On-the-Go Breakfast Cereals Market Size

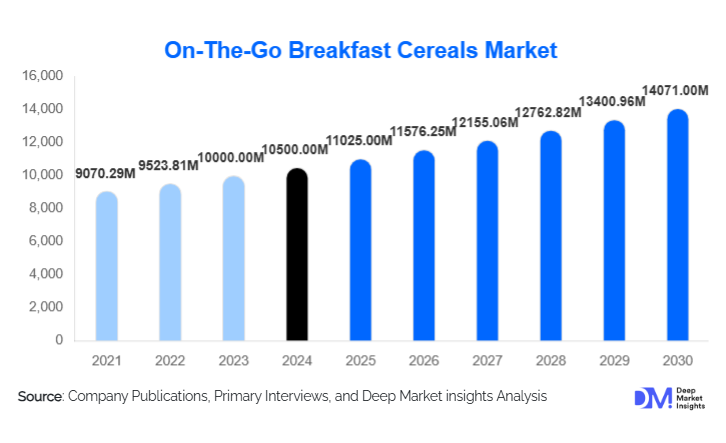

According to Deep Market Insights, the global on-the-go breakfast cereals market size was valued at USD 10,500 million in 2024 and is projected to grow from USD 11,025.00 million in 2025 to reach USD 14,071.00 million by 2030, expanding at a CAGR of 5.0% during the forecast period (2025–2030). Market growth is driven by increasing consumer demand for portable nutrition, rising health consciousness, rapid urbanization, and expanding modern retail infrastructure across emerging economies. The shift toward high-fiber, high-protein, and whole-grain cereal formats in convenient single-serve packaging is further accelerating global adoption.

Key Market Insights

- On-the-go cereals are rapidly evolving toward functional, health-forward formulations, including high-fiber, high-protein, low-sugar, and clean-label offerings.

- Single-serve cups and pouches dominate global consumption due to unparalleled convenience, portability, and portion control.

- Asia-Pacific represents the fastest-growing regional market, driven by urbanization, lifestyle changes, and rising middle-class incomes.

- North America remains the largest regional market due to strong convenience store ecosystems and early adoption of grab-and-go breakfast habits.

- E-commerce and direct-to-consumer channels are expanding rapidly, offering subscription models, customizable blends, and improved accessibility.

- Product innovation in packaging technology, including resealable pouches, microwavable cups, and sustainable materials, continues to reshape consumer purchasing behavior.

What are the latest trends in the on-the-go breakfast cereals market?

Health-Focused and Functional Formulations Gain Momentum

Manufacturers are increasingly emphasizing nutrient-dense, health-oriented formulations to meet rising consumer demand for better-for-you breakfast solutions. High-fiber, high-protein, whole-grain, gluten-free, and organic cereals are gaining traction, especially among professionals, students, and fitness-conscious consumers. Brands are incorporating functional ingredients such as chia seeds, quinoa, flaxseed, prebiotics, and plant-based proteins to offer products that deliver sustained energy and digestive benefits. Clean-label claims and reduced sugar formulations have become mainstream differentiators, with consumers showing greater preference for transparent and minimally processed ingredient profiles.

Packaging Innovation and Portability Redefine Consumption

Advancements in portable packaging are reshaping on-the-go breakfast cereal trends. Single-serve cups, microwavable bowls, slim pouches, and resealable packets enable easy consumption during commutes, in offices, and at educational institutions. Sustainable packaging, compostable films, recyclable cups, and paper-based alternatives are increasingly being adopted to meet consumer and regulatory expectations. These innovations not only support convenience but also enhance shelf life, reduce spillage risks, and improve product freshness, leading to higher consumer loyalty.

What are the key drivers in the on-the-go breakfast cereals market?

Rapid Urbanization and Time-Poor Lifestyles

Growing urban populations and busier professional routines are driving strong demand for quick, nutritious morning meals. As more consumers prioritize work schedules and commuting efficiency, ready-to-eat cereals in portable formats have become essential. Single-serve cups and cereal bars are particularly popular among working professionals, students, and commuters seeking convenience without compromising on nutritional value. The expansion of modern retail formats, including convenience stores, micro markets, and vending stations, further supports this trend.

Rising Health & Wellness Orientation

Global awareness around nutrition has accelerated demand for cereals that offer functional benefits. High-fiber and protein-rich blends, whole grains, and allergen-free varieties are preferred over traditional sugary cereals. Governments and health organizations are advocating for reduced sugar intake, pushing manufacturers to reformulate products with healthier ingredients. This shift has created opportunities for innovative, premium-positioned products that appeal to health-conscious consumers while still meeting portability needs.

What are the restraints for the global market?

High Raw Material and Packaging Costs

The cost of producing on-the-go cereals is significantly higher than traditional boxed cereals due to premium ingredients (nuts, seeds, fruits) and advanced single-serve packaging. Volatility in grain and nut prices, combined with sustainability-driven packaging requirements, increases operational costs, which may limit affordability in price-sensitive regions. Smaller manufacturers in particular face challenges scaling production while maintaining healthy margins.

Growing Scrutiny of Sugar and Processed Foods

Despite shifts toward healthier formulations, some on-the-go cereals still contain elevated sugar levels or processed additives. Increasing regulatory pressure on sugar content, clean-label requirements, and health claims poses challenges for manufacturers. Negative consumer perception of overly processed foods may limit demand for certain product types unless reformulated to align with evolving standards.

