Gaming as a Service Market Size

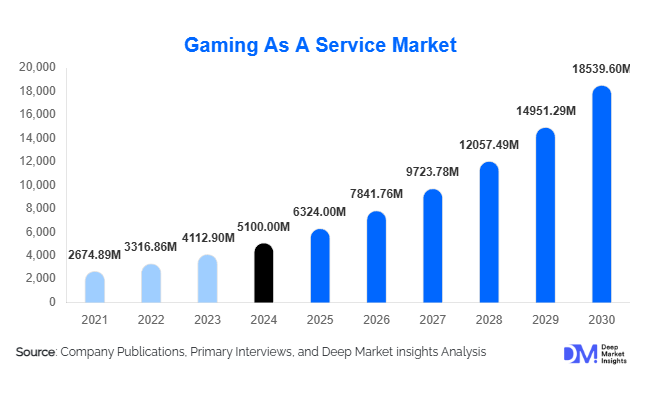

According to Deep Market Insights, the global gaming as a service market size was valued at USD 5,100 million in 2024 and is projected to grow from USD 6,324.0 million in 2025 to reach USD 18,539.6 million by 2030, expanding at a CAGR of 24.0% during the forecast period (2025–2030). This rapid expansion is driven by the gaming industry’s ongoing shift from one-time purchases to subscription-based and live-service models, the growth of cloud gaming infrastructure, and the proliferation of high-speed mobile internet across emerging markets.

Key Market Insights

- The global gaming industry is transitioning toward service-based revenue models, where continuous content updates, live events, and microtransactions are central to monetization.

- Cloud and streaming platforms are democratizing gaming access, allowing players to enjoy AAA titles without expensive hardware investments.

- Asia-Pacific dominates the GaaS market, driven by large mobile gamer populations in China, Japan, and India.

- North America remains a mature market with strong adoption of subscription services like Xbox Game Pass and PlayStation Plus.

- Emerging markets in Latin America and the Middle East & Africa are expected to witness double-digit growth due to expanding broadband and 5G infrastructure.

- Technological adoption, including AI-driven personalization, cross-platform play, and edge computing, is redefining user experiences and engagement models.

What are the latest trends in the Gaming as a Service Market?

Rise of Cloud and Streaming Platforms

Cloud gaming has become the backbone of GaaS, allowing gamers to stream high-quality titles on any device without dedicated hardware. The integration of 5G and edge computing enables low-latency gameplay, enhancing accessibility in emerging markets. Leading companies such as Microsoft, NVIDIA, and Sony are expanding cloud infrastructure to deliver scalable, subscription-based gaming. This trend is democratizing gaming access and opening new revenue streams through cross-device experiences and flexible subscription tiers.

Monetization through Live Services and Microtransactions

Microtransactions, battle passes, and downloadable content (DLC) now account for more than one-third of total GaaS revenue. Developers are designing long-term engagement loops, seasons, limited events, and virtual goods that sustain player retention and lifetime value. As free-to-play models mature, publishers are optimizing monetization strategies to maintain a balance between user experience and revenue generation. The trend also promotes deeper community involvement and regular content refresh cycles that extend a game’s lifespan.

What are the key drivers in the Gaming as a Service Market?

Growth of Mobile and Connected Devices

The ubiquity of smartphones and affordable data plans has expanded the global gaming audience exponentially. Mobile platforms now represent one of the fastest-growing GaaS delivery modes, with cloud integration enabling console-quality experiences on handheld devices. This device democratization fuels subscription and in-game purchase growth across all regions.

Shift to Recurring Revenue Models

Publishers are prioritizing sustainable monetization strategies over single-purchase sales. Subscription and live-service frameworks generate consistent cash flows and improve player retention. This shift is transforming game design itself, focusing on long-term community engagement and incremental content delivery rather than static releases.

Advances in Cloud and Edge Infrastructure

Improved broadband penetration and deployment of regional data centers are eliminating latency bottlenecks. Cloud-native gaming platforms empower developers to reach new markets without hardware barriers. The rollout of 5G networks and dedicated edge servers further enhances real-time responsiveness, crucial for multiplayer and competitive gaming.

What are the restraints for the global market?

Infrastructure Gaps and Latency Issues

Despite progress, many emerging economies still face inconsistent connectivity and high latency, which hinder smooth cloud gaming experiences. Limited local data centers in certain regions increase operational costs and restrict service reliability.

Subscription Fatigue and Monetization Backlash

With the proliferation of subscription services across media and entertainment, gamers are showing signs of subscription fatigue. Furthermore, over-reliance on microtransactions has occasionally led to consumer dissatisfaction and regulatory scrutiny, particularly in regions enforcing stricter digital purchase guidelines.

