Low-Cost Airlines Market Size

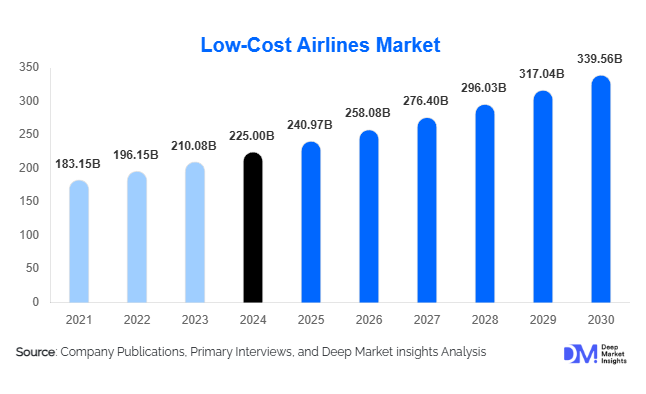

According to Deep Market Insights, the global low-cost airlines market size was valued at USD 225 billion in 2024 and is projected to grow from USD 240.97 billion in 2025 to reach USD 339.56 billion by 2030, expanding at a CAGR of 7.1% during the forecast period (2025–2030). The low-cost airlines market growth is primarily driven by surging demand for affordable air travel, rapid expansion in emerging economies, and increasing reliance on ancillary revenue streams supported by digital innovation and fleet modernization.

Key Market Insights

- Asia-Pacific leads the global market, driven by booming domestic air travel in India, China, and Southeast Asia, which together account for over one-third of total low-cost carrier (LCC) traffic worldwide.

- Digital and direct booking channels dominate, representing more than 70% of total LCC bookings in 2024 as airlines prioritize cost reduction and customer engagement through mobile-first platforms.

- Narrow-body aircraft remain the backbone of LCC fleets, comprising around 80% of total deployed aircraft, ensuring optimal cost efficiency and high utilization rates.

- Ancillary revenue streams such as baggage and seat selection fees are contributing over 20% of total airline income, enhancing profitability even in price-competitive environments.

- Pure low-cost carrier models hold approximately 45% of the global market share, outperforming hybrid and ultra-low-cost carriers due to extensive route networks and standardized operations.

- Fuel-efficient aircraft, automation, and sustainability initiatives are reshaping operational strategies as airlines aim to reduce costs and carbon emissions simultaneously.

What are the latest trends in the low-cost airlines market?

Expansion into Emerging Regional Markets

Low-cost carriers are aggressively expanding into underserved regions such as Southeast Asia, India, and Africa, capitalizing on rapid urbanization and rising disposable incomes. Governments are liberalizing air transport policies and investing in regional airport infrastructure, creating favorable conditions for new entrants. Secondary city connectivity is emerging as a key growth catalyst, enabling carriers to tap new passenger pools and reduce congestion at major hubs. For instance, India's regional connectivity programs and Southeast Asia’s open-skies agreements have fueled double-digit capacity growth for budget airlines across the region.

Digital Transformation and Ancillary Monetization

Digital innovation is redefining the LCC business model. Airlines are using data analytics, AI-driven pricing, and mobile applications to personalize offerings and boost ancillary revenues. Features such as dynamic seat pricing, in-app upgrades, and real-time notifications improve customer engagement while increasing per-passenger revenue. Mobile-first strategies also enable carriers to lower distribution costs by bypassing intermediaries, thereby reinforcing direct customer relationships. With ancillary income comprising up to one-fifth of total airline revenue, digital integration remains a crucial profitability driver.

Rise of Long-Haul Low-Cost Travel

Technological advances in aircraft efficiency, such as the Airbus A321XLR and Boeing 737 MAXare enabling budget airlines to operate profitable long-haul and transcontinental routes. This segment, though still emerging, represents a high-growth opportunity as travelers increasingly seek affordable intercontinental travel options. Low-cost long-haul models are particularly gaining traction in Europe, Asia, and North America, Caribbean corridors, bridging the gap between full-service carriers and budget operations.

What are the key drivers in the low-cost airlines market?

Rising Demand for Affordable Air Travel

Growing middle-class populations and increased tourism across emerging economies have fueled an unprecedented rise in budget air travel. As disposable incomes rise and airfares remain competitive, first-time flyers and price-sensitive travelers are migrating from ground transport to air travel, particularly in Asia-Pacific and Latin America. This sustained demand underpins the sector’s expansion.

Fleet Standardization and Operational Efficiency

Low-cost airlines operate highly standardized fleets, mainly single-aisle aircraft such as the Airbus A320 and Boeing 737 familieswhich lowers maintenance and training costs while enhancing scheduling flexibility. High aircraft utilization rates and point-to-point networks further reduce turnaround times, making LCCs structurally more efficient than legacy carriers.