What are the key opportunities in the on-the-go breakfast cereals industry?

Premium Functional Cereal Innovation

The demand for performance-oriented breakfast solutions presents opportunities for high-protein, probiotic, antioxidant-rich, and superfood-infused cereal formats. Brands can differentiate through formulations targeted at fitness enthusiasts, office-goers, and wellness-focused consumers. Personalized, customizable cereal blends delivered through e-commerce subscription models also represent a fast-growing niche.

Expansion into Emerging Markets & Modern Retail Ecosystems

Rapid growth of urban middle-class populations in Asia-Pacific, Latin America, and parts of Africa offers significant expansion potential. Increasing penetration of supermarkets, convenience stores, and online grocery platforms provides a strong distribution foundation for on-the-go cereal brands. Government incentives supporting food processing and modern retail infrastructure further enhance market accessibility. Localized flavors and region-specific formulations represent untapped opportunities for global players.

Product Type Insights

Single-serve packaging formats, including cups and pouches, dominate the market, accounting for over 40% of total share due to unparalleled convenience and ease of consumption. Cereal bars and portable snack clusters are rapidly gaining popularity, particularly among fitness-oriented and young adult consumers. Whole-grain and multigrain formulations command strong demand due to perceived health benefits, while low-sugar and high-fiber products continue to redefine product positioning across premium tiers. Functional variants enriched with seeds, nuts, dried fruits, and plant proteins are creating new growth avenues within the mid-premium and premium segments.

Application Insights

The largest application segment is breakfast consumption among busy professionals and commuters, driven by hectic lifestyles and the need for fast, nutritious meals. Students and young adults also represent a rapidly expanding consumer group, favoring affordable flavored cups and bars. Health-conscious convenience seekers are increasingly adopting high-fiber and protein-rich cereal formats for morning routines, workouts, and meal replacement. Institutional demand, from hotels, airlines, workplaces, vending systems, and educational institutions, continues to rise as on-the-go cereals become favored for bulk breakfast offerings and snack programs.

Distribution Channel Insights

Convenience stores, fuel stations, and urban kiosks dominate sales due to their strategic placement in high-footfall commuting zones. Supermarkets and hypermarkets remain strong contributors, offering variety and competitive pricing. E-commerce is the fastest-growing channel, driven by subscription-based delivery, customizable cereal blends, and D2C brand expansion. Enhanced brand websites, social media marketing, and online grocery platforms are reshaping the purchasing journey, particularly among younger consumers.

Consumer Segment Insights

Busy professionals and commuters account for the largest share of on-the-go cereal consumption, benefiting from single-serve formats and portion-controlled packages. Students increasingly rely on portable cereals as affordable, nutritious meal replacements. Families are adopting multipacks of portable cereals to support children’s school routines and after-school snacking. Health-conscious consumers represent a premium segment, prioritizing organic, gluten-free, and functional formulations.

| By Product Type | By Grain Source | By Distribution Channel | By End-User Demographic | By Packaging Format |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is the largest market, with high adoption of portable breakfast solutions and a strong culture of convenience. The U.S. leads consumption due to established convenience store chains and widespread availability of single-serve and bar formats. Health-forward cereal innovations have gained significant traction among Millennials and Gen Z. Canada shows similar trends, with rising demand for organic and clean-label products.

Europe

Europe remains a mature but steadily expanding market. Countries such as the U.K., Germany, and France have a strong demand for whole-grain and low-sugar on-the-go cereals. Sugar regulations and clean-label movements are shaping innovation, while convenience stores in urban centers are boosting sales. Functional bars and resealable snack pouches are gaining popularity among health-conscious European consumers.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by urbanization, increasing disposable income, and shifting breakfast habits. China and India lead regional momentum as consumers transition from traditional hot breakfasts to packaged, portable alternatives. Japan and Australia contribute mature demand for high-quality, functional breakfast solutions. Expansion of modern retail and e-commerce continues to accelerate market penetration.

Latin America

Latin America is witnessing rising adoption of on-the-go cereals, with Brazil and Mexico at the forefront. Growth is driven by expanding supermarkets, convenience stores, and young urban consumers seeking quick breakfast substitutes. Mid-premium and flavored bar formats are gaining popularity, particularly among students and working professionals.

Middle East & Africa

The region shows increasing demand for fortified and premium breakfast cereals, especially in GCC countries with high-income populations and busy professional lifestyles. South Africa and Kenya are emerging markets with growing modern retail penetration. Government support for food processing and fortified foods is boosting adoption in several African markets.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the On-the-Go Breakfast Cereals Market

- Kellogg Company

- General Mills, Inc.

- Nestlé S.A.

- Post Holdings, Inc.

- PepsiCo, Inc.

- Nature’s Path Foods

- Weetabix Ltd.

- Bob’s Red Mill Natural Foods

- B&G Foods

- Bagrry’s India Ltd.

Recent Developments

- In March 2025, Kellogg's introduced a new line of high-protein portable cereal cups featuring plant-based ingredients aimed at fitness-conscious consumers.

- In January 2025, General Mills expanded its functional granola bar range with high-fiber variants, launching across major U.S. convenience store chains.

- In February 2025, Nestlé announced investments in sustainable packaging technologies to transition its single-serve cereal cups into fully recyclable formats across Europe.