Meal Replacement Market Size

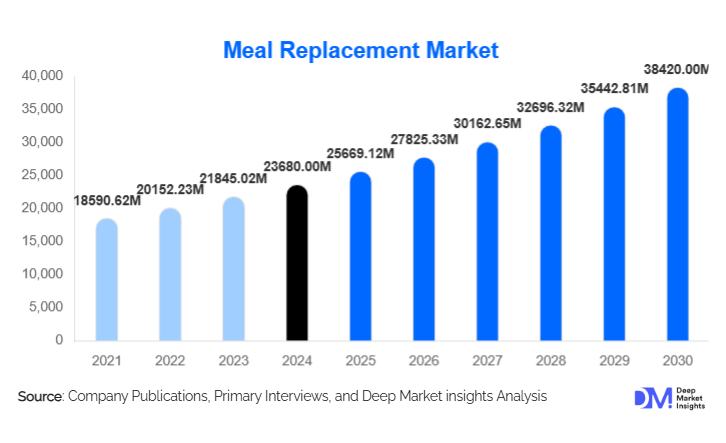

According to Deep Market Insights, the global meal replacement market size was valued at USD 23,680.00 million in 2024 and is projected to grow from USD 25,669.12 million in 2025 to reach USD 38,420.00 million by 2030, expanding at a CAGR of 8.4% during the forecast period (2025–2030). The meal replacement market growth is primarily driven by rising health consciousness, increasing demand for convenient nutrition solutions, and the growing adoption of plant-based and functional formulations. Expanding e-commerce channels and direct-to-consumer (D2C) models are further accelerating market penetration across both developed and emerging economies.

Key Market Insights

- Powder meal replacements dominate the product landscape, accounting for nearly 40% of global market revenue in 2024, due to affordability, versatility, and longer shelf life.

- North America leads the market with a 42% share, supported by mature product adoption, strong brand presence, and growing consumer preference for healthy eating habits.

- Asia-Pacific is the fastest-growing region, projected to grow at a double-digit CAGR through 2030, driven by urbanization, expanding middle-class income, and Western dietary influence.

- Weight management remains the largest application segment, representing 45% of 2024 revenue, reflecting global awareness around obesity and lifestyle diseases.

- Plant-based and clean-label formulations are witnessing rapid adoption, aligning with consumer demand for vegan, organic, and allergen-free products.

- Online and subscription-based sales channels are transforming distribution, offering personalization, convenience, and brand loyalty through recurring purchases.

Latest Market Trends

Plant-Based and Clean-Label Formulations Rising

Plant-based and vegan meal replacements are gaining momentum as consumers prioritize sustainability and animal-free protein sources. Brands are increasingly formulating with pea, soy, rice, and hemp proteins to attract health-conscious and environmentally aware consumers. The clean-label trend is driving transparency in ingredient sourcing, reduction of artificial additives, and emphasis on naturally derived nutrients. Organic-certified and allergen-free variants are further strengthening consumer trust, especially among younger demographics that value ethical consumption and environmental impact reduction.

Direct-to-Consumer (D2C) Models and Subscription Growth

The digital transformation of food and nutrition markets is reshaping how meal replacements reach consumers. D2C brands such as Huel and Soylent are leveraging personalized subscription models that ensure regular supply and tailored nutrition profiles. These models enhance customer retention through convenience, discounts, and brand engagement. Additionally, online marketplaces and wellness apps are integrating AI-driven recommendations, allowing users to track macronutrient intake, set health goals, and receive automated reorders. This channel shift is significantly reducing dependence on offline retail networks.

Meal Replacement Market Drivers

Rising Health Awareness and Weight-Management Focus

Global awareness of obesity, diabetes, and metabolic health has led to a surge in meal replacement consumption. These products provide balanced nutrition with controlled calories, appealing to consumers managing weight and seeking healthier lifestyles. The prevalence of lifestyle-related disorders, coupled with increasing adoption of high-protein and low-sugar diets, continues to fuel demand for structured, convenient nutrition solutions.

On-the-Go Nutrition and Urban Lifestyle Shifts

Rapid urbanization and longer working hours are increasing reliance on meal replacements as quick, balanced meal alternatives. Younger professionals and students are adopting powders, shakes, and bars as breakfast or lunch substitutes. This convenience-driven trend is prominent in metropolitan regions across Asia-Pacific and North America, where time scarcity fuels interest in portable, ready-to-drink nutrition options.

Innovation in Functional and Fortified Nutrition

Manufacturers are enriching products with vitamins, minerals, probiotics, and dietary fiber to enhance health benefits and differentiate from competitors. Functional meal replacements targeting energy, immunity, and digestive health are expanding product portfolios. This innovation aligns with rising consumer demand for multipurpose nutrition that supports both performance and wellness.

