Smart Pet Feeder Market Size

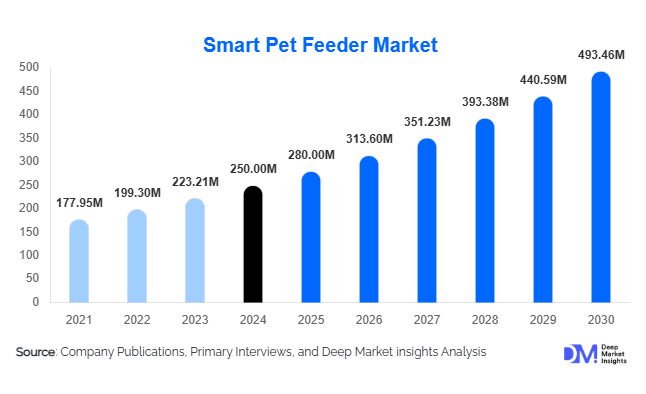

According to Deep Market Insights, the global smart pet feeder market size was valued at USD 250 million in 2024 and is projected to grow from USD 280 million in 2025 to reach USD 493.46 million by 2030, expanding at a CAGR of 12.0% during the forecast period (2025–2030). The growth of the smart pet feeder market is primarily driven by increasing pet ownership worldwide, rising demand for automated and health-focused feeding solutions, and the integration of IoT-enabled features that allow remote monitoring and scheduling.

Key Market Insights

- Dogs dominate the market, holding nearly 70% of the share in 2024, reflecting higher feed requirements and greater willingness among dog owners to invest in automation.

- Wi-Fi-enabled feeders account for over 60% of global sales, supported by strong consumer preference for remote control, real-time notifications, and app integration.

- 3–5 liter capacity feeders remain the most popular size segment, offering the right balance between usability, affordability, and refill frequency.

- Household use is the leading end-use application, while commercial applications (veterinary clinics, kennels, daycares) are expected to rise in the coming years.

- North America leads with more than 50% of market share in 2024, but Asia-Pacific is the fastest-growing region, with India and China driving demand at double-digit growth rates.

- The top five companies control about 45% of the market, with competition intensifying as new entrants introduce innovative, feature-rich, and cost-effective devices.

What are the latest trends in the smart pet feeder market?

Integration with Health and Wellness Analytics

Manufacturers are increasingly embedding health-focused features into feeders, such as weight monitoring, calorie tracking, and feeding alerts. Integration with veterinary apps and AI-powered analytics is enabling pet owners to identify irregular eating patterns early, reducing the risks of obesity or dietary issues. These value-added services are evolving into subscription models, creating long-term recurring revenue opportunities for companies.

Growth of E-commerce Channels

Online sales channels are growing rapidly, driven by the ability of consumers to compare models, read reviews, and access promotions. While offline retail still commands a larger share, platforms like Amazon, Chewy, and regional e-commerce leaders are accelerating product penetration in emerging economies. Social media marketing and influencer-led campaigns are also driving awareness among younger pet owners.

Premiumization and Smart Home Integration

As disposable incomes rise, premium feeders with advanced features such as dual feeding systems, integrated cameras, voice interaction, and smart assistant compatibility (Alexa, Google Home) are gaining traction. This trend is particularly strong in North America, Europe, and affluent households in APAC, reflecting a broader movement toward smart, connected home ecosystems.

What are the key drivers in the smart pet feeder market?

Rising Pet Ownership and Humanization of Pets

With more households treating pets as family members, expenditure on premium pet care products is increasing. This shift is especially evident in urbanized markets where long working hours and busy lifestyles encourage the adoption of automated feeders for convenience and consistency in pet care.

Advances in IoT and Smart Connectivity

IoT adoption has made it possible to create feature-rich feeders with Wi-Fi modules, app-based control, and data-sharing capabilities. This technological evolution enhances consumer trust and product attractiveness, enabling feeder manufacturers to offer differentiated value in an increasingly competitive landscape.

Expansion of Online Sales

The rise of e-commerce has improved market accessibility for smart pet feeders, especially in regions where offline retail infrastructure is limited. Online platforms not only boost product visibility but also reduce distribution costs, improving market penetration for both established and new entrants.

