Smart Ovens Market Size

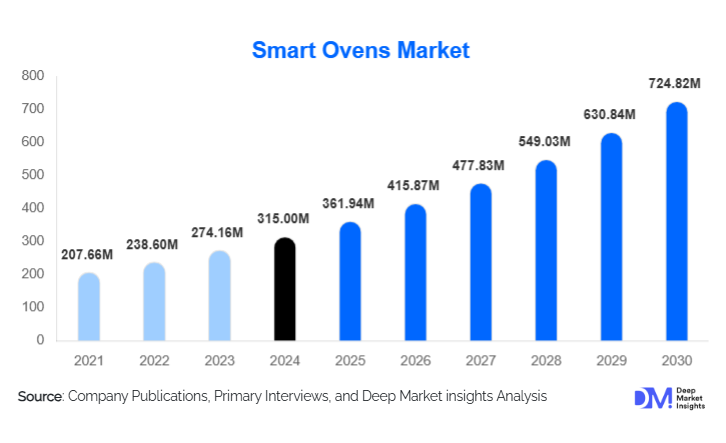

According to Deep Market Insights, the global smart ovens market size was valued at USD 315 million in 2024 and is projected to grow from USD 361.94 million in 2025 to reach USD 724.82 Million by 2030, expanding at a strong CAGR of 14.9% during the forecast period (2025–2030). Market growth is driven by rising smart home penetration, rapid consumer adoption of IoT-enabled kitchen appliances, and increasing demand for multifunctional cooking devices that integrate baking, air frying, grilling, and remote operation into a single compact solution.

Key Market Insights

- Countertop smart ovens dominate global shipments, driven by their affordability, compactness, and growing use in urban homes.

- Wi-Fi–enabled models hold over 50% of the global market share, supported by rising consumer appetite for remote control, app-linked cooking, and smart automation.

- Residential users account for nearly 70–75% of smart oven purchases, making home kitchens the strongest adoption segment.

- Asia-Pacific is the fastest-growing region, fueled by rising disposable income, urbanization, and growing smart home adoption in China and India.

- North America remains the largest market, with high smart-device penetration and strong retail infrastructure for premium connected appliances.

- Increased integration of AI-based cooking features, including adaptive heating, auto food recognition, and recipe automation, is reshaping user experience.

What are the latest trends in the smart ovens market?

AI-Enhanced and IoT-Integrated Cooking

Smart ovens are increasingly incorporating AI-driven cooking intelligence and cloud-based recipe databases. New-generation appliances can automatically identify food type, adjust temperature settings, and monitor doneness using camera sensors and machine learning algorithms. Integration with IoT ecosystems, such as smart thermostats, energy monitors, and voice assistants, is further enhancing their role within connected homes. These innovations appeal strongly to tech-forward consumers who prioritize seamless, intuitive cooking experiences with minimal manual intervention.

Rise of Multifunctional Compact Appliances

Urbanization and shrinking kitchen spaces are driving demand for multi-function smart ovens that combine convection baking, air frying, steaming, grilling, and dehydrating within a single appliance. Consumers are shifting toward versatile countertop models that save space and reduce reliance on multiple appliances. Compact smart ovens are also gaining traction among renters, students, and small families who want premium cooking convenience without the cost or complexity of built-in systems.

What are the key drivers in the smart ovens market?

Growing Smart Home Adoption

As smart speakers, connected lighting, and IoT appliances become mainstream, consumers are rapidly extending this ecosystem to their kitchens. Smart ovens that integrate with Alexa, Google Assistant, and smartphone apps offer greater control, automation, and convenience. The ability to preheat, monitor, or shut off the oven remotely has significantly boosted consumer interest, particularly among younger households adopting smart living solutions.

Health, Convenience, and Energy Efficiency

Consumer preferences are shifting toward healthier, faster cooking methods. Smart ovens with air frying, steam cooking, and automated recipe presets align strongly with this trend. Their built-in energy optimization features, such as power-saving modes, real-time energy tracking, and auto-shutoff, also address the rising demand for sustainable, low-waste appliances. Combined, these features position smart ovens as ideal for busy households seeking healthier, more convenient cooking solutions.

What are the restraints for the global market?

High Cost of Advanced Models

Smart ovens typically cost 2–4 times more than traditional ovens, making them less accessible in price-sensitive regions. Built-in models, in particular, require higher installation costs and often target premium households. Limited affordability constrains wider adoption across emerging markets where consumers prioritize basic functionality over advanced smart features.

Complexity, Reliability, and Cybersecurity Concerns

Connectivity issues, complex interfaces, firmware glitches, and security vulnerabilities in IoT devices hinder adoption. Some consumers remain hesitant about the long-term reliability of smart ovens and the risk of unauthorized device access. Manufacturers must invest in simpler UX design, stronger customer education, and enhanced cybersecurity to overcome these barriers.

What are the key opportunities in the smart ovens industry?

