Solo Travel Market Size

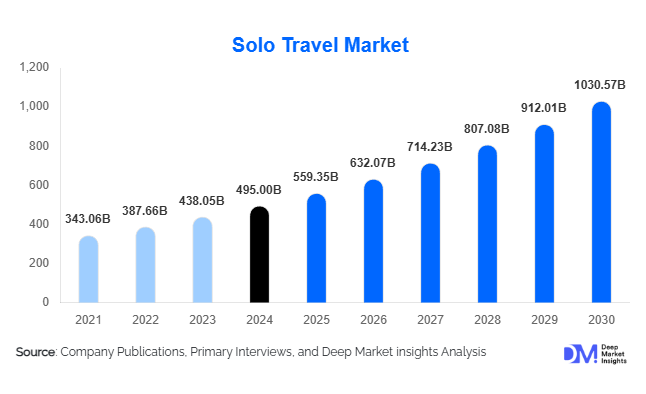

According to Deep Market Insights, the global solo travel market size was valued at USD 495 billion in 2024 and is projected to grow from USD 559.35 billion in 2025 to reach USD 1,030.57 billion by 2030, expanding at a CAGR of 13.0% during the forecast period (2025–2030). The solo travel market growth is primarily driven by increasing independence among travelers, the rise of digital nomadism, and growing demand for personalized and experiential travel options tailored to individuals seeking self-discovery and cultural immersion.

Key Market Insights

- Female solo travelers account for more than half of global solo travel demand (54% share in 2024), highlighting gender inclusivity and empowerment as key market drivers.

- Europe leads the global solo travel market with a 40% share in 2024, owing to its strong travel infrastructure, safety standards, and culture of independent exploration.

- Asia-Pacific is the fastest-growing region, projected to expand at over 16% CAGR from 2025 to 2030, fueled by rising middle-class affluence in India, China, and Southeast Asia.

- Online Travel Agencies (OTAs) and digital platforms dominate distribution, capturing more than 53% of solo travel bookings worldwide.

- Domestic solo travel represents nearly two-thirds (64%) of total solo trips, reflecting affordability, safety, and convenience as leading motivators.

- Digital innovation, including AI itinerary planners, travel safety apps, and community platforms, is redefining how solo travelers plan and experience journeys.

What are the latest trends in the solo travel market?

Technology-Enabled Independent Travel

Technology is playing a pivotal role in reshaping solo travel experiences. From AI-powered itinerary planning tools to mobile applications that connect travelers with local guides or fellow solo adventurers, digitalization is simplifying every aspect of solo travel. Features such as real-time language translation, GPS-based safety alerts, and AI-curated recommendations have made independent travel safer and more convenient. Augmented reality (AR) and virtual reality (VR) tools also allow travelers to preview destinations, while integrated insurance and emergency-response apps offer peace of mind for first-time solo explorers.

Rise of Female and Wellness-Oriented Solo Journeys

The surge in female solo travel is one of the most transformative trends in the market. Women are increasingly pursuing solo trips focused on wellness, self-care, and cultural exploration. This segment has encouraged the growth of women-only tours, yoga retreats, and spiritual getaways emphasizing safety and empowerment. Hotels and tour operators are responding with dedicated female-only packages, safety certifications, and social community networks that facilitate connection among travelers.

Remote Work and Digital Nomadism

With the global acceptance of remote work, more professionals are combining work and leisure through extended solo stays abroad. Digital nomads now form a significant share of solo travelers, seeking flexible accommodations, co-working spaces, and destinations with reliable digital infrastructure. Countries such as Portugal, Thailand, and Indonesia are introducing digital nomad visas and incentives, further accelerating this trend.

What are the key drivers in the solo travel market?

Growing Desire for Personal Freedom and Exploration

Modern travelers increasingly prioritize experiences that promote self-discovery, independence, and flexibility. The rise in disposable income among Millennials and Gen Z, coupled with social media showcasing solo adventures, is inspiring a new generation of independent travelers.

Technological Transformation in Travel Planning

The evolution of online travel agencies, dynamic pricing algorithms, and social media communities has made solo trip planning seamless. Platforms like Airbnb, Booking.com, and Expedia provide safe, transparent, and convenient booking experiences tailored for individuals, eliminating previous barriers associated with traveling alone.

Shift Toward Experiential and Sustainable Travel

Solo travelers often seek deeper cultural engagement and sustainable experiences over conventional sightseeing. Eco-tourism, volunteer travel, and locally immersive programs are increasingly popular, aligning with the growing global emphasis on responsible and ethical tourism.

What are the restraints for the global market?

Safety and Security Concerns

Perceptions of risk, particularly among female and first-time solo travelers, continue to challenge market growth. Concerns related to personal safety, scams, and healthcare accessibility discourage potential participants from traveling alone. Destinations that lack robust infrastructure or social safety mechanisms face difficulty in attracting solo visitors.

High Single-Occupancy Costs

The persistent “single supplement” in accommodation and tours remains a financial barrier. Solo travelers often pay up to 20–40% higher per-person rates compared to groups or couples. Although the hospitality sector is introducing single-room models and removing such surcharges, cost sensitivity continues to restrict adoption among younger demographics.

