High Heels Market Size

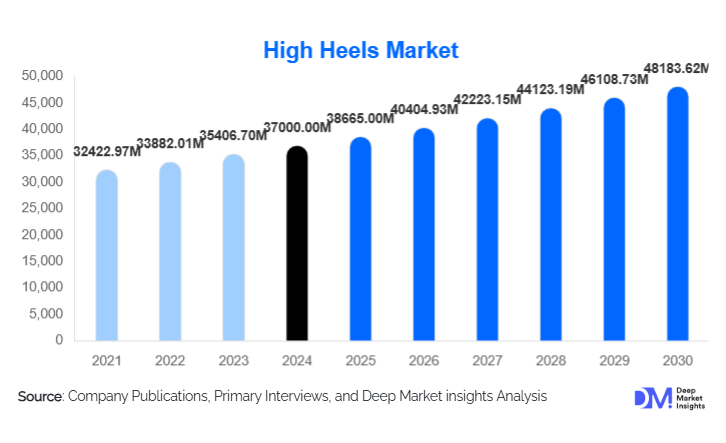

According to Deep Market Insights, the global high heels market size was valued at USD 37,000.00 million in 2024 and is projected to grow from USD 38,665.00 million in 2025 to reach USD 48,183.62 million by 2030, expanding at a CAGR of 4.50% during the forecast period (2025–2030). The high heels market growth is primarily driven by increasing fashion consciousness, rising disposable incomes in emerging markets, expansion of e-commerce and omnichannel retail, and growing demand for comfort-enhanced and designer footwear.

Key Market Insights

- Stilettos and luxury high heels dominate the market, catering to consumers seeking style, prestige, and formal occasion wear.

- Asia-Pacific is the fastest-growing region, led by China and India, fueled by rising female workforce participation and increasing urbanization.

- Offline specialty retail remains the leading distribution channel, though online channels are rapidly expanding due to convenience, wider choices, and e-commerce penetration.

- Consumer preference is shifting toward comfort and sustainability, creating demand for ergonomic, eco-friendly materials and innovative high-heel designs.

- Emerging markets offer significant expansion potential, particularly in bridal and occasion wear segments where high pricing and volume converge.

- Technological integration, including 3D foot scanning, smart insoles, and modular heels, is reshaping consumer experience and product offerings.

What are the latest trends in the high heels market?

Comfort and Ergonomic Designs

Brands are increasingly integrating comfort technologies into high heels, including memory foam insoles, shock-absorbing soles, and adjustable heel heights. This trend is particularly appealing to working professionals and frequent wearers who seek style without compromising on foot health. Many luxury brands now combine ergonomic features with designer aesthetics, ensuring that heels remain both fashionable and wearable. Innovations such as lightweight materials, anti-slip platforms, and arch-support systems are also driving product differentiation, catering to a broader consumer base beyond occasional wearers.

Sustainable and Eco-Friendly Materials

Consumer awareness of environmental and ethical production practices is pushing brands toward vegan leathers, recycled synthetics, and low-impact manufacturing methods. High heels made from sustainable materials appeal to younger demographics and premium buyers, especially in Europe and North America. Several companies are implementing transparent supply chains and eco-certifications, which not only enhance brand image but also allow them to command higher price points. This trend is expected to accelerate as governments and consumers increasingly favor sustainable fashion products.

What are the key drivers in the high heels market?

Rising Fashion Consciousness and Social Media Influence

The proliferation of social media and fashion influencers has significantly influenced high heels. Platforms such as Instagram and TikTok drive trends in design, color, and styling, increasing consumer willingness to invest in new products. Designer collaborations and celebrity endorsements further boost demand for premium and luxury heels, especially among millennials and Gen Z consumers. This trend has led brands to continuously innovate and release seasonal collections that align with online fashion trends.

Growth of E-Commerce and Omnichannel Retail

The increasing penetration of online retail has transformed high heels. Consumers can now access global brands from anywhere, benefiting from virtual try-ons, reviews, and easy returns. Omnichannel strategies, combining offline experience with online convenience, enable brands to reach both urban and semi-urban consumers. Rapid growth in mobile commerce and social media shopping also supports impulse purchases, particularly for mid-range and luxury heels.

Urbanization and Rising Female Workforce Participation

As urbanization accelerates and more women join the workforce globally, demand for professional and formal high heels is increasing. Office wear heels, mid-range and premium heels for daily work, and social occasions are gaining traction. In addition, events, weddings, and nightlife in emerging markets are driving occasion wear demand, particularly in India, China, and the Middle East.

What are the restraints for the global market?

Comfort and Health Concerns

High heels are often associated with foot fatigue, posture issues, and musculoskeletal strain. Growing awareness of ergonomic health has led many consumers to opt for low heels or flats, particularly for daily wear. This trend limits growth in extremely high or thin heel categories and challenges brands to balance style with comfort innovation.

Raw Material Costs and Supply Chain Challenges

Price fluctuations in leather, synthetic materials, and labor costs impact production expenses. Global supply chain disruptions, tariffs, and logistical delays can affect availability and pricing, reducing market responsiveness. Manufacturers must navigate these challenges while maintaining quality, sustainability, and competitive pricing.

