Portable Coffee Makers Market Size

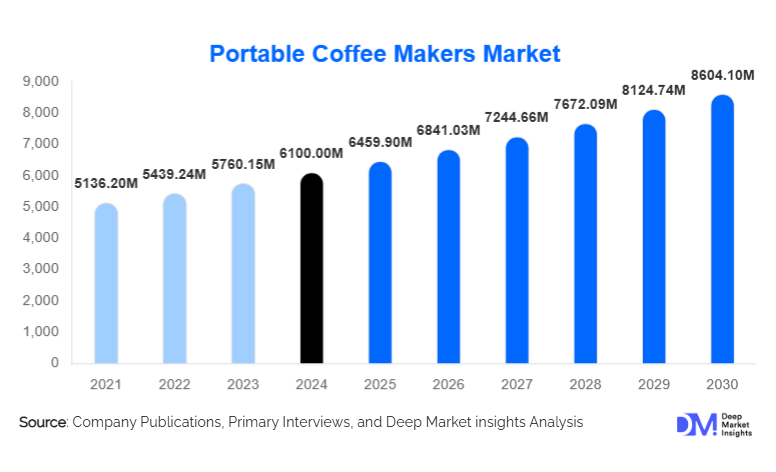

According to Deep Market Insights, the global portable coffee makers market size was valued at USD 6,100.00 million in 2024 and is projected to grow from USD 6,459.90 million in 2025 to reach USD 8,604.10 million by 2030, expanding at a CAGR of 5.90% during the forecast period (2025–2030). The market growth is primarily driven by rising on-the-go coffee consumption, the growing specialty coffee culture, and increasing adoption of technologically advanced and sustainable portable coffee solutions.

Key Market Insights

- Electric and battery-assisted portable coffee makers are leading adoption, catering to tech-savvy consumers seeking convenience and high-quality brew outside the home.

- Single-serve form factors dominate, reflecting consumer preference for compact, travel-friendly coffee makers for individual use.

- North America holds the largest share of the market in 2024, led by the U.S. and Canada due to high disposable income and a strong coffee culture.

- Asia-Pacific is the fastest-growing region, driven by urbanization, rising disposable incomes, and the expansion of café and coffee culture in China, India, and Japan.

- Online retail is the leading distribution channel, providing consumers with easy access to portable coffee makers and driving growth via e-commerce and D2C platforms.

- Innovation in smart connectivity and eco-friendly materials is reshaping the product landscape, with manufacturers integrating battery power, Bluetooth/WiFi controls, and sustainable materials to attract premium consumers.

What are the latest trends in the portable coffee makers market?

Rise of Smart and Sustainable Coffee Makers

Manufacturers are increasingly incorporating smart features such as app-controlled brewing, battery-powered heating, and temperature monitoring. These innovations enhance convenience for travelers and remote workers. Sustainability is also a key focus, with products utilizing recycled plastics, stainless steel, and biodegradable components, appealing to eco-conscious consumers. Premium models integrate reusable filters and energy-efficient heating systems, aligning with global trends toward responsible consumption.

Growth of Travel and Outdoor Coffee Culture

The portable coffee makers market is benefiting from the growth of outdoor activities, remote working, and travel culture. Consumers are investing in rugged, compact, and lightweight devices for camping, hiking, or office travel. Travel retail stores, airport duty-free outlets, and online marketplaces are key channels enabling access to these products, with specialized marketing campaigns targeting millennials and young professionals seeking convenience and premium coffee experiences outside traditional cafes.

What are the key drivers in the portable coffee makers market?

Increasing On-the-Go Coffee Consumption

Busy lifestyles and remote/hybrid work models are driving consumers to seek convenient, portable coffee solutions. Portable coffee makers allow brewing at home, offices, or outdoors without sacrificing quality, meeting the rising demand for flexibility and mobility in coffee consumption.

Growing Specialty Coffee Culture

The preference for high-quality, personalized coffee is fueling demand for premium portable coffee makers. Innovations such as battery-assisted espresso systems and high-quality drip brewers cater to coffee enthusiasts who wish to replicate café-style beverages while on the move, contributing to market expansion.

Technological Advancements and Product Diversification

Integration of battery-powered systems, smart connectivity, and improved material construction (stainless steel, durable polymers) enhances product reliability and portability. Manufacturers are diversifying offerings across brewing methods, materials, and designs, increasing adoption globally.

What are the restraints for the global market?

