Pregnancy Care Products Market Size

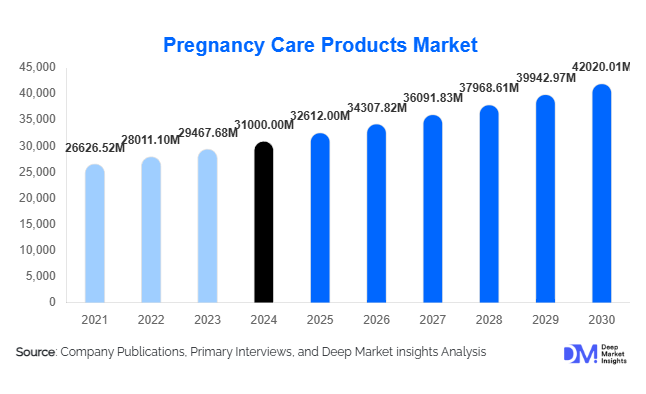

According to Deep Market Insights, the global pregnancy care products market size was valued at USD 31,000 million in 2024 and is projected to grow from USD 32,612 million in 2025 to reach USD 42,020.01 million by 2030, expanding at a CAGR of 5.2% during the forecast period (2025–2030). Market growth is driven by rising maternal health awareness, increasing disposable incomes, a growing preference for natural and organic pregnancy-safe products, and expanding digital and e-commerce distribution channels.

Key Market Insights

- Stretch-mark minimizers remain the largest product segment, accounting for about 40% of total revenue in 2024, driven by their widespread use and aesthetic appeal among pregnant women.

- Postpartum and lactation products are witnessing rapid expansion, supported by growing emphasis on maternal recovery and holistic wellness after childbirth.

- Online and e-commerce platforms are reshaping purchasing behavior, offering privacy, convenience, and subscription-based maternity-care kits.

- North America leads the market with a 35–38% share, supported by high healthcare spending and strong consumer awareness, while Asia-Pacific is the fastest-growing region.

- Natural, toxin-free, and organic formulations dominate consumer preference, with brands increasingly seeking clean-label certifications.

- Emerging economies such as India and Brazil are witnessing high adoption rates due to rising disposable incomes and government-supported maternal health initiatives.

Latest Market Trends

Digital Transformation and E-Commerce Boom

Pregnancy care brands are embracing digital marketing, influencer partnerships, and direct-to-consumer (D2C) channels. Mobile apps and online communities allow mothers to track pregnancy stages, consult telehealth professionals, and purchase personalized product bundles. Subscription models providing trimester-specific care boxes are gaining traction, enhancing consumer loyalty and recurring revenue streams.

Shift Toward Clean-Label and Organic Ingredients

Consumers increasingly demand transparency and safety in maternal-care products. Organic shea butter, cocoa butter, plant oils, and vitamin-enriched formulations are replacing synthetic chemicals. This trend not only elevates product quality but also enables brands to command premium pricing. Regulatory approvals and certification standards such as USDA Organic and ECOCERT are becoming important differentiators in marketing strategies.

Pregnancy Care Products Market Drivers

Rising Maternal Wellness Awareness

Global campaigns and social media influencers are spreading awareness about maternal well-being, emphasizing stretch-mark prevention, nutritional supplementation, and postpartum recovery. Pregnant women are increasingly investing in self-care routines that improve comfort and aesthetic confidence throughout pregnancy.

Growing Disposable Income and Premiumization

Urbanization and dual-income households are fueling demand for premium maternity-care products. Consumers now prefer branded, dermatologically tested, and clinically proven formulations, driving up average selling prices and encouraging innovation among global manufacturers.

Expanding Retail and E-Commerce Distribution

Wider access to maternity-care products through pharmacies, retail chains, and online marketplaces such as Amazon and specialty maternity stores has boosted overall availability. E-commerce contributes 25–30% of market revenues and continues to expand rapidly, especially in Asia-Pacific and Latin America.

Market Restraints

Stringent Safety and Regulatory Compliance

Pregnancy care products face strict formulation controls. Regulatory approvals demand evidence of safety for both mother and fetus, limiting certain active ingredients and increasing R&D costs. These hurdles extend product development cycles and can delay market entry for new players.

Price Sensitivity in Emerging Markets

In developing regions, high prices for premium imported products limit penetration. Local consumers often opt for affordable generic alternatives, restricting overall profit margins for multinational brands. Balancing cost-efficiency with quality remains a major challenge for global expansion.

