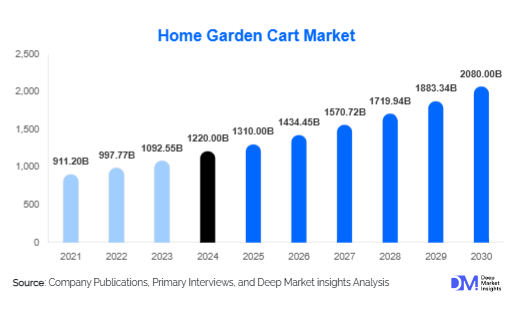

Home Garden Cart Market Size

The global home garden cart market size was valued at USD 1,220 million in 2024 and is projected to grow from USD 1,310 million in 2025 to reach USD 2,080 million by 2030, expanding at a CAGR of 9.5% during the forecast period (2025-2030). The growth of the home garden cart market is primarily driven by rising urban gardening trends, increased consumer focus on home landscaping, and innovations in ergonomic and multipurpose garden carts that enhance convenience and sustainability for residential users.

Key Market Insights

- Home gardening is increasingly becoming a lifestyle choice, with consumers seeking efficient tools such as garden carts for planting, maintenance, and transportation of gardening materials.

- Material innovation, including lightweight metals, durable plastics, and foldable designs, is boosting product adoption by enhancing portability and ease of use.

- North America dominates the home garden cart market, led by the U.S. and Canada, where high disposable income and an extensive DIY gardening culture drive demand.

- Europe is emerging as the fastest-growing region, fueled by eco-conscious consumers adopting organic gardening practices and sustainable landscaping solutions.

- Asia-Pacific is witnessing rapid adoption due to rising urban green initiatives, increasing middle-class disposable income, and the expansion of organized home improvement retail chains.

- Technological integration, including smart carts with modular attachments and ergonomic designs, is enhancing user convenience and expanding product applications.

What are the latest trends in the home garden cart market?

Shift Toward Multipurpose and Ergonomic Designs

Manufacturers are increasingly developing garden carts that serve multiple purposes, such as tool storage, compost transportation, and planting assistance. Ergonomic handles, lightweight wheels, and collapsible frames are being widely adopted to improve usability for all age groups, particularly elderly gardeners. These innovations are enhancing user convenience, reducing physical strain, and promoting longer usage durations, driving market adoption globally.

Sustainable and Eco-Friendly Materials

There is a growing preference for home garden carts made from recycled plastics, aluminum, and other sustainable materials. Eco-conscious consumers are demanding products that align with environmental sustainability, prompting manufacturers to integrate recyclable and long-lasting components. Solar-powered carts with motorized assistance for large gardens are also emerging as niche innovations, blending sustainability with functionality and appealing to premium consumers.

What are the key drivers in the home garden cart market?

Rising Home Gardening Adoption

The increasing popularity of home gardening, fueled by urban green space initiatives and DIY landscaping trends, has significantly driven demand for garden tools, including carts. Consumers are investing in ergonomic and durable products to simplify routine gardening tasks. Seasonal planting campaigns, rooftop gardens, and backyard vegetable cultivation are also expanding usage across urban and suburban households, especially in North America and Europe.

Growth of E-Commerce and Organized Retail

E-commerce platforms and organized retail chains have made home garden carts easily accessible to a wider audience. Online marketplaces provide detailed product comparisons, customer reviews, and direct delivery, making garden carts more convenient to purchase. Organized retail stores are offering specialized gardening sections, bundling carts with complementary products such as watering systems and garden tools, further boosting adoption.

Innovation in Lightweight and Foldable Designs

Advancements in lightweight alloys, corrosion-resistant metals, and foldable designs have improved mobility and storage convenience. These features are particularly appealing to urban gardeners with limited space. Multipurpose attachments for transporting soil, tools, or plants are also increasingly integrated, supporting high utility and versatility. Such innovations have fueled premium product adoption, especially in Europe and the Asia-Pacific.

Restraints

High Product Cost for Premium Models

While standard carts remain affordable, premium and technologically advanced models with motorized assistance, ergonomic designs, or sustainable materials are priced significantly higher. This limits adoption among price-sensitive consumers in emerging markets. Retailers face challenges in balancing affordability and feature-rich products to address diverse consumer segments.

Supply Chain and Raw Material Volatility

Fluctuations in raw material costs, particularly metals and plastics, affect manufacturing expenses and pricing strategies. Supply chain disruptions, including transportation delays and import restrictions, can impact timely product availability, slowing market expansion in certain regions.

What are the key opportunities in the home garden cart market?

