Horse Blanket Market Size

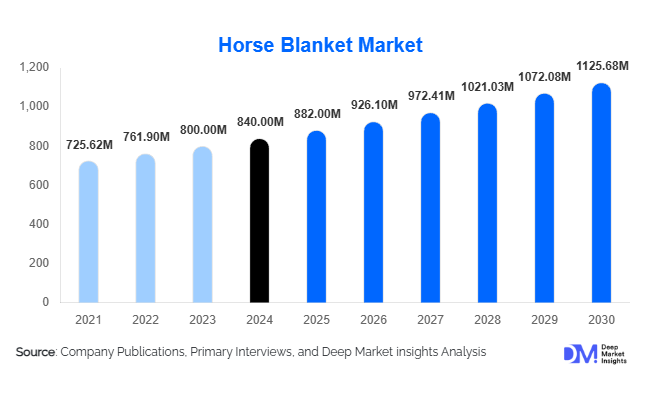

According to Deep Market Insights, the global horse blanket market size was valued at USD 840 million in 2024 and is projected to grow from USD 882 million in 2025 to reach USD 1125.68 million by 2030, expanding at a CAGR of 5.0% during the forecast period (2025–2030). The growth of the horse blanket market is primarily driven by the rising awareness of equine health and welfare, increased participation in equestrian sports and leisure riding, and continuous innovations in materials and blanket functionality.

Key Market Insights

- Turnout blankets dominate the market, accounting for nearly 34% of global revenue in 2024 due to their versatility and suitability for outdoor protection.

- Polyester remains the leading material segment, representing approximately 41% of global demand, driven by its durability, weather resistance, and cost efficiency.

- Racing horses constitute the largest end-use segment, contributing around 37% of global sales, owing to higher spending capacity among professional stables and competitive riders.

- North America leads the global market, holding a 38% revenue share in 2024, while Asia-Pacific is the fastest-growing region with a forecast CAGR of over 7% through 2030.

- Online distribution channels are expanding rapidly, now representing around 29% of total global sales as equestrian consumers shift toward digital shopping platforms.

- Premiumization and sustainable materials are key trends, with growing demand for waterproof, breathable, and eco-friendly fabrics.

Latest Market Trends

Rise of Premium and Technical Blankets

As equine owners become more conscious of animal comfort, performance, and well-being, demand for premium and technologically advanced blankets is growing rapidly. Manufacturers are introducing turnout and stable blankets with innovative features such as waterproof membranes, thermal insulation layers, and breathable linings. Smart textiles that monitor temperature or humidity levels are in early development stages, while eco-conscious owners increasingly prefer blankets made from recycled or sustainable fibers. This premiumization trend is reshaping product pricing structures and pushing the market toward higher-value segments.

Digitalization and Direct-to-Consumer Sales

Online and omnichannel sales are transforming the horse blanket market. Equestrian owners now research, compare, and purchase blankets through digital platforms offering detailed sizing guides, fitting tutorials, and customization tools. Leading brands are enhancing e-commerce strategies with subscription-based blanket replacement models and virtual fitting assistance. The shift toward direct-to-consumer models is improving brand visibility and customer loyalty, while reducing reliance on distributors and tack retailers. This trend is expected to accelerate as younger, digitally engaged horse owners dominate the market demographic.

Horse Blanket Market Drivers

Increasing Focus on Equine Health and Welfare

Rising global awareness of animal welfare is a primary growth driver for the horse blanket industry. Proper blanketing protects horses from cold weather, moisture, and insects, reducing health risks such as respiratory illness, muscle stiffness, and skin irritation. Veterinarians and equine care experts increasingly recommend appropriate blanket use, leading to higher replacement rates and adoption across both professional and recreational owners.

Growth in Equestrian Sports and Leisure Riding

The expansion of equestrian sports, including show jumping, dressage, and racing, has directly boosted the demand for high-performance blankets. Simultaneously, leisure riding, equine therapy programs, and horse tourism are broadening the consumer base. Rising disposable incomes and urban interest in equestrian activities in emerging economies such as China, India, and Brazil are opening new markets for both premium and affordable blankets.

Technological and Material Innovation

Manufacturers are adopting advanced synthetic fibers, weather-resistant coatings, and ergonomic designs to improve comfort, breathability, and durability. Developments such as ripstop polyester, antibacterial linings, and thermal insulation are redefining product quality. The introduction of modular blanket systems, with interchangeable liners and adjustable fits, further enhances usability, reducing the need for multiple seasonal purchases.

Market Restraints

Seasonal and Climate Dependence

Horse blanket sales are inherently seasonal, peaking in colder months and dropping sharply during warmer seasons. In tropical and equatorial regions, usage is limited, constraining total market potential. This seasonality creates inventory management challenges and limits steady year-round cash flow for manufacturers and retailers.

Raw Material Price Volatility

Fluctuations in the prices of key raw materials such as polyester, nylon, and cotton can significantly affect production costs and profitability. Supply chain disruptions, energy costs, and shipping constraints add further pressure, especially for manufacturers operating in highly competitive mid-range blanket segments. The ability to balance cost and quality is a persistent challenge for industry participants.

Horse Blanket Market Opportunities

Premiumization and Advanced Materials

Growing consumer willingness to invest in higher-quality blankets provides opportunities for manufacturers to launch advanced, performance-oriented products. Integrating features such as waterproof-breathable membranes, temperature-regulating fabrics, and antibacterial coatings can command premium pricing. Moreover, sustainable material innovation, using recycled polyester, organic cotton, or biodegradable fibers, aligns with evolving environmental preferences and strengthens brand positioning.