Market Restraints

Consumer Skepticism Regarding Nutrition Quality

Despite increasing adoption, a portion of consumers remains skeptical about meal replacements’ ability to substitute balanced meals. Concerns regarding artificial ingredients, taste fatigue, and long-term health effects can hinder market expansion. Transparent labeling, clinical validation, and improved product taste are critical for overcoming this perception barrier.

Regulatory Complexity and Competitive Pressures

Stringent food safety and labeling regulations across regions pose compliance challenges for manufacturers. Additionally, the rising popularity of fresh, natural meal alternatives, such as protein bowls and meal kits, creates stiff competition. Price sensitivity in emerging markets may further constrain premium product penetration.

Meal Replacement Market Opportunities

Expansion in Emerging Economies

Rapid economic growth, urbanization, and rising disposable incomes in the Asia-Pacific and Latin America create lucrative opportunities. Localization of flavors and affordable packaging formats can attract first-time users in India, China, and Brazil. Strategic partnerships with local distributors and health retailers can accelerate regional penetration and brand recognition.

Functional and Personalized Nutrition Development

The integration of AI and data analytics enables brands to offer personalized meal replacement solutions. Products tailored to dietary preferences, allergies, and health goals, such as keto, diabetic-friendly, or immune-boosting options, represent an untapped growth frontier. Companies investing in R&D to develop such solutions can capture high-margin premium niches.

Integration with Fitness and Wellness Ecosystems

Meal replacement brands are increasingly collaborating with fitness centers, digital health platforms, and wellness influencers. Cross-promotional campaigns that integrate wearable data and nutrition tracking can create holistic health ecosystems. The synergy between fitness technology and nutrition products enhances consumer engagement and lifetime value.

Product Type Insights

Powder meal replacements dominate the global meal replacement market, accounting for approximately 40% of total revenue in 2024. Their leadership stems from cost-effectiveness, long shelf life, and flexible serving sizes, making them ideal for both household and institutional use. Consumers appreciate the customizable nature of powdered mixes, allowing adjustments in portion control and nutritional content. Innovation in taste and texture, particularly chocolate, vanilla, and fruit-based flavors, continues to attract repeat purchases. Meanwhile, ready-to-drink (RTD) liquids are emerging as the fastest-growing category, driven by on-the-go convenience, impulse purchasing, and increased adoption in fitness and workplace settings. RTD products are especially popular in North America and Asia-Pacific, where time-constrained professionals prefer single-serve packaging. Bars represent a dynamic sub-segment, positioned between snacks and functional meals, benefiting from the trend of “mini-meals” and high-protein snack replacements. Lastly, other formats such as soups and sachets are gaining ground in emerging markets for their localized flavors, cultural adaptability, and long shelf stability.

Formulation Insights

The conventional formulation segment currently captures about 75% of global sales, led by well-established dairy- and soy-based protein sources. These products are favored for their complete amino acid profiles and proven efficacy in muscle recovery and satiety. However, the plant-based formulation segment is witnessing the fastest growth, expected to register a double-digit CAGR through 2030. The surge is driven by sustainability considerations, allergen awareness, and vegan lifestyle adoption. Brands are investing heavily in plant-protein blends (pea, rice, oat) and clean-label certifications to appeal to health-conscious consumers. Balanced or mixed formulations, combining dairy and plant proteins, are also gaining popularity for their broad mass-market appeal, marketed as “complete nutrition” solutions. Meanwhile, specialized products such as keto-friendly or allergen-free options cater to niche, high-margin segments where personalized nutrition and certified claims enhance brand loyalty and premium pricing potential.

Distribution Channel Insights

Offline retail channels, including supermarkets, hypermarkets, and specialty nutrition stores, account for around 55% of global market sales in 2024. These outlets offer visibility, product trials, and promotional bundling that drive volume purchases. However, online and direct-to-consumer (D2C) channels are rapidly reshaping the market landscape, projected to surpass offline sales by 2029. The e-commerce and subscription-based D2C models thrive on direct brand relationships, personalized recommendations, and margin efficiency. This trend is particularly pronounced in the U.S., China, and Western Europe, where digital penetration and health influencer marketing are highest. Modern trade retains relevance due to its promotional reach and convenience, while specialty and health stores maintain credibility for clinical or premium-positioned brands. Emerging channels such as vending machines and on-site sales (e.g., in gyms, offices, and airports) are capturing micro-moments of consumer demand for instant nutrition solutions.