What are the key opportunities in the solo travel industry?

Development of Solo-Centric Tourism Ecosystems

Destinations and operators can design end-to-end solo-friendly services — from safety-certified accommodations and single-rate pricing to community-based events — catering exclusively to independent travelers. Themed experiences such as culinary solo tours, mindfulness retreats, and cultural immersion programs are strong growth niches.

Tech-Driven Personalization Platforms

There is vast potential for startups and established players to develop AI-based travel companions, interactive itineraries, and solo-traveler social networks. Blockchain-based safety verification, digital identity management, and integrated insurance products also present untapped opportunities in ensuring trust and transparency.

Rising Demand from Emerging Markets

In Asia-Pacific and Latin America, growing middle-class affluence and social acceptance of independent travel are driving a new wave of solo travelers. Governments can leverage this trend through tourism-friendly visa policies, infrastructure investment, and targeted campaigns showcasing destinations as safe and welcoming for solos.

Travel Type Insights

Leisure and vacation travel dominates the solo travel market, accounting for around 30% of total market revenue in 2024. The segment benefits from rising disposable incomes, expanding flight connectivity, and growing preference for city breaks, cultural tours, and relaxation retreats. Adventure and eco-travel are emerging subcategories appealing to younger demographics seeking experiential engagement, while spiritual and wellness-focused trips are expanding among older solo travelers.

Booking Mode Insights

Online Travel Agencies (OTAs) and digital platforms captured approximately 53.5% of global bookings in 2024. This dominance is attributed to transparency, real-time reviews, and customization flexibility. Direct booking through hotel or airline websites is also increasing, driven by loyalty programs and dynamic pricing. Peer-to-peer booking models such as Airbnb Experiences and co-living platforms further enhance accessibility for solo travelers.

Traveler Type Insights

Domestic solo travel leads with about 64% market share in 2024, as travelers prefer exploring within their own countries due to cost efficiency, familiarity, and safety. However, international solo travel is expanding at a faster CAGR as border restrictions ease and visa-free regimes proliferate. This shift is particularly visible in Europe and Asia, where short-haul flights and regional connectivity encourage cross-border solo trips.

Age and Gender Insights

The 25–40-year age group holds nearly 44% share of solo travel expenditure in 2024, driven by digital-savvy Millennials and early Gen Z professionals seeking flexible, experience-rich lifestyles. Female solo travelers constitute about 54% of total solo travelers, reflecting rising economic independence and societal acceptance. The 41–56 segment is emerging as a strong secondary contributor, especially for wellness and cultural journeys.

| By Travel Type | By Traveler Demographics | By Booking Channel | By Purpose of Travel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounted for roughly USD 95 billion of solo travel spending in 2024, growing at an estimated 12.4% CAGR. The U.S. dominates, with strong demand from Millennials and older professionals seeking wellness or digital nomad travel experiences. Increasing preference for domestic road trips, adventure tourism, and women’s travel groups supports market growth.

Europe

Europe remains the largest regional market with a 40% global share. Countries such as the U.K., Germany, France, and Italy feature mature infrastructure, affordable intra-regional travel, and robust solo travel communities. Government initiatives promoting sustainable and cultural tourism further strengthen the region’s leadership position.

Asia-Pacific

Asia-Pacific is the fastest-growing market, projected to expand at more than 16% CAGR through 2030. India and China are driving exponential growth, supported by increasing disposable income, improved connectivity, and pro-tourism policies. Japan, South Korea, and Australia exhibit steady growth due to high digital adoption and solo-friendly hospitality models.

Latin America

Latin America is witnessing rising outbound solo travel, particularly from Brazil, Mexico, and Argentina. While domestic solo travel remains small, cultural and eco-tourism programs are enhancing appeal for independent explorers.

Middle East & Africa

The Middle East, led by the UAE, Saudi Arabia, and Qatar, is emerging as a solo travel hub through strategic investments in tourism infrastructure. Africa’s inbound solo travel is strengthening, with destinations such as South Africa, Kenya, and Morocco becoming hotspots for adventure and cultural solos seeking authenticity and affordability.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Solo Travel Market

- Intrepid Travel

- G Adventures

- Contiki Holidays

- Flash Pack

- Trafalgar Tours

- Exodus Travels

- EF Education First

- Solos Holidays

- Hostelworld Group

- Airbnb, Inc.

- Expedia Group

- Booking Holdings Inc.

- TripAdvisor, Inc.

- Austin Adventures

- Withlocals

Recent Developments

- In August 2025, Flash Pack announced expansion into Asia-Pacific, introducing women-only and sustainability-led solo tour packages in Thailand and Indonesia.

- In May 2025, G Adventures launched an AI-driven trip matching platform that connects solo travelers based on shared interests, enhancing personalization and safety.

- In March 2025, Intrepid Travel removed all single supplements across its global itineraries, setting a new industry benchmark for solo inclusivity.

- In February 2025, Airbnb introduced a Solo Traveler Safety feature using AI to monitor host verification and provide real-time emergency support through its app.