Integration with Smart Energy & Grid Systems

A major opportunity lies in linking smart ovens with home energy monitors and smart meters. This enables dynamic scheduling for off-peak hours, reducing electricity bills and contributing to cleaner energy consumption. Governments promoting energy-efficient appliances could amplify this trend through incentives, rebates, and eco-certification programs, accelerating adoption.

Commercial & Institutional Adoption

Restaurants, cloud kitchens, hotels, and institutional kitchens represent a high-value opportunity. Smart ovens can reduce labor costs, improve cooking consistency, and provide predictive maintenance insights, making them increasingly attractive for large-scale food operations. As commercial players digitize their kitchens, demand for robust, high-capacity smart ovens is expected to rise steadily.

Product Type Insights

Countertop smart ovens dominate the market, accounting for over 60–65% of 2024 revenue due to their portability, affordability, and strong adoption among apartment dwellers and smaller households. Built-in smart ovens appeal mainly to premium homeowners and kitchen remodelers seeking integrated, luxury kitchen aesthetics. Multifunction smart ovens, which combine air frying, grilling, baking, and steaming, are the fastest-growing product category, driven by the popularity of compact, all-in-one appliances.

Application Insights

Residential applications account for nearly 70–75% of global demand, fueled by the rise of smart homes and heightened interest in healthier home cooking. Smart ovens are particularly attractive to families and young professionals seeking IoT-enabled convenience. The commercial segment is expanding due to growing adoption in restaurants, cafés, hotels, and cloud kitchens, where automation and consistency are essential. Institutional kitchens, such as culinary schools and food R&D labs, are emerging adopters of advanced AI-enabled cooking systems.

Distribution Channel Insights

Online channels dominate with 55–60% market share, supported by rapid e-commerce expansion, consumer access to product reviews, and competitive pricing. Offline appliance stores continue to thrive in the premium category, where customers seek hands-on product demonstrations. Direct-to-consumer sales through brand-owned websites are rising as manufacturers invest in digital storefronts, subscription-based recipe platforms, and integrated customer support ecosystems.

Consumer Type Insights

Tech-savvy buyers, young families, and urban households are the primary adopters of smart ovens. Budget and mid-range consumers prefer compact countertop devices, while premium consumers gravitate toward built-in ovens with advanced automation and AI-driven cooking assistance. Commercial buyers prioritize durability, time-saving automation features, and cross-location consistency.

Price Tier Insights

Mid-tier smart ovens hold the largest share (~50%), balancing affordability with smart connectivity and multifunction cooking. Premium models target affluent households seeking superior design, advanced AI cooking, and deep smart-home integration. Entry-level smart ovens with basic Wi-Fi and preset capabilities are gaining popularity in emerging markets as manufacturers introduce cost-optimized designs.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America leads the global market with a 35–40% share in 2024, driven by widespread smart home adoption, strong purchasing power, and a mature retail ecosystem for home appliances. The U.S. remains the single largest country-level market, with high demand for premium brands and AI-integrated kitchen solutions. Replacement sales and kitchen remodeling trends continue to support long-term growth.

Europe

Europe accounts for 25–30% of global demand, led by Germany, the U.K., France, and Italy. Consumer preference for energy-efficient, built-in appliances boosts market expansion. Sustainability-focused regulations and high disposable incomes support strong traction for premium and mid-tier smart ovens, particularly in urban regions.

Asia-Pacific

Asia-Pacific is the fastest-growing region, accounting for 20–25% of the global market in 2024 and projected to expand rapidly through 2030. China drives the bulk of demand, while India and Southeast Asia represent emerging hotspots due to rising middle-class incomes. Japan and South Korea remain mature but stable demand centers for high-tech kitchen appliances.

Latin America

The region shows growing adoption in Brazil, Mexico, and Argentina, supported by rising urbanization and expanding e-commerce penetration. Demand is still in early stages but growing steadily as affordable smart ovens enter the mid-tier price range.

Middle East & Africa

MEA holds a smaller share but shows rising interest in affluent markets such as the UAE and Saudi Arabia, where premium smart kitchen appliances are popular among luxury households. Africa’s growth remains limited but increasing in hospitality and commercial kitchens.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Manufacturers in the Smart Ovens Market

- Whirlpool Corporation

- BSH Home Appliances (Bosch)

- Samsung Electronics

- LG Electronics

- Breville Group

- Panasonic Corporation

- Miele

- Haier

- Sharp Corporation

- Electrolux AB

- GE Appliances

- Tovala

- June Oven

- Brava Home

- Sub-Zero Group

Recent Developments

- In April 2025, Samsung launched a new AI-powered smart oven with automatic food recognition and adaptive cooking algorithms in the U.S. and Europe.

- In March 2025, Breville expanded its smart countertop oven line with multifunction steam-convection models designed for small kitchens.

- In January 2025, Bosch introduced energy-optimized built-in smart ovens integrated with smart home energy-management systems across select EU markets.