Cordless Power Tools Market Size

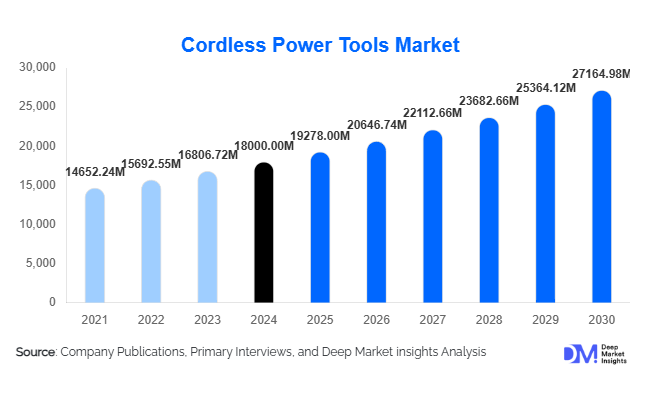

According to Deep Market Insights, the global cordless power tools market size was valued at USD 18,000.00 million in 2024 and is projected to grow from USD 19,278.00 million in 2025 to reach USD 27,164.98 million by 2030, expanding at a CAGR of 7.1% during the forecast period (2025–2030). The market growth is primarily driven by rising demand for battery-operated, portable tools across construction, woodworking, automotive repair, and DIY segments, coupled with technological advancements such as lithium-ion batteries and brushless motors, enhancing efficiency and usability.

Key Market Insights

- Lithium-ion battery-powered tools dominate the market, favored for their energy efficiency, long life, and portability, making them ideal for both professional and consumer applications.

- North America and Europe hold the largest market shares, supported by high industrialization, technological adoption, and a strong DIY culture.

- Asia-Pacific is emerging as the fastest-growing region due to rapid urbanization, infrastructure development, and increasing consumer awareness.

- Professional construction and industrial segments drive the adoption of advanced cordless tools with higher power output and specialized applications.

- Online sales channels are expanding rapidly, offering easier access to consumers and enabling direct engagement with manufacturers for customized tools.

- Technological innovations such as IoT-enabled tools, battery management systems, and brushless motors are reshaping product design and efficiency.

What are the emerging trends in the cordless power tools market?

Smart and IoT-Enabled Tools

Manufacturers are increasingly integrating IoT and smart technology into cordless tools. Features such as real-time battery monitoring, predictive maintenance alerts, and usage analytics are gaining traction among professional users. These innovations not only improve operational efficiency but also create recurring revenue streams through connected services, software subscriptions, and maintenance packages, appealing particularly to industrial clients seeking productivity optimization.

Shift Toward DIY and Home Improvement Segments

The DIY culture continues to grow, fueled by social media, online tutorials, and e-commerce platforms. Consumers are increasingly demanding lightweight, multi-functional, and ergonomic tools for home projects. This trend has led to higher adoption of cordless drills, saws, and multi-tools in residential applications, expanding market penetration and influencing manufacturers to introduce user-friendly, entry-level cordless tools targeting the consumer segment.

Which factors are driving growth in the global cordless power tools market?

Rising Demand from Construction and Industrial Sectors

Professional contractors and industrial users are increasingly replacing corded tools with cordless alternatives to enhance mobility, efficiency, and safety on worksites. The adoption of high-performance battery-powered drills, saws, and grinders is driving overall market growth, particularly in regions experiencing infrastructure development and industrial expansion.

Technological Advancements in Batteries and Motors

The widespread adoption of lithium-ion batteries, coupled with brushless motors, has enhanced tool performance, durability, and operational safety. Tools with longer runtimes, faster charging, and lighter weight are gaining preference among both professionals and DIY users, stimulating demand globally.

Expansion of E-Commerce Channels

Online retail platforms have made cordless tools more accessible, providing features such as product comparison, real-time reviews, and direct delivery. Manufacturers are increasingly leveraging e-commerce to reach end-users in emerging regions, thus broadening their market footprint and driving sales growth.

What challenges or restraints could limit the growth of the cordless power tools market?

High Initial Costs of Advanced Tools

High-performance cordless tools often come with premium prices due to advanced battery technology and integrated features. This can limit adoption among small businesses and price-sensitive DIY consumers, slowing penetration in certain regions.

