Functional Tea Market Size

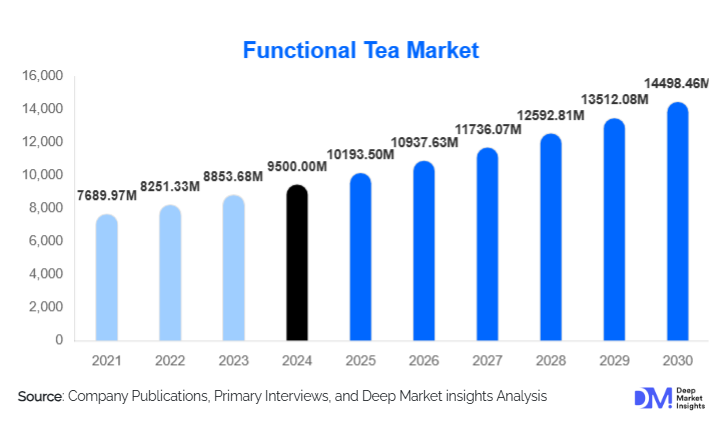

According to Deep Market Insights, the global functional tea market size was valued at USD 9,500 million in 2024 and is projected to grow from USD 10,193.5 million in 2025 to reach USD 14,498.46 million by 2030, expanding at a CAGR of 7.3% during the forecast period (2025–2030). The functional tea market growth is primarily driven by rising consumer interest in health-and-wellness beverages, increasing innovation in functional ingredients and formats, and the expansion of direct-to-consumer and digital retail channels.

Key Market Insights

- Consumers are seeking tea products that offer targeted health benefits, such as immunity boosting, digestion support, stress relief, and weight management, pushing the functional tea category beyond regular tea.

- Premiumisation is accelerating, with brands crafting premium loose-leaf, single-origin, adaptogen-infused, and botanical-blend functional teas to command higher price points.

- Online and direct-to-consumer channels dominate new growth, allowing niche functional tea brands to access health-conscious consumers globally, reduce reliance on traditional retail, and build loyalty via subscriptions.

- Asia-Pacific is emerging as the fastest-growing market, driven by large tea-consuming populations, rising disposable incomes, growing wellness awareness, and local brand innovation.

- North America remains the largest single regional market, with a well-established functional-beverage culture, a high willingness to pay for wellness brands, and strong retail and e-commerce infrastructure.

- Sustainable sourcing, clean-label botanicals, and traceability technologies are reshaping the functional tea competition, with brands adopting eco-friendly packaging, an ethical supply chain, and digital traceability tools.

What are the latest trends in the functional tea market?

Botanical & Adaptogen-Enhanced Blends

Functional tea brands are increasingly combining traditional tea bases (like green or black tea) with botanicals and adaptogens such as turmeric, ashwagandha, ginger, herbal mushrooms and probiotics. These blends tap into consumer demand for specific health outcomes, for example, digestion support, stress relief or immune boost, rather than general wellness alone. The move from pure tea to “tea + functional ingredient” is a key differentiator in this category, enabling brands to charge premium prices and appeal to younger, wellness-driven cohorts.

Direct-to-Consumer & Subscription Models Gaining Ground

The digital channel is playing a major role in functional tea growth. Brands are leveraging D2C websites, online marketplaces, social-commerce campaigns and subscription models (monthly wellness tea boxes) to reach health-oriented consumers directly. This allows for rapid product launches, agile customer feedback loops and personalised communication (e.g., “which blend suits your digestion goals”). The flexibility of online channels also helps new entrants access global markets without the heavy investment of traditional retail shelf space.

Eco-friendly Packaging & Sustainable Supply Chains

Sustainability is strongly influencing the functional tea market. Consumers not only expect functional benefits, but also transparency about sourcing, ethical farming practices and sustainable packaging (e.g., compostable tea bags, recycled cartons). Brands that emphasise clean-label, organic certification and supply-chain traceability are gaining consumer trust and premium positioning. This trend is especially important in mature markets (North America, Europe) where consumers are very conscious of ethical credentials.

What are the key drivers in the functional tea market?

Rising Health Consciousness & Prevention-Oriented Wellness

Globally, consumers are shifting from reactive health behaviours to preventive wellness and lifestyle management. This trend fuels demand for beverages that do more than refresh; they provide functional benefits such as immunity support, digestion aid, stress management or clean energy. Functional teas are benefit-oriented products that align with this wellness shift, and brands are tapping into these consumer motivations by promoting health-specific blends rather than plain tea.

Innovation in Ingredients & Format Innovations

The functional tea market benefits from innovation in both ingredients and formats. Brands are incorporating novel botanicals, adaptogens, probiotics/prebiotics, and super-herbs, and offering formats like loose-leaf premium, single-serve sachets, powdered blends and online-only subscription packs. These innovations help differentiate products and allow companies to command a premium, driving growth and value-creation in the segment.

Expansion of Digital & Online Distribution Channels

The proliferation of e-commerce and D2C models has significantly lowered the barrier to entry and enabled wider global reach for functional tea brands. Through online platforms, direct brand-consumer relationships can be built, data captured, and subscription models created, which encourage repeat purchases. This shift supports the rapid scale-up of functional tea offerings and increases the accessibility of premium wellness products to a broader audience.

Restraints for the global market

Higher Price Points and Cost Sensitivity

Functional teas generally carry a premium price compared to conventional teas due to specialised ingredients, more complex sourcing and premium packaging. In more price-sensitive markets or among budget-conscious consumers, this higher cost can limit adoption. If economic pressures increase or consumer spending tightens, the premium functional segment may face headwinds.

