Pet Educational Toys Market Size

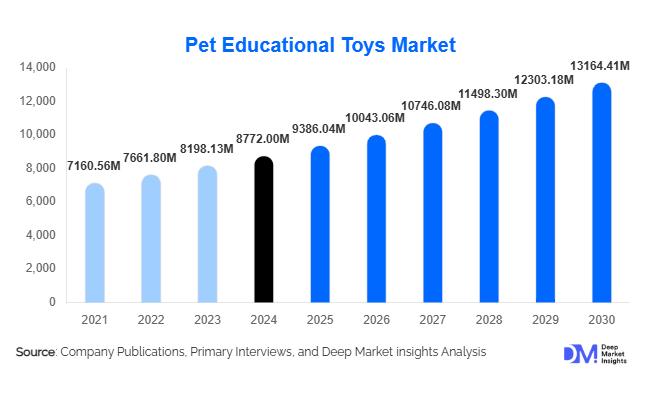

According to Deep Market Insights, the global pet educational toys market size was valued at USD 8,772.00 million in 2024 and is projected to grow from USD 9,386.04 million in 2025 to reach USD 13,164.41 million by 2030, expanding at a CAGR of 7.0% during the forecast period (2025–2030). The market growth is driven by rising pet humanization, increasing awareness of pet mental stimulation and behavioral training, and strong demand for interactive and technology-enabled toys among urban pet owners. Educational toys are increasingly viewed as essential wellness products rather than discretionary accessories, supporting sustained demand globally.

Key Market Insights

- Pet humanization continues to reshape purchasing behavior, with owners prioritizing cognitive development, anxiety reduction, and enrichment-based toys.

- Dogs dominate global demand, accounting for over 60% of total market value due to higher training and engagement requirements.

- Mid-range educational toys (USD 15–40) represent the largest revenue segment, balancing affordability with functionality.

- Online and e-commerce channels lead distribution, driven by subscription models, product variety, and convenience.

- Smart and connected toys are the fastest-growing product category, supported by AI, IoT, and app-based monitoring features.

- Asia-Pacific is the fastest-growing regional market, fueled by rising pet adoption and disposable incomes in China and India.

What are the latest trends in the pet educational toys market?

Smart and Connected Pet Toys Gaining Momentum

The integration of technology into pet educational toys is one of the most prominent trends shaping the market. Smart toys equipped with motion sensors, adaptive learning algorithms, and mobile app connectivity allow pet owners to monitor engagement levels and customize play patterns. These products are particularly popular among tech-savvy millennials and working professionals seeking automated engagement solutions for pets left alone for extended periods. Smart toys currently account for less than one-fifth of total revenue but are expanding at a significantly higher growth rate than traditional toys, driven by premium pricing and repeat purchase potential.

Rising Demand for Sustainable and Non-Toxic Materials

Eco-conscious consumer behavior is influencing material choices across the pet care industry. Pet owners are increasingly seeking educational toys made from recyclable plastics, natural rubber, bamboo fibers, and non-toxic fabrics. Sustainability certifications and transparent sourcing are becoming key differentiators for brands, particularly in North America and Europe. This trend is also supported by tightening regulations on chemical safety and plastic usage, encouraging manufacturers to invest in sustainable product innovation.

What are the key drivers in the pet educational toys market?

Increasing Pet Humanization and Wellness Awareness

Pets are increasingly treated as family members, leading owners to invest in products that support mental stimulation and emotional well-being. Educational toys are widely recommended to reduce boredom, separation anxiety, and destructive behavior, making them a core component of modern pet care routines. This shift has significantly increased per-pet spending across developed markets.

Growth in Urban Pet Ownership

Urbanization and smaller living spaces have increased demand for toys that provide cognitive engagement indoors. Educational toys enable pets to remain mentally active even in constrained environments, making them highly relevant for apartment-dwelling pet owners. This driver is particularly strong in Asia-Pacific and Europe, where urban pet ownership is rising rapidly.

