Medicine Cabinets Market Size

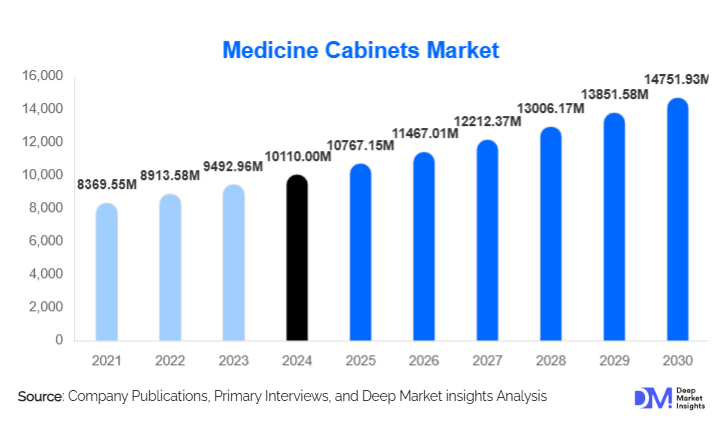

According to Deep Market Insights, the global medicine cabinets market size was valued at USD 10,110.00 million in 2024 and is projected to grow from USD 10,767.15 million in 2025 to reach USD 14,751.93 million by 2030, expanding at a CAGR of 6.50% during the forecast period (2025–2030). The market growth is primarily driven by the rising focus on organized home storage solutions, technological advancements in smart medicine cabinets, and growing healthcare infrastructure across both developed and emerging economies.

Key Market Insights

- Integration of smart and connected storage systems is reshaping the medicine cabinets market with IoT-enabled features for inventory monitoring and automated reminders.

- Residential remodeling projects and increasing home healthcare adoption are driving strong product replacement demand globally.

- North America dominates the market with a 35.4% share, supported by advanced healthcare systems and rising wellness-focused consumer spending.

- Asia-Pacific is the fastest-growing region, driven by rapid urbanization, rising middle-class income, and government-backed healthcare reforms.

- Sustainability in design and materials—including recyclable metals and FSC-certified wood—is influencing product innovation across manufacturers.

- Online retail channels are gaining strong traction, particularly post-pandemic, as consumers increasingly prefer digital shopping for home furnishing products.

What are the latest trends in the medicine cabinets market?

Smart and Connected Medicine Cabinets

Technology integration is transforming medicine cabinets into intelligent health management systems. Smart cabinets now include IoT connectivity, digital locks, motion-sensor lighting, and medication tracking through smartphone apps. These connected systems alert users about expiration dates, dosage schedules, and inventory levels. Integration with home assistants such as Alexa or Google Home allows users to manage medication routines more effectively. Hospitals and smart homes are adopting such products to enhance patient safety and streamline medical supply management, reflecting a broader shift toward digital healthcare ecosystems.

Sustainable Materials and Eco-Friendly Designs

Manufacturers are emphasizing the use of eco-friendly materials like recycled aluminum, bamboo composites, and low-VOC finishes. Consumers are increasingly demanding environmentally conscious products that combine aesthetics with sustainability. Green certifications are becoming a key differentiator for premium brands. Companies such as Duravit and Kohler are investing in renewable manufacturing processes, while modular and repairable designs are gaining traction to reduce waste and extend product lifespan. This trend aligns with global movements toward circular economy practices and sustainable construction materials.

Customization and Modular Storage Systems

Customization has emerged as a leading trend in residential and commercial spaces. Consumers now demand modular medicine cabinets that fit specific bathroom layouts, storage requirements, and design themes. Adjustable shelving, integrated mirrors, built-in lighting, and anti-fog glass features are standard in premium offerings. Interior designers and developers are incorporating such modular systems into high-end projects, driving steady demand. The customization trend also supports the growth of online configurators that allow customers to visualize and order personalized cabinets.

What are the key drivers in the medicine cabinets market?

Rising Healthcare Awareness and Home Medical Storage

Increased healthcare awareness among consumers, combined with the rise in chronic diseases, has led to growing demand for secure and organized storage of medications at home. Home healthcare setups have become more common post-pandemic, creating consistent demand for ergonomic medicine cabinets that ensure hygiene and accessibility. Urban households increasingly consider medicine cabinets as essential bathroom fixtures, expanding their penetration across both new and renovated homes.

Residential Remodeling and Bathroom Upgrades

The global trend toward bathroom renovations and home improvement is a major growth driver. In mature markets like the U.S. and Europe, rising disposable income and aesthetic upgrades drive demand for premium recessed and mirrored medicine cabinets. In emerging markets, rising construction activities and growing urban populations contribute to new installations. Consumer preference for sleek, multi-functional storage designs is reinforcing product innovation among key manufacturers.

Expansion of Healthcare and Hospitality Sectors

Commercial spaces such as hospitals, clinics, hotels, and wellness centers are increasingly adopting advanced medicine cabinets for safety and compliance reasons. The expansion of healthcare infrastructure, particularly in the Asia-Pacific and the Middle East, is creating new procurement opportunities. Moreover, regulatory guidelines promoting hygiene and organized drug storage in medical facilities continue to stimulate steady demand in this sector.

What are the restraints for the global market?

High Installation and Customization Costs

Premium medicine cabinets featuring advanced lighting, sensors, and anti-fog mirrors often carry high installation and maintenance costs. For budget-conscious consumers, these costs pose adoption barriers, particularly in developing regions. Additionally, customized cabinetry solutions often involve design and setup fees, limiting scalability for mass-market segments.