Limited Consumer Awareness & Regulatory Complexity

In many emerging markets, consumers may not fully recognise or be willing to pay for “functional tea” benefits, limiting penetration. Additionally, the regulatory environment around health claims for beverages and botanicals varies across countries (labelling, permissible ingredients, import tariffs), which can complicate product launches, cross-border trade and marketing. These factors restrain growth in less mature geographies.

What are the key opportunities in the functional tea industry?

Premiumisation and Differentiated Product Development

There is a compelling opportunity for brands to move beyond commodity tea and into premium, differentiated functional tea offerings. By launching high-margin formats (for example: single-origin green tea infused with adaptogens, herbal blends with clinically studied botanicals, limited edition wellness teas), companies can capture value and build brand loyalty. In emerging markets, as disposable incomes rise, there is further potential for the adoption of premium functional teas. Packaging innovation, sustainability credentials and wellness narratives will be key to unlocking this opportunity.

Digital Expansion & Subscription-Driven Growth

The functional tea market stands to benefit strongly from the shift towards e-commerce, direct-to-consumer (D2C) business models and personalised subscription services. Brands can launch targeted online campaigns, use data analytics to tailor product recommendations (“which blend suits you for stress or immunity”), and expand into new geographies cost-effectively without heavy retail overheads. New entrants can particularly leverage this model to reach wellness-driven audiences globally.

Regional Expansion & Localisation of Functional Tea Formats

Emerging geographies – especially in Asia-Pacific, Latin America and the Middle East & Africa – present strong growth potential for functional tea. Many of these markets have large tea-consuming populations but limited exposure to value-added functional formats. Localising formulations (for example, using Ayurvedic herbs in India, traditional botanicals in China), local manufacturing or sourcing partnerships, and wellness-policy support from governments increase the opportunity. Participants can thus capture both volume growth and premiumisation in new regional markets.

Product Type Insights

Within the functional tea market, the tea-based type of “Green Tea” dominates. Green tea holds approximately 35% of the total 2024 market share (≈ USD 2,975 million of the USD 8,500 million). This leadership is driven by strong global consumer familiarity with green tea’s health credentials (antioxidants, metabolism support), its easier transition into functional blends (such as green tea + botanicals), and broad geographic acceptance across North America, Europe and Asia-Pacific. Less familiar tea bases (such as white tea or flower tea) are growing, but from a smaller base. As a result, green tea remains the launch platform of choice for many functional tea brands.

Application Insights

The functional tea market primarily serves household retail consumption, where wellness-oriented consumers purchase teas for home use. However, growing applications include speciality cafés and tea bars offering premium functional blends, corporate wellness programs (office health boxes, subscriptions) and export-driven wellness market demand (brands in tea-producing countries exporting value-added functional teas). Among end-use segments, subscription/online wellness-tea boxes and foodservice wellness cafés are growing fastest. As the broader health & wellness beverage industry expands, the functional tea category benefits from extended applications into new end-uses beyond traditional retail shelf purchase.

Distribution Channel Insights

Functional teas are distributed through traditional store-based retail (supermarkets/hypermarkets, convenience, health-food stores, tea cafés) and increasingly through online/digital channels. Online platforms (brand D2C sites, marketplaces) and subscription models are rapidly gaining share, enabling direct consumer engagement, subscription loyalty and faster product innovation. Speciality tea cafés and health-food retail are also important for premium functional blends, giving experiential purchase settings and sampling opportunities. As consumer behaviour shifts toward online and wellness-driven purchase paths, the digital channel continues to reshape the distribution landscape in the functional tea market.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America remains the largest regional market for functional tea, with the U.S. and Canada driving demand for wellness-oriented beverage formats, premium tea brands, and online subscription offerings. With approximately 40% of the global market (USD 3,400 million of the USD 8,500 million) in 2024, the region benefits from high consumer awareness of functional beverages and strong retail infrastructure. Growth is supported by wellness trends, premium pricing capability, and digital adoption.

Asia-Pacific

Asia-Pacific is emerging as the fastest-growing region in the functional tea market, with large tea-consuming populations in China, India, and Japan, rising disposable incomes, growing wellness consciousness, and local brand innovation. Holding about 30% share (USD 2,550 million) in 2024, the region’s growth rate is projected to exceed the global average as premiumisation and functional blends penetrate traditional tea markets.

Europe

Europe accounts for approximately 20% share (USD 1,700 million) of the global functional tea market in 2024. Key countries such as the U.K., Germany, and France show strong interest in botanical/functional tea formats and premium wellness beverages. Growth is steady, albeit slightly slower than in Asia-Pacific, due to saturation in traditional tea markets and slightly higher price sensitivity.

Latin America

Latin America represents a smaller share of the functional tea market (USD 425 million of the global total) but is seeing increasing interest in wellness tea formats among urban consumers in Brazil, Argentina, and Mexico. Outbound premium tea imports and niche wellness brands are gradually entering the region.

Middle East & Africa (MEA)

MEA holds a modest share (USD 425 million) of the global functional tea market, but specific countries such as the UAE, Saudi Arabia, and South Africa show strong potential due to rising incomes, luxury wellness demand, and increased interest in premium tea blends. Intra-African trade and export-led value-added tea formats also contribute to growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Functional Tea Market

- Unilever PLC

- Tata Consumer Products Limited

- Nestlé S.A.

- Associated British Foods plc

- The Hain Celestial Group, Inc.

- Organic India Pvt. Ltd.

- Yogi Tea

- Numi Organic Tea, Inc.

- Dilmah Ceylon Tea Company PLC

- Barry’s Tea

- Harney & Sons Fine Teas

- Rishi Tea & Botanicals

- Pukka Herbs

- The Republic of Tea, Inc.

- Celestial Seasonings