What are the key opportunities in the Gaming as a Service Industry?

Expansion into Emerging Markets through Cloud Infrastructure

The global expansion of 5G and cloud technology presents enormous potential for GaaS adoption in markets like India, Brazil, and the Middle East. These regions, previously constrained by hardware costs, can now access high-quality gaming experiences via streaming platforms, unlocking vast untapped user bases for service providers.

Gamification and Commercial Applications

Beyond consumer gaming, GaaS platforms are being deployed in education, fitness, and corporate training sectors. Enterprises use gamified environments to enhance employee engagement and skill development. eSports arenas and gaming cafés are also integrating subscription-based GaaS systems to diversify their offerings and attract recurring customers.

Integration of AI, Analytics, and Cross-Platform Ecosystems

Artificial intelligence is enhancing GaaS personalization through dynamic content recommendations, adaptive difficulty, and predictive retention analytics. Cross-platform ecosystems, where users can seamlessly transition between console, mobile, and PC, are becoming standard, fostering unified player identities and higher engagement metrics.

Platform Insights

PCs & Laptops accounted for approximately 36% of the global Gaming as a Service (GaaS) market in 2024, maintaining their dominance due to superior processing power, hardware customization, and immersive visual capabilities. This platform caters strongly to competitive and multiplayer gaming communities, supporting complex live-service titles such as MMORPGs, strategy games, and online shooters. The continued integration of cross-platform compatibility and cloud synchronization enhances the appeal of PC-based gaming ecosystems. Furthermore, the growing penetration of high-speed internet and affordable gaming hardware has expanded the player base across both mature and emerging markets. While mobile platforms are rapidly catching up, the PC ecosystem remains the benchmark for advanced game development and streaming fidelity, especially in regions with robust broadband penetration and established eSports infrastructure.

Revenue Model Insights

In-Game Purchases and Microtransactions dominated the market in 2024, contributing approximately 36% of total GaaS revenue. This segment’s success is underpinned by the widespread adoption of freemium models, which monetize user engagement rather than upfront sales. Developers increasingly rely on cosmetic skins, loot boxes, in-game currencies, and seasonal battle passes to sustain player interest and generate recurring income. These microtransactions have become integral to maintaining long-term user retention through personalization and continuous content refresh. Meanwhile, subscription-based models, exemplified by services like Xbox Game Pass, PlayStation Plus, and Apple Arcade, are growing steadily but still trail behind in sheer profitability. The scalability and flexibility of microtransactions, combined with predictive analytics and player segmentation, are enabling developers to optimize monetization while minimizing churn.

Game Genre Insights

Role-Playing and Massively Multiplayer Online (RPG/MMO) Games captured nearly 19% of total GaaS revenue in 2024, making them one of the most lucrative genres in the service-based model. These games thrive on community-driven gameplay, persistent online worlds, and dynamic narrative evolution, elements that align naturally with GaaS frameworks. Frequent content updates, character expansions, and real-time events encourage player loyalty and recurrent spending. Titles such as Final Fantasy XIV and World of Warcraft continue to illustrate the model’s scalability by combining subscription income with microtransaction ecosystems. The rise of social gaming and immersive world-building through AR/VR integrations is expected to further enhance the RPG/MMO segment’s appeal. As live operations and user analytics become central to retention, this genre will continue driving global revenue through sustained engagement and digital content cycles.

End-Use Insights

The individual consumer segment constituted the vast majority of global demand in 2024, fueled by the accessibility of online platforms, cross-device synchronization, and the appeal of multiplayer communities. The shift toward cloud-based access and subscription bundles has empowered individuals to experience premium titles without heavy hardware investment. Meanwhile, the commercial segment, including eSports arenas, gaming cafés, and entertainment hubs, is witnessing rapid growth, expanding at a double-digit CAGR through 2030. This surge is driven by rising institutional investments in eSports, local gaming tournaments, and the commercialization of social gaming spaces. Operators are adopting subscription-based or pay-per-use GaaS solutions to reduce upfront costs and enhance scalability. The emergence of dedicated gaming lounges and competitive gaming networks, especially in Asia and the Middle East, further supports commercial adoption trends.

| By Platform | By Revenue Model | By Game Genre | By End Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounted for approximately 23–25% of the global GaaS market in 2024, led by the United States, which remains a powerhouse for digital gaming ecosystems. The region’s strength lies in its advanced cloud infrastructure, high-speed broadband availability, and early adoption of subscription services such as Xbox Game Pass and PlayStation Plus. Continuous innovation in live-service models and integration with next-gen consoles further sustains the region’s growth. The U.S. market also benefits from a strong presence of leading developers and publishers, alongside rising investments in immersive technologies like AR and VR. Canada contributes notably through its vibrant gaming development hubs in Montreal and Vancouver, supported by favorable tax incentives and a highly skilled workforce. Looking ahead, the increasing convergence between entertainment streaming and gaming subscriptions, such as Netflix’s gaming initiatives, will drive further expansion across North America.

