Pet Wearables Market Size

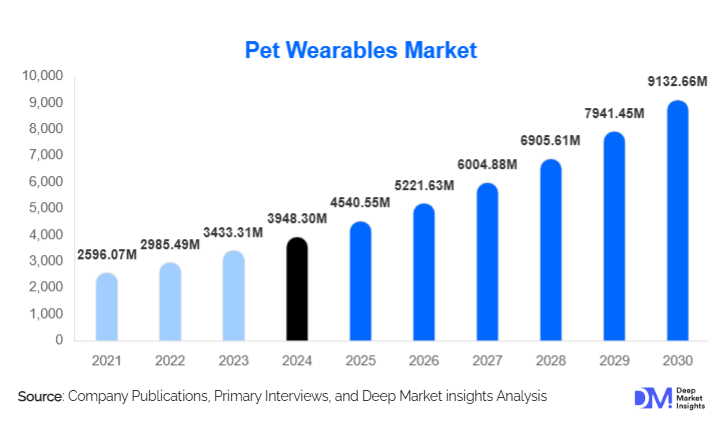

According to Deep Market Insights, the global pet wearables market size was valued at USD 3,948.30 million in 2024 and is projected to grow from USD 4,540.55 million in 2025 to reach USD 9,132.66 million by 2030, expanding at a CAGR of 15.00% during the forecast period (2025–2030). Market growth is fueled by the rising humanization of pets, increasing focus on animal health and safety, and rapid technological advancements such as GPS tracking, IoT integration, and AI-driven behavior analytics. As pet owners increasingly seek real-time monitoring, health insights, and safety assurance, demand for smart collars, activity trackers, and diagnostic wearables continues to surge globally.

Key Market Insights

- Smart collars dominate the market, accounting for nearly 60% of 2024 revenues, due to multifunctional capabilities such as GPS tracking, fitness, and health monitoring.

- North America leads globally, representing about 40% of the 2024 market share, while Asia-Pacific is the fastest-growing region with a CAGR exceeding 15%.

- Dogs remain the largest animal segment, capturing nearly 60% of market revenue, supported by higher adoption rates and outdoor activity levels.

- Integration with tele-veterinary and pet-insurance services is creating recurring revenue models and deeper ecosystem connectivity.

- AI and IoT technologies are enabling predictive health analytics, personalized pet-care recommendations, and smart-home interoperability.

- Online sales channels dominate, driven by e-commerce convenience, product variety, and direct-to-consumer (D2C) marketing strategies.

What are the latest trends in the pet wearables market?

Integration of Health Analytics and Veterinary Tele-Services

Pet wearables are rapidly evolving from simple GPS trackers into comprehensive health-monitoring platforms. Smart collars and harnesses now collect vital metrics such as heart rate, body temperature, and sleep patterns. The collected data integrates seamlessly with tele-veterinary platforms, allowing real-time diagnostics and preventive care. This convergence of pet healthcare and IoT technology is transforming veterinary practice, enabling data-driven consultations and early disease detection. Subscription-based analytics services are becoming a major trend, where owners pay monthly fees for data storage, insights, and tele-vet access.

AI-Enabled Behavioral Insights and Predictive Monitoring

Artificial intelligence is being used to analyze motion and biometric data to detect behavioral changes, stress, or medical abnormalities in pets. Algorithms interpret patterns in movement and rest cycles, alerting owners to potential illnesses or anxiety. These AI features appeal to urban consumers who spend long hours away from home, offering peace of mind and timely alerts. The integration of AI with smartphone apps, cloud dashboards, and vet systems is expected to significantly enhance long-term value for users and expand product adoption across developed markets.

Sustainable and Ergonomic Device Design

Manufacturers are emphasizing lightweight, waterproof, and recyclable designs to improve pet comfort and meet the eco-friendly expectations of consumers. Flexible materials, long-battery sensors, and solar-assisted charging options are emerging as differentiators. With pet owners prioritizing comfort and durability, companies are investing heavily in ergonomic innovation and sustainable materials to extend device life cycles and reduce electronic waste.

