Pet Travel Accessories Market Size

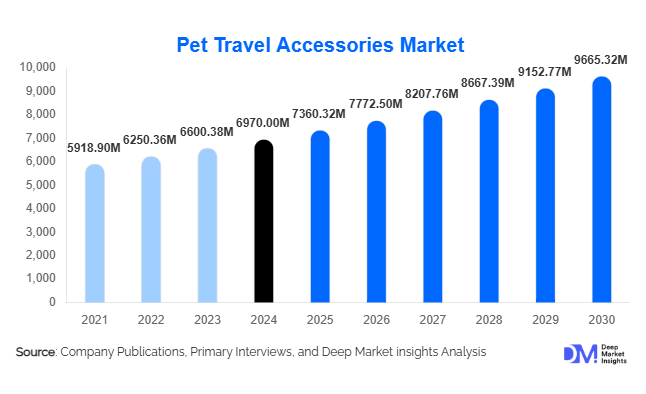

According to Deep Market Insights, the global pet travel accessories market size was valued at USD 6,970.00 million in 2024 and is projected to grow from USD 7,360.32 million in 2025 to reach USD 9,665.32 million by 2030, expanding at a CAGR of 5.6% during the forecast period (2025–2030). The market growth is primarily driven by increasing pet ownership, rising disposable income, growing trends of pet humanization, and the expansion of pet-friendly travel infrastructure globally.

Key Market Insights

- Pet owners are increasingly seeking high-quality, ergonomic travel accessories that ensure safety, comfort, and entertainment for pets during travel, driving demand for carriers, harnesses, and collapsible feeding kits.

- Technological integration is reshaping the market, with smart carriers, GPS-enabled travel kits, and automated feeding systems becoming mainstream for pet safety-conscious owners.

- North America dominates the market, with the U.S. and Canada leading demand due to high pet ownership, premium product adoption, and robust e-commerce channels.

- Asia-Pacific is the fastest-growing region, led by China, India, and Japan, fueled by rising disposable income, urbanization, and increasing pet-friendly infrastructure.

- Europe remains a significant contributor, with Germany, the U.K., and France showing strong demand for premium and eco-friendly travel accessories.

- Online retail channels are transforming distribution, offering convenience, wider selection, and direct access to premium and niche products.

What are the latest trends in the pet travel accessories market?

Premiumization and Pet Humanization

Pet owners increasingly treat pets as family members, driving the demand for high-end, multi-functional travel accessories. Premium carriers, orthopedic travel beds, and stylish collapsible feeding kits are witnessing robust growth. Manufacturers are emphasizing quality, design, and safety, catering to affluent pet owners who prioritize comfort and aesthetic appeal during travel.

Smart and Tech-Integrated Products

Technological adoption in the pet travel accessories market is accelerating. GPS-enabled carriers, automated feeding bowls, and wearable pet monitors allow owners to track location and health while traveling. IoT-based accessories enhance safety and convenience, appealing to tech-savvy consumers who prioritize real-time monitoring and innovative functionality.

What are the key drivers in the pet travel accessories market?

Increasing Pet Ownership Worldwide

The rising number of households with pets, particularly dogs and cats, drives the demand for travel accessories. Urban lifestyles, nuclear family setups, and the popularity of pets as companions have led to higher consumption of travel-specific carriers, safety harnesses, and portable feeding solutions.

Growth of Pet-Friendly Travel

The revival of global travel and expansion of pet-friendly hotels, airlines, and resorts are significant growth drivers. Pet owners increasingly seek convenience and safety during travel, resulting in higher adoption of carriers, travel kits, and portable accessories tailored for pets.

Rise in Disposable Income and Affluence

Higher disposable income and willingness to spend on premium pet care products fuel market growth. Pet owners are increasingly purchasing advanced, high-quality travel accessories, particularly in North America and Europe, supporting the expansion of the premium segment.

What are the restraints for the global market?

High Product Costs

Premium and technologically advanced pet travel accessories have higher price points, limiting adoption in price-sensitive markets. Affordability remains a challenge, especially in emerging economies, slowing the overall market expansion.

