Outdoor Vacation Market Size

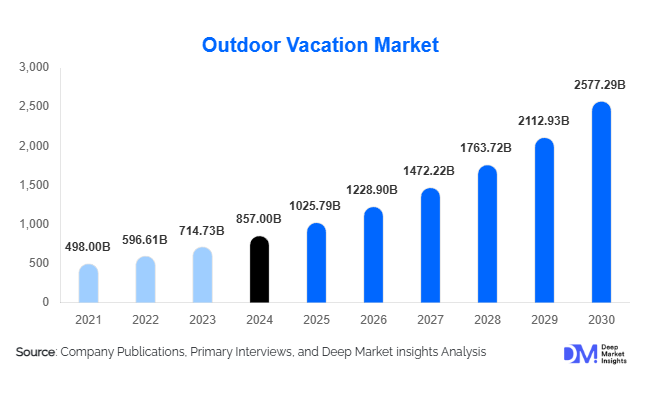

According to Deep Market Insights, the global outdoor vacation market size was valued at USD 857.0 billion in 2024 and is projected to grow from USD 1,025.79 billion in 2025 to reach USD 2,577.29 billion by 2030, expanding at a CAGR of 19.8% during the forecast period (2025–2030). The outdoor vacation market growth is driven by rising consumer preference for nature-based experiences, wellness and adventure tourism, and the expansion of digital booking platforms that make outdoor travel more accessible worldwide.

Key Market Insights

- Outdoor vacations are shifting from basic camping to premium, experience-driven glamping and eco-lodges, reflecting travelers’ desire for comfort and sustainability.

- Wellness-focused and adventure-hybrid retreats are gaining traction as travelers seek holistic outdoor experiences combining health, relaxation, and exploration.

- North America leads the global outdoor vacation market, accounting for around 30% of total market share in 2024, supported by strong travel infrastructure and consumer spending.

- Asia-Pacific is the fastest-growing region, fueled by expanding middle-class populations and domestic travel booms in India and China.

- Digital transformation, including mobile-first bookings, VR destination previews, and AI itinerary personalization, is reshaping how travelers plan outdoor experiences.

- Sustainability and regenerative tourism principles are becoming essential differentiators for operators seeking eco-conscious global travelers.

Latest Market Trends

Rise of Glamping and Premium Outdoor Stays

Outdoor tourism is evolving from traditional camping toward high-comfort “glamping” experiences. Travelers increasingly prefer eco-lodges, treehouses, and luxury tents that combine immersion in nature with premium amenities. Operators are investing in innovative accommodations that integrate renewable energy, local materials, and minimal environmental footprints. The glamping segment, representing about 45% of the total outdoor vacation market, has emerged as the primary growth engine, particularly among millennials and family travelers. The segment’s success stems from its ability to deliver adventure with convenience, creating memorable, Instagram-worthy experiences that resonate with modern travelers.

Technology-Enabled Outdoor Experiences

Digitalization is transforming the outdoor vacation landscape. Mobile booking platforms and online travel agencies (OTAs) now account for roughly 50% of all outdoor vacation reservations. Virtual and augmented reality tools allow users to preview hiking trails, national parks, or camping resorts before booking. AI-powered platforms personalize itineraries based on user preferences, travel behavior, and sustainability ratings. Wearable devices, GPS navigation, and real-time trail apps enhance safety and engagement during trips. This technological integration not only broadens accessibility but also attracts younger, tech-savvy audiences seeking customized outdoor adventures.

Outdoor Vacation Market Drivers

Growing Disposable Incomes and Middle-Class Expansion

Rising disposable incomes in emerging economies and increasing participation in travel by the global middle class are major growth drivers. As more households allocate income to leisure and wellness, the demand for outdoor vacations, especially affordable mid-tier options, continues to surge. Improved air connectivity and regional tourism policies further encourage domestic and cross-border outdoor travel.

Health, Wellness, and Experience-Oriented Travel

Consumers are prioritizing mental well-being and health, leading to increased demand for vacations that promote rejuvenation in natural environments. Activities such as hiking, yoga retreats, forest bathing, and eco-volunteering are central to this trend. Wellness-focused outdoor experiences, including sustainable resorts and nature retreats, are expanding rapidly as they align with global wellness tourism movements.

Digital Access and Remote-Work Mobility

Digital transformation and the “work-from-anywhere” culture have enabled travelers to combine productivity with outdoor leisure. Digital nomads are opting for extended stays in scenic natural environments, boosting revenue in the long-stay segment. Enhanced broadband and mobile networks in rural regions have made outdoor destinations more accessible and appealing for remote workers.

Market Restraints

Infrastructure and Accessibility Limitations

Many natural destinations still lack sufficient infrastructure, such as reliable transportation, energy supply, and hospitality facilities. These limitations restrict the potential for tourism growth, particularly in remote mountain, desert, or island regions. The high cost of infrastructure development poses barriers to new entrants seeking to expand outdoor vacation offerings in underdeveloped areas.

