RFID Electronic Lock Market Size

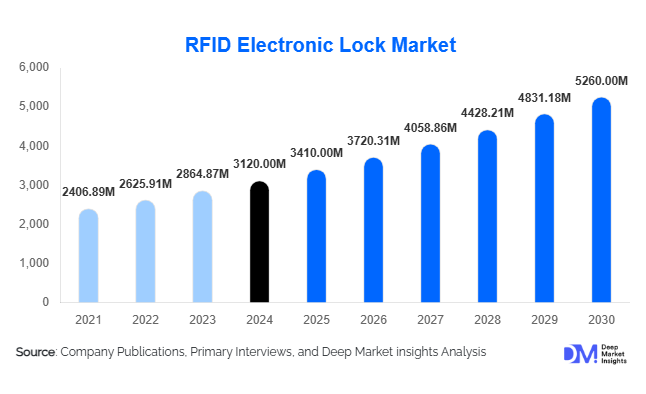

According to Deep Market Insights, the global RFID electronic lock market size was valued at USD 3,120 million in 2024 and is projected to grow from USD 3,410 million in 2025 to reach USD 5,260 million by 2030, expanding at a CAGR of 9.1% during the forecast period (2025–2030). The market growth is primarily driven by increasing security concerns across residential, commercial, and industrial sectors, rising adoption of contactless and smart access control solutions, and technological advancements such as mobile-enabled and networked RFID locks integrated with IoT systems.

Key Market Insights

- RFID electronic locks are increasingly integrated with mobile and cloud platforms, offering remote monitoring, real-time access management, and user-friendly interfaces for homes, offices, and hospitality sectors.

- Networked locks dominate commercial and hospitality installations, enabling centralized access control, audit trails, and multi-user management, which enhance operational efficiency and security.

- North America leads the global market, accounting for a significant share due to high adoption of smart building technologies and the presence of major hospitality and commercial infrastructure.

- Asia-Pacific is the fastest-growing region, driven by infrastructure development, smart city initiatives, and increasing industrial automation in China, India, and South Korea.

- Technological innovation is shaping market trends, including biometric integrations, mobile access, cloud-based management, and IoT-enabled locks for smart homes and enterprises.

- Hospitality, healthcare, and industrial sectors are driving end-use demand, as organizations seek secure, scalable, and contactless access solutions.

Latest Market Trends

Mobile and IoT-Enabled RFID Locks

The market is witnessing strong adoption of RFID electronic locks integrated with mobile apps, cloud platforms, and IoT devices. Users can remotely control access, manage multiple doors, and monitor real-time entry logs. Smart homes, offices, and industrial facilities increasingly demand these systems for convenience and operational efficiency. AI-enabled predictive maintenance and multi-factor authentication are emerging as differentiators for advanced lock solutions, particularly in high-security and enterprise environments.

Cloud-Based Access Control

Networked RFID locks with cloud management capabilities allow centralized control for commercial buildings, hotels, and hospitals. Facilities managers can remotely add or revoke access, generate audit trails, and integrate locks with building management systems. Cloud-based platforms also support data analytics, enabling security optimization and trend analysis. Adoption of these technologies is rising as enterprises seek scalable, flexible, and future-proof access control solutions.

RFID Electronic Lock Market Drivers

Increasing Security Concerns

Rising incidents of burglary, theft, and unauthorized access in residential, commercial, and industrial sectors are fueling the adoption of RFID electronic locks. These locks provide keyless, contactless access and reduce risks associated with physical key duplication. Security-conscious consumers and enterprises are prioritizing advanced lock solutions, driving significant market growth.

Technological Advancements

Innovations such as mobile-enabled locks, biometric integrations, and cloud-connected systems are propelling market growth. Integration with smart home ecosystems and enterprise building management solutions enhances convenience and efficiency, attracting more users. Continuous innovation in RFID technology and IoT integration is enabling differentiated products with higher value propositions.

Infrastructure Development and Smart Cities

Public and private investment in smart city projects, industrial facilities, and commercial buildings is creating significant opportunities for RFID electronic locks. Government-backed initiatives in emerging markets, coupled with the modernization of residential and hospitality infrastructure, are driving the adoption of scalable, networked, and mobile-access locks.

Market Restraints

High Initial Costs

RFID electronic locks are costlier than traditional mechanical locks, especially networked and mobile-enabled solutions. Higher installation and maintenance expenses limit adoption among price-sensitive customers, particularly in residential and small business sectors.

Security Vulnerabilities

Networked and cloud-connected RFID locks may face hacking and cybersecurity threats. Concerns about unauthorized remote access and potential data breaches slow adoption, particularly in sensitive sectors like healthcare, finance, and government buildings.

RFID Electronic Lock Market Opportunities

Smart Cities and Public Infrastructure

Governments investing in smart city initiatives present a significant opportunity for RFID electronic lock adoption. Smart residential complexes, public offices, and commercial buildings increasingly demand integrated, secure, and scalable access control solutions compatible with IoT and cloud-based management.

Hospitality Sector Modernization

Hotels and resorts are rapidly adopting mobile-enabled and networked RFID locks to improve guest experience, operational efficiency, and security. Custom solutions tailored for hospitality operations, including remote monitoring and personalized access, offer significant growth potential for market participants.

Integration with Mobile and Cloud Platforms

The growing use of smartphones and connected devices creates opportunities to develop mobile-controlled and cloud-managed locks. Advanced features such as predictive maintenance, user analytics, multi-layer authentication, and remote access management provide value-added differentiation for new entrants and existing players.