What are the key drivers in the pet wearables market?

Rising Pet Humanization and Health Awareness

Global pet ownership continues to rise, with a growing sentiment of treating pets as family members. This cultural shift drives willingness to spend on premium health and safety solutions. Pet owners seek wearable devices that monitor movement, sleep, and nutrition levels, aligning with broader trends in preventive healthcare and lifestyle tracking seen in human wearables.

Technological Innovations and IoT Integration

Rapid advances in GPS tracking, Bluetooth Low Energy (BLE), and multi-sensor technologies have transformed product functionality. IoT integration enables seamless data transmission between devices, mobile apps, and veterinary systems. Hybrid connectivity (LTE/5G + Bluetooth/GPS) solutions allow global tracking and reduce data loss, thereby enhancing user reliability and adoption. As a result, pet wearables are increasingly being positioned as part of the smart-home ecosystem.

Growth in Subscription-Based and Data-Analytics Services

Hardware manufacturers are diversifying into cloud-based analytics and subscription models that provide monthly insights, geofencing alerts, and wellness reports. These recurring revenue streams improve profitability and deepen customer engagement. The growing synergy between hardware and software is redefining competitive strategies and long-term monetization.

What are the restraints for the global pet wearables market?

High Product Costs and Limited Battery Performance

Advanced pet wearables remain expensive, limiting adoption among price-sensitive consumers. Device battery life and frequent recharging requirements further hinder convenience, especially for smaller pets, where weight and size are constraints. Manufacturers are addressing these issues through low-power sensors, modular batteries, and improved chip efficiency, yet cost remains a significant barrier in emerging markets.

Lack of Awareness and Distribution Gaps in Developing Regions

In Asia, Africa, and Latin America, consumer awareness about the benefits of pet wearables remains low, compounded by limited retail availability and weaker connectivity infrastructure. These factors restrict large-scale adoption despite rising pet ownership. Local partnerships with veterinary networks, e-commerce channels, and telecom providers will be essential to bridge these gaps.

What are the key opportunities in the pet wearables industry?

Tele-Veterinary Integration and Pet Insurance Partnerships

Pet wearables are well-positioned to integrate with veterinary care and pet insurance ecosystems. Real-time data transmission allows continuous health monitoring and early detection of diseases, reducing medical costs for owners and insurers alike. Partnerships between device makers, tele-health providers, and insurers present a vast opportunity to create recurring service revenues and drive hardware sales.

Emerging Market Expansion and New Pet Categories

Rapid urbanization and rising disposable incomes in Asia-Pacific, Latin America, and the Middle East are opening new frontiers. Beyond dogs and cats, demand for wearables for birds, rabbits, and small livestock is increasing. Developing region-specific products with lower cost and local language interfaces can significantly expand market reach and volumes.

Product and Service Innovation

Next-generation wearables with multi-sensor capabilities, AI behavioral algorithms, and cross-platform integration with smart home devices are expected to redefine the competitive landscape. Offering premium subscription services—such as activity coaching, nutrition recommendations, and health alerts—will help manufacturers differentiate their brands and build long-term customer loyalty.

Product Type Insights

Smart collars lead the global market, representing approximately 60% of total 2024 revenues. These devices combine GPS, health tracking, and communication features in one compact form factor. Smart harnesses and tags follow, targeting specialized functions like behavior monitoring and vital sign tracking. Smart cameras and emotion sensors are gaining traction in urban markets for remote monitoring and AI-based interaction with pets. Ongoing R&D efforts focus on battery longevity, comfort design, and data security for connected devices.

