Processed Meat Market Size

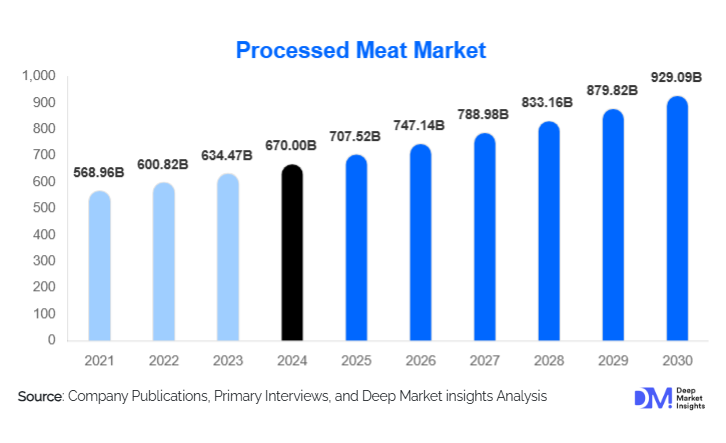

According to Deep Market Insights, the global processed meat market size was valued at USD 670 billion in 2024 and is projected to grow from USD 707.52 billion in 2025 to reach USD 929.09 billion by 2030, expanding at a CAGR of 5.6% during the forecast period (2025–2030). The processed meat market growth is primarily driven by rising demand for convenient protein-based foods, expansion of cold-chain logistics across emerging markets, and increasing adoption of advanced processing technologies that enhance safety, shelf life, and efficiency.

Key Market Insights

- Poultry-based processed meat leads the global market, accounting for nearly 40% of demand, driven by affordability, faster production cycles, and rising preference for lean protein.

- Sausages and hot dogs remain the dominant product category, supported by widespread consumption in both households and foodservice channels.

- Frozen processed meat accounts for over 60% of total processing-method share, enabling long-distance trade and reducing spoilage.

- Asia-Pacific is the largest regional market, driven by rapid urbanization, rising incomes, and the expansion of modern retail.

- Health-focused and clean-label processed meat products are gaining traction, reflecting growing demand for low-sodium, nitrite-free, and natural-ingredient options.

- Automation, AI, and smart packaging are reshaping manufacturing efficiency, traceability, and food safety standards globally.

What are the latest trends in the processed meat market?

Premium & Clean-Label Processed Meats on the Rise

As consumers become increasingly health-conscious, manufacturers are reformulating products to reduce sodium, limit nitrites, and incorporate natural preservatives. Clean-label processed meats, featuring organic ingredients, minimal additives, and transparent sourcing, are rapidly gaining shelf space in supermarkets. Companies are investing in microbial hurdle technologies, natural curing methods, and antioxidant-rich ingredients to improve safety while maintaining taste. Premium and artisanal offerings such as craft sausages, heritage-breed cured meats, and organic deli slices are expanding, attracting consumers willing to pay more for healthier and higher-quality processed meats.

Technology-Driven Product & Packaging Innovation

Emerging technologies are transforming the processed meat sector. Automation and AI-assisted sorting systems are enhancing precision in cutting and portioning, reducing waste, and improving operational margins. Smart packaging innovations such as modified atmosphere packaging (MAP), vacuum sealing, and freshness indicators are significantly extending shelf life. Blockchain-powered traceability systems enable consumers and regulators to track meat origin, processing steps, and safety certifications. These advancements enhance food safety, reduce spoilage, and build consumer trust. E-commerce-driven packaging formats, such as portioned meal packs and freezer-ready bundles, are also reshaping distribution and consumption patterns.

What are the key drivers in the processed meat market?

Growing Demand for Convenience & Ready-to-Eat Proteins

Increasingly busy lifestyles and rising urban populations are driving preference for ready-to-eat, ready-to-cook, and pre-seasoned meat products. Processed meats, including sausages, deli meats, meat snacks, and pre-cooked meals, offer quick meal solutions that align with modern consumer habits. Growth of quick-service restaurants (QSRs), food delivery platforms, and institutional catering further amplifies demand for consistent, cost-effective, and easily stored processed meat products.

Expansion of Cold-Chain Infrastructure & Global Trade

Investments in cold storage, refrigerated transport, and modern retail infrastructure, particularly in Asia-Pacific, the Middle East, and Latin America, are enabling wider availability of frozen and chilled processed meat. Improved cold-chain reliability reduces spoilage, supports international trade, and facilitates penetration into previously underserved regions. Export-oriented production hubs in the U.S., Brazil, and Europe are increasingly supplying processed meat products to emerging markets, accelerating global market expansion.

What are the restraints for the global market?

Health Concerns & Regulatory Pressures

Growing awareness of the potential health risks associated with processed meat consumption, which include high levels of sodium, saturated fats, and chemical preservatives, continues to challenge market growth. Regulatory agencies are tightening guidelines on labeling, nitrite usage, and nutritional transparency. These restrictions increase compliance costs and may limit certain high-margin product lines. Consumer skepticism toward ultra-processed foods further pressures the segment to reformulate and innovate.

