Food Flavors Market Size

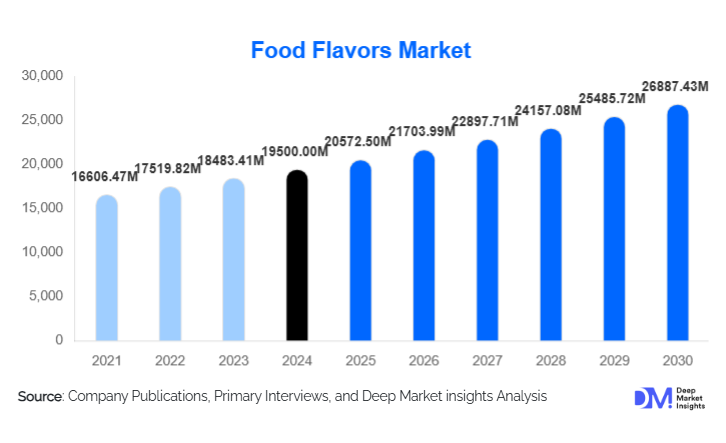

According to Deep Market Insights, the global food flavors market size was valued at USD 19,500 million in 2024 and is projected to grow from USD 20,572.50 million in 2025 to reach USD 26,887.43 million by 2030, expanding at a CAGR of 5.5% during the forecast period (2025–2030). The market growth is primarily driven by rising consumer demand for natural and clean-label ingredients, rapid adoption of processed and convenience foods, and technological advancements in flavor production, including precision fermentation and micro-encapsulation.

Key Market Insights

- Clean-label and natural flavors are rapidly gaining traction, reflecting consumer preference for healthy, transparent, and recognizable ingredients across beverages, snacks, and dairy products.

- Emerging markets in Asia-Pacific and Latin America are driving demand, fueled by rising disposable incomes, urbanization, and expanding processed food sectors.

- Beverages and savory foods dominate flavor consumption, as flavor innovation becomes critical to product differentiation and taste consistency in these applications.

- Technological innovations, such as fermentation-derived flavors, AI-driven flavor design, and micro-encapsulation, are reshaping the development and delivery of flavors globally.

- Export-oriented growth is significant, with flavor houses supplying both natural extracts and high-tech flavor compounds to food manufacturers worldwide.

- Regulatory frameworks and sustainability initiatives are increasingly influencing market strategies, especially in North America and Europe.

What are the latest trends in the food flavors market?

Shift Toward Natural and Clean-Label Flavors

Consumers are increasingly seeking clean-label products with natural ingredients. Flavor manufacturers are responding by expanding botanical, fermentation-derived, and plant-based flavors that comply with clean-label standards. This trend is especially strong in beverages, snacks, and confectionery, where natural flavors enhance taste without artificial additives. Leading flavor houses are investing in research to replicate complex tastes using biotechnology and precision fermentation, reducing dependence on traditional agricultural sourcing while meeting regulatory requirements.

Technology-Driven Flavor Innovation

Advanced technologies such as AI-assisted flavor design, digital sensory analysis, and micro-encapsulation are transforming the flavor development process. These tools enable manufacturers to create tailored, stable, and high-impact flavors efficiently. Precision fermentation is generating natural-like molecules with greater sustainability and scalability. Encapsulation technology allows flavors to remain stable in complex food matrices, enhancing shelf-life and product quality. These innovations enable flavor companies to respond quickly to consumer preferences, regional taste demands, and emerging trends in processed foods and beverages.

What are the key drivers in the food flavors market?

Rising Demand for Processed and Convenience Foods

The increasing urbanization and busy lifestyles of consumers are driving demand for processed, ready-to-eat, and convenience foods. Flavoring agents are essential in these products to deliver consistent taste, aroma, and sensory appeal. High consumption of beverages, snacks, frozen meals, and dairy products globally is providing a steady growth base for the food flavors market.

Growing Preference for Clean-Label and Natural Ingredients

Health-conscious consumers are increasingly avoiding artificial additives, favoring products with natural, organic, or minimally processed ingredients. This trend is prompting manufacturers to develop natural and clean-label flavors, which command premium pricing and encourage brand loyalty. It also drives investment in research and development for botanical extracts, fermentation-derived flavors, and plant-based solutions.

Technological Advancements in Flavor Production

Innovations such as precision fermentation, bio-conversion, and AI-assisted flavor creation are enabling flavor houses to produce high-quality flavors efficiently and sustainably. These advancements reduce dependency on raw agricultural sources, improve production scalability, and allow for rapid customization of flavors to meet regional preferences and emerging trends in the global food and beverage industry.

What are the restraints for the global market?

Regulatory and Compliance Challenges

Stringent food safety and labeling regulations, such as GRAS status in the U.S. and EFSA approvals in Europe, create barriers for new product introductions. The regulatory approval process can be time-consuming and expensive, particularly for novel natural and biotech-derived flavors, limiting market entry and expansion for smaller players.