Integration of Smart and Automated Features

Opportunities exist to integrate smart features, such as motorized movement, modular attachments, or IoT-based garden management systems. Smart carts can assist in weight distribution, soil transportation, or automated watering, catering to tech-savvy consumers. Adoption of connected garden carts could create premium product segments, particularly in North America, Europe, and parts of the Asia-Pacific.

Expansion in Emerging Urban Centers

Rapid urbanization in Asia-Pacific and Latin America is increasing demand for home gardening solutions, including compact garden carts suitable for rooftop or balcony gardening. Governments promoting urban green initiatives and sustainable living further boost potential for market growth. New entrants can capitalize on rising awareness of indoor and small-space gardening trends to capture untapped demand.

Eco-Friendly Product Launches

Consumers are increasingly seeking garden carts manufactured using recycled materials, biodegradable components, or energy-efficient motorized systems. Companies focusing on sustainable innovations can differentiate themselves and build brand loyalty among environmentally conscious buyers. Public incentives for sustainable home improvements in regions such as Europe and North America amplify the market opportunity.

Product Type Insights

Plastic garden carts dominate the market, capturing approximately 42% of global market share in 2024 due to affordability, durability, and resistance to rust. Steel carts, accounting for 35%, are preferred for heavy-duty use in large gardens and commercial landscaping. Aluminum and foldable variants, representing 23%, are increasingly popular in urban settings for portability and ease of storage. Market trends indicate a shift toward lightweight, multipurpose designs across all product types, driving overall growth.

Application Insights

Residential gardening remains the primary application, accounting for over 60% of market demand in 2024. Commercial landscaping and horticulture applications contribute around 25%, primarily driven by maintenance of public parks, resorts, and golf courses. Specialty applications such as urban rooftop gardening, indoor plant management, and community gardens represent the remaining 15%, emerging as fast-growing niches due to space constraints and lifestyle changes in urban centers.

Distribution Channel Insights

Online sales dominate with approximately 48% of the market share, driven by e-commerce platforms offering doorstep delivery and product comparison tools. Retail chains and garden specialty stores account for 35%, providing hands-on product experience. Direct-to-consumer sales through company websites contribute 17%, focusing on premium and customized offerings. Social media marketing and influencer partnerships are increasingly shaping purchasing behavior, particularly among younger urban consumers.

End-Use Insights

Homeowners and gardening enthusiasts represent the largest end-use segment, with growing demand for DIY gardening solutions and urban green spaces. Commercial landscaping companies are expanding their use of heavy-duty carts for maintenance operations. Emerging demand is observed in hospitality and recreational facilities, including resorts and golf courses, which require specialized garden carts for operational efficiency. Export-driven demand is rising from Europe and North America, supporting global revenue growth.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for 35% of the global home garden cart market in 2024, with strong demand from the U.S. and Canada. High disposable income, urban gardening popularity, and DIY landscaping culture are key growth drivers. Premium and smart garden carts are particularly popular among affluent homeowners.

Europe

Europe represents 28% of market share, led by Germany, France, and the U.K. Demand is driven by eco-conscious consumers, urban green initiatives, and government incentives promoting sustainable gardening. Foldable and lightweight carts are increasingly adopted in urban areas with space constraints.

Asia-Pacific

Asia-Pacific is the fastest-growing region, fueled by rising middle-class disposable income, urban green space projects, and increased DIY gardening awareness in China, India, Japan, and Australia. Compact and multipurpose garden carts are particularly popular in urban centers with limited garden space.

Latin America

Brazil, Argentina, and Mexico are witnessing growing demand for home gardening tools, though overall adoption of garden carts remains modest. Rising awareness of sustainable landscaping and urban gardening is driving incremental growth.

Middle East & Africa

South Africa, the UAE, and Saudi Arabia are key markets, supported by urban development projects and residential landscaping initiatives. Adoption is slower compared to North America and Europe, but is expected to increase with growing disposable income and lifestyle gardening trends.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Home Garden Cart Market

- Fiskars

- Aluminium Garden Products Ltd.

- Garant

- Gorilla Carts

- Polar Trailer Products

- True Temper

- Agri-Fab

- AMES Companies

- Bulldog

- Craftsman

- Troy-Bilt

- WORX

- Stanley Outdoor

- Lifetime Products

- Field King

Recent Developments

- In March 2025, Fiskars launched a line of lightweight, foldable garden carts with ergonomic handles and modular attachments, targeting urban gardeners in Europe and North America.

- In January 2025, Gorilla Carts expanded its e-commerce operations globally, enabling direct sales of premium and motorized garden carts to consumers in Asia-Pacific and Latin America.

- In December 2024, Agri-Fab introduced eco-friendly garden carts made from recycled plastics, focusing on sustainability-driven consumers in North America and Europe.