Regulatory Compliance Challenges

Pet travel accessories must comply with airline safety standards and material regulations. Non-compliance risks product recalls or bans, posing operational challenges for manufacturers and restricting market growth in certain regions.

What are the key opportunities in the pet travel accessories market?

Expansion of Pet-Friendly Travel Infrastructure

The growth of pet-friendly airlines, hotels, and resorts worldwide presents opportunities for manufacturers to supply airline-approved carriers, travel kits, and portable feeding solutions. Collaborations with hospitality providers can help brands capture high-volume bulk orders and increase brand visibility in premium markets.

Emerging Markets in Asia-Pacific and LATAM

Rising pet ownership, urbanization, and disposable incomes in Asia-Pacific and Latin America create new growth avenues. Early entry into these markets, with localized products and region-specific pricing strategies, offers high potential for revenue generation.

Eco-Friendly and Smart Accessories

Consumer preference is shifting toward sustainable, biodegradable, and tech-enabled products. Companies that innovate with eco-friendly materials or integrate smart features, such as GPS trackers and automated feeding bowls, can differentiate their offerings and capture high-value segments.

Product Type Insights

Travel carriers and crates dominate the market with approximately 38% share in 2024, driven by demand for airline-approved and multi-functional carriers for dogs and cats. Fabric-based accessories, including travel bags and collapsible feeding kits, hold the largest share in material types (42% in 2024) due to their portability, lightweight nature, and ease of cleaning. Products for dogs lead pet type segments (55%), reflecting their prevalence as traveling pets. Online retail accounts for 46% of the distribution channel market, fueled by convenience and wider product availability, while individual pet owners constitute 62% of end-use demand.

Application Insights

Travel and tourism-related applications are growing rapidly, driven by pet-friendly airlines, hotels, and resorts requiring carriers, travel kits, and feeding solutions. Veterinary and animal health facilities also contribute to niche demand for safe transportation accessories. Export-driven demand is strong, with North America and Europe importing premium products from Asia-Pacific manufacturers.

Distribution Channel Insights

Online retail platforms dominate sales due to convenience, wider selection, and competitive pricing. E-commerce enables direct-to-consumer access, particularly for premium and tech-enabled products. Offline channels, including pet specialty stores and veterinary clinics, remain relevant but are growing at a slower pace.

| By Product Type | By Pet Type | By Distribution Channel | By End Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America leads the market (38% of 2024 share), with high pet ownership, premium product adoption, and extensive e-commerce channels driving demand. The U.S. and Canada show a strong preference for technologically advanced and high-quality travel accessories.

Europe

Europe accounts for 30% of the 2024 market, with Germany, the U.K., and France leading due to high disposable incomes, pet humanization, and eco-conscious consumer trends. Premium and sustainable products are particularly popular.

Asia-Pacific

APAC is the fastest-growing region (CAGR 9.1%), driven by China, India, and Japan. Rising urbanization, disposable income, and pet adoption contribute to robust demand, especially for online retail and tech-integrated accessories.

Latin America

Brazil and Mexico are key markets, with growing demand for mid-range and premium accessories among emerging affluent pet owners. Outbound travel also fuels demand for high-quality travel kits.

Middle East & Africa

The UAE, Saudi Arabia, and Qatar show increasing demand for luxury travel accessories. Africa benefits from local travel and premium imports, with intra-African tourism expanding usage of carriers and safety kits.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pet Travel Accessories Market

- Petmate

- K&H Pet Products

- Sleepypod

- PetSafe

- Ruffwear

- Outward Hound

- Bergan

- Sherpa Pet Products

- Midwest Homes for Pets

- Kurgo

- Amazon Basics (Pet Division)

- Trixie

- Ferplast

- Lixit

- JW Pet

Recent Developments

- In March 2025, Petmate launched a line of smart, GPS-enabled carriers with integrated health monitoring features, targeting premium pet owners in North America.

- In February 2025, Sleepypod expanded its collapsible carrier portfolio across Europe, emphasizing airline compliance and eco-friendly materials.

- In January 2025, Ruffwear introduced a multifunctional travel kit including portable feeding solutions, safety harnesses, and collapsible toys, targeting Asia-Pacific e-commerce markets.