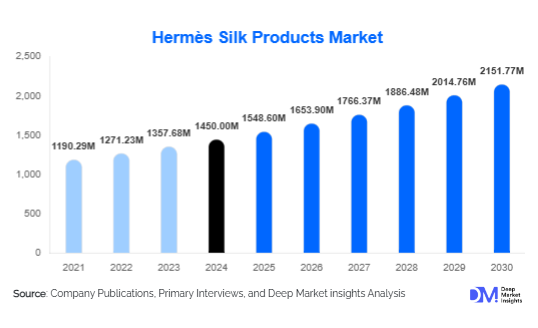

Hermès Silk Products Market Size

According to Deep Market Insights, the global Hermes Silk Products market size was valued at USD 1,450 million in 2024 and is projected to grow from USD 1,548.6 million in 2025 to reach USD 2,151.77 million by 2030, expanding at a CAGR of 6.8% during the forecast period (2025–2030). The market growth is primarily driven by rising global demand for luxury fashion accessories, increasing consumer preference for premium artisanal silk products, and the expansion of e-commerce channels, enhancing accessibility to Hermès silk collections worldwide.

Key Market Insights

- Luxury silk scarves and accessories are witnessing robust demand, driven by iconic Hermès designs, limited edition releases, and collaborations with renowned artists.

- Emerging markets in Asia-Pacific and Latin America present new growth opportunities as disposable incomes rise and the appetite for luxury goods expands.

- Sustainability and ethical sourcing are gaining importance, with consumers favoring eco-friendly production and responsible silk sourcing.

- Digital platforms and e-commerce adoption are reshaping purchase behavior, enabling personalized shopping experiences and broader global reach.

- Brand heritage and craftsmanship remain key differentiators, fostering high customer loyalty and premium pricing.

- Technological adoption in production ensures consistent quality, innovative designs, and protection against counterfeiting.

What are the latest trends in the Hermès silk products market?

Premium and Limited Edition Collections

Hermès continues to introduce limited edition silk scarves and accessories, which appeal to collectors and high-net-worth individuals. These exclusive collections drive both brand desirability and market value. Collaborations with contemporary artists and seasonal themed designs enhance the product’s uniqueness, creating strong repeat purchase behavior among luxury consumers.

Eco-Friendly and Sustainable Production

Growing consumer awareness of sustainability is influencing luxury markets. Hermès has incorporated eco-conscious production methods, including responsibly sourced silk and organic dyes. This trend is attracting environmentally conscious consumers while reinforcing the brand’s commitment to craftsmanship and ethical practices.

What are the key drivers in the Hermès silk products market?

Rising Global Affluence

Increasing high-net-worth populations, especially in Asia-Pacific and North America, are driving demand for luxury silk products. Hermès’ iconic silk scarves, shawls, and accessories cater to these affluent consumers seeking premium, timeless fashion statements.

Cultural Appreciation for Silk

Silk’s association with sophistication and elegance fuels sustained demand. In key markets like China, Japan, and Europe, silk accessories are culturally significant, contributing to strong sales growth.

Strong Brand Loyalty and Heritage

Hermès’ longstanding reputation for craftsmanship and premium quality ensures a loyal customer base, helping the brand maintain market leadership and command premium pricing in the luxury segment.

What are the restraints for the global market?

Economic Volatility

Global economic fluctuations may impact discretionary spending on luxury silk products. Reduced consumer confidence and slower economic growth can hinder sales of high-end Hermès products, particularly in emerging markets.

Counterfeit Products

The prevalence of counterfeit luxury goods threatens brand equity and consumer trust. Hermès must continue investing in anti-counterfeiting measures, product authentication, and intellectual property enforcement to mitigate this challenge.

What are the key opportunities in the Hermès silk products industry?

Expansion into Emerging Markets

Regions such as Asia-Pacific and Latin America present high growth potential due to rising disposable incomes and growing interest in luxury fashion. Hermès can expand flagship stores, enhance regional marketing, and offer localized exclusive collections to capture new consumers.

Sustainability-Driven Product Lines

There is increasing consumer demand for eco-conscious luxury products. Hermès can integrate environmentally friendly production practices, including sustainable silk sourcing, biodegradable packaging, and organic dye processes, appealing to environmentally aware consumers and enhancing brand perception.

Digital Transformation and E-commerce Growth

Hermès has a significant opportunity to leverage online channels for global outreach. Enhanced e-commerce platforms, AR-based virtual try-ons, and personalized online shopping experiences enable Hermès to tap into younger, tech-savvy demographics while expanding sales beyond physical boutiques.

Product Type Insights

Silk scarves dominate Hermès silk product sales, contributing over 50% of the market in 2024. The iconic Hermès carré remains highly sought after, with limited editions and seasonal designs reinforcing brand value. Other products, such as shawls and silk accessories, are gradually gaining popularity, driven by growing fashion trends and gifting demand.

Application Insights

Fashion and gifting are the primary applications driving demand. Luxury consumers seek Hermès silk scarves and shawls for personal use, while gifting remains a key revenue segment during festive seasons and special occasions. Emerging trends include corporate gifting and bespoke, personalized products, and expanding market opportunities.

Distribution Channel Insights

Hermès primarily sells through owned boutiques and official e-commerce platforms, ensuring control over brand experience. Online channels are increasingly important, complemented by high-end department stores in key regions. Social media marketing and influencer collaborations are also shaping purchase behavior, particularly among younger luxury consumers.

Traveler Type Insights

Not applicable for this market.

Age Group Insights

Consumers aged 31–50 years represent the largest share, combining high disposable income with fashion-conscious tendencies. Younger consumers (18–30 years) are adopting digital-first purchasing behaviors and are attracted to limited-edition collections, while older consumers (51+) remain loyal to heritage designs and premium quality.

| By Product | By Collection type | By Distribution |

|---|---|---|

|

|

|

Regional Insights

North America

The U.S. and Canada hold a substantial share of the Hermès silk products market, accounting for nearly 30% of global demand in 2024. High disposable income, strong brand awareness, and premium retail presence support robust sales.

Europe

Europe represents the second-largest market (~28% of global share), led by France, the U.K., and Germany. The brand’s heritage in France and cultural affinity for silk accessories drive demand, with sustainable and limited-edition collections being particularly popular.

Asia-Pacific

China, Japan, and India are rapidly growing markets, driven by rising luxury consumption and cultural preference for silk. China, in particular, is the fastest-growing region, supported by e-commerce penetration and aspirational consumer behavior.

Latin America

Brazil, Mexico, and Argentina are emerging markets for Hermès silk, with growth fueled by increasing affluent consumers and luxury brand penetration.

Middle East & Africa

The UAE, Saudi Arabia, and South Africa are key markets, with high disposable incomes and a preference for luxury fashion. Boutique expansions and exclusive collections are strengthening brand presence.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Hermès Silk Products Market

- Hermès

- Louis Vuitton

- Gucci

- Chanel

- Prada

- Fendi

- Dior

- Burberry

- Salvatore Ferragamo

- Versace

- Ermenegildo Zegna

- Valentino

- Alexander McQueen

- Givenchy

- Balenciaga

Recent Developments

- In January 2025, Hermès launched a limited-edition silk scarf collection celebrating contemporary art, increasing global consumer engagement.

- In March 2025, Hermès expanded its flagship boutique in Shanghai to cater to growing demand in the Asia-Pacific.

- In May 2025, Hermès introduced sustainable silk production practices, including organic dyes and ethically sourced silk, reinforcing the brand's reputation and eco-conscious appeal.