Nursing Bras Market Size

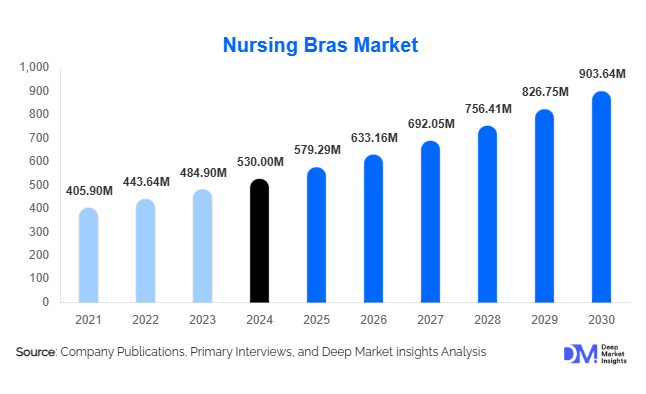

According to Deep Market Insights, the global nursing bras market size was valued at USD 530 million in 2024 and is projected to grow from USD 579.29 million in 2025 to reach USD 903.64 million by 2030, expanding at a CAGR of 9.3% during the forecast period (2025–2030). The market growth is primarily driven by rising awareness of postpartum comfort, increasing global birth rates in emerging economies, and the expansion of premium maternity lingerie brands offering functional yet stylish designs.

Key Market Insights

- Comfort-driven innovation is reshaping the nursing bras market, with seamless, wire-free, and breathable fabrics gaining wide adoption.

- Online retail channels are rapidly expanding, providing greater accessibility and product variety for postpartum mothers.

- Asia-Pacific is the fastest-growing region, supported by rising maternal health awareness and increasing disposable incomes.

- North America dominates the global market, driven by high maternity wear penetration and product innovation by key players.

- Technological integration, including smart textiles and adjustable support mechanisms, is enhancing comfort and fit for lactating mothers.

- Eco-friendly materials and sustainable manufacturing practices are emerging as strong differentiators among premium brands.

Latest Market Trends

Sustainable and Organic Fabrics Gain Popularity

Consumers are increasingly prioritizing eco-conscious purchasing behavior, leading to a surge in demand for nursing bras made from organic cotton, bamboo fiber, and recycled fabrics. Brands are focusing on sustainable production methods, including water-efficient dyeing, biodegradable packaging, and ethically sourced raw materials. This trend aligns with broader consumer preferences for environmentally friendly maternity apparel and reinforces brand loyalty among millennial and Gen Z mothers.

Hybrid and Multifunctional Nursing Bras

Manufacturers are introducing multifunctional bras that combine nursing, pumping, and comfort features in one design. These hybrid bras allow hands-free pumping and easy nursing access, meeting the needs of modern mothers balancing childcare and work. Innovative closures, magnetic clasps, and adjustable straps are enhancing convenience. The growing adoption of wearable breast pumps is also influencing bra design, driving demand for flexible, supportive, and compatible structures.

Nursing Bras Market Drivers

Rising Maternal Health Awareness

Global campaigns promoting maternal health and breastfeeding benefits are fueling nursing bra adoption. Organizations such as WHO and UNICEF emphasize breastfeeding as a critical early-life practice, prompting mothers to seek comfortable and supportive apparel. Educational initiatives and postpartum care programs have further raised awareness about the importance of well-designed nursing wear for breast support and hygiene.

Expanding E-Commerce Channels

The proliferation of online retail platforms such as Amazon, ASOS, and specialty maternity stores has made nursing bras widely accessible. Digital marketplaces enable product comparisons, virtual fittings, and personalized recommendations, reducing the stigma and inconvenience associated with in-store maternity shopping. The rise of influencer-driven marketing and social media campaigns also strengthens consumer engagement and purchasing confidence among new mothers.

Market Restraints

Price Sensitivity in Emerging Markets

High-quality nursing bras, particularly those featuring premium fabrics or multifunctional features, often come at elevated prices. In developing regions, limited purchasing power and a lack of awareness about product benefits hinder market penetration. The dominance of low-cost alternatives compromises product comfort and durability, restricting the adoption of premium nursing wear in cost-sensitive markets.

