Pre-Workout Supplements Market Size

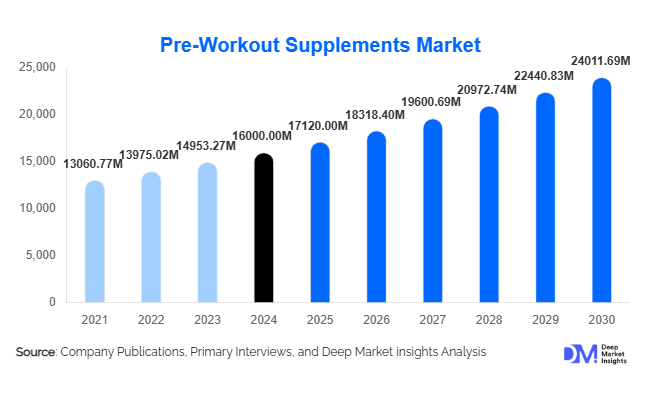

According to Deep Market Insights, the global pre-workout supplements market size was valued at USD 16,000 million in 2024 and is projected to grow from USD 17,120 million in 2025 to reach USD 24,011.69 million by 2030, expanding at a CAGR of 7% during the forecast period (2025–2030). The market growth is primarily driven by increasing fitness awareness, the rise in gym memberships, the growing popularity of performance-enhancing supplements, and innovations in product formulations, including plant-based and ready-to-drink options.

Key Market Insights

- Caffeine-based supplements dominate the market, offering energy and endurance benefits that appeal to both professional athletes and casual fitness enthusiasts.

- Powdered forms remain the leading format, due to customizable dosages, flavor variety, and affordability, while ready-to-drink (RTD) formats are gaining traction in convenience-focused regions.

- E-commerce is the fastest-growing distribution channel, driven by online fitness communities, influencer marketing, and subscription models.

- North America leads the global market, with high disposable income, a mature fitness culture, and a strong retail infrastructure supporting pre-workout supplement adoption.

- Asia-Pacific is emerging as the fastest-growing region, fueled by rising middle-class health awareness in countries like China, India, and Japan.

- Technological integration, including fitness apps, wearable-based personalized recommendations, and digital marketing, is reshaping product accessibility and consumer engagement.

What are the latest trends in the pre-workout supplements market?

Shift Toward Natural and Plant-Based Formulations

There is increasing consumer demand for pre-workout supplements made with natural ingredients, herbal extracts, and plant-based proteins. Clean-label formulations free from artificial colors, flavors, or banned substances are gaining preference, particularly among millennials and Gen Z consumers. This trend has prompted manufacturers to innovate proprietary blends incorporating adaptogens, amino acids, and herbal energy boosters, positioning their products as safer and healthier alternatives to traditional stimulant-heavy formulations.

Ready-to-Drink (RTD) and Convenient Formats

RTD pre-workout supplements are gaining popularity due to convenience, portability, and ease of dosing. Busy lifestyles and the growth of on-the-go fitness routines have contributed to the adoption of RTDs across gyms, retail outlets, and e-commerce channels. Brands are also exploring innovative packaging solutions and functional flavor profiles to attract a broader consumer base, including casual fitness enthusiasts and office-goers seeking energy-boosting solutions before workouts.

What are the key drivers in the pre-workout supplements market?

Rising Fitness Awareness and Lifestyle Changes

Growing awareness about health, physical fitness, and preventive care is encouraging consumers to adopt supplements that enhance exercise performance, endurance, and recovery. This trend is particularly pronounced among millennials and working professionals seeking efficient ways to improve energy levels and achieve fitness goals.

Increasing Gym Memberships and Athletic Activities

The number of gyms, boutique fitness studios, and professional sports programs has risen significantly, creating consistent demand for performance-enhancing supplements. Pre-workout products are increasingly seen as essential for energy, stamina, and focus, contributing to sustained market growth.

Innovation in Formulations and Flavors

New product innovations, including plant-based ingredients, natural caffeine sources, and flavor variations, have increased consumer adoption. Enhanced formulations that address endurance, strength, and recovery simultaneously are attracting a wider audience beyond professional athletes, expanding market penetration.

What are the restraints for the global market?

Regulatory Challenges Across Regions

Varying regulations regarding supplement safety, labeling, and health claims pose challenges for global market expansion. Companies face compliance costs and delays in product approvals, which may slow market growth in certain regions.