Volatile Raw Material Prices

Fluctuations in livestock prices, feed costs, and transportation expenses significantly impact the profitability of processed meat producers. Disease outbreaks such as avian flu or swine fever can disrupt supply chains, resulting in sharp cost spikes. Producers often struggle to pass increased costs to consumers due to competitive pricing pressures in commodity processed meat categories, resulting in margin compression.

What are the key opportunities in the processed meat industry?

Healthier, Functional & Hybrid Meat Products

Future growth lies in developing low-fat, low-sodium, additive-free, and functional processed meats enriched with nutrients or plant-based blends. Hybrid meat products combining animal protein with vegetables, legumes, or plant fibers appeal to flexitarian consumers seeking balanced health and sustainability. This segment presents significant margin potential for companies investing in R&D and clean-label innovations.

Expansion into Emerging Markets

Rapid urbanization and the rise of middle-class populations in Asia-Pacific, Africa, and Latin America present substantial untapped growth potential. By investing in regional production facilities, cold-chain expansion, and localized flavor innovations, companies can gain early-mover advantages. Partnerships with regional distributors, supermarkets, and QSR chains will further accelerate penetration and brand adoption in high-growth markets.

Product Type Insights

Sausages and hot dogs dominate the product landscape, driven by their affordability, versatility, and widespread consumption across households and foodservice. Ready meals and prepared meats are gaining traction as consumers increasingly seek quick meal solutions. Premium cured meats, such as salami, bacon, and artisanal deli cuts, are expanding due to rising interest in gourmet and speciality food products. Meat snacks such as jerky and sticks are experiencing rapid growth, particularly among younger demographics seeking portable, high-protein, on-the-go options.

Application Insights

Household consumption remains the largest application segment, driven by the demand for easy-to-cook protein options and meal-time convenience. Foodservice and QSRs represent one of the fastest-growing segments due to rising consumption of burgers, sandwiches, pizza toppings, and breakfast menus that heavily rely on processed meats. Processed meat is also increasingly used as an ingredient in ready meals, frozen dishes, and meal kits, boosted by the growth of organised retail and e-commerce.

Distribution Channel Insights

Supermarkets and hypermarkets dominate distribution, accounting for the majority of retail processed meat sales. Convenience stores support impulse purchases and single-serve meat products, especially in urban regions. Online channels are rapidly expanding, fueled by the growth of grocery delivery services, subscription models, and direct-to-consumer meat brands. Foodservice distributors supply restaurants, hotels, and catering services, forming a critical channel for high-volume processed meat sales. Institutional buyers such as schools, hospitals, and government programs are emerging as important long-term demand drivers.

End-User Insights

Households account for over half of total processed meat consumption, while foodservice, including QSRs, cafes, and catering, is the fastest-growing end-user segment. Industrial users, such as ready-meal manufacturers, rely on processed meat as a key ingredient for premium frozen and chilled meals. Exporters and international distributors form an additional end-user group, trading frozen processed meat across borders to meet rising global demand.

| By Meat (Animal) Type | By Product Type | By Processing Method | By Distribution Channel | By End-Use / Application |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains one of the most mature processed meat markets, with high per-capita consumption of sausages, bacon, deli meats, and ready-to-eat products. Strong retail infrastructure, advanced processing technologies, and robust demand from QSRs support stable market performance. Premium and clean-label products are gaining significant traction, especially in the U.S.

Europe

Europe has a strong tradition of cured and fermented meats, with high consumption in Germany, Italy, and Spain. Strict food safety regulations drive high-quality standards and strong demand for organic, artisanal, and regional specialty meats. Sustainability-focused consumers are accelerating the shift toward clean-label and nitrate-free processed meats.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing region, driven by rising disposable incomes, rapid urbanization, and increasing acceptance of Western-style processed meats. China leads consumption, while India is witnessing sharp growth in poultry-based processed meats. Expansion of cold-chain infrastructure and modern retail is enabling deeper market penetration.

Latin America

Latin America, led by Brazil and Mexico, is experiencing growing demand for processed poultry and pork products. Brazil’s strong meat production and export capabilities support processed meat expansion both regionally and globally. Changing lifestyles and rising food delivery app usage are accelerating ready-to-eat meat adoption.

Middle East & Africa

Growing populations, rising incomes, and expanding retail networks are boosting demand for processed meat across the Middle East & Africa. Halal-certified processed meats dominate consumption in the Gulf region, while African markets are benefiting from improved cold-chain logistics and increased availability of affordable processed poultry products.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Processed Meat Market

- Tyson Foods

- JBS S.A.

- Smithfield Foods

- Hormel Foods

- BRF S.A.

- Cargill

- Danish Crown

- WH Group

- OSI Group

- Pilgrim’s Pride

Recent Developments

- In March 2025, Tyson Foods announced a major investment in automated processing lines aimed at improving yield efficiency and reducing labor dependency across U.S. facilities.

- In January 2025, JBS launched a new line of clean-label deli meats featuring reduced sodium, natural seasonings, and transparent ingredient sourcing.

- In November 2024, Hormel Foods expanded its ready-meal production capacity in Asia-Pacific to meet rising regional demand for convenient protein-based meals.