shifting toward cooking methods that retain nutrients, reduce oil usage, and improve food safety. Sous vide technology meets these needs by cooking food at precise, lower temperatures that maintain flavor and nutrient density, driving adoption among health-conscious households globally.

Growth of E-commerce Distribution

The rise of online retail has significantly improved product availability, particularly in developing regions. Platforms like Amazon, Walmart Online, and regional marketplaces allow easy price comparison, access to discounts, and doorstep delivery, boosting demand for sous vide cooking machines worldwide.

Product Innovation and Differentiation

Companies are investing in R&D to deliver compact, energy-efficient, and multifunctional sous vide machines. App-controlled cooking, touchscreen displays, and advanced safety features have improved customer satisfaction and brand loyalty, accelerating global adoption.

Market Restraints

High Initial Cost

Premium sous vide machines are priced significantly higher than traditional kitchen appliances, restricting adoption in cost-sensitive markets. Although lower-cost entry models exist, affordability remains a barrier for mass penetration in emerging economies.

Need for Technical Familiarity

Sous vide cooking, despite being simple once mastered, requires basic knowledge of temperature settings, vacuum sealing, and timing. First-time users often find the learning curve intimidating, slowing down adoption among mainstream households.

Sous Vide Cooking Machine Market Opportunities

Expansion in Emerging Economies

Countries across Asia-Pacific, Latin America, and the Middle East are witnessing rising demand for gourmet cooking tools, supported by urbanization and income growth. E-commerce channels further provide a low-cost way for manufacturers to penetrate these new markets and reach first-time buyers.

Technological Integration

The addition of IoT, AI-powered recipe assistance, and smart sensors presents opportunities for product differentiation. Companies can develop premium models offering predictive cooking features, remote monitoring, and personalized cooking recommendations, catering to modern lifestyle demands.

Commercial and Institutional Use

Hotels, catering firms, and restaurants are adopting sous vide machines to improve efficiency and deliver consistent quality. Partnerships with culinary schools and hospitality chains create opportunities for long-term growth and market credibility.

Product Type Insights

Immersion circulators dominate the market, accounting for 52% of the global share in 2024. Their portability, compact design, and affordability make them the most preferred type among home users. Water ovens and combination models remain niche but are gaining popularity among professionals who prioritize capacity and precision.

Application Insights

Residential applications hold 62% of the market share in 2024, driven by the surge in home chefs, social media cooking culture, and increasing preference for healthy meals. The commercial segment is expanding rapidly at 9% CAGR, with adoption in restaurants, hotels, and catering services rising due to efficiency and consistency benefits.

Distribution Channel Insights

Online retail dominates with 58% of global sales in 2024, supported by digital adoption, consumer preference for convenience, and widespread availability of competitive pricing. Offline stores remain important for high-end models, where hands-on experience and brand showrooms influence purchasing decisions.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds the largest market share at 40% in 2024, led by the U.S., where sous vide cooking has gained popularity in both residential and commercial settings. High disposable incomes, culinary innovation, and robust e-commerce infrastructure drive sustained growth.

Europe

Europe accounts for 28% of global demand, with Germany, France, and the U.K. being key markets. Culinary sophistication, preference for gourmet dining, and strong adoption of smart kitchen tools drive regional demand. Germany is the fastest-growing country in Europe.

Asia-Pacific

Asia-Pacific is the fastest-growing region, projected to grow at nearly 10% CAGR through 2030. China, Japan, South Korea, and India are fueling growth with rising middle-class incomes, urbanization, and expanding e-commerce channels.

Middle East & Africa

MEA shows moderate growth, led by the UAE and Saudi Arabia, where premium appliances are increasingly purchased by affluent households and commercial users.

Latin America

LATAM markets such as Brazil and Mexico are gradually adopting sous vide machines, with demand supported by urbanization and growing culinary awareness among younger consumers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Sous Vide Cooking Machine Market

- Anova Culinary

- SousVide Supreme

- Breville Group

- Instant Brands

- KitchenBoss

- Caso Design

- ChefSteps

- Gourmia

- Lavatools

- Wancle

- Polyscience Culinary

- Simeo

- Klarstein

- Inkbird

- Hamilton Beach

Recent Developments

- In May 2025, Anova Culinary announced the launch of a new app-connected immersion circulator designed for precision temperature control and integrated recipe sharing.

- In March 2025, Breville Group expanded its sous vide product line in Europe, targeting premium residential consumers with multifunctional cooking systems.

- In February 2025, KitchenBoss introduced a budget-friendly sous vide immersion circulator in Asia-Pacific markets to attract first-time buyers and expand regional penetration.