Mixed Martial Arts Equipment Market Size

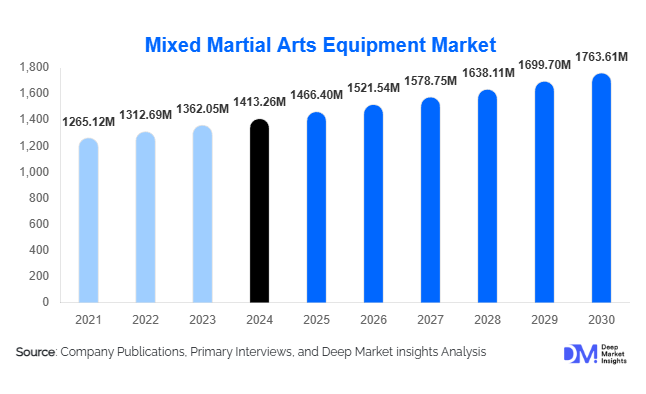

According to Deep Market Insights, the global mixed martial arts equipment market size was valued at USD 1,413.26 million in 2024 and is projected to grow from USD 1,466.4 million in 2025 to reach USD 1,763.61 million by 2030, expanding at a CAGR of 3.76% during the forecast period (2025–2030). Growth in this market is primarily driven by rising participation in MMA as both a professional sport and fitness activity, expansion of MMA gyms and academies, and the increasing demand for premium-quality protective and training gear among both professional fighters and recreational users.

Key Market Insights

- Gloves dominate the MMA equipment market, accounting for approximately 38% of global sales in 2024, owing to their universal usage and high replacement cycle.

- Offline retail remains the leading distribution channel, representing around 70% of the market in 2024, as customers prefer to test products physically before purchase.

- North America holds the largest regional share (around 33% in 2024), led by the U.S., which has a mature MMA ecosystem and strong consumer spending on sports gear.

- Asia-Pacific is the fastest-growing regional market, fueled by increasing MMA participation in countries such as China, India, and Japan.

- Premiumisation and smart-gear integration are reshaping the competitive landscape as brands focus on advanced materials, connectivity, and ergonomic designs.

- E-commerce is transforming sales dynamics, enabling smaller and emerging brands to reach global audiences through D2C and marketplace channels.

What are the latest trends in the MMA Equipment Market?

Smart and Connected Gear

Technological integration is one of the most prominent trends in the MMA equipment industry. Manufacturers are introducing smart gloves and punching bags equipped with sensors that measure impact force, speed, and accuracy. These devices pair with mobile apps to offer real-time performance analytics and training insights. The combination of IoT, wearable sensors, and data analytics is turning traditional MMA gear into performance-enhancing tools, appealing to both professional fighters and fitness enthusiasts seeking measurable progress.

Growing Participation and Fitness Integration

MMA is increasingly being incorporated into mainstream fitness programs worldwide. Combat-inspired fitness routines, MMA-based cardio sessions, and youth MMA programs are proliferating. This broadening of the consumer base beyond competitive fighters to recreational athletes has significantly expanded market demand. The inclusion of MMA workouts in global fitness chains, such as UFC Gym and local boutique studios, is driving consistent growth in the training equipment and apparel segments.

Rise of Women’s and Youth MMA

The increasing participation of women and youth in MMA has diversified demand patterns. Manufacturers are responding with specialized gear tailored to these demographics, lighter gloves, protective gear with ergonomic fits, and design-driven apparel. The popularity of women’s MMA leagues and youth training camps is expected to further support market expansion, particularly in North America and the Asia-Pacific.

What are the key drivers in the MMA Equipment Market?

Expansion of MMA Gyms and Academies

The global rise in MMA training facilities, both independent gyms and franchise models, has created a strong institutional customer base. These facilities require bulk equipment procurement and frequent replacements due to high usage rates. Partnerships between gyms and manufacturers for exclusive branding and supply contracts have further boosted institutional demand.

Growth in E-Commerce and Direct-to-Consumer Sales

Online platforms have become a crucial growth enabler. Consumers now have access to a broader range of gear through global marketplaces and brand-owned online stores. The ease of comparison, reviews, and fast shipping has helped e-commerce capture a growing share of total sales, particularly among younger consumers and in emerging economies.

Premiumisation and Safety Innovation

With heightened awareness of sports injuries, athletes are prioritizing safety and durability over cost. Brands are investing in advanced materials such as gel-infused padding, impact-absorbing foams, and moisture-control fabrics. Premium gear not only enhances protection but also provides superior comfort and performance, fueling higher-margin sales.

What are the restraints for the global market?

High Cost of Premium Equipment

Premium MMA gear is often priced beyond the reach of casual participants, limiting market penetration in emerging regions. Cost pressures from advanced materials and import duties make it difficult for brands to balance affordability with quality, slowing adoption among entry-level users.

