Nutritional Serum Market Size

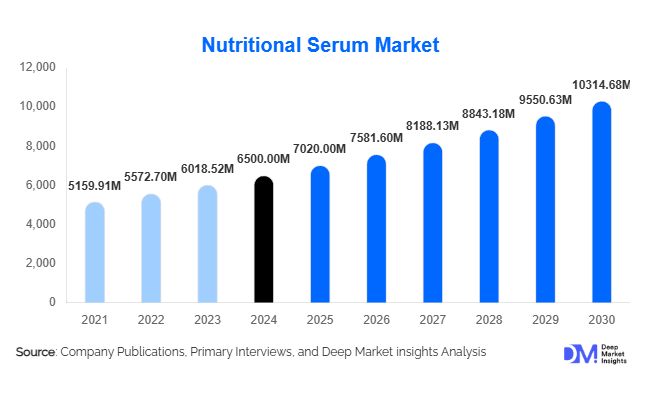

According to Deep Market Insights, the global nutritional serum market size was valued at USD 6500.00 million in 2024 and is projected to grow from USD 7020.00 million in 2025 to reach USD 10314.68 million by 2030, expanding at a CAGR of 8.0% during the forecast period (2025–2030). The nutritional serum market growth is primarily driven by rising consumer awareness of preventive skincare, the popularity of nutrient-rich formulations, and the rapid expansion of e-commerce and personalized beauty solutions worldwide.

Key Market Insights

- Nutritional serums are becoming a core part of preventive skincare routines, as consumers shift from cosmetic appearance to overall skin health and nourishment.

- Vitamin-based serums dominate the product category, driven by proven antioxidant, brightening, and anti-aging benefits.

- Asia-Pacific leads the global market, accounting for around 35% of total demand, with China, South Korea, and India emerging as key consumption hubs.

- Online sales channels represent over half of global distribution, driven by the boom in direct-to-consumer beauty brands and influencer marketing.

- Premiumization is reshaping the market, with clean-label, sustainable, and science-backed products commanding higher price points.

- Technological innovation in formulation stability and smart skincare devices is expanding the efficacy and personalization of serums.

What are the latest trends in the nutritional serum market?

Ingredient Transparency and Clean Beauty

Consumers are increasingly scrutinizing ingredients and demanding clean, vegan, and cruelty-free formulations. Brands are responding by highlighting active ingredients such as vitamin C, niacinamide, peptides, and botanical antioxidants while eliminating parabens and artificial fragrances. The “skin nutrition” concept, merging skincare and wellness, is driving demand for serums that nourish and repair the skin barrier with natural actives. This trend also aligns with sustainability initiatives, including recyclable or refillable packaging and environmentally safe sourcing practices, further enhancing consumer trust.

Personalized and Tech-Enabled Skincare Solutions

The integration of technology into skincare is transforming the nutritional serum landscape. AI-powered skin diagnostics, smartphone-based skin analysis, and smart dispensers are enabling personalized product recommendations. Consumers are increasingly subscribing to monthly serum plans tailored to their specific skin needs and environmental conditions. This digital convergence allows brands to capture detailed user data, enhance customer retention, and expand lifetime value. Startups leveraging personalization technology are quickly gaining market share among millennials and Gen Z consumers who demand tailored, results-driven solutions.

What are the key drivers in the nutritional serum market?

Rising Demand for Preventive and Functional Skincare

Global consumers are increasingly treating skincare as an extension of overall health. Nutritional serums, formulated with antioxidants, vitamins, and peptides, are designed to prevent damage before it occurs, addressing hydration, pigmentation, and aging at the cellular level. This preventive approach has boosted the adoption of daily-use serums across age groups and genders, particularly in urban populations exposed to pollution and lifestyle stressors.

Advancements in Ingredient and Delivery Technology

Innovation in active ingredient stabilization, such as microencapsulation of vitamin C, peptide complexes, and nano-lipid carriers, has improved product efficacy and shelf life. These scientific advances are fueling premiumization and expanding the consumer base to include professional dermatological users and medical spas. Brands emphasizing clinically tested formulations and visible results are gaining a competitive edge.

Rapid Expansion of E-commerce and Omnichannel Retail

E-commerce has become the largest distribution channel for nutritional serums, accounting for approximately 55% of global revenue in 2024. The convenience of online purchasing, extensive product education via influencers, and direct-to-consumer subscription models are all key factors driving sales. Offline retail continues to complement growth, with department stores and specialty beauty retailers offering in-store sampling and cross-category promotions.

What are the restraints for the global market?

High Raw Material and Product Development Costs

Nutritional serums rely on specialized active ingredients, such as peptides, botanical extracts, and vitamin complexes, which are often expensive and sensitive to formulation. Stability testing, airless packaging, and clinical validation further add to costs. These expenses lead to higher retail prices, potentially restricting affordability in price-sensitive regions.

