RGP Contact Lenses Market Size

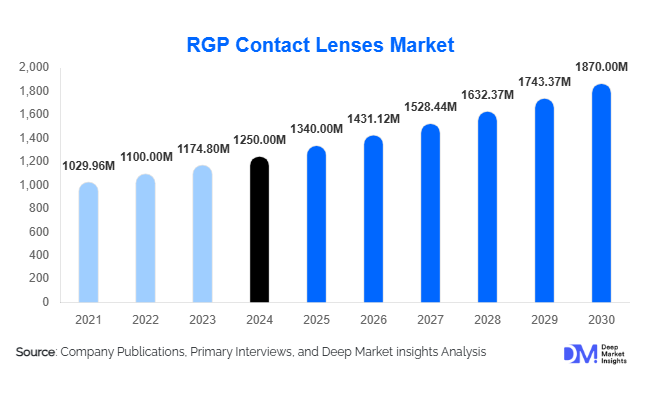

According to Deep Market Insights, the global RGP (Rigid Gas Permeable) contact lenses market size was valued at USD 1,250 million in 2024 and is projected to grow from USD 1,340 million in 2025 to reach USD 1,870 million by 2030, expanding at a CAGR of 6.8% during the forecast period (2025–2030). The market growth is primarily driven by increasing prevalence of vision disorders such as keratoconus and astigmatism, rising adoption of technologically advanced lens materials, and growing awareness regarding the benefits of custom and hybrid RGP lenses over traditional soft lenses.

Key Market Insights

- Toric and hybrid RGP lenses are gaining preference globally, especially for patients with irregular corneal shapes and high astigmatism, providing superior vision correction compared to soft lenses.

- Fluorosilicone acrylate materials dominate the market, offering high oxygen permeability and durability, leading to increased adoption for long-term and specialty applications.

- North America leads the market, driven by a mature ophthalmology infrastructure, technological adoption, and high patient awareness regarding vision correction options.

- Asia-Pacific is the fastest-growing region, fueled by rising middle-class populations in China and India, improving eye care infrastructure, and increasing tele-optometry services.

- E-commerce and tele-optometry platforms are expanding market reach, enabling patients in urban and semi-urban areas to access customized lenses more conveniently.

- Technological innovations, including digital lens fitting, AI-enabled diagnostics, and hybrid RGP designs, are reshaping patient experiences and adoption rates worldwide.

Latest Market Trends

Rise of Hybrid and Custom Lens Designs

Manufacturers are increasingly focusing on hybrid RGP lenses that combine a rigid center with a soft peripheral skirt to improve comfort without compromising visual clarity. Custom-designed lenses are also gaining traction, particularly for keratoconus patients or post-surgical vision correction. This trend is driven by patient demand for tailored solutions and improved lens performance, creating opportunities for premium, higher-margin products in the market.

Technological Advancements in Lens Materials

High-Dk fluorosilicone acrylate materials are revolutionizing RGP lenses, providing superior oxygen permeability and durability. Advanced lens shaping technologies, including front and back surface designs, allow precise fitting for irregular corneas, reducing adaptation time and improving patient satisfaction. The adoption of digital fitting systems and AI-based eye measurements is further enhancing lens accuracy and enabling remote prescription services, particularly in emerging markets.

RGP Contact Lenses Market Drivers

Increasing Prevalence of Eye Disorders

The global rise in myopia, astigmatism, and keratoconus is a key driver for RGP lenses. Patients requiring high-precision vision correction increasingly prefer RGP lenses over soft lenses due to their durability and superior oxygen permeability. Rising screen time, urban lifestyle changes, and aging populations contribute to growing eye health challenges, supporting long-term market demand.

Growing Awareness of Vision Care and Eye Health

Educational campaigns, eye health programs, and optometrist recommendations have improved awareness of RGP lens benefits. Patients are increasingly seeking solutions that offer long-term comfort, precise vision correction, and durability. Adoption is particularly high in urban regions where access to ophthalmology clinics is greater and disposable income allows investment in premium lenses.

Technological Innovations and Digital Fitting

Advanced lens design, hybrid models, and AI-enabled fitting solutions are driving adoption. These technologies ensure accurate prescriptions, reduce adaptation time, and allow tele-optometry-based ordering. Companies investing in R&D for material enhancements and precision fitting can command higher margins and expand their consumer base.

Market Restraints

Higher Initial Cost Compared to Soft Lenses

RGP lenses are costlier upfront and require a longer adaptation period. This can deter price-sensitive patients, particularly in emerging markets, slowing overall adoption. High cost relative to soft lenses remains a significant restraint for wider market penetration.

