Leather and Allied Products Market Size

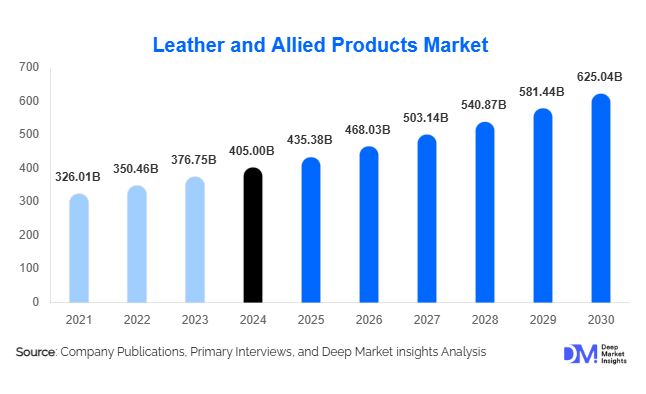

According to Deep Market Insights, the global leather and allied products market size was valued at USD 405.0 billion in 2024 and is projected to grow from USD 435.38 billion in 2025 to reach USD 625.04 billion by 2030, expanding at a CAGR of 7.5% during the forecast period (2025–2030). The growth of the leather and allied products market is primarily driven by the rising demand for premium fashion goods, the increasing use of leather in the automotive and furniture industries, and the emergence of sustainable and eco-friendly leather alternatives.

Key Market Insights

- Leather footwear remains the largest segment, accounting for nearly 30% of the global market in 2024, driven by premiumization trends and rising consumer purchasing power.

- Asia-Pacific dominates global production, with China, India, and Vietnam emerging as the leading exporters of leather goods and processed leather.

- Europe remains the global hub for luxury leather products, supported by heritage brands and advanced craftsmanship.

- Automotive and furniture applications are expanding, driven by increased demand for high-quality interiors and upholstery materials.

- Eco-friendly and vegan leather materials are rapidly gaining traction, reshaping manufacturing practices and attracting environmentally conscious consumers.

- Digital transformation and e-commerce expansion are redefining the distribution landscape, with major brands investing in omnichannel retail and direct-to-consumer sales.

Latest Market Trends

Sustainable Leather Innovations Gaining Momentum

Environmental regulations and consumer awareness are accelerating the transition toward sustainable leather production. Manufacturers are investing in chrome-free tanning, vegetable tanning, and water-based dyeing processes to minimize ecological impact. The adoption of bio-based and lab-grown leather materials, such as mycelium leather and pineapple-based alternatives, is creating new product categories within the allied products market. Brands are increasingly obtaining certifications for ethical sourcing and traceability, enhancing brand loyalty among environmentally conscious consumers. Sustainable packaging and circular economy initiatives are also becoming integral to the global leather supply chain.

Digitalization and E-commerce Integration

Rapid digitization is reshaping the way leather products are marketed and sold. Global brands are focusing on direct-to-consumer (D2C) channels, virtual product customization, and AI-driven customer analytics. E-commerce platforms enable global reach, while augmented reality (AR) fitting tools allow buyers to visualize products before purchase. The increasing adoption of Industry 4.0 technologies such as automated cutting, RFID tracking, and predictive maintenance enhances production efficiency and reduces waste. Digital transparency in sourcing and material traceability is now a competitive advantage for manufacturers targeting the premium segment.

Leather and Allied Products Market Drivers

Rising Disposable Income and Premiumization

Growing middle-class populations in Asia-Pacific, Latin America, and the Middle East are driving global demand for luxury and premium leather goods. Consumers are shifting from mass-market to branded leather products that emphasize craftsmanship and exclusivity. This premiumization trend is reflected across footwear, handbags, and accessories, with major brands expanding into emerging markets through online and retail channels.

Expansion of Automotive and Furniture Leather Applications

Automotive manufacturers increasingly use leather for high-end vehicle interiors, seats, and steering wheels. Similarly, demand for leather in furniture and home décor is rising with the global growth of the real estate and hospitality sectors. These applications not only drive volume but also stimulate innovation in treated and performance-grade leathers designed for durability and aesthetics.

Rapid Growth of E-commerce and Global Trade

The expansion of global online marketplaces has created access to international consumers for both established brands and small-scale producers. E-commerce facilitates higher margins through direct sales and offers customers customizable products. Trade liberalization and cross-border retail have also increased export opportunities, especially from Asia to North America and Europe.

Market Restraints

Volatility in Raw Materials and Labor Costs

Fluctuations in prices of raw hides, tanning chemicals, and labor costs remain significant challenges for manufacturers. The global shortage of skilled tannery labor in certain regions has increased production costs, while energy and logistics expenses add further pressure on profit margins. These cost fluctuations compel producers to optimize supply chains and explore automation to maintain competitiveness.

Regulatory and Environmental Challenges

Stringent environmental regulations and growing concerns about animal welfare are compelling manufacturers to adopt cleaner, costlier production methods. Compliance with wastewater treatment standards, emissions control, and responsible sourcing certifications increases operational complexity. Furthermore, the growing acceptance of vegan and synthetic substitutes is gradually influencing traditional leather demand in certain consumer categories.