What are the key opportunities in the high heels market?

Integration of Smart and Comfortable Designs

High heels incorporating ergonomic features, smart insoles, and modular heel designs represent a major growth opportunity. Brands that combine fashion with comfort and health-oriented features can capture a wider demographic, including daily wear professionals and frequent event-goers. Technology adoption, such as 3D foot scanning for custom fits, also enables personalized solutions, enhancing brand loyalty and repeat purchases.

Expansion in Emerging Markets

Rising disposable income and urbanization in Asia-Pacific and Latin America present significant opportunities for high heel manufacturers. Demand is particularly strong in bridal and occasion wear markets, as well as professional and corporate segments. Localization of design, pricing strategies, and e-commerce penetration can help brands capitalize on these high-growth regions.

Sustainable and Ethical Footwear Segment

Consumer interest in eco-friendly and ethical products is creating a niche for high heels made from sustainable materials. Brands that adopt vegan leathers, recycled synthetics, and transparent supply chains can differentiate themselves while attracting premium customers. Regulatory incentives and increasing consumer awareness about sustainability further reinforce this opportunity.

Product Type Insights

Stilettos lead the market in value and popularity, particularly for luxury and formal occasions, accounting for 32–35% of the global market in 2024. Pumps and wedges follow as mid-range options with higher comfort levels. Luxury high heels dominate revenue share due to high pricing and brand appeal, while mid-tier and economical categories are gaining traction in emerging markets. Designers are innovating with hybrid styles, including block heels and platforms, to cater to changing consumer preferences and comfort demands.

Application Insights

Formal and evening wear remains the largest application segment (40–45% share), driven by weddings, events, and corporate functions. Daily wear and office heels are growing rapidly, particularly in urban and professional segments. Bridal and special-occasion heels command premium pricing and are high-volume drivers in markets such as India and China. Casual and lifestyle applications, including platform and block heels, are also expanding among younger demographics seeking comfort with style.

Distribution Channel Insights

Offline specialty retail dominates (60–70% of sales), providing consumers with a fitting and tactile experience. E-commerce is the fastest-growing channel, offering convenience, global brand access, and digital try-on capabilities. Department stores, brand boutiques, and online marketplaces support omnichannel strategies. Direct-to-consumer websites, social media-driven sales, and subscription models are emerging as key engagement channels.

Traveler Type Insights

End-user demographics primarily include professional women, event-goers, and fashion-conscious consumers aged 25–45. Office and casual wear segments drive frequent purchases, while luxury and bridal heels cater to high-value, occasional buyers. Younger consumers (18–30 years) favor mid-range and comfort-oriented heels, often influenced by social media trends, while older demographics prioritize fit, durability, and designer appeal.

| By Product Type | By Material | By Distribution Channel | By Application / End Use | By Pricing Tier |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for 30% of the global high heels market in 2024, led by the U.S. Strong brand presence, high disposable income, and fashion-conscious consumers sustain demand. Luxury, designer, and occasion heels dominate, with e-commerce growth supporting mid-range sales.

Europe

Europe contributes 25–30% of the market, with key countries including the UK, France, Italy, and Germany. Mature markets focus on premium, designer, and sustainable products. Consumer preference for ethical and high-quality materials is driving innovation in both luxury and mid-tier segments. Growth is moderate but value-driven.

Asia-Pacific

Asia-Pacific is the fastest-growing region (20–25%), led by China and India. Rising urbanization, growing female workforce, and increasing disposable incomes are driving both professional and bridal heels demand. E-commerce penetration accelerates market expansion. Japan and South Korea remain mature but steady-growth markets.

Latin America

Latin America (5–8%) is emerging, with Brazil, Mexico, and Argentina showing rising interest in mid-range and premium heels. Affluent consumers increasingly purchase for social events and fashion purposes, with e-commerce enabling wider access.

Middle East & Africa

Middle East and Africa (5–8%) benefit from luxury demand in GCC countries and established local markets. Dubai, UAE, Saudi Arabia, and South Africa are key hubs for luxury heels. Growing urban middle-class segments also drive mid-tier sales, while Africa provides regional production and export opportunities.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the High Heels Market

- Kering Group

- Salvatore Ferragamo S.p.A.

- Steve Madden Ltd.

- Clarks International Ltd

- Belle International Holdings Ltd

- Red Dragonfly Footwear Co., Ltd

- Nine West Holdings, Inc.

- Manolo Blahnik International S.A.

- Geox S.p.A.

- Daphne International Holdings Ltd

- Kawano Shoes Co., Ltd

- DIANA Co., Ltd

- ECCO Sko A/S

- Stuart Weitzman LLC

- Jimmy Choo Ltd

Recent Developments

- In May 2025, Steve Madden launched a new eco-friendly high-heel collection featuring recycled synthetics and ergonomic cushioning to enhance comfort without compromising style.

- In April 2025, Kering Group announced a collaboration between Gucci and a sustainable material innovator, introducing luxury heels with vegan leathers and a reduced carbon footprint.

- In February 2025, Salvatore Ferragamo introduced a modular heel line allowing consumers to adjust height, targeting both comfort and fashion-conscious buyers.