Limited Awareness and Accessibility

Despite growing awareness in developed regions, a large segment of women in rural and low-income areas remains unaware of the functional advantages of nursing bras. Distribution challenges, cultural barriers, and limited retail presence restrict product availability, particularly in parts of Africa, South Asia, and Latin America. This gap underscores the need for targeted education campaigns and improved retail networks to boost adoption.

Nursing Bras Market Opportunities

Smart and Adaptive Fit Technologies

The integration of smart textiles and adaptive fit technologies presents a major growth opportunity. Temperature-regulating fabrics, antibacterial finishes, and memory-foam padding enhance wearer comfort and hygiene. Startups and established brands are exploring IoT-enabled bras with embedded sensors that monitor lactation levels and breast health, offering personalized postpartum care solutions.

Expansion of Premium and Designer Maternity Lines

Luxury lingerie brands are entering the maternity wear segment, emphasizing aesthetics alongside functionality. Designer collaborations and limited-edition nursing collections appeal to fashion-conscious mothers seeking style during the postpartum period. This trend is expanding profit margins and diversifying product portfolios across leading fashion houses and online retailers.

Product Type Insights

Wireless nursing bras continue to dominate the market, driven by the global trend toward comfort, flexibility, and sleepability. These designs appeal especially to mothers seeking low-pressure support suitable for all-day wear and nighttime use. Underwire nursing bras maintain steady demand among consumers prioritizing breast shape, posture, and aesthetic support, with medical endorsements increasingly validating their safety and functionality. Front-open or clip-down bras are witnessing fast growth due to their convenience for frequent breastfeeding and appeal among busy, on-the-go mothers. Pull-over and sleep bras are expanding their presence in the nighttime and lounge wear segments, with subtle support and stretchable designs catering to mothers prioritizing rest and comfort. Sports nursing bras are an emerging category, driven by the growing participation of postpartum women in fitness and wellness routines, coupled with demand for breathable, moisture-wicking materials that deliver high-impact support. Hands-free pumping bras represent one of the most dynamic growth areas, supported by rising corporate lactation support initiatives, workplace pumping facilities, and technological advances in wearable breast pumps.

Material Insights

Material innovation plays a pivotal role in consumer choice and brand differentiation. Cotton and organic cotton nursing bras remain highly popular among eco-conscious and sensitive-skin consumers, with sustainability and “clean fabric” messaging strongly influencing purchasing decisions. Microfiber and performance fabrics are gaining traction among active mothers who value durability, breathability, and moisture control during postpartum activities. Lace and fashion fabrics are driving the aesthetic and social-media-influenced segment, where visual appeal and style complement functionality — a key differentiator in mid- to premium-tier markets.

Size and Fit Insights

Sizing inclusivity has become a defining feature of the modern nursing bras market. Regular sizing dominates in terms of volume, reflecting its mass-market accessibility and affordability. Plus-size and extended fit segments are growing rapidly, addressing the needs of an underserved demographic through targeted marketing and body-positive branding. Mastectomy and adaptive bras remain a niche but stable category, supported by patient advocacy programs and medical referrals that drive consistent institutional demand.

Price Tier Insights

Across pricing tiers, distinct drivers shape consumer behavior. Value and mass-market products lead volume growth in developing markets, driven by competitive pricing, private label initiatives, and supermarket expansions. Mid-market brands achieve the strongest overall positioning by balancing functionality, aesthetics, and affordability, with online reviews and brand trust significantly influencing purchase decisions. Premium and designer nursing bras cater to affluent consumers who value premium materials, stylish design, and brand reputation, often purchased as luxury maternity gifts or fashion statements for new mothers.