What are the restraints for the global market?

High Costs and Price Sensitivity

Smart feeders are significantly more expensive than traditional options, limiting adoption in price-sensitive markets. Premium devices with advanced connectivity and camera integration often exceed affordability thresholds for mainstream consumers, particularly in developing regions.

Technical Reliability and Maintenance Challenges

Issues such as food jamming, device malfunction, or unreliable internet connections can undermine consumer trust. Additionally, cleaning and maintenance requirements can discourage repeat purchases, particularly among first-time buyers seeking hassle-free solutions.

What are the key opportunities in the smart pet feeder industry?

AI-Powered Health Monitoring

Smart feeders that integrate AI for diet analysis and wellness tracking represent a new revenue frontier. Companies that link devices with veterinary telehealth or nutritional services can capture recurring subscription-based revenues while building long-term brand loyalty.

Emerging Market Expansion

Regions like India, China, and Southeast Asia represent high-growth opportunities, with rising pet ownership, internet penetration, and e-commerce adoption fueling demand. Adapting pricing strategies and localized features will be critical for success in these fast-developing markets.

Commercial Applications

Veterinary clinics, pet hotels, kennels, and daycares are beginning to adopt smart feeders to manage multiple animals efficiently. These clients often purchase feeders in bulk, creating opportunities for companies to supply higher-capacity and commercial-grade devices at premium pricing.

Product Type Insights

Mid-range smart feeders dominate the market with nearly 50% share in 2024, balancing affordability with must-have features like portion scheduling, app connectivity, and food storage safety. High-end feeders are growing in popularity among affluent households, while budget devices attract price-sensitive consumers but remain limited in functionality.

Application Insights

Household use accounts for the majority of sales, representing over 80% of the market in 2024. This is driven by the growing adoption of smart devices in everyday life and the convenience demanded by urban pet owners. Commercial use, though smaller, is expected to expand as pet boarding and daycare services scale globally.

Distribution Channel Insights

Offline retail still holds the largest market share in 2024 (over 50%), but online platforms are the fastest-growing sales channel. Consumers increasingly prefer online shopping for variety, discounts, and reviews. Direct-to-consumer brand websites are also emerging as important sales drivers.

| Feeder Type | Features | Power Source |

|---|---|---|

|

|

|

Regional Insights

North America

North America remains the largest market, commanding about 50–55% share in 2024. The U.S. leads this dominance due to high pet ownership, strong disposable incomes, and early adoption of smart home technologies. Premium feeders with camera integration and AI capabilities are particularly popular in this region.

Europe

Europe contributes a significant share, with the U.K., Germany, and France leading adoption. The region’s strong regulatory standards and preference for eco-friendly, sustainable devices are shaping product development. Growth is steady, with premiumization being a core theme.

Asia-Pacific

APAC is the fastest-growing region, with a CAGR of about 9.1%. China and India are key contributors, supported by rising disposable incomes, urbanization, and expanding e-commerce. India alone accounted for USD 40.7 million in 2024, projected to reach nearly USD 70 million by 2030.

Latin America

Brazil and Argentina are driving demand in this region, though the base is smaller compared to APAC. Growth is fueled by rising middle-class spending and online retail expansion.

Middle East & Africa

MEA holds a minor share, but Gulf nations such as the UAE and Saudi Arabia are showing rising adoption of premium feeders. Africa is at an early stage, with affordability and distribution challenges restraining growth, though potential exists as urban pet ownership rises.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Smart Pet Feeder Market

- PetSafe Brands

- Sure Petcare (Allflex Group)

- Whisker

- Dogness Group

- Petlibro

- Xiaomi

- PETKIT

- Skymee

- Wopet

- Welltobe

- Aqara

- Tuya Smart

- LUSMO

- Cat Mate

- PortionProRx

Recent Developments

- In May 2025, Whisker launched a new AI-enabled smart feeder with built-in cameras and wellness monitoring features, targeting premium households in North America.

- In April 2025, PETKIT expanded its e-commerce presence in India and Southeast Asia, offering mid-range feeders with localized pricing.

- In February 2025, Dogness Group introduced a commercial-grade smart feeder for veterinary hospitals and kennels, emphasizing durability and high-capacity storage.