Volatility in Raw Material Prices

Many natural flavors are sourced from agricultural products, including herbs, spices, and fruits, whose prices fluctuate due to climate conditions, seasonal yield variations, and supply chain disruptions. Price volatility can affect profit margins and force manufacturers to absorb costs or increase prices, potentially impacting market growth.

What are the key opportunities in the food flavors industry?

Expansion of Clean-Label and Natural Flavor Portfolios

The increasing global demand for natural and clean-label flavors presents a significant growth opportunity. Flavor manufacturers can innovate in botanical extracts, fermentation-derived compounds, and plant-based flavors. Companies investing in research for sustainable and scalable natural flavors can gain competitive advantages while meeting evolving consumer expectations.

Regional Flavor Customization in Emerging Markets

Emerging regions such as the Asia-Pacific and Latin America are witnessing growing demand for ethnic and regionally tailored flavors. Flavor houses can localize production, co-create regional profiles, and capture niche market segments. Tailored solutions for local tastes help strengthen customer loyalty and drive long-term growth in high-potential markets.

Integration of Digital and Biotechnological Platforms

Advanced platforms, including AI-driven flavor design and precision fermentation, offer opportunities for faster, cost-effective, and sustainable flavor production. These technologies enable rapid response to changing market trends, reduced dependence on traditional agricultural inputs, and creation of premium, high-margin products.

Product Type Insights

Synthetic/artificial flavors dominate the global market, accounting for roughly 50–55% of the 2024 market. They remain popular due to cost efficiency, consistency, and versatility across applications. Natural and nature-identical flavors are gaining share due to clean-label demand, especially in premium beverages, snacks, and dairy products.

Application Insights

Beverages and savory foods represent the largest applications for food flavors. Beverages, including functional drinks, flavored waters, and soft drinks, require complex flavor formulations to deliver a consistent taste experience. Savory snacks, RTE foods, and dairy products are also significant consumers of flavors. Growth is driven by global urbanization, rising disposable incomes, and increasing processed food consumption.

Distribution Channel Insights

B2B direct sales to food and beverage manufacturers dominate the distribution landscape, with distributors and ingredient traders serving emerging markets. Export-oriented growth is prominent, as flavor houses supply high-value natural extracts and advanced flavor compounds globally. Online procurement and digital marketplaces are also gaining adoption, especially among smaller manufacturers and startups.

End-Use Insights

Beverages, dairy, savory snacks, and bakery products are the leading end-use segments. Beverages are growing fastest due to the demand for flavored functional drinks and low-sugar alternatives. Ready-to-eat foods and plant-based products are emerging applications, while the global export of processed foods is increasing demand for standardized and high-quality flavors across regions.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific is the largest and fastest-growing region, accounting for approximately 33.7% of the 2024 market (~USD 6.6 billion). China and India are major contributors due to rising urbanization, disposable incomes, and processed food consumption. The demand for regional and exotic flavors is accelerating, supported by local flavor houses and international flavor companies establishing production facilities.

North America

North America holds about 24% of the global market (~USD 4.7–5 billion in 2024), led by the U.S. and Canada. Growth is driven by clean-label trends, plant-based products, and functional beverages. Innovation in flavor technology and strong consumer awareness reinforce demand in this mature market.

Europe

Europe contributes roughly 20–25% of the global market, with Germany, the U.K., France, and Italy leading demand. Regulatory compliance and consumer preference for natural flavors drive innovation, while sustainable and clean-label initiatives are increasingly influencing product development.

Latin America

Latin America is emerging, with Brazil, Mexico, and Argentina showing rising demand for processed foods and ethnic flavors. While smaller in share, the region offers high growth potential for flavor customization and export-oriented production.

Middle East & Africa

MEA has a smaller market share but offers opportunities in the GCC nations and South Africa. Rising incomes, urbanization, and expanding foodservice sectors are fueling demand for premium flavors and ready-to-eat products.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Food Flavors Market

- Givaudan

- International Flavors & Fragrances (IFF)

- Symrise

- Firmenich

- Kerry Group

- T. Hasegawa

- Mane

- Sensient Technologies

- Bell Flavors & Fragrances

- Takasago International

- Robertet

- Huabao Flavours & Fragrances

- Synergy Flavors

- McCormick & Company

- Frutarom (IFF)

Recent Developments

- In March 2025, Givaudan expanded its fermentation-derived flavor production in Switzerland to enhance natural vanilla and citrus compounds.

- In February 2025, IFF launched a new AI-based flavor design platform to accelerate clean-label flavor innovation for global beverage manufacturers.

- In January 2025, Symrise announced an investment in a micro-encapsulation plant in the Asia-Pacific region, targeting rapid delivery of stable flavors for snack and confectionery applications.