Price Sensitivity and Competition from Low-Cost Alternatives

While premium portable coffee makers offer convenience and quality, high prices and competition from manual or instant coffee solutions limit adoption in price-sensitive markets, especially in emerging economies.

Functional Limitations and Portability Trade-Offs

Portable coffee makers often compromise capacity, pressure, or durability to maintain portability. Consumers may perceive these devices as less effective than full-sized machines, affecting adoption rates. Battery life and cleaning requirements further impact convenience.

What are the key opportunities in the portable coffee makers market?

Expansion into Emerging Markets and Travel Segments

Asia-Pacific, Latin America, and the Middle East/Africa present significant growth potential. Rising urbanization, disposable income, and travel culture are increasing demand for compact and rugged coffee makers tailored for outdoor and travel use. Strategic marketing through travel retail and e-commerce channels can capture these emerging segments.

Smart and Eco-Friendly Product Innovations

Manufacturers can leverage technology and sustainability to differentiate products. Features such as app-controlled brewing, energy-efficient heating, and reusable filters attract tech-savvy and eco-conscious consumers, opening premium revenue streams and increasing brand loyalty.

Direct-to-Consumer Channels and Experiential Marketing

E-commerce, subscription models for accessories or coffee pods, and experiential marketing (pop-up mobile coffee bars, influencer campaigns) can boost consumer engagement and recurring sales. Expansion into new applications like co-working spaces, mobile offices, and outdoor events provides additional growth avenues.

Product Type Insights

Electric/battery-assisted portable coffee makers lead the market globally (40% of 2024 market share), driven by convenience and reliability. Manual coffee makers and capsule/pod-based solutions maintain niche adoption, while travel/outdoor specialized products are growing rapidly in emerging markets.

Application Insights

Household/residential use dominates (50% of the 2024 market), while out-of-home applications such as travel, camping, outdoor activities, and corporate offices are the fastest-growing segments. Corporate offices, co-working spaces, and mobile hospitality are increasingly adopting portable coffee solutions, contributing to incremental market growth.

Distribution Channel Insights

Online retail dominates (55% of the 2024 market) due to convenience and global reach. Store-based retail, specialty travel outlets, and duty-free shops remain important for mass-market and premium segments. Subscription models and D2C platforms are emerging as innovative channels to enhance customer retention.

| By Product Type | By Design / Form Factor | By Material / Construction | By End-Use / Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is the largest market (30% of 2024 share), led by the U.S. High disposable income, strong coffee culture, and remote working trends drive household and office adoption. Travel and outdoor segments also contribute to growth, supported by established retail and e-commerce channels.

Europe

Europe (25% of 2024 share) shows high adoption in Germany, the UK, and France due to demand for premium, design-focused, and eco-friendly portable coffee makers. Sustainability and technological integration are key drivers, while younger demographics increasingly influence online sales.

Asia-Pacific

Asia-Pacific is the fastest-growing region (20% of 2024 share) with strong demand from China, India, Japan, and South Korea. Urbanization, rising disposable income, and the growth of café culture boost adoption. Battery-assisted, smart, and travel-friendly units are highly preferred.

Latin America

LATAM (10% share) is emerging, with Brazil and Mexico leading adoption. Travel and outdoor-focused portable coffee makers are increasingly popular among millennials and urban consumers.

Middle East & Africa

MEA (5% share) is growing moderately, with UAE, Saudi Arabia, and South Africa driving demand. High-income consumers and luxury travel adoption support premium product segments.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Portable Coffee Makers Market

- Keurig Dr Pepper

- Nestlé SA

- Hamilton Beach Brands, Inc.

- Newell Brands Inc.

- Koninklijke Philips N.V.

- Electrolux AB

- Breville Group Ltd.

- Cuisinart / Conair Corp.

- Zojirushi Corporation

- BUNN-O-Matic Corporation

- Barsetto Appliances

- Smeg S.p.A.

- Sunbeam Products Inc.

- Presto Brands Inc.

- Mika Appliances

Recent Developments

- In 2025, Keurig Dr Pepper expanded its portable coffee maker lineup with battery-powered, travel-focused units targeting global e-commerce channels.

- In 2024, Nestlé introduced eco-friendly, reusable pod systems for portable coffee makers in Europe and Asia-Pacific, boosting premium segment sales.

- In early 2025, Breville launched a smart, app-controlled portable espresso machine with temperature monitoring, enhancing consumer engagement and premium positioning.