RTA Furniture Market Size

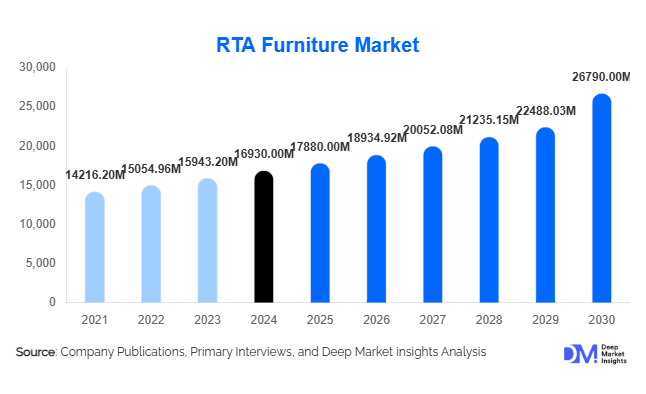

According to Deep Market Insights, the global Ready-to-Assemble (RTA) furniture market was valued at USD 16,930 million in 2024 and is projected to grow from USD 17,880 million in 2025 to reach USD 26,790 million by 2032, expanding at a CAGR of 5.9% during the forecast period (2025–2032). The market growth is primarily driven by rising urbanization, the proliferation of e-commerce platforms, growing demand for cost-effective and space-saving furniture, and increasing consumer preference for sustainable and customizable home furnishing solutions.

Key Market Insights

- Urbanization and smaller living spaces are driving demand for compact and multifunctional RTA furniture, which allows consumers to optimize home interiors efficiently.

- Online retail channels dominate distribution, with the convenience of digital platforms significantly increasing the adoption of RTA furniture worldwide.

- Sustainability and eco-friendly furniture are gaining traction, with manufacturers increasingly offering products made from recycled materials to meet consumer and regulatory expectations.

- Customization and modular design trends enable consumers to personalize furniture for aesthetic and functional purposes, enhancing overall market appeal.

- Technological integration in manufacturing, including automation, advanced materials, and enhanced logistics, is improving product quality while reducing costs.

Latest Market Trends

Rise of E-commerce and Digital Retailing

The expansion of online platforms is transforming the RTA furniture market. Consumers now prefer purchasing furniture through e-commerce sites that provide real-time price comparisons, detailed product descriptions, and doorstep delivery. Retailers are leveraging augmented reality (AR) tools, 3D visualizations, and AI-assisted recommendation systems to enhance consumer experience and reduce product returns. This trend is particularly strong among tech-savvy younger demographics who value convenience, personalization, and immediate access to a variety of designs.

Sustainability and Eco-Friendly Offerings

Increasing environmental awareness is prompting manufacturers to adopt eco-conscious materials such as FSC-certified wood, recycled metals, and sustainable laminates. RTA furniture brands are positioning sustainability as a key differentiator, providing certifications and promoting low-carbon footprint designs. Additionally, companies are experimenting with biodegradable packaging and circular economy strategies, strengthening brand loyalty among environmentally conscious consumers and aligning with regional regulations on waste and material use.

Customization and Modular Design Adoption

Consumer demand for personalized and flexible furniture solutions is growing. Modular RTA furniture allows for adaptable configurations, which can suit changing home layouts and lifestyle requirements. Manufacturers offering interchangeable components, multiple finish options, and expandable designs are witnessing higher adoption rates. This trend is particularly significant in urban markets with limited space, as it provides both functional and aesthetic benefits while supporting long-term customer engagement.

RTA Furniture Market Drivers

Urbanization and Space Constraints

The rise of urban housing with smaller apartments and compact living spaces has created strong demand for RTA furniture. Consumers increasingly seek multifunctional and space-saving designs, such as foldable tables, modular shelving, and stackable chairs. These products enable homeowners to optimize space without compromising on style, thereby driving market growth globally.

Cost-Effectiveness

RTA furniture is inherently more affordable than traditional pre-assembled furniture, as flat-pack manufacturing and shipping reduce logistical costs. The price advantage appeals to budget-conscious consumers, students, and young families. This cost efficiency has fueled RTA furniture adoption in emerging markets and contributed to consistent demand in mature markets.

Technological Advancements in Manufacturing

Automation, CNC machinery, and advanced material engineering have improved production efficiency, precision, and product durability. Companies are now able to offer high-quality furniture at competitive prices, supporting faster market expansion and meeting the increasing expectations of consumers seeking both functionality and aesthetics.

Market Restraints

Perceived Quality Concerns

Despite improvements, some consumers still associate RTA furniture with lower durability compared to pre-assembled furniture. Perceptions of inferior quality may deter certain buyer segments, requiring manufacturers to invest in marketing, warranty programs, and demonstrable quality assurances.

