Portable Tool Market Size

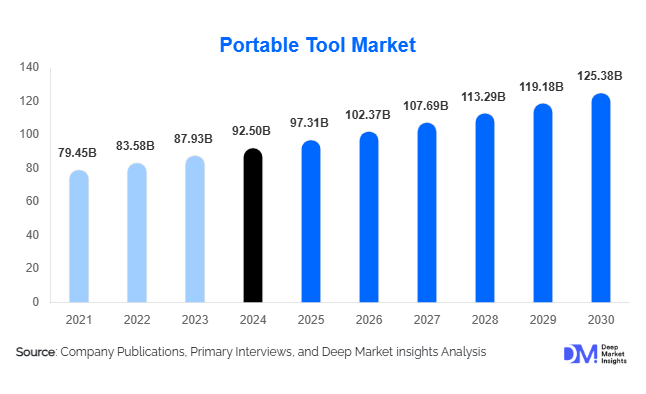

According to Deep Market Insights, the global portable tool market size was valued at USD 92.5 billion in 2024 and is projected to grow from USD 97.31 billion in 2025 to reach USD 125.38 billion by 2030, expanding at a CAGR of 5.2% during the forecast period (2025–2030). The portable tool market growth is primarily driven by rising demand for cordless and battery-powered tools, increased industrialization and construction activities, and technological advancements such as smart and IoT-enabled tools, enhancing efficiency and user experience.

Key Market Insights

- Power tools dominate the portable tool market, accounting for approximately 42% of market value in 2024, driven by demand from industrial, construction, and automotive applications.

- Cordless and battery-powered tools are rapidly gaining traction, offering mobility, improved ergonomics, and environmentally friendly operations, appealing to both professionals and DIY consumers.

- Industrial and construction end-use segments are the largest contributors, representing nearly 48% of global demand in 2024 due to ongoing infrastructure and maintenance projects.

- North America holds the largest market share, led by the U.S. and Canada, with high demand for premium and professional-grade tools.

- Asia-Pacific is the fastest-growing region, driven by rapid urbanization, industrial expansion, and rising middle-class incomes in China, India, and Southeast Asia.

- Technological integration, including IoT-enabled diagnostics, predictive maintenance, and smart battery platforms, is reshaping professional and consumer tool usage.

What are the latest trends in the portable tool market?

Growth of Cordless and Battery-Powered Tools

Cordless and battery-powered portable tools are increasingly replacing corded and gas-powered variants due to advancements in lithium-ion batteries, brushless motors, and ergonomic design. Multi-tool battery platforms allow users to power multiple devices with a single battery, improving convenience and cost efficiency. These tools also support sustainability by reducing emissions and noise pollution, making them suitable for both industrial and residential use. The trend is strongest in construction, maintenance, and home improvement projects, where mobility and flexibility are critical.

Smart and IoT-Enabled Tools

Smart portable tools equipped with sensors, connectivity, and diagnostics are gaining traction. Features such as predictive maintenance, usage tracking, and safety alerts improve operational efficiency and extend tool lifespan. Industrial enterprises benefit from reduced downtime and optimized workforce performance, while consumer-grade smart tools enhance ease-of-use, safety, and maintenance. Manufacturers offering IoT-enabled tools are creating new revenue streams via software services and analytics platforms.

What are the key drivers in the portable tool market?

Infrastructure and Construction Investments

Expanding urbanization, industrialization, and infrastructure projects are major drivers for portable tool demand. Construction, maintenance, and industrial sectors require reliable power tools, hand tools, and measuring devices. Governments’ focus on infrastructure spending and industrial modernization directly boosts demand for durable and high-performance portable tools.

Rising DIY Culture

Home improvement, renovation, and hobbyist projects are increasingly popular, especially in developed and emerging markets. Lightweight, ergonomic, and battery-powered tools enable broader adoption of DIY activities. Digital tutorials, social media content, and e-commerce accessibility are supporting the expansion of this segment.

Technological Advancements

Advances in battery technology, brushless motors, and smart integration are improving tool efficiency, safety, and user experience. Connected tools with predictive analytics, diagnostics, and asset tracking are creating opportunities for professional and industrial users to optimize operations while appealing to tech-savvy consumers.

What are the restraints for the global market?

Raw Material and Component Cost Volatility

Fluctuating prices of steel, aluminum, plastics, and battery materials such as lithium and cobalt impact manufacturing costs and profit margins. Supply chain disruptions and geopolitical tensions may affect tool availability and pricing.

Regulatory and Compliance Challenges

Portable tools must comply with multiple safety, environmental, and quality standards, varying across regions. Meeting electrical, vibration, noise, and battery disposal regulations increases operational complexity and delays product launches, potentially restricting market access.

What are the key opportunities in the portable tool industry?

Expansion in Emerging Markets

Asia Pacific, Latin America, and Africa present strong growth opportunities due to rapid urbanization, industrialization, and government infrastructure initiatives. Rising disposable incomes and local manufacturing incentives make these regions attractive for both new entrants and established players.

Smart and Connected Tools

Developing IoT-enabled and sensor-integrated tools presents opportunities to differentiate products. Enterprises benefit from predictive maintenance and asset tracking, while consumers enjoy enhanced safety and usability. Companies creating digital ecosystems around tools are likely to capture recurring revenue streams.