Digital Sales and Ancillary Revenue Growth

By prioritizing direct online channels and ancillary upselling, LCCs have created robust digital ecosystems that improve margins while keeping base fares low. This strategy has enabled airlines to diversify income sources, stabilize profitability, and sustain market competitiveness even during periods of fare compression.

What are the restraints for the global market?

Fuel Price Volatility

Fuel remains the single largest operating expense for airlines, representing up to 30% of total costs. Price volatility linked to global crude oil markets can erode margins and force fare adjustments, impacting competitiveness. While newer aircraft and hedging strategies mitigate this risk, exposure to energy fluctuations remains a persistent challenge.

Infrastructure and Regulatory Constraints

Slot limitations at congested airports, limited regional airport capacity, and complex international aviation regulations continue to restrict route expansion. Emerging markets, despite strong demand, often face delays in infrastructure upgrades and inconsistent regulatory frameworks, slowing the pace of market penetration for new carriers.

What are the key opportunities in the low-cost airlines industry?

Emerging Market Penetration

Rapidly developing economies in Asia-Pacific, Africa, and Latin America present significant untapped potential for low-cost carriers. Rising tourism, supportive government policies, and the emergence of secondary airports create lucrative opportunities for network expansion. For instance, India’s regional connectivity schemes and African open-sky agreements are unlocking new growth corridors for budget airlines.

Technological Innovation and Automation

Automation in operations, digital ticketing, and AI-driven pricing engines are transforming the passenger journey and optimizing cost management. Airlines leveraging these technologies can achieve higher margins through predictive maintenance, dynamic scheduling, and efficient resource deployment, thereby gaining a competitive advantage.

Long-Haul Low-Cost Operations

The next frontier for LCCs lies in long-haul routes enabled by new-generation fuel-efficient aircraft. Budget airlines such as AirAsia X and Jetstar are pioneering these models, offering affordable transcontinental flights that combine low fares with ancillary-driven profitability. This sub-segment is projected to grow at over 13% CAGR through 2030.

Product Type Insights

Pure Low-Cost Carriers (LCCs) remain the dominant force in the global low-cost airline market, commanding approximately 45% share in 2024. Their success is anchored in operational efficiency, unbundled pricing, and a high-frequency point-to-point model that maximizes aircraft utilization. The leading driver for this segment is their ability to maintain high load factors through dense scheduling on short- and medium-haul routes, while keeping costs low via standardized fleets and rapid turnaround times. These carriers have built strong brand loyalty in domestic and regional markets through affordability and reliability.

Ultra-Low-Cost Carriers (ULCCs) are gaining rapid traction in both North America and Europe, supported by an ancillary-first pricing model and ultra-lean cost structures. This segment’s profitability hinges on ancillary revenue streams such as baggage fees, seat selection, and in-flight sales, accounting for up to 45% of total revenues for some operators. ULCCs are expected to post double-digit growth through 2030 as they continue to penetrate price-sensitive routes and attract first-time flyers.

Hybrid Low-Cost Carriers are emerging as a bridge between full-service and low-cost models, combining affordable base fares with premium add-ons like flexible ticketing and extra legroom. Their leading driver is the ability to upsell bundles and capture both leisure and premium leisure/business travelers without assuming full-service cost burdens. This strategy has been particularly successful in Asia and the Middle East, where mixed demographics demand both affordability and flexibility.

Long-Haul Low-Cost Carriers (LH-LCCs) remain a smaller portion of the global market but are expanding rapidly, supported by new-generation fuel-efficient aircraft such as the Boeing 787 and Airbus A321XLR. The segment’s growth driver is its ability to maintain yield on long sectors through low seat-mile costs and optimized ancillary bundling. Carriers like Norse Atlantic Airways and AirAsia X are pioneering sustainable long-haul affordability.

Route and Operation Insights

Domestic routes accounted for nearly 60% of global low-cost airline revenues in 2024, underscoring the dominance of local and regional travel in sustaining LCC operations. Markets such as the U.S., China, and India lead this category, driven by strong leisure and visiting-friends-and-relatives (VFR) traffic. High aircraft utilization, rapid turnarounds, and efficient slot management enable LCCs to achieve load factors exceeding 85% on average.

International short- and medium-haul routes continue to expand, particularly within Europe, Southeast Asia, and Latin America, supported by open skies agreements and cross-border travel growth. Meanwhile, long-haul low-cost travel represents a nascent but high-potential segment, with fleet modernization allowing new nonstop links between secondary city pairs. LCCs such as Scoot, Jetstar, and Norse Atlantic are capitalizing on this emerging opportunity.

Distribution Channel Insights

Direct online bookings dominate low-cost carrier ticket sales, accounting for 70–75% of total transactions in 2024. Airlines are increasingly leveraging digital ecosystems — including mobile apps, digital wallets, and AI-powered loyalty platforms — to boost customer retention and reduce distribution costs. This mobile-first approach enhances transparency, promotes dynamic pricing, and improves ancillary conversion rates.