Application Insights

Weight-management applications lead the global meal replacement market, commanding approximately 45% of total market share in 2024. This dominance is underpinned by diet culture, calorie-control awareness, and clinically validated low-calorie meal replacements. Products targeting weight loss and maintenance are increasingly marketed with clinical trials and endorsements from nutrition experts. The sports and performance nutrition segment follows as the fastest-growing category, benefiting from the surge in gym memberships, protein-centric diets, and recovery-focused formulations. Clinical and medical nutrition applications, used in hospitals and elderly care, are gaining prominence due to prescriber endorsements and integration into patient recovery protocols. Meanwhile, convenience- and on-the-go consumption continues to expand, appealing to urban professionals seeking quick, balanced meals during travel or work commutes. This trend reflects a growing overlap between meal replacement and functional snacking categories.

| By Product Form | By Application | By Ingredient Type | By Distribution Channel | By Price Tier |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global meal replacement market with a 42% share in 2024, anchored by the U.S. and Canada. Regional growth is driven by a strong fitness and weight-management culture, coupled with a highly mature direct-to-consumer (DTC) and e-commerce ecosystem. Consumers in this region display a high willingness to pay for premium, protein-rich, and clinically backed formulations. RTD liquids and meal replacement bars dominate sales channels due to lifestyle convenience and active nutrition positioning. The widespread adoption of fitness trackers, calorie-tracking apps, and subscription nutrition programs (e.g., personalized shakes) further amplifies demand. Strategic collaborations between fitness brands, healthcare professionals, and digital health platforms are reinforcing the region’s leadership.

Europe

Europe accounts for about 25% of global revenue, led by the U.K., Germany, France, and the Nordic countries. Growth is supported by stringent regulations on health claims, rising consumer trust in certified nutritional products, and increasing demand for natural and clean-label formulations. The region’s aging demographic is driving consumption of protein-enriched and easy-to-digest options, particularly within clinical and elderly nutrition segments. Plant-based and sustainable offerings are rapidly gaining traction due to environmental awareness and evolving food ethics. Urban convenience culture, especially in Western Europe, is boosting RTD and on-the-go meal formats, while digital grocery channels are broadening access across markets.

Asia-Pacific

Asia-Pacific (APAC) is the fastest-growing regional market, capturing nearly 20% of global revenue in 2024 and expected to post a double-digit CAGR through 2030. Rapid urbanization, expanding middle-class populations, and rising disposable incomes across China, India, Japan, South Korea, and Australia are fueling demand. Key regional drivers include busy white-collar lifestyles, strong adoption of RTD and powdered forms, and localized taste innovations such as matcha, black sesame, and mango-based flavors. Increasing health consciousness and social media–driven fitness culture are accelerating category penetration. In addition, expanding online retail ecosystems and cross-border e-commerce are enabling global brands to penetrate regional markets efficiently.

Latin America

Latin America contributes approximately 8% of the global market share in 2024, with Brazil and Mexico emerging as primary consumption centers. The region’s growth is supported by increasing awareness of health and wellness, urban lifestyle shifts, and expanding modern retail infrastructure. However, the market remains price-sensitive, emphasizing opportunities for value-priced, fortified meal replacement products. Influencer-led fitness trends and the proliferation of affordable e-commerce platforms are also supporting adoption among young consumers. Local players are leveraging flavor localization and affordability to compete effectively against international brands.

Middle East & Africa

Middle East & Africa (MEA) holds roughly 5% of the global market, with demand concentrated in the GCC countries (UAE, Saudi Arabia, Qatar) and South Africa. Growth is driven by a young population, an expanding expatriate workforce, and growing acceptance of Western nutrition concepts. Increasing health awareness campaigns and fitness facility investments are stimulating consumer interest in RTD and bar formats. However, fragmented distribution networks and higher import costs remain challenges to mass-market adoption. International brands entering the region are focusing on localized marketing, digital retail expansion, and government-aligned health initiatives to capture emerging opportunities.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Meal Replacement Market

- Abbott Laboratories

- Nestlé S.A.

- Glanbia plc

- Kellogg Company

- Herbalife Nutrition Ltd.

- Amway Corporation

- Huel Ltd.

- Soylent Corp.

- Danone S.A.

- PepsiCo, Inc.

- The Coca-Cola Company

- General Mills, Inc.

- Unilever PLC

- Bayer AG

- Mead Johnson Nutrition Company

Recent Developments

- In March 2025, Huel Ltd launched a new line of personalized nutrition shakes integrating AI-based dietary tracking for customized macro profiles.

- In January 2025, Nestlé introduced a plant-based, high-protein meal replacement range in Asia-Pacific, focusing on localized flavors for China and India.

- In September 2024, Abbott Laboratories expanded its production facility in the U.S. to increase the output of clinical and sports meal replacements, supported by rising domestic demand.