Gyro Cameras Market Size

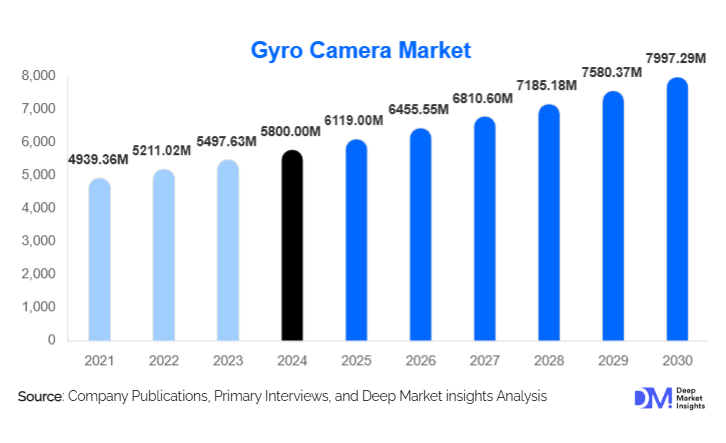

According to Deep Market Insights, the global gyro cameras market size was valued at USD 5,800 million in 2024 and is projected to grow to USD 6,119.00 million in 2025 and reach USD 7,997.29 million by 2030, expanding at a CAGR of 5.5% during the forecast period (2025–2030). Market growth is driven by rising drone adoption, increasing demand for stabilized video content, rapid expansion of industrial inspection applications, and advancements in MEMS and AI-driven stabilization technologies.

Key Market Insights

- Drone gyro cameras dominate the market, fueled by expanding consumer, commercial, and industrial UAV applications.

- Asia-Pacific leads global production and consumption, supported by strong electronics manufacturing ecosystems and rapid drone adoption.

- Content creation and social media trends continue to accelerate demand for compact, stabilized imaging systems.

- AI, MEMS, and sensor-fusion technologies are driving innovation across consumer and industrial-grade gyro cameras.

- Industrial inspection and infrastructure monitoring represent fast-growing application segments as enterprises adopt drones and autonomous systems.

- Defense and surveillance applications remain a high-value segment, requiring rugged, high-precision stabilization systems.

What are the latest trends in the gyro cameras market?

AI-Driven and Sensor-Fusion Stabilization

Manufacturers are rapidly integrating artificial intelligence and advanced sensor-fusion algorithms into gyro cameras to achieve ultra-smooth stabilization. AI models now predict motion patterns and compensate for vibrations before they occur, enabling highly stable footage in challenging environments. These systems are especially critical in drone-based inspection, aerial mapping, and defense applications. Predictive stabilization also supports low-light and high-speed video capture, enhancing image clarity in industrial and cinematic settings.

Integration With Autonomous and Drone Systems

Gyro cameras are becoming core components of autonomous robots and UAVs. They support real-time mapping, object detection, and infrastructure inspection workflows. The trend is being accelerated by utility companies, logistics providers, and government agencies that increasingly deploy drones equipped with gyro-stabilized cameras for power line monitoring, pipeline surveys, environmental mapping, and security patrols. Lightweight gimbal designs and improved power efficiency are expanding use cases across commercial and industrial automation systems.

What are the key drivers in the gyro cameras market?

Growing Popularity of Content Creation & Social Media

Demand for high-quality stabilized video is soaring as creators, vloggers, live streamers, and adventure enthusiasts produce more professional-grade content. Platforms such as YouTube, TikTok, and Instagram have intensified the need for cinematic footage, driving sales of consumer-grade gyro cameras and action cameras equipped with advanced stabilization. Compact handheld gimbal systems and wearable gyro cameras have become essential tools for influencers and mobile creators.

Rising Industrial and Infrastructure Inspection Needs

Utilities, oil & gas companies, and construction firms are increasingly adopting drone-based gyro camera systems to inspect critical infrastructure. These cameras enable high-resolution, vibration-free imaging of pipelines, bridges, transmission lines, and rail networks. As industrial safety standards tighten globally, organizations are investing in stabilized imaging to reduce operational risk, minimize downtime, and lower inspection costs. This is one of the fastest-growing drivers of the gyro cameras market.

What are the restraints for the global market?

Competition From Advanced Smartphone Stabilization

High-end smartphones now offer robust optical (OIS) and electronic (EIS) stabilization features that satisfy casual users, reducing the need for entry-level gyro cameras. As mobile imaging systems improve, consumers may opt for smartphones instead of purchasing standalone stabilized cameras, impacting adoption at the lower end of the market. This trend puts pressure on manufacturers to innovate with premium features to defend market share.

High Manufacturing and Integration Costs

Professional-grade gyro cameras require precise motors, gimbals, MEMS sensors, and complex calibration software, resulting in elevated production costs. Industrial and defense systems are even more expensive due to rugged design requirements and specialized components. These costs can deter small enterprises and restrict adoption among price-sensitive customers. Additionally, integration with drones, robotics, and autonomous systems requires specialized engineering, further raising deployment expenses.

What are the key opportunities in the gyro cameras industry?

