Non-Fiction Books Market Size

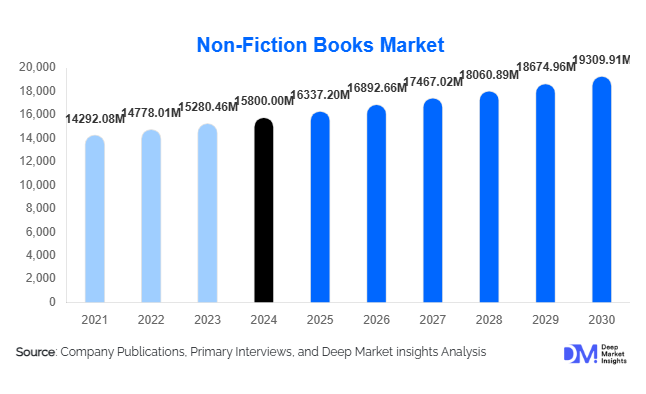

According to Deep Market Insights, the global non-fiction books market size was valued at USD 15,800 million in 2024 and is projected to grow from USD 16,337.2 million in 2025 to reach USD 19,309.91 million by 2030, expanding at a CAGR of 3.4% during the forecast period (2025–2030). Market growth is primarily driven by the surge in digital reading formats, increasing global appetite for self-improvement and professional development content, and rapid expansion across emerging markets fueled by online distribution and localized publishing initiatives.

Key Market Insights

- Digital transformation is reshaping the non-fiction publishing ecosystem, with eBooks and audiobooks gaining notable traction among younger demographics and professional audiences.

- Self-help and personal development books dominate global demand, accounting for nearly one-fifth of total non-fiction book revenues in 2024.

- Asia-Pacific emerges as the fastest-growing region, driven by rising literacy rates, expanding middle-class populations, and digital accessibility in India, China, and Southeast Asia.

- Print formats continue to lead the market with over 60% share, but hybrid print–digital offerings are becoming the industry standard among leading publishers.

- Online channels now account for nearly 45% of total sales, as e-commerce and subscription-based models redefine reader engagement.

- The top five global publishers hold approximately 35–40% market share, with significant investments in audiobooks, AI-powered publishing tools, and data-driven marketing strategies.

Latest Market Trends

Rise of Digital and Audio Consumption

Readers increasingly prefer mobile-friendly digital formats and audiobooks due to convenience, affordability, and accessibility. Audiobook streaming platforms and subscription-based services such as Audible, Scribd, and Storytel are enabling continuous revenue generation for publishers and authors. Integration of AI narration, multi-language support, and personalization algorithms is enhancing user experiences and helping publishers target micro-niches within global markets.

Localization and Regional Content Expansion

Localization of non-fiction content across emerging markets is transforming readership patterns. Publishers are translating global bestsellers into regional languages, tailoring themes to cultural contexts, and using local influencers for promotion. India, Indonesia, and Brazil are witnessing a surge in local-language non-fiction publications, especially in self-help, business, and spirituality segments. This trend is significantly broadening the addressable audience base for international publishers.

Non-Fiction Books Market Drivers

Growing Demand for Self-Improvement and Professional Learning

The rising global interest in mental well-being, productivity, leadership, and personal finance continues to drive demand for non-fiction titles. As hybrid work models and continuous learning gain traction, professionals increasingly consume books to acquire new skills and insights. Corporate training programs are also incorporating licensed non-fiction titles into their learning modules, amplifying demand across institutional channels.

Digital Distribution and Subscription Model Expansion

The proliferation of e-commerce and digital platforms has democratized publishing, enabling both established publishers and independent authors to reach global readers. Subscription-based reading platforms and bundled audiobook services are generating recurring revenue streams. These channels are improving discoverability for niche authors and supporting new monetization models such as micro-subscriptions and direct author–reader engagement.

Emerging Market Growth and Rising Literacy

Emerging economies in Asia-Pacific, Latin America, and the Middle East are driving incremental market expansion. Increasing literacy rates, smartphone penetration, and government-backed education initiatives have significantly enlarged the reader base. As digital payment ecosystems mature, readers in these markets are purchasing more eBooks and participating in global subscription ecosystems, accelerating long-term market penetration.

Market Restraints

Market Saturation and Competitive Intensity

The non-fiction category is heavily saturated, with millions of titles competing for limited reader attention. The influx of self-published works has intensified competition and diluted average sales per title. As discoverability becomes challenging, publishers must rely on data analytics and targeted digital marketing to sustain visibility and profitability in an increasingly crowded marketplace.

Stagnation in Mature Print Markets

While print books still dominate global revenues, demand in mature regions such as North America and Western Europe is plateauing. Rising production and logistics costs, coupled with declining bookstore traffic, are constraining growth. Paper price volatility and sustainability pressures are prompting publishers to diversify formats and adopt environmentally responsible printing practices.