Online Travel Agencies (OTAs) remain important for cross-border and multi-leg itineraries, but their share is gradually declining as LCCs prioritize customer ownership through proprietary booking platforms. Offline travel agents now represent less than 10% of global ticket sales, primarily serving small corporate accounts and older demographic travelers. The next frontier for LCCs is personalization, where predictive analytics drive targeted offers and maximize per-passenger yield.

Passenger Type Insights

Leisure travelers form the backbone of low-cost airline demand, accounting for approximately 55–60% of total passengers in 2024. The affordability of LCCs has democratized air travel, allowing budget-conscious tourists to replace ground transport with short-haul flights. Visiting Friends and Relatives (VFR) travel has also surged, particularly across migrant-heavy corridors in the Middle East, Southeast Asia, and Europe, supporting consistent year-round demand.

Business travelers represent a smaller but growing customer base, accounting for 15–20% of total passengers in 2024. The adoption of hybrid and bundled fare products, seat selection options, and flexible rescheduling has made LCCs a viable alternative to full-service carriers for cost-sensitive corporate travelers. The growth of remote work and “bleisure” travel further enhances this segment’s relevance.

| By Product Type | By Route & Operation | By Distribution Channel | By Passenger Type |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America captured approximately 22–25% of the global low-cost airline market in 2024, driven by a mature ecosystem and strong domestic connectivity. The region’s structural driver is the large leisure and VFR traffic base, combined with hub-free point-to-point demand. The U.S. remains the world’s second-largest LCC market after Asia-Pacific, led by Southwest Airlines, Spirit, Frontier, and Allegiant. These carriers are capitalizing on airport slot flexibility and low-fare penetration in mid-tier cities. Canada’s growth is supported by carriers like WestJet and Flair, focusing on expanding affordable regional access and transborder routes.

Europe

Europe holds a 27–30% market share in 2024, with the region’s driver being high price sensitivity, dense short-haul networks, and open competition enabled by EU deregulation. The European LCC landscape is led by Ryanair, easyJet, and Wizz Air, whose strategies revolve around ultra-frequent, point-to-point services and cost efficiency. Intra-European tourism recovery and new secondary airport utilization are fueling growth. Eastern and Southern Europe are key expansion corridors, benefiting from liberalized aviation agreements and post-pandemic leisure travel revival.

Asia-Pacific

Asia-Pacific leads globally, commanding around 35% market share in 2024 and projected to grow at a CAGR exceeding 12% through 2030. The region’s dominant growth driver is rapid intra-regional middle-class travel, expanding secondary city pairs, and supportive airport capacity expansion. India’s IndiGo, Malaysia’s AirAsia Group, and Vietnam’s VietJet are spearheading fleet and route growth, while China’s Spring Airlines continues to benefit from rising domestic consumption. Policy liberalization, infrastructure upgrades, and competitive fares underpin Asia’s leadership in low-cost aviation.

Latin America

Latin America contributes approximately 8–10% of global revenues, led by Brazil and Mexico. The region’s growth driver is route expansion into secondary cities and price-elastic leisure demand across under-penetrated markets. Carriers such as GOL, Volaris, and SKY Airline are investing in fleet modernization and digital sales to boost efficiency. Despite macroeconomic volatility and regulatory inconsistencies, the long-term outlook remains positive, supported by liberalization and growing middle-class mobility.

Middle East & Africa

The Middle East and Africa collectively account for 10–13% of the global market share in 2024. The primary regional driver is rapid airport investment, tourism development, and expanding cross-regional partnerships that enable efficient short-haul connectivity. Flydubai, Air Arabia, and Jazeera Airways lead the Middle East segment, while Africa’s market remains nascent but promising, with FlySafair and Fastjet driving low-cost penetration. Open-skies agreements and infrastructure funding are expected to enhance connectivity and affordability through 2030, despite challenges in regulatory harmonization and airport capacity.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Low-Cost Airlines Market

- Ryanair Holdings plc

- Southwest Airlines Co.

- InterGlobe Aviation Ltd (IndiGo)

- easyJet plc

- AirAsia Group Berhad

- Spirit Airlines Inc.

- Wizz Air Holdings plc

- flydubai

- Jetstar Airways Pty Ltd

- Volaris

- Frontier Group Holdings, Inc.

- GOL Linhas Aéreas Inteligentes

- VietJet Aviation

- Cebu Pacific Air

- Pegasus Airlines

Recent Developments

- In July 2025, Ryanair announced a USD 5 billion fleet expansion plan with Boeing for 150 new 737 MAX aircraft to strengthen capacity across Europe.

- In May 2025, IndiGo launched new long-haul operations connecting India to Europe using Airbus A321XLR aircraft, marking its entry into budget intercontinental travel.

- In April 2025, AirAsia introduced its AI-based dynamic pricing platform and integrated loyalty ecosystem to optimize ancillary revenue streams.

- In March 2025, Wizz Air unveiled its sustainability roadmap, targeting a 25% reduction in carbon emissions per passenger by 2030 through fleet modernization.