Protein Supplements Market Size

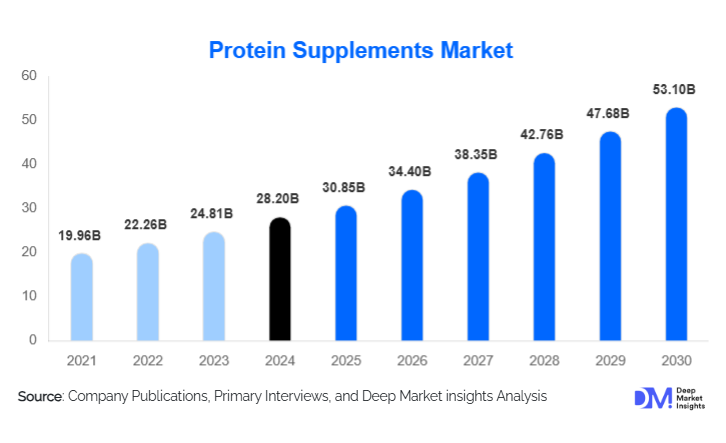

According to Deep Market Insights, the global protein supplements market size was valued at USD 28.2 billion in 2024 and is projected to grow from USD 30.85 billion in 2025 to reach USD 53.1 billion by 2030, expanding at a CAGR of 11.5% during the forecast period (2025–2030). The protein supplements market growth is primarily driven by rising health awareness, increasing demand for fitness and sports nutrition, and growing adoption of plant-based and functional protein products among health-conscious consumers worldwide.

Key Market Insights

- Rising fitness and wellness culture continues to propel global demand for protein powders, bars, and ready-to-drink (RTD) protein beverages.

- Plant-based protein supplements are rapidly gaining market share, driven by vegan and lactose-intolerant consumers seeking sustainable and allergen-free protein sources.

- North America dominates the protein supplements market, accounting for the largest revenue share due to a mature fitness industry and strong retail penetration.

- Asia-Pacific is the fastest-growing region, led by increasing disposable incomes, urbanization, and expanding gym memberships in India, China, and Japan.

- E-commerce and direct-to-consumer channels are transforming sales dynamics, enabling global reach and product personalization.

- Innovation in protein formats, including collagen blends, hybrid plant–animal proteins, and fortified snacks, is reshaping consumer preferences.

What are the latest trends in the protein supplements market?

Surge in Plant-Based and Clean-Label Proteins

Consumers are increasingly opting for clean-label and plant-based protein supplements made from peas, rice, soy, and hemp. This shift reflects growing ethical and environmental awareness as well as health concerns over synthetic additives. Brands are focusing on transparent ingredient sourcing, non-GMO claims, and allergen-free certifications. The trend is further supported by the rise of flexitarian diets and demand for sustainable nutrition, pushing major players to expand their vegan product lines.

Functional and Lifestyle-Oriented Formulations

Protein supplements are evolving beyond muscle gain toward holistic wellness applications, including weight management, immune support, and beauty-from-within benefits. Companies are developing multifunctional products infused with probiotics, collagen, and adaptogens. Ready-to-drink (RTD) protein shakes and snack bars designed for on-the-go lifestyles are witnessing robust demand, especially among busy professionals and millennials seeking convenient nutrition.

What are the key drivers in the protein supplements market?

Growing Health and Fitness Awareness

The global focus on preventive health and active lifestyles has significantly boosted protein supplement consumption. Gym memberships, athletic participation, and social media fitness trends are fueling demand for high-protein diets. Consumers associate protein intake with energy, recovery, and metabolic health, driving consistent market growth across all demographics, including women and older adults.

Rise in E-commerce and Direct-to-Consumer Models

Online platforms are revolutionizing product accessibility and brand discovery in the protein supplements market. Personalized recommendations, subscription-based models, and influencer-driven marketing are enhancing consumer engagement. Major brands are strengthening their D2C channels, offering exclusive online bundles and loyalty programs that cater to fitness communities and niche dietary segments.

What are the restraints for the global market?

Regulatory Complexity and Product Mislabeling

The protein supplements market faces scrutiny over product quality, misleading claims, and adulteration risks. Inconsistent labeling regulations across countries pose challenges for global brands, particularly regarding protein content verification and health benefit claims. Regulatory compliance costs may limit market entry for smaller manufacturers.

