Pepper Spray Market Size

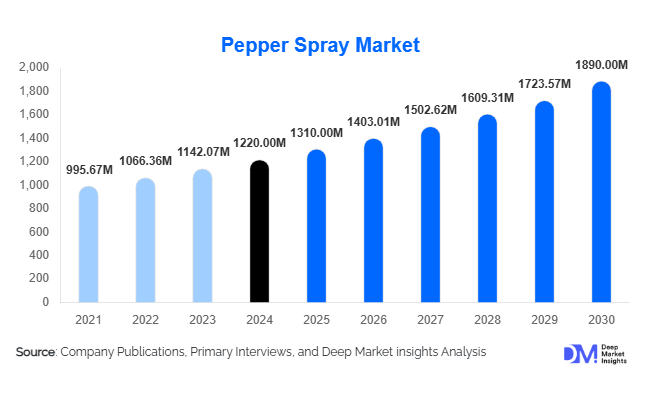

According to Deep Market Insights, the global pepper spray market size was valued at USD 1,220 million in 2024 and is projected to grow from USD 1,310 million in 2025 to reach USD 1,890 million by 2030, expanding at a CAGR of 7.1% during the forecast period (2025–2030). The market growth is primarily driven by increasing personal safety awareness, rising law enforcement and private security spending, and technological advancements in non-lethal self-defense products.

Key Market Insights

- Personal safety and self-defense adoption is rising globally, particularly among women, students, and travelers, fueling civilian demand for non-lethal deterrents.

- Law enforcement agencies and private security services represent a significant demand segment, with growing institutional procurement of pepper sprays for crowd control and public safety.

- North America leads the global market, driven by high civilian adoption and extensive law enforcement use in the U.S. and Canada.

- Asia-Pacific is the fastest-growing region, led by increasing urbanization, disposable income, and rising security awareness in India, China, and South Korea.

- Technological innovations, such as gel sprays, foam sprays, and smart GPS-enabled devices, are reshaping product offerings and enhancing market appeal.

- Offline retail remains dominant, but online and e-commerce channels are rapidly gaining share, especially for civilian and premium products.

Latest Market Trends

Technological Advancements in Pepper Sprays

Manufacturers are increasingly introducing gel, foam, and smart sprays with GPS-enabled alert systems to enhance accuracy, safety, and ease of use. These innovations are driving adoption among civilians and law enforcement alike. Gel and foam sprays reduce blowback risks, while smart devices enable remote alerts in emergencies, increasing product appeal. Technological integration is particularly attracting tech-savvy users, students, and urban commuters seeking reliable self-defense solutions. Companies are also exploring miniaturized, keychain-compatible devices and multi-functional products combining pepper spray with alarms and flashlights, further broadening market applications.

Expansion of Online and Direct Sales Channels

E-commerce and direct B2B channels are reshaping the market. Online platforms allow consumers to purchase pepper sprays conveniently while comparing product specifications, legal compliance, and reviews. Direct supply to security firms and law enforcement agencies simplifies bulk procurement and strengthens supplier relationships. Social media campaigns and influencer endorsements have become critical in raising awareness about personal safety and driving sales, especially among younger demographics. Subscription models and digital-first marketing strategies are emerging, offering recurring revenue opportunities for manufacturers.

Pepper Spray Market Drivers

Rising Personal Safety Concerns

Increasing crime rates, urban threats, and domestic safety concerns are fueling civilian demand for non-lethal defense solutions. Pepper sprays are seen as an affordable, accessible, and effective option. In 2024, personal-use sprays accounted for approximately 42% of the global market, highlighting the growing consumer adoption trend. Awareness campaigns targeting students, women, and frequent travelers are further accelerating adoption in both developed and emerging regions.

Law Enforcement and Private Security Procurement

Institutional spending on crowd control and public safety is driving market growth. Law enforcement agencies and private security services represent roughly 35% of the total market share. Increased government budgets in North America and Europe for non-lethal weapons are a key growth factor. Organizations are investing in innovative spray formulations and training programs, reinforcing consistent demand for pepper sprays in professional applications.

Product Innovation and Technological Adoption

Innovations such as gel sprays, foam sprays, and smart GPS-enabled devices have enhanced usability, safety, and portability. Technologically advanced products appeal to high-end civilian segments and law enforcement agencies seeking efficiency and reliability. Integration of multi-functional devices combining pepper sprays with alarms and lighting is emerging as a differentiating factor in a competitive market.

Market Restraints

Regulatory Restrictions

Strict government regulations in some countries limit the sale, concentration, and portability of pepper sprays. For instance, certain European nations and U.S. states restrict OC concentrations or enforce licensing requirements. These regulatory constraints can impede market growth, especially in high-potential civilian markets.