Regulatory Complexity and Claims Management

The regulatory environment for cosmeceutical products is complex and differs across regions. Marketing claims such as “anti-aging,” “dermatologist-tested,” or “nutrient-infused” must comply with local cosmetic and pharmaceutical standards. Navigating these regulatory hurdles delays product launches and increases compliance costs, especially for smaller entrants lacking global legal infrastructure.

What are the key opportunities in the nutritional serum industry?

Expansion in Emerging Markets

Emerging economies such as India, Indonesia, Brazil, and the UAE offer vast untapped potential for premium skincare, driven by rising disposable incomes and growing awareness of skincare wellness. Localized product formulations adapted to climate, skin tone, and price preferences can help brands capture significant market share. Establishing local manufacturing and distribution partnerships can further reduce costs and strengthen regional positioning.

Integration of Smart Beauty and AI Personalization

Smart beauty ecosystems, integrating AI skin scanners, data analytics, and app-linked dispensers, represent a major growth frontier. Personalization through technology allows brands to deliver precise nutrient combinations tailored to each consumer’s skin condition, boosting loyalty and reducing product waste. This also enables the shift toward subscription-based models, offering recurring revenue streams for brands.

Clean Label and Sustainable Premiumization

Sustainability, transparency, and clean formulations are transforming consumer expectations. Brands that can merge clinical efficacy with eco-friendly packaging and traceable ingredient sourcing stand to gain long-term brand equity. Premium consumers are willing to pay higher prices for ethically sourced, science-backed, and dermatologist-approved nutritional serums. This trend opens avenues for new entrants to differentiate through ethical innovation and sustainability certifications.

Product Type Insights

Vitamin-based serums continue to dominate the nutritional serum market, accounting for nearly 20% of total global revenue in 2024. These formulations, enriched with vitamins C, E, and B3 (niacinamide), are widely recognized for their antioxidant, brightening, and protective properties, effectively addressing pigmentation, dullness, and environmental skin stress. Their popularity is reinforced by the growing preference for functional skincare products that deliver visible results and preventive care benefits.

Hydrating and hyaluronic-acid serums represent another strong product category, particularly favored in arid and cold climates where hydration and skin barrier repair are essential. The increasing prevalence of urban pollution and screen-induced skin fatigue has also driven demand for deep-hydration and anti-oxidative solutions.

Anti-aging and peptide-based serums are projected to exhibit the highest growth through 2030, propelled by rising consumer focus on age-prevention and skin renewal. These formulations appeal to both mature consumers seeking wrinkle reduction and younger consumers embracing early-age skin maintenance.

Multi-functional serums that blend hydration, brightening, and sun protection into single-step routines are gaining traction among younger demographics who prioritize efficiency and minimalist skincare regimes. This shift toward hybrid and multi-tasking products reflects the broader movement toward “skinimalism,” merging convenience with performance.

Application Insights

Individual home use remains the largest application segment, contributing to approximately 65% of the global market value. The surge in at-home skincare routines during and post-pandemic has permanently shifted consumer behavior, with growing reliance on self-administered treatments supported by digital product education and influencer-led tutorials.

The professional skincare segment, encompassing dermatology clinics, aesthetic centers, and spas, is emerging as a high-value growth niche. Demand is fueled by the adoption of medical-grade serums in advanced facial procedures such as micro-needling, chemical peels, and laser recovery care. These environments favor nutrient-dense serums with high absorption rates and clinically tested results.

Male skincare applications are another fast-growing category, expanding at an estimated CAGR of 10% from 2025 to 2030. This growth is driven by increasing male awareness of grooming, wellness, and anti-aging solutions. Additionally, export-oriented demand for professional-grade serums, particularly from Asia-Pacific manufacturers to Europe and North America, is rising as consumers seek premium, clinical-grade quality at competitive prices.

Distribution Channel Insights

Online platforms continue to dominate global nutritional serum sales, generating over 55% of total revenue in 2024. E-commerce channels, powered by digital-first brands and established players like Amazon, Sephora, and specialized beauty marketplaces, have made serums accessible across diverse geographies. Social media-driven marketing, influencer collaborations, and real-time consumer reviews are key conversion drivers. Subscription-based delivery models and virtual skin consultations are further strengthening online engagement.

Offline retail, however, remains essential for experiential marketing and brand credibility. Department stores, pharmacies, and cosmetic boutiques offer tactile product experiences, skin diagnostics, and professional consultations that support premium brand positioning. Increasing adoption of omnichannel retail strategies, where online discovery complements in-store trial and purchase, is emerging as a key differentiator for leading skincare brands.

Consumer Demographic Insights

Female consumers continue to represent approximately 70% of the global market share, reflecting established skincare habits and greater spending on personal wellness. However, gender-neutral and male-focused skincare lines are reshaping the demographic landscape, with male participation expanding rapidly as cultural barriers diminish.

Millennials and Gen Z (ages 20–40) remain the most influential consumer base, driving innovation through their demand for transparency, sustainability, and personalization. This group values evidence-based claims, social validation, and instant results, often discovered through social media channels.