Sustainability and Eco-Friendly Products

Battery recycling, energy-efficient designs, and eco-friendly materials appeal to environmentally conscious consumers. Regulatory requirements and growing green preferences in developed markets are increasing the adoption of sustainable portable tools.

Product Type Insights

Power tools dominate the global portable tool market, accounting for 42% of the market in 2024, followed by hand tools and garden/outdoor tools. Within cordless power tools is the fastest-growing segment due to their mobility, convenience, and eco-friendliness, making them ideal for both industrial and residential use. Cordless tools offer freedom from cords, enhancing usability in remote and outdoor environments, which is a key driver for their adoption. Electric tools, by contrast, provide a consistent power supply required for heavy-duty construction and industrial tasks, while pneumatic tools are preferred for applications demanding high torque and long operational hours, such as automotive and aerospace manufacturing. The demand for industrial-grade storage and safety tools is also expanding, particularly in construction, manufacturing, and large-scale industrial projects, where operational efficiency and compliance with safety standards are critical.

Application Insights

Industrial and construction applications account for nearly 48% of global portable tool demand, driven by sectors requiring high-precision and durable tools, including automotive, aerospace, and manufacturing industries. Residential and DIY applications are growing steadily, fueled by home improvement trends, urbanization, and the rising popularity of DIY projects. Commercial applications, including maintenance, repair, and facility management, are also expanding due to the need for professional-grade tools. Asia-Pacific acts as a key manufacturing hub, exporting portable tools to North America, Europe, and other regions, thus supporting global demand. The rise of smart, IoT-enabled tools further enhances industrial efficiency and adoption in precision-dependent applications.

Distribution Channel Insights

Offline retail and distributor networks remain dominant channels for high-value portable tools, especially for industrial buyers requiring bulk orders and after-sales support. Online platforms and direct brand websites are rapidly growing, driven by convenience, real-time comparison, and global accessibility. B2B sales to industrial enterprises remain critical for the market, providing recurring revenue streams. Emerging subscription and service-based models around smart tools are gaining traction, particularly in North America and Europe, offering continuous revenue and value-added services such as maintenance, monitoring, and predictive tool analytics.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds 32% of the global portable tool market in 2024. The U.S. and Canada lead demand for premium and industrial-grade tools due to high consumer purchasing power, strong construction activity, and extensive industrial maintenance requirements. Technological integration, including smart tools with IoT capabilities and app-enabled diagnostics, enhances efficiency and accuracy, driving adoption across commercial and industrial segments. DIY and residential applications are also witnessing growth due to increased home renovation activities.

Europe

Europe accounts for 22% of the global market, with Germany, the UK, and France as primary contributors. Growth is largely fueled by stringent regulatory standards for safety and environmental compliance, which drive demand for high-quality, eco-friendly portable tools. Industrial users prefer tools meeting European safety certifications, while commercial and residential segments benefit from well-established distribution channels and high product awareness. Replacement demand for tools in mature markets like Germany and France further stabilizes the region’s growth trajectory.

Asia-Pacific

Asia-Pacific is the fastest-growing region, representing 28% market share in 2024. China, India, and Southeast Asia are leading the growth due to rapid industrialization, urbanization, and rising consumer incomes. The region’s role as a major manufacturing hub drives domestic consumption and export-oriented production. Growth in industrial applications, particularly in automotive, electronics, and construction, is supporting the adoption of power and pneumatic tools. The region’s CAGR is projected to be higher than the global average, estimated at 5.8–6.5% during 2025–2030.

Latin America

Latin America holds approximately 10% of the market, with Brazil and Mexico as key contributors. Economic development and ongoing investments in infrastructure, industrialization, and urban projects are driving demand for portable tools, particularly power and hand tools. Rising middle-class income and DIY awareness further boost residential and commercial tool adoption. Government-backed infrastructure projects, including transportation and energy sector initiatives, are additional growth drivers in the region.

Middle East & Africa

MEA represents roughly 8% of the global market. The GCC countries, South Africa, and Nigeria are the leading markets, fueled by infrastructure expansion and ongoing industrial development in the oil, gas, and construction sectors. Demand is particularly strong for high-durability power tools and industrial-grade equipment suitable for harsh working conditions. Government investments in large-scale projects, combined with commercial and construction activity, underpin regional growth. Residential adoption remains limited but is gradually increasing in urbanized areas with rising household incomes.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Portable Tool Market

- Stanley Black & Decker

- Robert Bosch GmbH

- Makita Corporation

- Hilti Corporation

- Techtronic Industries Co. Ltd.

- Ingersoll Rand

- Snap-On Incorporated

- Atlas Copco AB

- Emerson Electric Co.

- Festool GmbH

- Chervon Group

- Apex Tool Group

- Metabo

- Husqvarna Group

- Koki (Hitachi Koki)

Recent Developments

- In March 2025, Stanley Black & Decker launched a new series of cordless battery platforms in North America, enhancing interoperability and runtime performance.

- In February 2025, Makita expanded its industrial-grade cordless tool lineup in Asia-Pacific, targeting construction and infrastructure projects in India and Southeast Asia.

- In January 2025, Bosch introduced smart IoT-enabled drills and measuring tools in Europe, offering predictive maintenance and usage tracking for industrial customers.