Need for Specialized Fitting and Maintenance

RGP lenses require professional fitting and periodic adjustments. In regions with limited optometry infrastructure, the complexity of fitting and maintenance reduces patient access and adoption, acting as a barrier to market growth.

RGP Contact Lenses Market Opportunities

Expansion in Emerging Markets

Emerging regions such as India, China, and Latin America present untapped growth potential. Rising disposable incomes, urbanization, and increasing awareness of eye care are driving demand. Companies can capitalize on these markets through partnerships with clinics, local manufacturing, and tailored marketing campaigns targeting first-time and premium lens users.

Integration of Advanced Lens Technologies

Innovations such as high-Dk hybrid lenses and AI-enabled digital fitting solutions offer significant growth opportunities. Companies investing in R&D to enhance comfort, precision, and customization can attract patients with complex vision correction needs, creating premium segments within the market.

Growth of Tele-optometry and E-Commerce Channels

Direct-to-consumer platforms and tele-optometry services are expanding market reach, allowing patients to order custom lenses remotely. Subscription models, lens replacement services, and online consultation options present new revenue streams for market participants, especially in regions with limited clinic access.

Product Type Insights

Toric RGP lenses dominate the market, accounting for 35% of global revenue in 2024, driven by rising astigmatism prevalence. Hybrid lenses, combining RGP and soft skirts, are rapidly gaining adoption, particularly for irregular corneas and keratoconus, due to comfort and improved visual clarity. Spherical lenses remain steady for standard myopia and hyperopia correction, while multifocal designs for presbyopia are emerging as niche high-value offerings.

Application Insights

Optical clinics and hospitals remain the primary end-use segment, accounting for 55% of global demand in 2024. Tele-optometry and e-commerce channels are emerging rapidly, allowing urban and semi-urban patients to access customized solutions. Specialty eye care centers focused on keratoconus, post-surgical care, and sports vision represent new applications driving incremental growth.

Distribution Channel Insights

Clinics, hospitals, and specialty centers dominate distribution, providing professional fitting and long-term support. E-commerce and tele-optometry platforms are expanding rapidly, allowing direct patient access. Subscription-based replacement services and online consultation models are emerging, particularly in Asia-Pacific and North America, increasing convenience and repeat purchases.

End-Use Insights

Optical clinics and hospitals dominate demand, while direct-to-consumer retail and tele-optometry channels are the fastest-growing segments (8–9% CAGR). Specialty vision care centers and sports vision clinics represent new applications. Export-driven demand flows from North America and Europe to emerging markets, primarily for custom and hybrid lenses, supporting global market expansion.

| By Product Type | By Material Type | By Lens Design | By Wear Mode | By End-Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads with 40% market share in 2024. Strong ophthalmology infrastructure, high awareness, and adoption of advanced RGP lenses drive market dominance. The U.S. and Canada are key contributors, particularly for keratoconus and post-surgical applications.

Europe

Europe accounts for 30% market share, led by Germany, the UK, and France. High patient awareness, technological adoption, and robust healthcare systems support steady growth. Eco-conscious and patient-specific lens trends are driving innovation adoption in this region.

Asia-Pacific

Asia-Pacific is the fastest-growing region (10.5% CAGR), driven by China, India, and Japan. Expanding middle-class populations, increasing access to eye care, and rising tele-optometry adoption are accelerating market growth.

Middle East & Africa

MEA shows moderate growth, led by the UAE, Saudi Arabia, and South Africa. Modernization of eye care infrastructure and urbanization are supporting adoption, particularly for premium and custom lenses.

Latin America

Brazil, Argentina, and Mexico are driving slow but steady growth, focusing on specialized clinics and outbound imports of advanced RGP lenses for astigmatism and keratoconus patients.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the RGP Contact Lenses Market

- Bausch + Lomb

- Alcon

- CooperVision

- Contamac

- Menicon

- SynergEyes

- Art Optical

- X-Cel Specialty Contacts

- BostonSight

- Paragon Vision Sciences

- Conoptica

- Blanchard Lab

- UltraVision CLPL

- GP Lens Labs

- EyeLab International

Recent Developments

- In May 2025, Menicon expanded its hybrid lens production in Japan to meet the rising demand for keratoconus patients.

- In April 2025, Bausch + Lomb launched an AI-assisted digital fitting platform in North America, enhancing prescription accuracy and patient satisfaction.

- In February 2025, CooperVision introduced a high-Dk custom RGP lens in Europe, targeting post-surgical patients and premium segments.