Expansion into Emerging Regions

Asia-Pacific, Latin America, and the Middle East are experiencing a rapid increase in equestrian sports, riding clubs, and horse ownership. These regions represent untapped markets for blanket manufacturers seeking new growth avenues. Localized manufacturing and regional distribution partnerships can significantly reduce logistics costs and enable competitive pricing. Increasing horse imports in China, India, and Saudi Arabia underscore strong potential for future market expansion.

Omnichannel and E-Commerce Integration

Online equestrian retail is becoming mainstream, presenting enormous opportunities for established and new entrants. Brands investing in user-friendly websites, AR-based sizing tools, and digital marketing are improving consumer reach and engagement. Subscription services offering seasonal blanket replacement or care packages are emerging as innovative business models that enhance recurring revenue and customer loyalty.

Product Type Insights

Turnout blankets are the dominant product category, capturing approximately 34% of the global market in 2024. Their all-weather versatility and protection against rain, wind, and temperature fluctuations make them indispensable for outdoor horses. Stable blankets follow as the second-largest segment, driven by indoor boarding stables and colder climates. Fly sheets and cooler blankets occupy niche positions but are gaining popularity due to increased awareness of insect protection and post-exercise care.

Material Insights

Polyester-based blankets lead the material segment, accounting for 41% of total market revenue in 2024. Their affordability, resilience, and ease of maintenance make polyester a preferred choice for both casual and professional horse owners. While wool and cotton blankets are valued for breathability and comfort, their higher cost and maintenance requirements limit widespread adoption. Recycled and blended synthetic materials are emerging as an eco-friendly alternative, especially in Europe and North America.

Size Insights

The Full-size category dominates, representing approximately 46% of total global demand in 2024. This is attributed to the large population of adult riding and sporting horses that require standard-sized blankets. Pony and cob sizes are gaining traction, particularly in youth riding programs and equine therapy applications, while miniature and custom sizes remain specialized segments with limited but stable demand.

Distribution Channel Insights

Online channels accounted for nearly 29% of global sales in 2024 and continue to expand rapidly. The proliferation of e-commerce and digital marketing has revolutionized the buying process for equestrian consumers, allowing them to access broader product assortments, reviews, and customization options. Specialty equestrian stores maintain significance in regions where hands-on fitting and consultation remain valued, but online convenience is increasingly dominant globally.

End-Use Insights

Racing horses constitute the largest end-use category, holding around 37% of market share in 2024. Professional stables and race clubs demand multiple, high-quality blankets per horse, emphasizing durability, thermal regulation, and performance. However, the leisure horse segment is expected to record the highest growth rate through 2030, driven by increasing recreational riding and equine therapy participation. Working horses, although representing a smaller portion of demand, maintain consistent blanket usage due to exposure to outdoor elements.

| By Product Type | By Material | By Size | By End-Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America dominates the global horse blanket market with a 38% share in 2024. The U.S. leads the region, supported by widespread equestrian participation, a mature stable infrastructure, and high consumer spending on premium equine products. Canada also contributes significantly, with a strong demand for winter and stable blankets due to its colder climate. The region’s well-established retail networks and growing e-commerce channels further strengthen its market leadership.

Europe

Europe holds approximately 28–30% of the global market share, with the U.K., Germany, and France being the major contributors. The region benefits from a rich equestrian tradition and high adoption of technical and eco-friendly blankets. Demand is driven by professional equestrian centers and recreational horse owners alike. Sustainability initiatives and strict textile regulations (e.g., REACH) are encouraging local manufacturers to adopt greener production methods.

Asia-Pacific

Asia-Pacific is the fastest-growing region, projected to expand at a 7.2% CAGR during 2025–2030. Rising middle-class affluence, growing interest in horse sports, and government investments in equestrian infrastructure are key factors. China, India, Japan, and Australia are leading markets, with increasing imports of premium horse care products. Local manufacturing in India and China is gradually improving price competitiveness and accessibility across the region.

Latin America

Latin America represents around 8–10% of global sales in 2024. Growth is supported by emerging equestrian activities in Brazil, Argentina, and Mexico. These countries are witnessing an increase in leisure horse ownership and interest in competitive sports such as show jumping. While the region’s market base is smaller, rising disposable incomes and better access to imported products are fostering healthy growth prospects.

Middle East & Africa

The Middle East & Africa region accounts for 6–8% of the 2024 global market. The UAE, Saudi Arabia, and South Africa are key growth hubs due to luxury equestrian culture and significant horse ownership among high-income populations. Regional demand focuses heavily on high-end, custom-fit blankets suited to arid and variable climates. Government support for horse racing and equestrian events continues to enhance market visibility and investment potential.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Horse Blanket Market

- Horseware Ireland

- WeatherBeeta

- Bucas

- Shires Equestrian Products

- Kensington Protective Products

- Derby House

- Pessoa

- Back on Track

- Horze

- Tough-1

- Premier Equine

- Rhino Blankets

- Schneiders Saddlery

- Amigo (brand under Horseware)

- Rambo (brand under Horseware)

Recent Developments

- In June 2025, Horseware Ireland launched an eco-friendly turnout blanket line using 100% recycled polyester fabrics, aiming to reduce environmental impact and appeal to sustainability-conscious customers.

- In April 2025, WeatherBeeta expanded its digital customization platform, allowing users to design color schemes and personalized embroidery directly through its e-commerce site.

- In February 2025, Shires Equestrian introduced a lightweight, antimicrobial stable blanket series with enhanced moisture-wicking technology for year-round comfort.