Gifts, Novelty, and Souvenirs Market Size

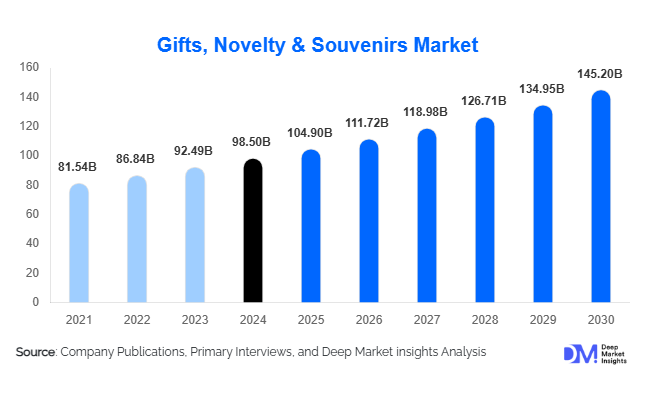

According to Deep Market Insights, the global gifts, novelty, and souvenirs market size was valued at USD 98.5 billion in 2024 and is projected to grow from USD 104.9 billion in 2025 to reach USD 145.2 billion by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The market growth is primarily driven by the rising popularity of personalized gifts, increasing tourism, expanding corporate gifting initiatives, and the proliferation of e-commerce platforms facilitating global access to customized and novelty items.

Key Market Insights

- Personalized and customized gifts are emerging as the most preferred choice among individual and corporate consumers, driving growth in high-value segments.

- Tourism-driven souvenirs continue to dominate the market, especially in culturally rich and heritage-heavy destinations across Europe and APAC.

- Online retail is rapidly expanding, with e-commerce platforms enabling global reach, convenient customization, and social commerce engagement.

- Corporate gifting is growing steadily, with organizations investing in branded, sustainable, and innovative products to strengthen client and employee relations.

- Technological adoption, including AI-based personalization, AR customization tools, and 3D printing, is transforming the gifting and souvenir experience globally.

- Sustainability trends, including eco-friendly and upcycled materials, are increasingly influencing consumer preferences and product innovation.

Latest Market Trends

Personalization and Novelty Driving Growth

Consumers are increasingly seeking unique, memorable, and personalized items. Products such as customized mugs, engraved plaques, nameplates, and 3D-printed souvenirs are seeing high demand. This trend is fueled by the millennial and Gen Z population, who prioritize individuality and exclusivity in gifting. Companies are integrating digital tools for customization, enabling real-time previews and seamless online ordering, further expanding market reach.

Integration of Technology in Gifting

Technological innovations, including augmented reality (AR) for product visualization, AI-driven design suggestions, and 3D printing for rapid prototyping, are reshaping consumer experiences. Digital platforms also support social commerce and influencer marketing, particularly appealing to younger consumers. Mobile applications and online marketplaces allow global access to high-quality gifts, expanding the market beyond regional limitations.

Gifts, Novelty, and Souvenirs Market Drivers

Rising Corporate Gifting Initiatives

Corporations increasingly leverage gifting to enhance brand loyalty, engage employees, and strengthen client relationships. High-value personalized items and sustainable gifts are gaining traction, creating premium market segments. Growing budgets for corporate incentives and promotional campaigns further propel demand in this sector, especially in North America and Europe.

Increasing Tourism and Hospitality Demand

Tourism continues to be a major driver of souvenirs, particularly in heritage-rich and culturally significant destinations. Emerging markets in APAC and the Middle East are experiencing high growth in tourism, leading to increased demand for regional crafts and destination-specific gifts. Government-backed tourism campaigns and experiential travel trends enhance souvenir consumption.

Growing Preference for Sustainable and Eco-Friendly Products

Consumers are showing increasing concern for environmental impact, driving demand for gifts made from recycled, biodegradable, or upcycled materials. Companies introducing eco-friendly products benefit from premium pricing and stronger brand loyalty. Sustainability also aligns with corporate social responsibility trends, making green gifts increasingly popular.

Market Restraints

High Competition and Price Sensitivity

The market faces intense competition from low-cost manufacturers, particularly in APAC. Price-sensitive consumers often opt for affordable mass-market items, limiting growth for premium and niche products. Maintaining profitability while ensuring quality remains a key challenge for market participants.