Competition from Alternative Fitness Activities

The MMA equipment market competes with alternative combat sports (boxing, kickboxing) and general fitness equipment segments. Consumers seeking versatile workouts may prefer more affordable or multipurpose fitness gear, potentially slowing the growth of MMA-specific product demand.

What are the key opportunities in the MMA Equipment Industry?

Emerging Regional Demand in Asia-Pacific and Latin America

Asia-Pacific and Latin America represent high-potential regions due to growing disposable income, urbanization, and fitness awareness. Local manufacturing partnerships and affordable product lines targeting new participants can unlock significant value. Hosting of MMA events and local league promotions in these regions is also creating a strong aspirational market.

Smart Equipment and Digital Coaching Integration

The convergence of MMA training with digital platforms offers a major opportunity. Smart gloves, connected punching bags, and app-based feedback systems can transform traditional training. Partnerships with tech firms and fitness app developers can create recurring revenue streams through data subscriptions and remote coaching solutions.

Institutional Sales and Certified Safety Standards

As MMA gains recognition within youth and amateur sports programs, institutions require safety-certified gear. Companies that meet or exceed global safety standards and supply to schools, gyms, and sports federations can secure long-term contracts. This segment promises volume-driven stability compared to cyclical retail demand.

Product Type Insights

Among product categories, gloves dominate with nearly 38% of market share in 2024. Their indispensable role across training and competition, combined with high wear-and-tear replacement cycles, sustains continuous demand. Protective gear, including headguards and shin guards, follows closely, driven by stricter safety standards. Training equipment such as punching bags and dummies accounts for a growing share as gyms and home users expand MMA training setups. Apparel and accessories form an additional value layer through branding and personalization trends.

Distribution Channel Insights

Offline retail remains dominant with a 70% market share, as consumers prefer physical trials for fit and comfort. However, online channels are the fastest-growing segment due to global marketplace accessibility, influencer marketing, and direct-to-consumer brand models. Hybrid distribution strategies, combining experiential in-store setups with online convenience, are becoming the industry norm.

End-User Insights

Individual consumers represent over 65% of market demand in 2024. Fitness enthusiasts and amateur fighters drive continuous sales of gloves, apparel, and entry-level gear. Institutional buyers, gyms, clubs, and sports academies are critical in volume sales due to bulk purchasing and replacement cycles. Growth in women’s and youth participation is also expanding end-user diversity, contributing to incremental market gains.

| By Product Type | By Application | By Distribution Channel | By End User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America leads the MMA equipment market with a 33% share in 2024, driven by a mature MMA ecosystem, numerous gym franchises, and strong brand presence. The U.S. dominates this region, supported by high consumer expenditure and established MMA leagues such as the UFC, which promote aspirational demand for branded gear.

Europe

Europe maintains steady growth led by the U.K., Germany, and France. Combat sports traditions, rising fitness consciousness, and a growing preference for premium, eco-friendly materials are supporting market expansion. The region’s established retail network and sports culture foster strong mid-tier product sales.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with countries like China, India, Japan, and South Korea witnessing rapid adoption of MMA training. Increased government support for sports development, proliferation of MMA events, and local manufacturing capacity are fueling double-digit growth. APAC’s market share is projected to rise from 25% in 2024 to nearly 30% by 2030.

Latin America

Latin America, led by Brazil and Mexico, is an emerging market where combat sports heritage aligns well with MMA’s rise. Local academies and youth programs are boosting equipment demand, though purchasing power constraints limit premium segment penetration.

Middle East & Africa

The Middle East and Africa are smaller but promising markets. The UAE and Saudi Arabia are investing in MMA events and sports facilities as part of broader wellness initiatives. Africa’s contribution, particularly from South Africa, is growing through localized manufacturing and regional tournaments.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the MMA Equipment Market

- Adidas AG

- Everlast Worldwide Inc.

- Hayabusa Fightwear Inc.

- Combat Brands LLC

- Century Martial Arts Supply LLC

- Venum International

- RDX Inc.

- TITLE Boxing LLC

- TWINS Special Co. Ltd.

- FAIRTEX Equipment Co. Ltd.

- Revgear Sports Co.

- King Martial Arts Supplies

- Outslayer Fight Gear

- MRX Products Inc.

- Tiger Claw

Recent Developments

- In July 2025, Hayabusa launched a line of smart training gloves featuring integrated impact sensors and app-based analytics for professional fighters and gyms.

- In May 2025, Venum International expanded its manufacturing plant in Thailand to increase regional production capacity and reduce export lead times.

- In March 2025, Century Martial Arts partnered with UFC Gym to supply protective and training gear across 100+ franchise locations globally.