Dependency on Raw Material Prices

Fluctuations in lithium, cobalt, and other battery-related material prices directly impact production costs. Sudden increases can reduce manufacturer margins and potentially lead to higher end-user prices, restraining overall market growth.

What are the major growth opportunities in the cordless power tools industry?

Emerging Markets Expansion

Rapid urbanization and industrialization in India, Southeast Asia, and Latin America are creating substantial demand for cordless power tools. Establishing localized manufacturing and distribution networks in these regions offers companies the chance to capture high-growth opportunities and mitigate import dependencies.

Integration of Green and Energy-Efficient Technologies

Global emphasis on energy efficiency and eco-friendly products presents opportunities for manufacturers to develop low-emission, long-lasting battery tools. Aligning with government initiatives such as “Make in India” and “Made in China 2025” can provide incentives and strengthen market positioning.

Growth in the DIY and Home Improvement Segment

The expanding DIY consumer base offers opportunities for multi-functional, ergonomic, and lightweight cordless tools. Manufacturers can explore bundled kits, subscription models, and tool customization services to enhance customer engagement and expand revenue streams.

Product Type Insights

Drills & drivers lead the market, accounting for approximately 28% of the 2024 market share. Their dominance is attributed to broad application across construction, woodworking, and automotive repair. Saws and grinders follow closely, benefiting from technological upgrades in battery performance and tool versatility. Nailers, staplers, and other tools are growing steadily due to increased adoption in specialized construction and DIY applications, especially among home improvement enthusiasts.

Application Insights

Construction and building applications hold the largest share, representing roughly 35% of global demand in 2024. Professional users prefer cordless tools for drilling, cutting, and fastening operations due to portability and reduced reliance on electrical outlets. Woodworking, automotive repair, and DIY applications are also expanding rapidly, supported by ergonomic designs, safety features, and lightweight tools tailored to consumer and industrial segments.

Distribution Channel Insights

Offline retail, including hardware and specialty stores, remains the primary distribution channel, contributing about 60% of total sales. However, online platforms are rapidly expanding, driven by convenience, competitive pricing, and direct-to-consumer models. E-commerce allows manufacturers to offer subscription services, bundled kits, and regional customization, which are increasingly preferred by DIY consumers and professional end-users.

End-Use Insights

Professional industrial users account for the largest share of demand, driven by the construction, automotive, and manufacturing sectors. The fastest-growing segment is DIY and home improvement, fueled by urban consumers seeking multi-functional, lightweight tools. Emerging industries such as renewable energy installation, smart home construction, and small-scale manufacturing are creating new applications for cordless tools, contributing to export-driven demand and market expansion globally.

| Tool Category | Battery & Drive Tech | End-user |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds approximately 30% of the 2024 market share, with strong demand in the U.S. and Canada. Adoption is driven by infrastructure development, widespread industrial activity, and a mature DIY culture. The region emphasizes high-performance tools with smart features and professional-grade durability.

Europe

Europe accounts for about 28% of the 2024 market share, led by Germany, the U.K., and France. Sustainability-focused products and technological integration drive demand. The region shows robust growth in lithium-ion battery tools, supported by strict energy efficiency regulations.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with China, India, Japan, and Australia leading adoption. Infrastructure projects, urbanization, and increasing middle-class affluence are key growth drivers. The market is expected to see double-digit growth in emerging economies due to expanding industrial and DIY demand.

Latin America

Latin America, including Brazil, Mexico, and Argentina, is growing steadily. Outbound imports and local distribution networks are expanding to meet rising industrial and residential demand.

Middle East & Africa

The Middle East shows growing adoption among industrial and construction segments, led by the UAE and Saudi Arabia. Africa’s demand is concentrated in South Africa and Nigeria, driven by urbanization, industrial development, and increased professional tool adoption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Cordless Power Tools Market

- Bosch

- DeWalt

- Makita

- Hilti

- Milwaukee

- Hitachi

- Ryobi

- Black & Decker

- Metabo

- Festool

- Einhell

- Porter-Cable

- RIDGID

- Skil

- Tacklife

Recent Developments

- In March 2025, Bosch launched a new line of brushless cordless drills with enhanced battery management and IoT connectivity for professional users.

- In January 2025, DeWalt expanded its lithium-ion battery tool portfolio, targeting the DIY and home improvement segment in North America and Europe.

- In February 2025, Makita introduced a series of lightweight, multi-functional cordless saws designed for industrial and residential applications in APAC.