Maternity Intimate Wear Market Size

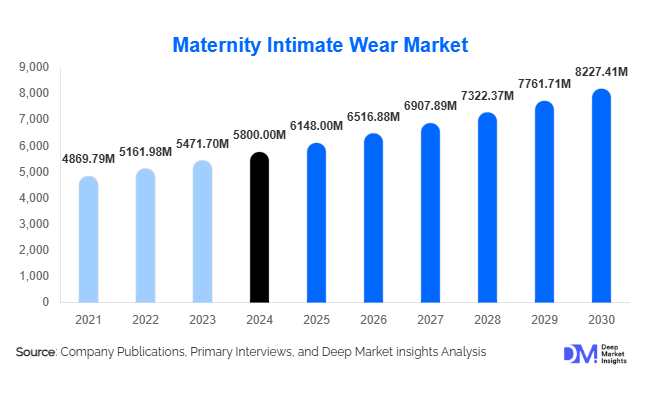

According to Deep Market Insights, the global maternity intimate wear market size was valued at approximately USD 5,800 million in 2024 and is projected to grow from around USD 6,148.00 million in 2025 to reach approximately USD 8,227.41 million by 2030, expanding at a CAGR of about 6.0% during the forecast period (2025–2030). This growth is largely driven by rising awareness of maternal comfort, increasing participation of women in the workforce, digital-commerce expansion, and innovations in fabric technologies tailored for pregnancy and nursing phases.

Key Market Insights

- Comfort-driven design and function are increasingly dominant, as expecting and nursing mothers prioritize intimate wear that adapts to body changes, offers support, and accommodates postpartum needs.

- Online and direct-to-consumer channels are surging, enabling specialized maternity intimate wear brands to reach underserved geographies and deliver size-inclusive and convenience-focused solutions.

- Asia-Pacific is emerging as a rapid-growth region, supported by rising disposable incomes, increasing urbanization, and growing awareness of maternity wellness and specialized apparel in markets such as China and India.

- North America retains a strong value share, due to higher unit prices, mature e-commerce penetration, and established maternity intimate wear brand presence.

- Sustainable fabrics and technical textile innovations such as moisture-wicking, anti-microbial knit, and adjustable designs are reshaping product development and differentiation.

- Size inclusivity and multi-functional designs (e.g., garments serving both pregnancy and postpartum) are gaining traction, addressing a broader demographic of women and encouraging repeat usage beyond the core maternity window.

Latest Market Trends

Dual-Purpose Pregnancy and Post-partum Wear

Brands are increasingly offering maternity intimate wear that serves both the pregnancy phase and the post-partum/nursing phase. Adjustable bands, nursing clasps, and designs that transition across body shape changes are becoming mainstream. This trend helps reduce wardrobe redundancy and appeals to eco- and cost-conscious consumers. With repeat purchases being a driver for lifetime value, dual-purpose items position brands strongly in this niche.

Sustainable and Technical Fabric Adoption

Expectant and nursing mothers are showing higher sensitivity to fabric comfort, skin safety, and sustainability credentials. As a result, manufacturers are adopting organic cotton, bamboo blends, seamless knit constructions, and moisture-wicking, anti-bacterial features tailored for maternity intimates. These innovations support premium pricing, brand differentiation, and consumer loyalty, particularly in developed markets where awareness is high.

Rise of Fit-Tech, Virtual Sizing & Customization

The intimate wear category, including maternity-specific products, has begun embracing digital tools, virtual fitting engines, AI size recommendations, and fit-guarantee policies to mitigate high returns and increase consumer confidence. For maternity intimate wear, where body changes are rapid and sizing complexity is high, such technologies reduce purchase risk and support online channel growth. Brands offering tailored sizing or custom-fit models are gaining a competitive advantage.

Market Drivers

Increasing Participation of Pregnant/Nursing Women in the Workforce

More women globally are working through pregnancy and returning to work earlier post-birth, which increases the demand for comfortable, supportive maternity intimate wear that can function across professional and active settings. The need for specialized maternity bras, support garments, and nursing-friendly intimates becomes more acute when transitioning between office, home, and leisure environments.

Growing Maternal Wellness Awareness and Demand for Comfort-Centric Intimates

Expectant and nursing mothers increasingly view intimate wear not just as a basic necessity, but as a wellness, comfort, and self-care product. This shift drives demand for tailored maternity intimates (e.g., nursing bras, support briefs, belly-bands) rather than generic non-maternity versions. Enhanced body-change support, pressure relief, and nursing access features improve the value proposition.

E-commerce and Specialty Channel Expansion

The growth of online retail and direct-to-consumer models has made specialized maternity intimate wear more accessible globally. Brands can now reach niche segments (plus-size maternity, active maternity, nursing athletes) more cost-efficiently and with better inventory flexibility. Online channels also allow for subscription models (e.g., trimester-based sizing updates), which boost repeat business and customer lifetime value.

Restraints

Complex Sizing and Product Development Costs

Designing maternity intimate wear is inherently more complex than standard intimate apparel: body shapes change rapidly through trimesters and postpartum, fit must address support, nursing access, shifting sizes, comfort, and often higher manufacturing complexity (e.g., adjustable bands, special fabrics). These factors raise product development and manufacturing costs, which may be passed on to consumers and limit adoption among price-sensitive segments.