Environmental and Seasonal Challenges

Outdoor vacations are highly dependent on climate stability and environmental preservation. Natural disasters, extreme weather, and over-tourism threaten the sustainability of key destinations. Seasonal demand fluctuations can lead to inconsistent revenue patterns and operational inefficiencies. Climate-conscious management and adaptive planning are essential to overcome these restraints.

Outdoor Vacation Market Opportunities

Untapped Regional Markets and Tourism Infrastructure Investments

Emerging economies in the Asia-Pacific, Latin America, and Africa present major opportunities for outdoor tourism expansion. Government-backed programs promoting eco-tourism, national park development, and cross-border travel corridors are opening new destinations for global travelers. Public-private partnerships to develop adventure parks, hiking trails, and heritage routes are expected to attract international operators and investors.

Integration of Technology and Personalized Experiences

AI, data analytics, and immersive technology provide opportunities for operators to personalize outdoor vacations. Platforms offering AR-based trail navigation, weather-integrated planning tools, and sustainability tracking can enhance traveler engagement. Technology-driven experiences, such as smart camping gear, digital concierge services, and VR previews, will help providers differentiate their offerings and attract younger demographics.

Sustainability and Regenerative Travel Models

As eco-conscious travel gains momentum, the adoption of regenerative tourism principles presents a high-potential growth avenue. Operators focusing on carbon-neutral stays, conservation-based itineraries, and community engagement can access new customer segments and policy incentives. Governments supporting sustainable infrastructure and certification schemes further accelerate this opportunity.

Product Type Insights

Mid-tier outdoor resorts and glamping accommodations dominate the market, holding nearly 45% share in 2024. These products appeal to travelers seeking both comfort and adventure, offering upgraded amenities such as Wi-Fi, spa services, and guided nature excursions. Budget accommodations, including camping grounds and basic lodges, capture 30% of demand, serving younger and cost-conscious travelers. Premium outdoor resorts, though niche, are expanding rapidly due to rising luxury travel demand and high margins associated with exclusive experiences.

Traveler Type Insights

Family travelers account for approximately 35% of the global outdoor vacation market, driven by demand for child-friendly nature retreats and multi-generational experiences. Couples form another key segment, favoring wellness-focused and romantic outdoor stays. Solo travelers and group travelers represent fast-growing demographics, often attracted by social adventure tours and eco-volunteering opportunities. These evolving traveler profiles are diversifying offerings and creating new product categories.

Age Group Insights

Millennials lead the outdoor vacation market with about 30% share in 2024, reflecting their preference for authentic, nature-centric experiences and digital convenience. Generation Z travelers are emerging as a critical future demographic, driven by adventure and social media influence. Generation X and Baby Boomers continue to sustain growth in the wellness and premium nature resort categories, emphasizing comfort, safety, and cultural immersion.

| By Vacation Type | By Traveler Type | By Booking Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America dominates the global outdoor vacation market, accounting for around 30% of total revenue in 2024 (approximately USD 252 billion). The United States leads in national park tourism, camping, and glamping, supported by well-established infrastructure and high consumer spending. Canada’s scenic destinations and adventure parks further bolster regional performance.

Europe

Europe represents about 20% of the global share, driven by strong demand for sustainable tourism and cultural outdoor experiences. Countries such as Germany, France, and the U.K. are leading in eco-tourism and heritage trails. Nordic regions and the Alps are popular for year-round outdoor recreation, supported by established sustainability regulations and eco-certification programs.

Asia-Pacific

Asia-Pacific is the fastest-growing region, holding about 25% of the global market in 2024 (USD 210 billion) and expected to outpace all regions through 2030. Rising middle-class wealth, improved connectivity, and domestic travel growth in China and India are key drivers. Australia and Japan contribute a mature demand for adventure and wellness-oriented outdoor travel.

Latin America

Latin America holds approximately 10% market share, led by Brazil, Chile, and Argentina. The region’s diverse landscapes, from rainforests to volcanoes, offer strong potential for eco-tourism development. Infrastructure investments and growing inbound travel interest from North America are enhancing prospects for outdoor resorts and adventure parks.

Middle East & Africa

The Middle East and Africa together hold about 15% of the market, led by South Africa, Kenya, and the UAE. The region benefits from unique natural reserves, desert adventure tourism, and luxury eco-resorts. Government initiatives such as Saudi Arabia’s Vision 2030 and the UAE’s sustainable tourism plans are fostering the rapid development of outdoor vacation infrastructure.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Outdoor Vacation Market

- Expedia Group

- American Express Travel Services

- TUI Group

- Intrepid Travel

- Thomas Cook Group

- G Adventures

- Abercrombie & Kent

- Kensington Tours

- Backroads

- Hipcamp

- Butterfield & Robinson

- Scott Dunn Ltd.

- Autocamp

- World Travel Inc.

- Micato Safaris

Recent Developments

- In June 2025, Intrepid Travel announced a new range of carbon-neutral outdoor tours across Asia-Pacific, focusing on eco-lodges and cultural immersion programs.

- In May 2025, TUI Group launched a global glamping division targeting European and North American travelers seeking sustainable luxury outdoor stays.

- In April 2025, Expedia Group integrated AI-based sustainability filters on its booking platform, allowing travelers to choose eco-certified outdoor resorts and camps.