Substitutes from Non-Lethal Defense Products

Alternatives such as tasers, stun guns, and personal alarms compete directly with pepper sprays. In regions where substitutes are culturally preferred or legally unrestricted, market penetration of pepper sprays may be restrained. Consumer education and awareness campaigns are critical to overcoming this challenge.

Pepper Spray Market Opportunities

Expanding Civilian Awareness and Adoption

Global awareness of personal safety is growing, especially among women, students, and travelers. Companies can leverage this trend by offering premium, technologically advanced products with GPS tracking, alarms, or compact designs. Educational campaigns and social media marketing are key opportunities to increase market penetration.

Institutional Procurement and Government Programs

Governments and law enforcement agencies are increasingly standardizing non-lethal weapons. Procurement programs provide high-volume, stable demand for manufacturers. Initiatives such as public safety enhancement and community policing drive market expansion and create opportunities for long-term supply contracts.

Emerging Regional Demand

Regions like Asia-Pacific, Latin America, and the Middle East are witnessing rising disposable incomes and urban security concerns. Untapped civilian and commercial segments in India, China, Brazil, and the UAE present high growth potential. Partnerships with local distributors and targeted marketing can help companies capitalize on these markets.

Technological Integration and Product Innovation

Smart sprays, gel and foam variants, and multi-functional devices present differentiation opportunities. Manufacturers investing in R&D to enhance safety, portability, and ease of use can achieve a competitive advantage in both premium civilian and professional segments.

Product Type Insights

Aerosol sprays dominate the market, accounting for 55% of global sales in 2024 due to ease of use, affordability, and availability. Gel and foam sprays are growing rapidly due to increased safety and accuracy, particularly among law enforcement and professional security users. Handheld and canister sprays cater to specialized requirements, including animal control and tactical operations.

Application Insights

Personal safety and self-defense are the leading applications, representing 42% of market share. Civilian adoption is increasing due to rising crime awareness and legal approvals. Law enforcement and private security follow closely, with demand for non-lethal crowd-control solutions. Animal control and commercial security applications are niche but growing steadily, especially in emerging regions.

Distribution Channel Insights

Offline retail, including specialty stores and licensed vendors, accounts for 50% of sales due to legal verification requirements. Online channels and e-commerce are rapidly gaining traction, particularly for premium civilian products. Direct B2B sales to law enforcement and security agencies ensure bulk procurement efficiency. Social media, influencer marketing, and subscription models are emerging as innovative engagement strategies.

End-User Insights

Civilian self-defense, law enforcement, and private security are the largest end-user segments. Civilian adoption is growing rapidly in urban centers, while law enforcement procurement remains steady. New applications in commercial establishments such as banks, hotels, and malls are expanding demand. Export-driven sales account for 25% of total volume, with APAC countries serving as major exporters to North America and Europe.

| By Product Type | By Formulation | By Application | By End-User Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America dominates the market, accounting for 40% of 2024 sales. The U.S. leads due to high civilian adoption and extensive law enforcement usage, followed by Canada. Strong public awareness campaigns, regulatory approval, and established retail and e-commerce channels support growth.

Europe

Europe holds 25% of the market, with Germany, the UK, and France as major contributors. Consumer preference for non-lethal self-defense, regulatory support, and professional procurement by law enforcement drives demand. Eco-conscious and technologically advanced products are increasingly preferred.

Asia-Pacific

APAC is the fastest-growing region (9% CAGR), led by India, China, and South Korea. Rising urbanization, disposable incomes, and safety concerns are driving civilian adoption, while growing security infrastructure and government support fuel institutional demand.

Middle East & Africa

UAE, Saudi Arabia, and South Africa are the primary markets. High-income populations and robust security awareness create opportunities for both civilian and professional applications. Africa also serves as a manufacturing hub for certain APAC exports.

Latin America

Brazil and Argentina drive growth, particularly in civilian and commercial security segments. Rising crime awareness, increasing disposable income, and regulatory support for self-defense products are contributing factors.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pepper Spray Market

- SABRE

- Mace Security International

- Fox Labs

- Kimber Manufacturing

- Guard Dog Security

- Security Equipment Corp

- Piexon AG

- North American Rescue

- PepperBall Technologies

- Smith & Wesson

- Combined Systems Inc.

- Def-Tec

- Security Products Corp

- JPX Jet Protector

- Cold Steel

Recent Developments

- In March 2025, SABRE launched a new GPS-enabled pepper spray for civilians in the U.S., enhancing personal safety features and connectivity with mobile devices.

- In February 2025, Mace Security International expanded its gel spray product line for law enforcement agencies across Europe, focusing on safety and accuracy.

- In January 2025, Fox Labs introduced a multifunctional handheld spray integrating alarm and flashlight features, targeting urban consumers and professional security personnel.