Product Type Insights

Networked RFID locks dominate the market with a 42% share in 2024 due to their centralized management capabilities, multi-user access control, and suitability for commercial and hospitality sectors. Enterprises prefer networked locks for real-time monitoring, audit trails, and integration with building management systems, making them ideal for large-scale operations. Standalone RFID locks remain popular in the residential sector for their cost-effectiveness, ease of installation, and simplicity, appealing to consumers seeking basic security without the complexity of network integration. Meanwhile, mobile-enabled or smart locks are rapidly gaining traction across both residential and commercial segments, as they offer IoT integration, cloud-based management, and enhanced convenience, aligning with the rising trend of smart homes and smart building ecosystems.

Application Insights

The hospitality sector is the leading application segment, holding 33% of the market in 2024. Hotels and resorts deploy RFID locks to improve guest experience through seamless keyless room access, operational efficiency, and enhanced security monitoring. Commercial offices are increasingly adopting RFID locks to manage employee access, secure sensitive areas, and maintain audit trails. Industrial facilities use these locks for warehouse management and restricted access areas. Residential adoption is rising with growing consumer awareness about home security and the proliferation of smart home systems. Government and institutional facilities implement RFID locks to protect sensitive infrastructure, while healthcare facilities prioritize patient safety and secure access to critical zones.

Distribution Channel Insights

Direct sales, system integrators, and online platforms dominate distribution. Large-scale enterprises and residential projects prefer direct engagement with manufacturers for customized, scalable solutions. Online channels are becoming increasingly popular for small-scale residential and commercial installations due to ease of comparison, streamlined purchasing, and simplified installation scheduling. Specialist integrators and IoT solution providers are emerging as key partners, particularly in large infrastructure projects and smart city initiatives, ensuring smooth deployment and integration of networked or mobile-enabled RFID systems.

End-Use Insights

The private sector accounts for approximately 50% of the market, driven by demand in residential complexes, commercial offices, and co-working spaces. Healthcare, hospitality, and industrial sectors are witnessing robust growth, with CAGRs ranging from 9–10%, fueled by the need for secure access to sensitive areas, improved operational efficiency, and compliance with regulatory standards. Export-driven demand is particularly notable from North America and Europe to APAC and LATAM, as infrastructure modernization, smart building projects, and hospitality sector upgrades accelerate RFID lock adoption. Emerging applications, such as industrial security, warehouse access management, and healthcare monitoring systems, are further broadening the end-use landscape and creating new market opportunities.

| By Lock Type | By Frequency Type | By Application | By End-User | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds 35% of the global market in 2024, with the USA as the leading contributor. Growth is driven by strong adoption of smart homes, IoT-enabled security solutions, and extensive commercial and hospitality infrastructure development. Enterprises in the U.S. are increasingly deploying networked RFID locks for centralized monitoring and compliance with regulatory standards. Canada shows moderate growth, primarily due to residential adoption of standalone and smart locks. Overall, the region’s mature technology ecosystem, high security awareness, and government initiatives supporting smart buildings act as key growth drivers.

Europe

Europe accounts for 28% of the market, with Germany and the UK leading adoption across commercial, industrial, and hospitality sectors. Strict regulatory compliance for building security in offices, educational institutions, and government facilities has accelerated the deployment of RFID electronic locks. Germany’s industrial sector drives the adoption of networked locks for centralized monitoring and access management, while the UK’s commercial real estate sector emphasizes smart building solutions. High consumer awareness, technological adoption, and integration with building automation systems continue to support market expansion across the continent.

Asia-Pacific

APAC is the fastest-growing region, projected at a CAGR of 11%, driven by rapid urbanization, expansion of hospitality and commercial infrastructures, and smart city initiatives. China and India are key markets due to rising investments in residential complexes, hotels, and commercial buildings, where both standalone and networked RFID locks are widely deployed. Japan and South Korea are mature markets focused on high-tech mobile-enabled and networked solutions. Government-backed infrastructure projects, increasing awareness of security and automation, and rapid adoption of IoT-enabled solutions further accelerate regional growth.

Middle East & Africa

The Middle East and Africa region is witnessing strong demand, led by the UAE and Saudi Arabia, where the market is driven by high investments in luxury residential and commercial real estate with advanced security features. RFID locks are increasingly adopted in hotels, corporate offices, and industrial installations to enhance operational efficiency and guest security. Africa remains a key hub for commercial and industrial installations, with growing intra-regional demand supported by urban development, industrialization, and modernization of hospitality facilities.

Latin America

Brazil and Argentina are the primary contributors in LATAM, driven by increasing investments in commercial buildings, hotels, and smart residential projects. Networked and mobile-enabled RFID solutions are seeing growing adoption in offices and hospitality properties, while standalone locks remain preferred in cost-sensitive residential applications. The region’s market growth is further supported by urbanization, modernization of real estate infrastructure, and rising awareness of security and access control technologies.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the RFID Electronic Lock Market

- ASSA ABLOY

- Allegion

- dormakaba

- Samsung SDS

- HID Global

- SimonsVoss

- Yale

- Onity

- ZKTeco

- Salto Systems

- Godrej Locks

- Spectrum Brands

- Ditec

- CISA

- Honeywell

Recent Developments

- In March 2025, ASSA ABLOY launched cloud-managed RFID locks for commercial and hospitality sectors, enhancing remote monitoring and multi-user access control capabilities.

- In February 2025, Allegion introduced mobile-enabled smart locks integrated with IoT and AI analytics for predictive maintenance in enterprise installations.

- In January 2025, dormakaba expanded its networked lock portfolio across APAC, focusing on smart city infrastructure and large-scale residential complexes.