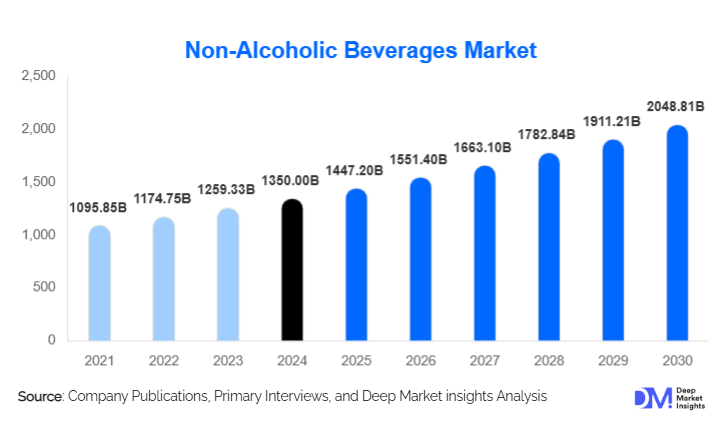

Non-Alcoholic Beverages Market Size

According to Deep Market Insights, the global non-alcoholic beverages market size was valued at USD 1,350 billion in 2024 and is projected to grow from USD 1,447.20 billion in 2025 to reach USD 2,048.81 billion by 2030, expanding at a CAGR of 7.2% during the forecast period (2025–2030). The market growth is primarily driven by rising health-conscious consumption, increasing demand for functional beverages, rapid urbanization, and technological innovations in packaging and distribution that cater to evolving consumer lifestyles.

Key Market Insights

- Functional and wellness beverages are driving market innovation, with products like probiotics, adaptogen-infused drinks, and fortified waters gaining popularity among health-conscious consumers.

- Asia-Pacific dominates the global market, led by China and India, due to urbanization, rising disposable incomes, and strong adoption of bottled water, RTD tea, and functional beverages.

- North America holds a significant market share, supported by high consumer awareness, premium offerings, and strong e-commerce and D2C penetration.

- Premium and sustainable packaging solutions, such as PET recycling, lightweight glass, and eco-friendly carton, are becoming critical differentiators for brand loyalty.

- Digital and direct-to-consumer channels are expanding rapidly, enabling personalized beverage offerings and improved consumer engagement.

- Regulatory focus on sugar content and clean-label products is driving beverage reformulations and new product launches across all regions.

What are the latest trends in the non-alcoholic beverages market?

Health & Functional Beverage Innovation

Consumer demand for beverages that offer health benefits is accelerating product innovation. Functional drinks, such as probiotic waters, energy and sports beverages, and adaptogen-infused beverages, are capturing significant market share. Companies are leveraging natural ingredients, vitamins, minerals, and plant-based extracts to meet rising wellness demands. Reformulated low-sugar sodas, organic juices, and plant-based milks are also driving growth. This trend is strongest in developed markets like North America and Europe, but is rapidly growing in emerging economies where urbanization and disposable income are rising.

Sustainable and Eco-Friendly Packaging

Sustainability is a major trend shaping the market. Beverage companies are investing in recyclable PET bottles, biodegradable packaging, refillable bottles, and lightweight glass alternatives. Brands adopting circular economy principles are attracting eco-conscious consumers and improving brand loyalty. Sustainability is particularly important in Europe and North America, where environmental regulations and consumer expectations are stringent. Circular initiatives, deposit-return schemes, and eco-certifications are influencing purchase decisions and providing growth opportunities for forward-thinking players.

Digital & Direct-to-Consumer Channel Expansion

E-commerce, subscription models, and D2C channels are reshaping beverage distribution. These channels allow companies to engage directly with consumers, offer personalized flavor packs, and gather real-time data on consumption preferences. Digital platforms enhance visibility for premium and niche functional products, and subscription models provide predictable revenue streams. Emerging markets in Asia-Pacific and Latin America are witnessing increased adoption of online beverage sales, especially for specialty and functional drinks.

What are the key drivers in the non-alcoholic beverages market?

Rising Health and Wellness Awareness

Health-conscious consumption is driving growth across functional and low-sugar beverage categories. Consumers are increasingly seeking products that support immunity, digestion, cognitive function, and stress relief. This has led to innovations in probiotics, adaptogens, vitamin-fortified waters, plant-based milks, and reduced-sugar soft drinks. The health and wellness trend is fueling premiumization, with higher-priced, value-added beverages capturing more revenue per unit.

Urbanization and Rising Disposable Income

Rapid urbanization and growing middle-class populations, particularly in the Asia-Pacific and Latin America, are increasing demand for packaged beverages. Consumers in urban areas have better access to modern retail outlets, such as supermarkets and convenience stores, which boosts mass-market and premium beverage consumption. Rising disposable income allows for greater adoption of higher-value functional and wellness beverages, expanding the market’s total value.

Innovation in Packaging and Distribution

Advances in packaging technology, including lightweight PET, aseptic cartons, and smart labels, improve shelf life, portability, and consumer engagement. Distribution innovations, particularly online channels and D2C models, enable beverage companies to reach a broader audience efficiently. Smart packaging and QR-enabled traceability also enhance brand transparency and loyalty.

What are the restraints for the global market?

Raw Material Cost Volatility

Fluctuations in commodity prices for ingredients such as fruit concentrates, plant extracts, and specialty additives can affect profit margins. Climate events, supply chain disruptions, and inflationary pressures exacerbate cost volatility, creating challenges for manufacturers in maintaining competitive pricing while ensuring product quality.