Health Concerns Related to Stimulants

Potential side effects from excessive caffeine or stimulant use, including jitters, heart palpitations, and gastrointestinal issues, create consumer hesitancy. Educating users and formulating safer alternatives are critical to mitigating this restraint.

What are the key opportunities in the pre-workout supplements industry?

Expansion in Emerging Markets

Asia-Pacific, Latin America, and parts of the Middle East offer significant growth opportunities due to increasing disposable incomes, urbanization, and fitness adoption. Localized marketing strategies, culturally tailored formulations, and competitive pricing can drive market penetration among new consumer segments.

Integration with Technology and Personalized Nutrition

Fitness apps, wearable devices, and data-driven platforms enable personalized supplement recommendations. Tailoring pre-workout formulations to individual biometrics, workout intensity, and dietary preferences enhances consumer engagement and retention while creating differentiation in a competitive market.

Government Initiatives and Health Awareness Campaigns

Public health programs promoting wellness, fitness, and nutritional awareness indirectly support the pre-workout supplements market. Simplified regulatory frameworks, quality certifications, and local manufacturing incentives further encourage domestic production and market expansion.

Product Type Insights

Caffeine-based supplements dominate globally, representing 35% of the market share in 2024. Their efficacy in boosting energy and endurance makes them highly popular among gym-goers and athletes. Creatine-based and nitric oxide boosters are growing steadily, especially in strength training and bodybuilding applications. Innovation in blends, such as combining caffeine with amino acids or herbal extracts, is also enhancing market appeal.

Form Insights

Powder forms are the leading segment, accounting for 50% of the 2024 market share, due to flexibility in dosing and flavor customization. Capsules/tablets remain convenient for casual users, while RTD formats are rapidly gaining adoption among busy professionals and urban consumers seeking on-the-go solutions.

Distribution Channel Insights

E-commerce dominates with 40% of global sales, driven by digital marketing, influencer promotions, and subscription models. Specialty stores and gyms are significant channels for fitness-focused communities, while hypermarkets and pharmacies support mass-market access. Direct-to-consumer channels are increasingly being leveraged to improve margins and brand loyalty.

End-Use Insights

Fitness enthusiasts and gym-goers are the largest consumers, accounting for 45% of market share. Professional athletes and bodybuilders follow closely, while emerging users include office professionals, students, and casual users. Corporate wellness programs and college sports teams are new end-use applications that are gradually driving additional demand.

| By Product Type | By Form | By Distribution Channel | By End-Use / Application |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for 38% of the global market, led by the U.S. due to high fitness adoption, disposable income, and advanced retail infrastructure. Canada also shows steady growth, particularly in urban fitness hubs. E-commerce and specialty stores are the primary distribution channels.

Europe

Europe holds approximately 25% of the market share, with Germany and the U.K. leading due to strong regulatory compliance, fitness culture, and growing awareness of natural supplements. France, Italy, and Spain contribute to mid-range supplement demand. The region emphasizes clean-label and sustainable products.

Asia-Pacific

Asia-Pacific is the fastest-growing market, with China, India, and Japan leading the expansion. Rising middle-class income, urbanization, and digital penetration are key drivers. The CAGR in this region exceeds 8%, making it a strategic focus for global players.

Latin America

Brazil and Mexico are key contributors to the market, showing growth due to increasing gym memberships and urban fitness adoption. Outbound exports from North America and Europe supplement local demand.

Middle East & Africa

The UAE, Saudi Arabia, and South Africa represent the primary markets in this region, supported by high-income consumers and increasing health-conscious lifestyles. While overall market share is smaller, adoption rates are growing rapidly in urban centers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pre-Workout Supplements Market

- Optimum Nutrition

- MuscleTech

- BSN

- Cellucor

- Dymatize Nutrition

- Nutrex

- GNC

- Myprotein

- Scivation

- Evlution Nutrition

- Redcon1

- Gaspari Nutrition

- Allmax Nutrition

- ProSupps

- RSP Nutrition

Recent Developments

- In 2025, Optimum Nutrition launched a new plant-based pre-workout powder line, targeting health-conscious millennials and vegetarians.

- In 2024, MuscleTech expanded its RTD pre-workout portfolio in North America and Asia-Pacific, improving e-commerce distribution and direct-to-consumer reach.

- In early 2025, Cellucor introduced customized pre-workout blends with app-based personalization, enabling tailored recommendations based on user fitness data.