Older demographics (50+) represent a steady and high-value customer segment, sustaining demand for anti-aging and peptide-rich formulations. Their preference for dermatologist-approved and clinically tested products underscores the importance of brand credibility and proven efficacy. This balance between youthful experimentation and mature sophistication continues to shape product portfolio strategies across the market.

| By Product Type | By Application | By Distribution Channel | By Consumer Demographics |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounted for around 30% of the global nutritional serum market in 2024, driven by high consumer awareness, advanced product innovation, and robust retail infrastructure. The United States remains the dominant contributor, supported by major market leaders such as Estée Lauder, L’Oréal, and Procter & Gamble, as well as an expanding base of indie brands offering clean-label and cruelty-free formulations.

Key growth drivers include the surge in demand for anti-aging and multifunctional serums, the rise of dermatology-grade skincare integrated into daily routines, and growing male grooming adoption. Canada contributes steadily through a rising preference for dermatologist-endorsed, eco-certified skincare and government-supported clean beauty initiatives. The region’s mature e-commerce environment and strong digital marketing ecosystem further amplify product visibility and accessibility.

Europe

Europe represents approximately 20% of the global market share and continues to be a stronghold for premium, ethical skincare. Consumers in the region exhibit a distinct preference for vegan, cruelty-free, and sustainably packaged serums, reflecting high regulatory standards and environmental consciousness. Germany, the U.K., France, and Italy are the primary contributors, each hosting established skincare brands with heritage and innovation-driven product pipelines.

Regional growth is driven by the increasing popularity of clean and organic skincare, strict EU cosmetic safety regulations enhancing consumer trust, and expanding distribution through pharmacy-based beauty retail. The ongoing shift toward ingredient transparency and “green science” formulations is further accelerating the adoption of nutritional serums that combine efficacy with ethical production practices.

Asia-Pacific

Asia-Pacific leads the global market, accounting for nearly 35% of global revenue in 2024, and is projected to record the fastest growth over the forecast period with a double-digit CAGR. The region’s dominance is anchored by innovation from South Korea and Japan, where K-beauty and J-beauty trends emphasize layering, lightweight formulations, and high-efficacy serums. China and India, meanwhile, are driving massive consumption volumes fueled by expanding middle-class populations and social media-driven beauty awareness.

Regional growth is propelled by rapid digital retail expansion, rising disposable incomes, local manufacturing capabilities, and consumer inclination toward natural and functional ingredients. India’s domestic brands are gaining prominence with affordable premium serums tailored to local climates and skin types. Increasing cross-border e-commerce between Asian countries and Western markets is also enabling regional players to expand globally.

Latin America

Latin America accounts for approximately 7–8% of the global nutritional serum market, with Brazil and Mexico emerging as the most dynamic markets. Consumers in this region are increasingly incorporating serums into daily skincare routines, driven by heightened social media exposure and growing wellness consciousness.

Key regional drivers include the proliferation of beauty influencers, rising urbanization, and greater access to global e-commerce platforms. Local beauty traditions emphasizing natural ingredients are merging with modern skincare science, resulting in hybrid formulations that appeal to middle-income consumers. Despite occasional economic volatility, demand for imported and premium skincare continues to strengthen in metropolitan areas.

Middle East & Africa

The Middle East and Africa (MEA) region contributes approximately 5–6% of global market value and is expected to see steady growth through 2030. The GCC countries, notably the UAE, Saudi Arabia, and Qatar, are key hubs for luxury skincare consumption, supported by high purchasing power and advanced retail infrastructure. Africa, led by South Africa, Nigeria, and Kenya, presents growing opportunities due to rising skincare awareness and improving distribution networks.

Drivers of regional growth include increasing adoption of Western beauty trends, a rising young population with growing disposable incomes, and government initiatives supporting beauty and wellness industries. The strong presence of international luxury brands in the Middle East and the gradual expansion of regional manufacturing and e-commerce in Africa further support long-term market expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Nutritional Serum Market

- L’Oréal S.A.

- Estée Lauder Companies Inc.

- Shiseido Company Limited

- Procter & Gamble Co.

- Unilever PLC

- Beiersdorf AG

- Amorepacific Corporation

- Coty Inc.

- Johnson & Johnson (Consumer Health)

- KOSÉ Corporation

- Natura & Co Holdings S.A.

- Mary Kay Inc.

- Revlon Inc.

- The Body Shop International Ltd.

- Nu Skin Enterprises Inc.

Recent Developments

- In May 2025, L’Oréal announced a new “Smart Serum Lab” initiative integrating AI-powered skin analysis with real-time formulation adjustment for personalized vitamin serums.

- In March 2025, Estée Lauder launched a sustainability-driven refillable packaging line for its flagship Advanced Night Repair Nutritional Serum series, reducing plastic waste by 35%.

- In January 2025, Shiseido introduced a biotechnology-based serum using micro-encapsulated peptides aimed at improving long-term skin barrier strength.