What are the restraints for the global market?

Price Sensitivity in Emerging Markets

While demand is growing globally, premium and technology-enabled educational toys remain cost-prohibitive in several developing economies. Limited purchasing power and lower awareness of cognitive pet wellness restrict adoption, particularly in price-sensitive regions.

Product Safety and Durability Concerns

Educational toys must comply with strict safety standards related to choking hazards, toxic materials, and electronic components. Product recalls and durability issues can negatively impact brand trust and increase compliance costs for manufacturers.

What are the key opportunities in the pet educational toys industry?

Expansion in Emerging Economies

Rapid growth in pet adoption across China, India, Brazil, and Southeast Asia presents a major opportunity for market expansion. Localized manufacturing, affordable pricing strategies, and culturally adapted designs can unlock significant untapped demand in these regions.

Integration with Veterinary and Training Services

Educational toys are increasingly being recommended by veterinarians, trainers, and pet wellness centers for behavioral therapy and obesity management. Partnerships with professional pet service providers offer opportunities to expand institutional and B2B sales channels.

Product Type Insights

Puzzle and problem-solving toys dominate the market, accounting for approximately one-third of global revenue in 2024. These toys are widely used for behavioral training and mental stimulation. Interactive and smart toys represent the fastest-growing product category, supported by technological advancements and premiumization trends. Treat-dispensing toys maintain steady demand due to their dual role in engagement and reward-based learning, while sensory and skill-development toys are gaining traction among younger pets and therapy animals.

Material Type Insights

Plastic-based educational toys hold the largest market share due to durability, cost efficiency, and design flexibility. Rubber and elastomer-based toys are widely used for chew-resistant applications, particularly for dogs. Fabric and plush-based toys cater primarily to cats and small mammals, while eco-friendly materials represent a rapidly growing niche driven by sustainability preferences.

Distribution Channel Insights

Online and e-commerce platforms account for the largest share of global sales, supported by subscription models, product reviews, and convenience. Pet specialty stores remain important for premium and trainer-recommended products. Supermarkets and hypermarkets cater to mass-market demand, while veterinary clinics and training centers serve as trusted channels for specialized educational toys.

End-Use Insights

Household pet owners dominate end-use demand, accounting for over 70% of total market value. Professional trainers and pet academies represent the fastest-growing segment, leveraging educational toys for structured training programs. Veterinary and animal wellness centers are emerging as important institutional buyers, particularly for behavioral therapy and rehabilitation applications.

| By Pet Type | By Product Type | By Material Type | By Distribution Channel | By End Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 38% of global market revenue, led by the United States. High disposable income, strong pet humanization trends, and early adoption of smart toys drive demand. Premium and technology-enabled products perform particularly well in this region.

Europe

Europe represents around 27% of the global market, with strong demand from Germany, the U.K., and France. Sustainability and safety standards strongly influence purchasing decisions, supporting the growth of eco-friendly educational toys.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by rising pet ownership in China, India, and Japan. Increasing urbanization and growing awareness of pet wellness are accelerating the adoption of educational toys, particularly in mid-range price segments.

Latin America

Latin America shows steady growth, led by Brazil and Mexico. Demand is primarily concentrated in urban centers, with growing interest in affordable educational toys.

Middle East & Africa

The Middle East & Africa remain emerging markets, supported by rising pet ownership in the UAE and South Africa. Premium imports dominate demand, particularly in high-income urban areas.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Leading Players in the Pet Educational Toys Market

- KONG Company

- PetSafe (Radio Systems Corporation)

- Outward Hound

- Nina Ottosson

- West Paw

- Trixie Pet Products

- JW Pet Company

- CleverPet

- Paw5

- Ethical Products

- Petstages

- All For Paws (AFP)

- Hyper Pet

- Company of Animals

- Catit (Hagen Group)