Expansion in Public Safety & Smart Infrastructure Projects

Governments worldwide are investing in smart cities, public safety modernization, and automated infrastructure monitoring. Gyro cameras can play a critical role in traffic surveillance, urban infrastructure assessment, and emergency response. High-stability imaging enhances situational awareness for agencies managing natural disasters, law enforcement, and border security. Manufacturers that partner with government bodies and technology integrators can capture significant value in this emerging sector.

Creator-Focused, Portable Professional Gyro Cameras

The explosive growth of the creator economy presents a major opportunity for gyro camera manufacturers. Compact, portable, AI-enhanced stabilized cameras tailored for influencers, travelers, and adventure users are in high demand. Companies can differentiate by offering cloud-based workflows, smartphone connectivity, automated editing features, and modular accessories. This segment offers strong long-term potential as content creation continues to globalize.

Product Type Insights

Drone gyro cameras represent the largest product segment, driven by extensive deployment in filmmaking, aerial photography, and industrial inspection. Their dominance is supported by rapid advances in lightweight gimbals and MEMS-based stabilization. Regular gyro cameras, including handheld stabilizers and fixed-rig systems, maintain a strong presence in cinematography, broadcasting, and professional video production. These systems are widely used in sports shooting, documentaries, and fast-motion environments. Hybrid and AI-enhanced models are gaining traction for commercial and industrial applications requiring precision imaging.

Application Insights

Media & entertainment remains the leading application segment, driven by high-quality film production, sports broadcasting, and influencer content creation. Security and surveillance applications are expanding as gyro cameras support border monitoring, maritime surveillance, and tactical defense operations. Industrial inspection is the fastest-growing segment as drones equipped with stabilized cameras replace manual inspections for utilities and infrastructure assets. Aerospace & defense continues to demand rugged, high-accuracy gyro cameras for reconnaissance and mission-critical operations.

Distribution Channel Insights

Online distribution channels dominate the market as customers, especially creators and hobbyists, increasingly purchase gyro cameras through e-commerce platforms. Direct-to-consumer sales from manufacturers are rising due to improved digital storefronts and online product demos. Specialist distributors and industrial solution integrators remain key for defense, aerospace, and industrial inspection segments, where customized, high-value systems require technical consultation. Retail electronics stores continue to serve casual buyers, but their share is gradually declining due to digital migration.

End-User Insights

Consumer electronics users, including vloggers, travel enthusiasts, and hobbyists, represent a major share of total demand, driven by portable stabilized cameras and handheld gimbals. Industrial users such as energy, utilities, and construction companies increasingly deploy gyro cameras for inspection and asset monitoring. Defense and aerospace end users account for high-value demand, purchasing specialized gyro-stabilized systems for ISR missions. The automotive and robotics sectors are emerging end users as autonomous navigation and vehicle testing require high-fidelity stabilized imaging.

Age Group Insights

Consumers aged 18–35 drive much of the demand for consumer-grade gyro cameras, influenced by digital media consumption and social platforms. The 31–50 age group represents a substantial share of professional creators and early technology adopters purchasing mid- to high-end camera systems. Professionals aged 51–65 dominate industrial and technical applications, including engineering, surveying, and security. Across age brackets, rising digital literacy and the growth of online creator communities continue to expand demand.

| By Product Type | By Application | By End-Use Industry | By Distribution Channel | By Stabilization Technology |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for roughly one-third of global demand, supported by strong adoption of drones, advanced cinematography, and infrastructure monitoring technologies. The U.S. remains the largest market, driven by entertainment, security, and industrial sectors. Defense-grade gyro camera demand is particularly strong due to federal investment in ISR and autonomous systems.

Europe

Europe features mature demand for stabilized imaging, especially in Germany, the U.K., and France. The region benefits from strong industrial automation, high filmmaking activity, and strict safety compliance standards that encourage the use of high-quality inspection tools. EU regulations supporting safe drone integration also fuel long-term growth.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing region, led by China, Japan, and South Korea. China dominates manufacturing and global exports of drone-based gyro cameras, while Japan and South Korea lead innovations in robotics, automotive testing, and industrial automation. Rising consumer spending and social media usage are also driving creator-focused demand.

Latin America

Latin American demand is emerging steadily, with Brazil and Mexico leading adoption in industrial inspection, media production, and growing drone usage. Infrastructure development programs and expanding security investments are expected to further support market growth.

Middle East & Africa

The region is witnessing rising adoption of gyro-stabilized cameras in defense, border security, and large-scale infrastructure projects. Countries such as the UAE and Saudi Arabia are adopting drone-based inspection and surveillance systems, while African nations increasingly use stabilized imaging for wildlife monitoring, mapping, and national security.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Gyro Cameras Market

- DJI

- GoPro

- Gyro-Stabilized Systems (GSS)

- Parrot

- Yuneec

- Teledyne FLIR

- PrecisionHawk

Recent Developments

- In March 2025, DJI launched a next-generation lightweight AI-stabilized drone camera designed for industrial inspection and autonomous mapping.

- In January 2025, GoPro introduced a modular gyro-stabilized action camera aimed at creators requiring cinematic-quality mobile video.

- In late 2024, Teledyne FLIR announced upgrades to its defense-grade gyro-stabilized gimbal systems to support long-range ISR operations.