Regulatory and Labeling Challenges

Increasingly strict regulations around sugar content, health claims, and labeling standards require beverage companies to reformulate products and invest in compliance. “Clean-label” trends further constrain ingredient choices, adding complexity and cost to product development and manufacturing.

What are the key opportunities in the non-alcoholic beverages industry?

Functional & Health-Oriented Product Expansion

There is a significant opportunity to launch beverages with targeted health benefits. Functional drinks addressing immunity, gut health, stress reduction, and cognitive support are gaining traction globally. Innovation with adaptogens, probiotics, vitamins, and plant-based ingredients allows brands to capture premium market segments and cater to the growing health-conscious demographic.

Sustainable Packaging and Circular Economy Adoption

Investing in eco-friendly packaging presents a dual opportunity: reducing environmental impact and appealing to environmentally conscious consumers. Brands can gain a competitive advantage through recyclable PET, refillable bottles, and biodegradable packaging. Deposit-return schemes and circular initiatives further enhance brand equity and consumer loyalty.

Digital and Direct-to-Consumer Channels

Leveraging e-commerce, subscription models, and D2C platforms allows beverage companies to offer personalized products, capture real-time consumer data, and increase profitability. Emerging markets, particularly in Asia-Pacific and Latin America, represent untapped growth potential through digital adoption and innovative consumer engagement.

Product Type Insights

Carbonated soft drinks dominate the product segment, accounting for roughly 25–30% of the 2024 market. Bottled water is the second-largest category, followed by juices and RTD teas. Functional beverages, including energy drinks, sports drinks, and probiotic waters, are the fastest-growing category due to rising health consciousness. Plant-based milks and dairy alternatives are also seeing increasing adoption, particularly in North America and Europe, driven by wellness and lactose-intolerance trends.

Application Insights

Mass-market consumption remains the largest application, driven by daily consumption of sodas, bottled water, and juices. Health-conscious and wellness consumers are fueling growth in functional and plant-based beverages. Sports and fitness enthusiasts contribute to the increasing demand for energy and sports drinks. Institutional applications, including hospitality, hotels, and workplaces, are adopting premium, functional, and specialty beverages, while exports from developed to emerging markets are rising steadily.

Distribution Channel Insights

Retail channels, especially supermarkets and hypermarkets, dominate sales, accounting for 50–60% of revenues. E-commerce and D2C models are rapidly expanding, particularly in premium and functional beverage categories. Convenience stores and specialty stores remain important for regional and niche products. Food-service channels, including restaurants, cafés, and hotels, are growing in importance for premium and wellness-focused beverages.

Traveler Type Insights

End consumers can be categorized into general consumers, health-conscious individuals, fitness enthusiasts, and institutional buyers. General consumers dominate overall consumption, accounting for 45–55% of the total market share. Health-conscious and fitness segments are the fastest-growing, driving demand for functional, low-sugar, and plant-based beverages. Institutional buyers, including hospitality and workplace cafeterias, contribute to premium and bulk consumption.

Age Group Insights

Consumers aged 31–50 account for the largest share due to higher disposable income and interest in premium and wellness-oriented products. The 18–30 age group drives the adoption of functional beverages and digital channels. Older demographics, 51–65 years, are significant in premium beverage consumption, while 65+ consumers create niche opportunities for convenient and health-focused offerings.

| By Product Type | By Application / End-Use | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America represents 25–28% of the global market (USD 350–380 billion in 2024). The U.S. dominates, driven by health-conscious consumption, functional beverages, and strong e-commerce adoption. Canada contributes with high per capita beverage consumption and a growing demand for plant-based and functional drinks.

Europe

Europe holds 20–22% of the global market, with Germany, the UK, and France as key contributors. The market is shaped by strict labeling regulations, sugar taxes, and sustainability-focused consumption. Functional, organic, and clean-label beverages are increasingly preferred.

Asia-Pacific

Asia-Pacific leads with 33–38% share (USD 440–500 billion in 2024). China and India are major growth engines, fueled by urbanization, rising income, and increasing demand for bottled water, RTD teas, juices, and functional beverages. Japan and Australia show steady adoption of premium and plant-based drinks.

Latin America

Brazil, Mexico, and Argentina are driving market growth. Urbanization and rising disposable income are increasing demand for juices, bottled water, and functional beverages. Outbound exports of premium beverages from North America and Europe support regional growth.

Middle East & Africa

MEA accounts for 10–12% of the global market. Gulf nations, including the UAE and Saudi Arabia, are growing in premium beverage consumption, while African countries like South Africa and Nigeria are expanding the adoption of modern retail and functional drinks.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Non-Alcoholic Beverages Market

- The Coca-Cola Company

- PepsiCo, Inc.

- Nestlé S.A.

- Danone S.A.

- Suntory Holdings

- Red Bull GmbH

- Monster Beverage

- Asahi Group

- Nongfu Spring

- Kirin Holdings

- GT’s Living Foods

- Tingyi (Cayman Islands)

- Keurig Dr Pepper

- Pepsi Lipton

- Frucor Suntory

Recent Developments

- In 2025, Coca-Cola launched a new line of adaptogen-infused beverages targeting wellness-conscious consumers in North America and Europe.

- In 2025, Nestlé expanded its bottled water production capacity in India, focusing on premium and mineral-rich variants for the growing urban market.

- In 2025, PepsiCo introduced sustainable PET bottles for its RTD teas and juices in Europe, aligning with circular economy initiatives and eco-conscious consumer trends.