Fluctuating Raw Material Prices

Volatility in the prices of metals, glass, and engineered wood materials directly impacts production costs. Supply chain disruptions, freight costs, and energy price hikes have increased manufacturing expenses in recent years. Smaller manufacturers struggle to absorb these fluctuations, which can affect product availability and profit margins. This volatility also leads to inconsistent retail pricing, potentially deterring end consumers from making discretionary upgrades.

What are the key opportunities in the medicine cabinets industry?

Integration of Smart Health Monitoring Systems

The integration of digital technologies such as AI, IoT, and RFID opens new avenues for smart medicine cabinets that can monitor and manage medication adherence. Future-ready products will likely include temperature control, UV sterilization, and biometric authentication. Such innovations are expected to appeal strongly to healthcare institutions and tech-savvy residential users, expanding the market’s long-term growth potential.

Growth of Sustainable and Modular Product Lines

Manufacturers are exploring eco-friendly and modular designs to meet growing sustainability demands. Modular cabinets made from recyclable aluminum, glass, or composite wood allow for easy customization and long-term use. Companies investing in low-carbon manufacturing and green certifications will gain competitive advantages in premium consumer markets such as Europe and North America, where environmental regulations are stringent.

Expanding Online Retail and E-commerce Penetration

The rapid expansion of online retail channels presents a major opportunity for global market players. E-commerce enables manufacturers to reach consumers directly, offer custom configurations, and manage pricing dynamically. Increased digital marketing, virtual visualization tools, and easy installation tutorials have boosted consumer confidence in purchasing large fixtures online, reshaping distribution models across the industry.

Product Type Insights

Among product types, recessed medicine cabinets held the largest market share of 32.1% in 2024. Their seamless integration, space efficiency, and aesthetic appeal make them a preferred choice for residential installations. Surface-mounted cabinets, though easier to install, are gradually declining in share due to their bulkier appearance. Smart cabinets are projected to be the fastest-growing segment with an expected CAGR of 8.4% through 2030, driven by digitalization trends and increased adoption in premium homes and healthcare facilities.

Application Insights

The residential segment accounted for approximately 55% of the market share in 2024. The rise in home healthcare practices, bathroom renovations, and customized furniture projects has accelerated product adoption. The commercial segment, including hospitals and clinics, is expanding steadily, with specialized cabinets for medicine storage and compliance with medical safety regulations. Institutional buyers such as offices, schools, and fitness centers are also emerging as niche customers, driven by the need for emergency first-aid storage solutions.

Distribution Channel Insights

Offline retail remains the dominant distribution channel, representing over 58% of total sales in 2024, largely due to customer preference for physical inspection before purchase. However, the online retail channel is growing rapidly, supported by the availability of diverse product ranges, reviews, and doorstep installation services. Direct-to-consumer websites and e-commerce platforms like Amazon, Wayfair, and Home Depot are significantly influencing global purchasing behavior.

| By Product Type | By Material Type | By Application | By Distribution Channel | By Installation Type |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global medicine cabinets market, accounting for 35.4% of the total market share in 2024. The region’s high healthcare awareness, robust renovation spending, and early adoption of smart home technologies contribute to consistent demand. The United States remains the largest market, while Canada is witnessing growing residential construction and healthcare facility upgrades.

Europe

Europe represents a mature but design-driven market, led by Germany, the U.K., and France. Consumers in this region prioritize sustainable and premium bathroom furnishings. EU policies encouraging eco-friendly materials and circular economy practices further promote the development of recyclable and modular medicine cabinets. Increasing investments in public healthcare facilities and hospitality renovations are additional demand drivers.

Asia-Pacific

The Asia-Pacific region is projected to be the fastest-growing market with a CAGR of 7.8% during 2025–2030. China, India, Japan, and South Korea are key contributors, driven by urbanization and rising healthcare spending. Government initiatives such as India’s “Ayushman Bharat” and China’s “Healthy China 2030” are expanding healthcare infrastructure, which, in turn, boosts commercial cabinet installations.

Latin America

Latin America, led by Brazil and Mexico, is witnessing increased product penetration through retail expansion and online sales. Demand is largely driven by mid-range products catering to residential remodeling. Gradual improvements in healthcare infrastructure are also promoting demand for commercial-grade cabinets across hospitals and clinics.

Middle East & Africa

MEA is emerging as a promising market driven by urban development in Gulf countries and healthcare expansion in South Africa and the UAE. Luxury housing projects in Dubai and Saudi Arabia are incorporating smart bathroom fixtures, including connected medicine cabinets. Meanwhile, public health investments in African countries are contributing to rising institutional demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Medicine Cabinets Market

- Kohler Co.

- Richelieu Hardware Ltd.

- Roca Sanitario S.A.

- American Pride, Inc.

- Duravit AG

- Jensen (Broan-NuTone LLC)

- FAB Glass and Mirror

- Alno AG

- HiB Ltd.

- Pelipal GmbH

Recent Developments

- In July 2025, Kohler Co. launched a new line of smart recessed medicine cabinets featuring voice-controlled LED lighting and Bluetooth-enabled speakers for luxury bathroom integration.

- In May 2025, Duravit AG introduced a sustainable cabinet series built from recycled aluminum and low-VOC composite wood, aligning with EU circular economy goals.

- In March 2025, Roca Sanitario expanded its production facility in Spain to boost the output of smart and modular medicine cabinets targeting the European and Middle Eastern markets.