High Product Costs and Ingredient Volatility

Premium protein sources such as whey isolate and pea protein command high production costs, influenced by raw material price fluctuations and supply chain disruptions. This affects affordability and profit margins, particularly in emerging markets. Additionally, competition from lower-cost local brands can pressure multinational companies to adjust pricing strategies.

What are the key opportunities in the protein supplements industry?

Expansion in Emerging Markets

Rapid urbanization, growing fitness awareness, and increasing middle-class incomes in Asia-Pacific and Latin America offer significant growth potential. Localized flavors, smaller pack sizes, and targeted marketing toward youth and women consumers can enhance penetration in these markets. Partnerships with regional distributors and fitness chains are key to long-term success.

Innovation in Protein Delivery Formats

Manufacturers are innovating new delivery systems such as protein gummies, functional waters, and fortified bakery items. These novel product forms attract non-traditional consumers seeking variety and convenience. The integration of personalized nutrition and AI-driven dietary tracking apps is expected to further propel innovation, enabling tailored protein intake solutions.

Product Type Insights

Protein powders remain the dominant segment due to widespread gym and sports usage, offering high customization and affordability. Protein bars and RTD beverages are gaining traction for their convenience and portability. Capsules and tablets are preferred in clinical nutrition and elderly wellness segments. Plant-based products are witnessing the fastest growth, driven by innovation in taste and texture profiles.

Application Insights

Sports nutrition remains the largest application segment, followed by functional foods and weight management. Increasing adoption among general consumers beyond athletes has broadened protein supplement usage into daily diets. Emerging applications in clinical nutrition and beauty supplements further expand the addressable market.

Distribution Channel Insights

Online sales dominate the market due to digital marketing, influencer endorsements, and ease of access. Specialty stores and pharmacies maintain relevance for premium and medically approved products. Supermarkets and hypermarkets are expanding their wellness product aisles, while gyms and fitness centers continue to serve as strong offline sales points for sports-oriented brands.

End User Insights

Adults aged 25–45 years form the core consumer base, driven by active lifestyles and gym culture. Teenagers and young professionals represent growing segments influenced by body image and social media fitness trends. Women consumers are increasingly driving demand for plant-based, collagen, and weight-management protein products. Seniors represent a rising demographic for protein supplementation to combat muscle loss and support bone health.

| By Product Type | By Application | By Distribution Channel | By End User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds the largest market share, driven by strong health awareness, premium brand presence, and widespread retail availability. The U.S. dominates regional growth with an established sports nutrition culture and continuous product innovation in whey and plant proteins.

Europe

Europe’s protein supplements market is characterized by a shift toward plant-based, organic, and clean-label products. The U.K., Germany, and France lead consumption, supported by stringent quality regulations and rising demand for sustainable nutrition solutions.

Asia-Pacific

Asia-Pacific is the fastest-growing region, fueled by expanding gym memberships, urban lifestyles, and influencer-led fitness culture. India and China are emerging as high-potential markets, while Japan and Australia continue to see steady premiumization trends in protein supplements.

Latin America

Latin America shows growing interest in fitness and wellness products, particularly in Brazil and Mexico. Local brands are launching affordable protein options, while global players are targeting online channels to capture emerging demand.

Middle East & Africa

The Middle East and Africa are witnessing the rising adoption of protein supplements among young fitness enthusiasts and sports professionals. The UAE and Saudi Arabia are leading markets, supported by the expansion of gym chains and increased participation in fitness events.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Protein Supplements Market

- Optimum Nutrition (Glanbia plc)

- Abbott Laboratories

- MusclePharm Corporation

- Quest Nutrition

- Herbalife International

- Myprotein (The Hut Group)

- Garden of Life (Nestlé Health Science)

- NOW Foods

- Orgain Inc.

- Dymatize Enterprises

Recent Developments

- In July 2025, Optimum Nutrition launched a new line of hybrid plant-whey protein powders targeting flexitarian consumers in North America and Europe.

- In May 2025, Myprotein introduced an AI-powered nutrition platform for personalized protein intake tracking and product recommendations.

- In March 2025, Orgain announced its entry into the functional beverage segment with plant-based protein waters fortified with vitamins and antioxidants.