Leather and Allied Products Market Opportunities

Emergence of Sustainable and Ethical Leather Alternatives

The shift toward cruelty-free and eco-conscious fashion presents a major opportunity for innovation. Companies are investing in biodegradable leathers, organic tanning agents, and lab-grown materials to attract environmentally aware consumers. Collaborations with biotechnology startups are expected to accelerate the commercialization of sustainable alternatives while maintaining the premium aesthetics associated with natural leather.

Expanding Regional Demand in Emerging Economies

Rapid urbanization, rising disposable incomes, and government incentives for manufacturing are transforming emerging markets into major consumption and export hubs. India’s “Make in India” initiative, Vietnam’s industrial parks, and Indonesia’s growing consumer base are supporting strong regional expansion. Western brands are increasingly partnering with local manufacturers to establish joint ventures and capture regional demand growth.

Digital Transformation and Omnichannel Retail Strategies

Brands that integrate digital solutions such as virtual try-ons, online customization, and AR-based product displays are expected to capture greater market share. Omnichannel retailing that blends in-store and online experiences helps brands deliver personalized shopping journeys, driving higher conversions and customer loyalty. Blockchain-based traceability for ethical sourcing is emerging as a key trust-building tool across supply chains.

Product Type Insights

Leather Footwear dominates the market, representing about 30% of the total 2024 revenue (USD 121 billion). The segment’s leadership is attributed to durable design, consumer preference for comfort, and premium styling trends. Non-leather footwear is growing steadily as sustainability-conscious consumers explore substitutes. Leather handbags and luggage constitute the second-largest product group, driven by luxury fashion demand and global brand expansion.

Material Type Insights

Split Leather accounts for around 35% of total volume, making it the most widely used leather material due to its balance of affordability and quality. Full-grain and top-grain leathers dominate premium segments, while bonded and synthetic variants serve cost-sensitive or vegan markets. The rise of bio-based and recycled leathers is creating new competitive dynamics within the material mix.

Application Insights

Consumer Goods hold nearly 65% of the total market share, encompassing footwear, bags, belts, and apparel. Automotive and furniture applications jointly represent over 25%, fueled by rising global demand for luxury interiors and high-end furnishings. Emerging industrial uses, including aviation seating and specialty equipment, contribute marginally but show high potential for niche growth.

Distribution Channel Insights

Offline retail continues to dominate with around 55% market share in 2024, thanks to the tactile and experiential nature of leather goods purchasing. However, online sales are rapidly gaining ground, supported by global logistics, influencer marketing, and direct brand websites. B2B and institutional channels remain vital for automotive and furniture manufacturers sourcing leather in bulk.

| By Product Type | By Source | By Application | By Distribution Channel | By End User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global market with an estimated 40% share in 2024 (USD 162 billion). China, India, and Vietnam serve as both major manufacturing bases and growing consumer markets. Government initiatives promoting exports and technology upgrades in tanning facilities have strengthened the region’s competitiveness. India and Vietnam are forecast to be the fastest-growing countries through 2030.

Europe

Europe represents about 25% of the global market (USD 101 billion) and continues to lead in luxury leather manufacturing, driven by Italy, France, and Spain. The region’s strong emphasis on quality craftsmanship and heritage branding sustains global demand for European-made products. Sustainability mandates and eco-certified production practices are also shaping future industry standards.

North America

North America accounts for a roughly 20% share (USD 81 billion). The U.S. and Canada maintain high per-capita consumption of leather goods, supported by fashion and automotive applications. Domestic production is limited compared to imports, but premium local brands continue to expand their export presence.

Middle East & Africa

This region holds about 8% share (USD 32 billion) and exhibits strong potential due to increasing urbanization and high disposable incomes in the Gulf states. Africa’s growing manufacturing base, particularly in Ethiopia and Kenya, positions it as an emerging production hub for both regional and export markets.

Latin America

Latin America contributes a roughly 7% share (USD 29 billion). Brazil and Mexico dominate regional leather exports, with robust tanning industries and growing domestic demand for footwear and fashion goods. Currency fluctuations and trade reforms will shape future competitiveness.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Leather and Allied Products Market

- LVMH Moët Hennessy Louis Vuitton SE

- Kering SA

- Tapestry Inc.

- Hermès International S.A.

- Adidas AG

- Nike Inc.

- Puma SE

- ECCO Sko A/S

- Samsonite International S.A.

- VF Corporation

- Burberry Group plc

- Coach (New York)

- Wolverine Worldwide Inc.

- Dr. Martens plc

- Aldo Group Inc.

Recent Developments

- In April 2025, Kering announced a major investment in lab-grown leather startup VitroLabs to scale production of sustainable leather alternatives.

- In March 2025, LVMH launched a traceable supply-chain platform leveraging blockchain to ensure transparency in sourcing hides and materials.

- In February 2025, ECCO introduced its waterless tanning technology expansion at its Netherlands facility, reducing environmental impact by 50%.