Europe

Europe contributed around 20–25% of global GaaS revenues in 2024, anchored by the U.K., Germany, and France. The region’s digital economy benefits from stringent data protection regulations, which foster consumer trust in online transactions. European gamers demonstrate a high preference for cross-platform play and flexible monetization options, including bundled game passes and cloud access. Growth is propelled by widespread broadband coverage, multilingual content adaptation, and strong console penetration. The European Commission’s focus on digital innovation and creative industries is also encouraging new startups to explore GaaS frameworks. The rise of eSports leagues and streaming partnerships across Western and Northern Europe is creating new engagement channels and boosting player monetization. Furthermore, countries such as Sweden and Finland, home to global studios like EA DICE and Supercell, continue to reinforce the region’s reputation as a creative and technical hub for live-service game development.

Asia-Pacific

Asia-Pacific dominated the global GaaS landscape with approximately 45% of total market share in 2024, positioning itself as the largest and fastest-growing regional segment. China, Japan, and India drive this momentum due to massive gaming populations, mobile-first consumption habits, and aggressive 5G rollouts. The proliferation of affordable smartphones and high-speed mobile internet has democratized access to cloud gaming and subscription services. China remains the epicenter of GaaS innovation, where publishers like Tencent and NetEase leverage extensive social ecosystems and AI-driven analytics to maximize engagement. Japan’s legacy gaming culture and integration of hybrid console-cloud gaming platforms also fuel growth, while India’s rapidly expanding middle class and digital payment adoption are opening vast new consumer segments. Regional governments are further supporting eSports and creative digital content industries, establishing Asia-Pacific as the global growth engine for GaaS expansion.

Latin America

Latin America represented approximately 5–10% of the global GaaS market in 2024, with Brazil, Mexico, and Argentina serving as the primary growth centers. The region’s expansion is propelled by rising smartphone adoption, growing youth demographics, and improved internet connectivity. Increasing localization of pricing and content, such as Portuguese and Spanish language integration, is enabling higher player conversion rates. Cloud infrastructure investments by major providers like Microsoft Azure and AWS are further enhancing game streaming quality and accessibility. Government support for digital entrepreneurship and eSports events, particularly in Brazil and Chile, is strengthening the local ecosystem. Although income disparities remain a challenge, flexible subscription tiers and ad-supported models are helping expand market reach among price-sensitive consumers.

Middle East & Africa

The Middle East & Africa accounted for around 5% of global GaaS revenue in 2024, but it stands out as one of the most rapidly developing regions in the forecast period. Countries such as the UAE, Saudi Arabia, and South Africa are investing heavily in national gaming strategies, aiming to position themselves as regional entertainment and eSports hubs. Saudi Arabia’s Vision 2030 initiative and the UAE’s digital economy policies have catalyzed private-sector investment in gaming studios and infrastructure. High disposable incomes, coupled with youthful populations and a growing appetite for digital leisure, are driving adoption. Meanwhile, Africa’s emerging markets, led by Nigeria, Kenya, and Egypt, are leveraging improved 4G/5G networks and affordable smartphones to broaden participation. The convergence of mobile gaming, cloud delivery, and eSports tournaments will be instrumental in shaping MEA’s next growth phase in the global GaaS landscape.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Global Gaming as a Service Market

- Microsoft Corporation

- Sony Group Corporation

- Tencent Holdings Ltd.

- Electronic Arts Inc.

- Nintendo Co., Ltd.

- Ubisoft Entertainment SA

- Activision Blizzard Inc.

- Valve Corporation

- Epic Games Inc.

- Square Enix Holdings Co., Ltd.

- Take-Two Interactive Software Inc.

- Bandai Namco Entertainment Inc.

- Capcom Co., Ltd.

- Sega Sammy Holdings Inc.

- Nexon Co., Ltd.

Recent Developments

- In September 2025, Microsoft announced new multi-region expansions for its Xbox Cloud Gaming service, adding India, the Middle East, and South America to its coverage footprint.

- In August 2025, Sony introduced adaptive cloud rendering for PlayStation Plus Premium subscribers, enabling dynamic quality adjustment for low-bandwidth regions.

- In May 2025, Tencent launched a new AI-driven live-service analytics suite to optimize monetization for its global cloud-gaming portfolio.