Low Penetration and Awareness in Emerging Regions

In many emerging markets, maternity-specific intimate wear remains under-penetrated. Consumers often continue using regular intimate wear due to low awareness, limited retail availability, or cultural norms. Distribution networks may be weak, return policies may be less mature, and online reach may still be developing. This creates a barrier to rapid market expansion in those geographies.

Market Opportunities

Expansion into Emerging Markets with Localized Offerings

Emerging regions such as India, Southeast Asia, and parts of Latin America represent a significant growth frontier. As disposable incomes rise and maternal health/wellness awareness increases, maternity intimate wear demand will expand. Brands that localize design (e.g., climate-adapted fabrics, culturally appropriate styles), size ranges (including plus-size), price points, and distribution (including Tier 2/3 cities) can capture this underserved segment. Moreover, e-commerce penetration is accelerating in these regions, further widening access.

Development of Multi-Functional & Active Maternity Intimates

There is a growing opportunity to serve the expectant/nursing mother who is also actively working out, practicing yoga, or simply maintaining a more dynamic lifestyle. Maternity intimate wear with features such as sports-bra style support, adjustable sizing for post-partum, breathable fabrics, and nursing functionality taps into this hybrid segment. As women seek both comfort and performance, brands that deliver active maternity intimates will gain share. This cross-sector integration (intimate wear + activewear) offers differentiated value.

Sustainability and Circular-Economy Models

Consumers are increasingly seeking environmentally-friendly products, even in maternity intimates. There is a strong opportunity to develop intimate wear from organic fabrics, recycled fibers, low-impact manufacturing, and to offer take-back/recycling programs for post-partum garments. Brands that build credible, sustainable credentials and messaging can command premium pricing and foster loyalty. Additionally, subscription or rental models (to address the short pregnancy/post-partum life cycle) open novel business models in this category.

Product Type Insights

Maternity bras and nursing bras dominate the product landscape, accounting for nearly 55% of the global market share in 2024. This dominance is attributed to continuous product innovation, such as wire-free designs, moisture-wicking materials, and dual-purpose features supporting both pregnancy and postpartum phases. Maternity panties and briefs form the second-largest segment, driven by increased adoption of seamless and stretch fabrics ensuring comfort and hygiene.

Distribution Channel Insights

Online retail and direct-to-consumer (D2C) platforms lead the market with approximately 62% share in 2024. The convenience of home delivery, privacy, and wider variety are key contributors to this dominance. Subscription-based models and influencer-led marketing campaigns are also driving repeat purchases. Specialty maternity stores continue to hold relevance in premium urban markets, offering personalized fittings and consultations.

End-Use Insights

Pregnancy and postpartum segments collectively account for nearly 80% of the market, with postpartum demand growing fastest. Increasing breastfeeding awareness and hospital-endorsed nursing lingerie support this trend. The rise of active and working mothers is creating niche demand for multipurpose maternity shapewear and support wear compatible with daily professional attire.

| By Product Type | By Material / Fabric Type | By Distribution Channel | By End Use / Consumer Segment |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains the largest regional market for maternity intimate wear, with an estimated share of 34 % in 2024 (USD 1,972 million). The U.S. is the dominant country, supported by high spending power, strong e-commerce infrastructure, and early adoption of specialized maternity intimates. While growth is steady, it is moderate compared to emerging regions.

Europe

Europe holds around a 29 % share ( USD 1,682 million) in 2024. Key countries such as the U.K., Germany, France, and Italy drive demand. The region benefits from sustainability-driven consumer behaviors, mature retail networks, and strong nursing-wear acceptance. Growth remains positive but slower than in high-growth regions.

Asia-Pacific

Asia-Pacific is emerging as a critical growth frontier. Though its 2024 value is lower (estimated 27 % share in 2024, roughly USD 1,566 million), its growth rate is higher (approx. 6–8 % CAGR) due to rising incomes, urbanization, and growing online penetration in China and India. China is likely the largest within the region; India is among the fastest-growing countries as awareness and penetration increase.

Latin America

Latin America accounts for a smaller share (under 6-7 %), but offers meaningful growth prospects driven by increasing working-women population, e-commerce growth, and brand awareness (e.g., Brazil, Mexico). The absolute value is smaller, but the growth trajectory is encouraging.

Middle East & Africa

The Middle East & Africa region holds roughly 5-7 % of the market in 2024. Within this region, GCC countries (UAE, Saudi Arabia) show stronger potential thanks to high-income demographics and increasing maternal wellness spending. Growth is moderate but limited by retail penetration and size-inclusive assortment challenges.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Maternity Intimate Wear Market

- H&M Group

- Gap Inc.

- Seraphine Group Ltd.

- Wacoal Holdings Corp.

- Cake Maternity Pty Ltd.

- Hotmilk Lingerie Ltd.

- Mothercare plc

- Thyme Maternity (Canada)

- Bravado Designs Inc. (Medela AG)

- Marks & Spencer plc

Recent Developments

- In May 2025, Seraphine Group launched its new eco-conscious collection featuring organic cotton nursing bras with biodegradable elastics, targeting the European market.

- In March 2025, H&M expanded its maternity line into India under its “Conscious Collection,” integrating locally sourced bamboo and organic cotton blends.

- In January 2025, Wacoal Holdings introduced AI-based virtual fit technology on its global e-commerce platform to enhance customer satisfaction and reduce product returns.