Raw Material Volatility

Fluctuations in prices of metals, ceramics, textiles, and wood impact production costs, especially for high-end and eco-friendly products. Supply chain disruptions and logistics challenges, particularly for international souvenir exports, can also hinder growth.

Gifts, Novelty, and Souvenirs Market Opportunities

Expansion in Corporate and Promotional Gifting

Organizations are increasingly investing in premium and personalized gifts for clients, employees, and stakeholders. Demand for sustainable and technologically enhanced products provides opportunities for innovation. Companies can differentiate through AI-driven customization, smart gifting solutions, and limited-edition product lines.

Tourism and Experiential Souvenir Growth

Tourism remains a major avenue for market expansion, particularly in APAC and Europe. Localized crafts, heritage-inspired items, and destination-specific souvenirs allow manufacturers to capitalize on experiential tourism trends. Partnerships with hospitality chains and tourist attractions further strengthen market penetration.

Technological Innovation and Online Retail Expansion

Integration of AR, 3D printing, and AI-enabled personalization is creating new avenues for consumer engagement. Online marketplaces and social commerce platforms allow smaller manufacturers and new entrants to reach global audiences efficiently. Technology adoption enhances user experience, increasing demand for high-quality, customizable gifts.

Product Type Insights

Personalized gifts lead globally with a 35% market share in 2024, driven by increasing consumer preference for bespoke items. Novelty items and corporate gifts are also significant, capturing 28% and 20% of the market, respectively. Traditional and seasonal gifts account for the remaining 17%, catering primarily to local and festival-based demand.

Material Insights

Textile-based gifts hold the largest share at 28%, including customized apparel, bags, and home textiles. Wood, metal, and ceramic gifts follow, driven by demand for heritage crafts and premium souvenirs. Plastic/resin-based items are popular for mass-market novelty products.

Distribution Channel Insights

Online retail accounts for 32% of market share, benefiting from digital customization tools, global access, and convenience. Offline retail, including specialty stores and souvenir shops, remains significant, particularly in tourist-heavy regions. Corporate and B2B channels account for 25% of market share, driven by bulk orders and promotional gifting programs.

End-Use Insights

The tourism and hospitality segment dominates with 40% of market share, fueled by souvenir purchases from domestic and international travelers. Corporate gifting is growing rapidly, contributing 28%, with new applications in tech-enhanced and eco-friendly products. Individual consumers and event management segments represent 20% and 12%, respectively, with emerging demand from social gifting platforms and digital engagement.

| By Product Type | By Material Type | By Distribution Channel | By End-Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for 22% of the market, driven by a strong corporate gifting culture and high adoption of online retail. The U.S. leads demand, followed by Canada. Growth is supported by rising consumer spending and technology adoption for personalized gifts.

Europe

Europe holds the largest regional share at 29%, with the UK, Germany, and France leading. Mature tourism, gifting traditions, and high disposable income support strong market demand. Sustainability-focused gifting is particularly prominent in these markets.

Asia-Pacific

APAC is the fastest-growing region, with a CAGR of 7.8%, led by China, India, Japan, and Southeast Asia. Rising tourism, growing middle-class income, and expanding e-commerce adoption drive market growth.

Latin America

Brazil and Argentina are key contributors. While the market is smaller, increasing outbound travel and interest in novelty gifts are supporting growth.

Middle East & Africa

The UAE, Saudi Arabia, and South Africa are major markets. Luxury gifting culture, tourism, and high disposable income drive regional demand. Intra-regional souvenir trade is also expanding.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Gifts, Novelty, and Souvenirs Market

- Hallmark Cards

- American Greetings

- Swarovski

- Paperchase

- Dartington Crystal

- Steiff

- Godiva Chocolatier

- Lenox

- Oriental Trading Company

- Villeroy & Boch

- Fortnum & Mason

- Faber-Castell

- Kate Spade Gifts

- Moleskine

- Hallmark Licensing Group

Recent Developments

- In March 2025, Hallmark Cards launched a digital platform for AI-driven personalized gifts, enhancing consumer customization capabilities.

- In January 2025, Swarovski expanded its souvenir and novelty collection, targeting tourism-heavy regions in Europe and APAC, incorporating sustainable crystal production methods.

- In February 2025, American Greetings introduced eco-friendly corporate gifting solutions, leveraging recycled materials and digital customization tools for B2B clients.