Assembly Challenges

RTA furniture requires consumer assembly, which can be a barrier for less DIY-inclined users. Complicated instructions, missing hardware, or errors in assembly may result in dissatisfaction. Companies are increasingly offering professional assembly services or simplified instructional materials to overcome this restraint.

RTA Furniture Market Opportunities

Expansion via E-Commerce Platforms

Online retail continues to be a major growth opportunity. Companies can tap into global demand by offering direct-to-consumer shipping, virtual visualization tools, and omnichannel experiences. Online marketplaces allow smaller RTA brands to reach wider audiences, while large players enhance customer engagement through AI-powered recommendations and AR tools that simulate furniture in a user’s home.

Sustainable and Eco-Friendly Product Lines

Growing environmental awareness creates opportunities for eco-conscious product offerings. Manufacturers producing RTA furniture with recycled materials, low VOC coatings, and energy-efficient production techniques can attract environmentally aware consumers and gain a competitive advantage. Government incentives for sustainable manufacturing further strengthen this opportunity.

Customization and Modular Design Innovations

There is significant potential for RTA furniture companies to expand modular and customizable offerings. Urban consumers increasingly prefer adjustable configurations, allowing furniture to adapt to evolving lifestyles and home layouts. Companies providing these options can differentiate themselves in a crowded market and enhance customer retention through repeat purchases and upgrades.

Product Type Insights

Tables are the leading product type in the RTA furniture market, accounting for approximately 21% of the 2024 market share. High demand stems from multifunctional tables suitable for dining, work-from-home setups, and storage. Trends favor modular, foldable, and extendable tables, which cater to limited space environments, particularly in urban households. The consistent rise in home offices and flexible living spaces has reinforced tables as a top-performing RTA furniture segment globally.

Material Insights

Wood dominates the RTA furniture material segment, holding around 47% of the market share in 2024. Consumers value wood for its durability, versatility, and classic aesthetic. Engineered wood, particleboard, and MDF are increasingly used to reduce costs while maintaining strength, contributing to steady adoption in residential and commercial applications.

Distribution Channel Insights

Online retail leads the distribution channel segment due to convenience, variety, and competitive pricing. Consumers increasingly rely on e-commerce to browse, compare, and purchase furniture without visiting physical stores. Specialty stores and home improvement centers remain relevant for tactile experiences, but digital platforms dominate sales growth, particularly in North America, Europe, and APAC.

End-Use Insights

The residential sector accounts for the largest demand for RTA furniture, driven by urbanization, homeownership trends, and increasing home office setups. The commercial sector, including offices, hospitality, and co-working spaces, also contributes to growth, as businesses seek cost-efficient, modular, and aesthetically versatile solutions. Rising exports to emerging markets further expand opportunities for manufacturers targeting both residential and commercial segments.

| By Product Type | By Material | By Distribution Channel | By End-Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America held approximately 27% of the global RTA furniture market in 2024. The United States and Canada are key demand drivers due to high urban population density, online shopping penetration, and the preference for space-saving furniture. Demand growth is supported by home renovation trends and increasing remote work setups.

Europe

Europe contributed roughly 25% of the global market in 2024. Germany, France, and the U.K. are leading countries due to strong consumer preference for sustainable and durable furniture. Modular and customizable RTA furniture adoption is high, particularly in urban areas with limited living space.

Asia-Pacific

APAC is the fastest-growing region, with strong demand in China, India, and Japan. Urbanization, rising disposable income, and increased e-commerce adoption are driving growth. Consumers increasingly favor compact, multifunctional furniture suitable for small apartments and urban lifestyles.

Middle East & Africa

Growth is moderate, with key markets including the UAE, Saudi Arabia, and South Africa. Urban development and rising demand for modern, functional furniture are primary drivers.

Latin America

Brazil and Mexico are emerging markets, witnessing increasing demand for affordable and stylish RTA furniture. Urbanization and growth in e-commerce adoption are key contributors to market expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the RTA Furniture Market

- IKEA

- Herman Miller

- HNI Corporation

- Ashley Furniture

- Hafele

- La-Z-Boy

- Flexsteel Industries

- Sauder Woodworking

- Hulsta

- Ligne Roset

- Furnitech

- Steelcase

- Koncept Furniture

- Muji

- Wayfair

Recent Developments

- In March 2025, IKEA launched a new line of modular RTA furniture focusing on eco-friendly materials and urban compact designs.

- In January 2025, Wayfair expanded its online customization platform, enabling customers to configure RTA furniture for home office and small-space applications.

- In February 2025, Ashley Furniture invested in automated assembly lines and sustainable material sourcing, increasing production efficiency and reducing carbon footprint.