Second-hand Books Market Size

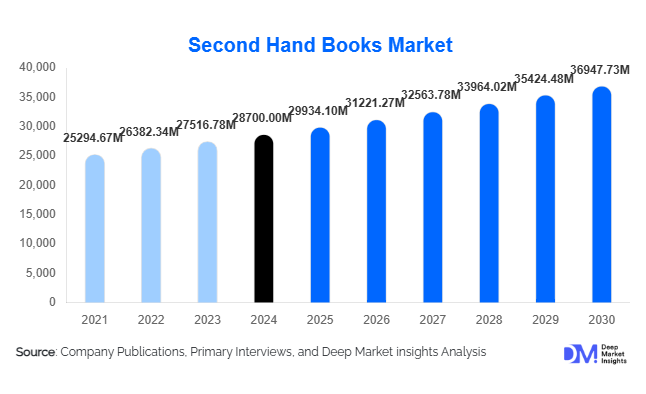

According to Deep Market Insights, the global second-hand books market size was valued at USD 28,700.00 million in 2024 and is projected to grow from USD 29,934.10 million in 2025 to reach USD 36,947.73 million by 2030, expanding at a CAGR of 4.3% during the forecast period (2025–2030). The second-hand books market growth is primarily driven by rising textbook prices, increasing adoption of circular economy practices, growth of online resale platforms, and strong demand for affordable reading materials across both developed and emerging economies.

Key Market Insights

- Academic and educational books dominate the market, accounting for the largest revenue share due to recurring demand cycles from students and institutions.

- Online marketplaces lead distribution, supported by improved logistics, digital payments, and peer-to-peer resale models.

- North America remains the largest regional market, driven by a mature resale ecosystem and high digital adoption.

- Asia-Pacific is the fastest-growing region, fueled by expanding student populations and price-sensitive consumers.

- Sustainability and reuse trends are strengthening consumer preference for second-hand books over new print copies.

- Technology adoption, including AI-based pricing and inventory optimization, is improving platform profitability and scalability.

What are the latest trends in the second-hand books market?

Shift Toward Organized Online Resale Platforms

The second-hand books market is witnessing a strong shift from informal resale channels toward organized online platforms. Dedicated used-book marketplaces and peer-to-peer resale applications are enabling transparent pricing, wider title availability, and faster fulfillment. These platforms are increasingly using AI-driven pricing models, condition grading tools, and demand forecasting to improve inventory turnover. Subscription-based resale models and buy-back guarantees are also emerging, particularly for academic textbooks, enhancing customer trust and repeat purchases.

Sustainability-Led Consumer Behavior

Environmental awareness is reshaping buying behavior, with consumers increasingly viewing second-hand books as a sustainable alternative to new print production. Reuse of books aligns with global circular economy goals by reducing paper consumption and carbon emissions. Educational institutions, libraries, and NGOs are also integrating second-hand procurement into sustainability initiatives, further strengthening long-term demand.

What are the key drivers in the second-hand books market?

Rising Cost of New Books

Escalating prices of new academic, professional, and reference books remain the strongest growth driver. Students can save 40–70% by purchasing second-hand books, making resale channels essential in higher education markets. This trend is particularly pronounced in North America, Europe, and India, where textbook inflation continues to outpace general consumer inflation.

Growth of Digital Commerce and Logistics

Improved last-mile delivery, digital wallets, and cross-border shipping have significantly reduced friction in the resale ecosystem. Consumers can now access global inventories of used books, including out-of-print and niche titles, supporting market expansion beyond local resale networks.

What are the restraints for the global market?

Inconsistent Quality and Condition Standards

Lack of uniform grading standards across platforms remains a challenge, particularly in online sales. Variability in book condition can lead to customer dissatisfaction and higher return rates, increasing operational costs for sellers.

Digital Substitution Risk

The increasing availability of e-books, open educational resources, and digital libraries poses a long-term restraint, especially in developed markets. While physical books remain preferred in many segments, digital alternatives continue to gain traction.

What are the key opportunities in the second-hand books industry?

Institutional and Bulk Procurement Programs

Governments, libraries, and educational institutions are expanding bulk procurement of second-hand books to reduce costs and meet sustainability goals. Structured B2B resale models and long-term supply contracts represent a significant opportunity for organized players.

Emerging Market Penetration

Asia-Pacific, Latin America, and Africa offer strong growth opportunities due to large student populations, rising literacy rates, and high price sensitivity. Localization of platforms, regional language inventory, and affordable logistics models can unlock substantial untapped demand.

Book Type Insights

Academic and educational books dominate the second-hand books market, accounting for approximately 42% of the 2024 market value. Trade books, including fiction and non-fiction books, represent a significant share driven by leisure reading and gifting. Children’s books are growing steadily due to frequent replacement cycles, while rare and collectible books form a smaller but high-margin premium segment supported by collectors and libraries.

Sales Channel Insights

Online marketplaces account for nearly 55% of total market revenue, benefiting from scale, convenience, and global reach. Offline channels such as independent used bookstores, street vendors, and college bookstores continue to play a vital role, particularly in emerging markets and local communities where digital penetration remains limited.

End-User Insights

Individual consumers represent the largest end-user group, contributing nearly 68% of total demand, led by students and leisure readers. Educational institutions and libraries are among the fastest-growing end users, driven by budget constraints and sustainability mandates. Collectors and bibliophiles drive demand for rare and antiquarian books, supporting premium pricing tiers.

| By Book Type | By Sales Channel | By End User | By Pricing Tier |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 32% of the global second-hand books market in 2024, led by the United States. High textbook costs, strong online resale infrastructure, and mature logistics networks underpin regional demand.

Europe

Europe holds around 28% market share, with strong demand from the U.K., Germany, and France. Sustainability-focused consumption and institutional reuse programs support steady growth.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at over 8% CAGR. India and China lead demand due to large student populations, expanding e-commerce adoption, and affordability-driven purchasing behavior.

Latin America

Latin America represents a developing market, with Brazil and Mexico emerging as key contributors. Growth is supported by expanding education access and rising online resale platforms.

Middle East & Africa

The Middle East & Africa region shows steady growth, particularly in South Africa, Nigeria, and the UAE, supported by education sector demand and NGO-led book redistribution programs.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Leading Players in the Second-Hand Books Market

- Amazon (Used Books Division)

- ThriftBooks

- Better World Books

- AbeBooks

- World of Books

- Half Price Books

- Alibris

- Powell’s Books

- Medimops

- Biblio