Non-Fiction Books Market Opportunities

Digital-First Publishing and Audio Integration

The rapid adoption of smartphones and smart speakers has unlocked major growth potential for digital-first and audiobook releases. Publishers are investing in AI narration, voice localization, and multilingual distribution to attract broader audiences. Digital-first strategies reduce capital expenditure and allow agile pricing and faster time-to-market for new titles.

Emerging Market Localization Strategies

Expanding into regional languages and culturally contextual content presents significant upside potential. Governments in India, Indonesia, and several African countries are promoting local-language publishing through grants and literacy programs. Partnerships between global publishers and local authors are bridging content gaps, enhancing authenticity, and improving engagement among first-time readers.

Niche and Value-Added Content Development

Focusing on specialized, high-value niches, such as data science, climate studies, wellness, and entrepreneurship, offers new monetization opportunities. Interactive eBooks and hybrid audio-text formats with embedded video, community access, or gamified learning elements can differentiate offerings and command premium pricing in both B2C and B2B markets.

Format Insights

Print remains the largest format segment, commanding approximately 60% of the global market in 2024, valued at around USD 9.2 billion. Despite modest growth, printed non-fiction books maintain strong demand due to their tactile value, gifting appeal, and continued dominance in educational and corporate settings. Digital formats, including eBooks and audiobooks, collectively represent the fastest-growing segment, projected to exceed USD 6 billion by 2030 as mobile and subscription adoption accelerates.

Category Insights

The Self-Help and Personal Development category leads global non-fiction sales, accounting for nearly 18% of total revenues in 2024 (approximately USD 2.75 billion). Topics such as wellness, productivity, emotional intelligence, and leadership continue to resonate across demographics. Business and economics, science and technology, and history categories follow closely, each contributing 10–15% of global revenues.

Distribution Channel Insights

Online sales represent the dominant and fastest-growing channel, with an estimated 45% share of the 2024 market. The shift toward digital marketplaces and direct-to-consumer (D2C) models enables global reach and improved margins for publishers. Brick-and-mortar bookstores continue to serve as key discovery points but are gradually transitioning toward experiential retail, events, and community engagement to sustain relevance.

End-Use Insights

Individual readers form the largest consumer segment for non-fiction books, driven by self-improvement and lifestyle content. The professional and academic segments are witnessing strong growth, particularly through corporate learning programs and educational institutions adopting non-fiction resources. Export-driven demand is rising for English-language content in Asia-Pacific and Latin America, while localized non-fiction books are seeing sharp uptake in domestic markets due to language accessibility and cultural resonance.

| By Genre | By Format | By Distribution Channel | By End-User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds roughly 25% of the global non-fiction market (about USD 3.8 billion in 2024). The U.S. remains a publishing powerhouse, driven by prolific author networks, strong retail infrastructure, and high digital adoption. Growth is stable, with digital audio and subscription services offsetting stagnation in physical sales.

Europe

Europe represents around 20% of the market (USD 3.0 billion), led by the U.K., Germany, and France. Demand for translated works, sustainability-themed titles, and academic publishing continues to drive moderate growth. However, digital adoption lags behind North America, and print still dominates overall sales.

Asia-Pacific

Asia-Pacific accounts for approximately 30% of global revenues and is the fastest-growing regional market. India and China are leading the growth, supported by literacy initiatives, expanding digital ecosystems, and rising incomes. Localized language editions and partnerships with mobile reading apps are unlocking new revenue streams.

Latin America

Latin America is a promising emerging region, contributing nearly 10% of global market value. Brazil and Mexico are key markets where digital distribution and regional-language non-fiction are gaining traction. Growth is supported by cultural emphasis on education and increased adoption of mobile reading platforms.

Middle East & Africa

MEA collectively accounts for around 8–10% of global revenues, with growth driven by educational reforms, literacy programs, and rising internet penetration. Gulf countries are witnessing higher consumption of English-language business and leadership books, while African markets like Nigeria and Kenya are expanding local-language publishing ecosystems.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Non-Fiction Books Market

- Penguin Random House LLC

- HarperCollins Publishers LLC

- Hachette Livre S.A.

- Macmillan Publishers Limited

- Scholastic Corporation

- Pearson PLC

- McGraw-Hill LLC

- Thomson Reuters Corporation

- Bloomsbury Publishing PLC

- W.W. Norton & Company, Inc.

- Oxford University Press

- Cambridge University Press

- Chronicle Books LLC

- Andrews McMeel Publishing LLC

- Diversion Books LLC

Recent Developments

- In September 2025, Penguin Random House announced new AI-assisted translation tools to accelerate localized publishing across Asia-Pacific and Latin America.

- In July 2025, HarperCollins expanded its audiobook production division, partnering with emerging voice-technology startups to enhance multilingual offerings.

- In March 2025, Macmillan Publishers launched a global direct-to-consumer platform integrating eBook, audiobook, and community subscription models under one interface.