Distribution Channel Insights

Online retail continues to lead global sales, propelled by convenience, personalized fit technologies, and flexible return policies. Younger and urban consumers rely heavily on e-commerce and D2C platforms for maternity wear purchases. Offline specialty maternity stores remain vital for first-time mothers who value personalized fitting services and immediate availability. Multi-brand retailers drive significant impulse purchases through bundled promotions and cross-selling with baby products. Pharmacies and hospitals serve as clinical points of sale, where healthcare professionals recommend nursing bras as part of postpartum care or include them in discharge packs.

| By Product Type | By Material | By Size Range | By Price Tier | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America dominates the global nursing bras market, supported by high awareness levels, strong D2C brand ecosystems, and widespread corporate lactation support initiatives. Increasing adoption of hands-free pumping bras aligns with the growing prevalence of workplace pumping rooms, extended maternity leave policies, and employer-sponsored breastfeeding programs. The U.S. remains the key market, where digital-first premium brands such as Bravado Designs and Kindred Bravely continue to lead through online subscription models and data-driven sizing solutions. Canada follows similar patterns, with a rising emphasis on sustainability and inclusive sizing driving consumer loyalty. Regional Growth Driver: Corporate lactation support programs and the robust direct-to-consumer retail ecosystem are key enablers of premium nursing bra demand.

Europe

Europe represents a mature and sustainability-driven market characterized by strong public health advocacy for breastfeeding and maternity protection policies. Government-backed campaigns promoting maternal wellbeing have increased awareness of the functional benefits of nursing bras, while European consumers continue to emphasize fashion and design alongside utility. Brands operating in this region are increasingly integrating organic fabrics, ethical manufacturing, and aesthetic appeal to meet consumer expectations. Key markets include Germany, the U.K., and France, where eco-friendly materials and hybrid comfort-fashion designs dominate. Regional Growth Driver: Public health breastfeeding initiatives and fashion-conscious consumer behavior collectively fuel demand for functional yet stylish nursing bras.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, fueled by rising disposable incomes, rapid e-commerce expansion, and increasing urban maternal awareness. China, India, and Southeast Asia represent substantial opportunity zones, driven by large populations of young mothers, growing access to online maternity products, and localized influencer marketing campaigns. Domestic and international brands are leveraging mobile-first platforms and affordable mid-tier products to capture market share. Additionally, the region’s growing working-mother population is accelerating demand for functional and stylish nursing bras suitable for daily and workwear use. Regional Growth Driver: Rapid e-commerce adoption and urban income growth drive strong volume expansion, particularly in mid-market and value segments.

Latin America

Latin America’s nursing bras market is expanding steadily, led by Brazil, Mexico, and Argentina. A young maternal demographic and growing awareness of postpartum health contribute to higher product adoption rates, especially for affordable, mass-market offerings. Online retail channels and social media-driven promotions are helping bridge access gaps in smaller urban and rural areas. Despite economic fluctuations, international maternity brands are entering the region through strategic retail partnerships and localized campaigns. Regional Growth Driver: A youthful mother population and rising maternal health awareness are fueling demand for affordable, mass-market nursing bras.

Middle East & Africa

The Middle East and Africa market is evolving, with urbanization and rising internet penetration reshaping retail access. Demand is particularly strong for modest, full-coverage nursing bras tailored to cultural preferences. Growing online sales platforms, combined with the region’s increasing female workforce participation, are opening new opportunities for both international and local maternity wear brands. Markets such as the UAE, Saudi Arabia, and South Africa are witnessing growth in premium maternity retail, while online platforms are addressing privacy and accessibility concerns across conservative demographics. Regional Growth Driver: Urbanization, modesty-focused design preferences, and expanding online retail channels are driving the adoption of coverage-oriented and discreet nursing bras.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Nursing Bras Market

- Bravado Designs

- Medela AG

- Wacoal Holdings Corp.

- Hotmilk Lingerie

- Mothercare

- Seraphine

- Kindred Bravely

- ThirdLove

Recent Developments

- In July 2025, Bravado Designs launched its “Sustain Collection,” featuring nursing bras made from 100% recycled nylon and plant-based dyes.

- In May 2025, Medela introduced a new hands-free nursing and pumping bra compatible with its smart breast pump line, enhancing multitasking convenience for working mothers.

- In February 2025, Hotmilk Lingerie announced a partnership with online retailer ASOS to expand its sustainable maternity line across Europe and Asia-Pacific.