Application Insights

Identification and Tracking remain the dominant application, accounting for over 50% of 2024 revenues. Owners prioritize location safety and pet recovery as primary concerns. Fitness and wellness monitoring applications are rapidly gaining share, especially in urban markets where pets face obesity and low activity levels. Medical diagnostics and treatment monitoring segments are emerging, supported by tele-veterinary adoption and connected healthcare ecosystems.

Distribution Channel Insights

Online channels dominate the global pet wearables market, driven by D2C brands and e-commerce platforms that offer wider availability and competitive pricing. Offline retail through pet specialty stores and veterinary clinics remains significant for premium devices requiring demonstration or installation assistance. Institutional sales (veterinary hospitals, boarding centers, and shelters) represent a fast-growing niche, projected to expand at a 15%+ CAGR through 2030 as organizations integrate wearables into pet care protocols.

End-Use Insights

Household pet owners account for nearly 78% of market demand, driven by increasing awareness of pet safety and wellness. Veterinary clinics and animal shelters represent the fastest-growing end-use segment, leveraging wearables for health tracking and disease prevention. Pet insurance firms and research organizations are also emerging users, utilizing wearable data for claims analytics and scientific studies on pet behavior and nutrition.

| By Product Type | By Pet Type | By Application | By Distribution Channel | By End Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America dominates the global pet wearables market with approximately 40% share in 2024. High pet ownership rates (>65% of households), technological advancement, and strong disposable incomes drive growth. The U.S. is the largest individual market, followed by Canada, supported by the presence of major manufacturers and subscription service providers. Continuous innovation and cloud integration fuel the region’s long-term leadership.

Europe

Europe accounts for around 30% of the market, led by the U.K., Germany, and France. The region’s regulations support micro-chipping and pet identification, boosting wearable adoption. Sustainability-focused product design and data-driven veterinary services are major trends in this region. European consumers are also more receptive to eco-friendly materials and privacy-secure data ecosystems.

Asia-Pacific (APAC)

Asia-Pacific is the fastest-growing region, projected to register a CAGR of 15–17% through 2030. Rising pet ownership in China, Japan, and India, coupled with urbanization and e-commerce penetration, is driving strong demand. Local manufacturing capabilities and government initiatives like “Made in China 2025” also support production and export growth.

Latin America

Latin America is an emerging region for pet wearables, with Brazil and Mexico showing early adoption in GPS tracking devices and smart tags. Rising middle-class incomes and pet ownership are expected to drive steady growth, supported by expanded distribution through e-commerce platforms and regional retailers.

Middle East & Africa (MEA)

MEA currently holds a smaller share but offers high potential in premium segments. The UAE and Saudi Arabia lead regional demand for luxury pet devices, while South Africa and Kenya see emerging interest in affordable trackers and veterinary-linked wearables. Infrastructure development and digital connectivity will be key growth enablers in this region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pet Wearables Market

- Garmin Ltd.

- Mars Incorporated (Whistle Labs)

- FitBark Inc.

- Tractive GmbH

- PetPace LLC

- Datamars SA

- Avid Identification Systems Inc.

- Scollar Inc.

- Loc8tor Ltd.

- IceRobotics Ltd.

- Nedap NV

- Binatone Global (Pet Tech Division)

- KYON Technologies

- Motorola Mobility (Pet Tracker Line)

- Petcube Inc.

Recent Developments

- In June 2025, Garmin Ltd. introduced its latest “Garmin Alpha Track Pro” smart collar with 5G connectivity and AI-powered activity recognition, aimed at enhancing real-time pet safety analytics.

- In April 2025, Tractive GmbH expanded its operations in India and Southeast Asia, launching region-specific, affordable GPS trackers for cats and dogs.

- In March 2025, Mars (Whistle Labs) partnered with a global pet insurance provider to bundle wearable-based health monitoring plans with insurance subscriptions.

- In January 2025, FitBark Inc. launched an AI-driven behavior analysis feature integrated with its mobile app, enhancing pet activity correlation with mental well-being metrics.