Pregnancy Care Products Market Opportunities

Digital and Subscription-Based Pregnancy Ecosystems

Brands integrating digital health platforms with e-commerce delivery models are unlocking new growth opportunities. Personalized kits that align with each trimester, virtual consultations, and AI-driven skincare or supplement recommendations appeal strongly to millennial mothers seeking convenience and expert-guided care.

Natural and Plant-Based Product Innovation

The global shift toward clean beauty and wellness presents enormous potential. Pregnancy-safe natural ingredients such as jojoba oil, rosehip seed oil, and vitamin E blends are driving innovation. Companies adopting sustainable sourcing and transparent labeling practices are gaining consumer trust and expanding into premium segments.

Untapped Potential in Emerging Economies

Asia-Pacific, Latin America, and parts of Africa are under-penetrated markets with growing birth rates and improving maternal healthcare infrastructure. Localized product manufacturing under initiatives like “Make in India” and “Made in China 2025” is reducing costs and fostering domestic brand growth. This creates a vast opportunity for global firms to partner with regional players.

Product Type Insights

Stretch-mark minimizers dominate the market, representing about 40% of total revenue in 2024. High adoption stems from widespread aesthetic concerns and preventive usage during early pregnancy stages. Nutritional supplements and body-care lotions are secondary contributors, followed by postpartum recovery aids and hygiene products.

Application Insights

Postpartum and lactation care products capture around 25–30% of market revenue. Growing awareness of postpartum recovery, body toning, and lactation support has created strong demand for body-restructuring gels, breast creams, and nipple protection ointments. Increasing hospital-based wellness programs further boost this category.

Distribution Channel Insights

Online and e-commerce platforms account for 25–30% of 2024 sales, supported by rapid smartphone adoption and internet penetration. E-commerce allows discreet, convenient, and bulk purchasing. Hospital pharmacies and retail drugstores remain key offline contributors, but digital channels are expected to outpace them by 2030.

| By Product Type | By Distribution Channel | By End Use |

|---|---|---|

|

|

|

Regional Insights

North America

North America leads the global pregnancy care products market with a 35–38% share in 2024. The U.S. dominates due to high consumer spending on maternal wellness, strong brand presence, and established retail infrastructure. Digital subscription models and premium organic products are key growth accelerators.

Europe

Europe holds 25–30% of the global market, driven by a strong preference for organic and dermatologically tested pregnancy-safe formulations. Markets such as Germany, France, and the U.K. have mature maternity-care ecosystems emphasizing sustainability and safety certifications.

Asia-Pacific

Asia-Pacific commands 20–23% of market share and is the fastest-growing region, projected to register 6–8% CAGR through 2030. Rising middle-class income, e-commerce expansion, and government health programs in China and India are propelling regional growth. Local brands focusing on affordable, plant-based solutions are thriving.

Latin America

Latin America accounts for a 5–7% share, led by Brazil and Mexico. Increasing awareness of prenatal nutrition and cosmetic maternity products supports gradual growth. Expansion of retail pharmacy networks and online shopping accessibility are contributing factors.

Middle East & Africa

This region holds 5–6% market share, with the UAE and Saudi Arabia showing growing demand for premium maternity-care brands. In Africa, South Africa is a leading importer of skincare and supplement products. Government-backed maternal wellness campaigns are expected to stimulate regional demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pregnancy Care Products Market

- Clarins Group

- Abbott Laboratories

- The Honest Company Inc.

- Dabur India Limited

- Artsana India Private Limited

- Expanscience S.A.S

- Johnson & Johnson

- Himalaya Global Holdings Ltd.

- Burt’s Bees Inc.

- Mama Mio U.S. Inc.

- Noodle & Boo LLC

- Mothercare (India) Limited

- Me N Moms Private Limited

- Earth Mama Organics LLC

- Biocorp Lifesciences Private Limited

Recent Developments

- June 2025 – Clarins Group expanded its natural maternity skincare line with the launch of “Clarins Mom Care,” a certified organic range targeting stretch-mark prevention and body-firming applications.

- April 2025 – The Honest Company Inc. introduced a digital subscription service offering trimester-specific pregnancy-care bundles across the U.S. and Canada.

- February 2025 – Abbott Laboratories enhanced its prenatal nutrition portfolio with the launch of “Similac Materna Plus,” a supplement line formulated for early pregnancy support.