Fancy Yarn Market Size

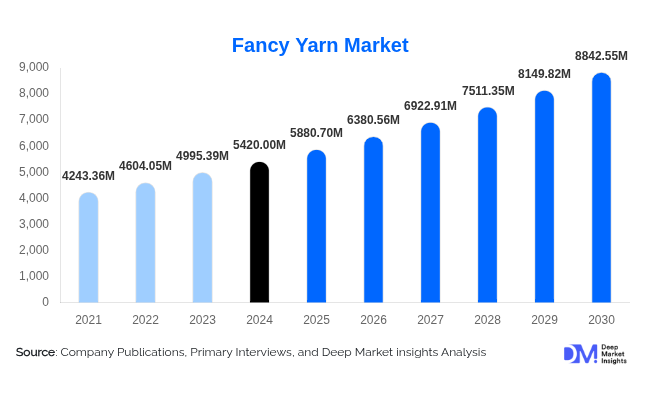

According to Deep Market Insights, the global fancy yarn market size was valued at USD 5,420 million in 2024 and is projected to grow from USD 5,880.70 million in 2025 to reach USD 8,842.55 million by 2030, expanding at a CAGR of 8.5% during the forecast period (2025–2030). The growth of the fancy yarn market is driven by rising demand for premium, aesthetic, and functional textiles across the fashion, home décor, and interior design industries. Increasing consumer preference for sustainable and designer fabrics, along with technological innovations in yarn processing and blending, are key contributors to this market expansion.

Key Market Insights

- Growing use of fancy yarns in fashion and luxury apparel is enhancing fabric texture, visual appeal, and customization in high-end clothing lines.

- Expanding application in home furnishings, including upholstery, carpets, and curtains, is fueling steady demand from interior design and residential sectors.

- Europe remains the largest market for fancy yarn, driven by advanced textile production and high consumer spending on fashion and décor.

- Asia-Pacific emerges as the fastest-growing region, owing to rapid industrialization, growth of textile exports, and the rise of domestic apparel brands in China and India.

- Sustainability trends are reshaping product innovation, with recycled fibers, eco-dyeing, and low-impact spinning gaining traction among manufacturers.

- Digital textile design technologies, including 3D knitting and computerized patterning, are enabling the creation of more complex yarn types and textures.

Latest Market Trends

Rising Popularity of Sustainable and Recycled Fancy Yarns

Environmental sustainability has become a central theme in the textile sector, and fancy yarn producers are embracing eco-friendly materials such as recycled polyester, organic cotton, and bamboo fiber. Manufacturers are incorporating biodegradable or regenerated fibers to reduce carbon footprints. Moreover, the adoption of closed-loop dyeing and waterless finishing technologies is promoting greener production. Sustainable fancy yarns not only align with global environmental goals but also cater to conscious consumers seeking traceable and ethically produced fabrics.

Digital Design and Automation Transforming Yarn Production

Technological advancements in computerized spinning and digital patterning are revolutionizing yarn aesthetics and performance. Automated twisting, wrapping, and fancy-effect machinery allow for consistent quality while enabling the creation of complex yarn types such as boucle, slub, and metallic yarns. Integration with CAD-based systems supports customization and short-run production for fashion designers. These innovations enhance manufacturing efficiency and reduce waste, providing a competitive edge to producers adopting Industry 4.0 technologies.

Fancy Yarn Market Drivers

Rising Demand for Fashion and Designer Textiles

Growing fashion consciousness, urbanization, and income growth are fueling the global appetite for designer apparel. Fancy yarns offer unique visual and tactile effects, such as irregular thickness, shine, and novelty twists, that appeal to fashion brands aiming to differentiate their collections. Demand for statement fabrics in women’s wear, luxury scarves, knitwear, and couture products is especially strong, driving higher consumption of textured and multi-colored fancy yarns.

Expanding Application in Home and Interior Furnishing

Fancy yarns are increasingly used in home décor products, including curtains, upholstery, rugs, and cushion covers. The growing emphasis on interior aesthetics, along with rising residential construction and renovation activities, particularly in urban centers, is driving market growth. Consumers favor textured and decorative fabrics for premium home designs, further expanding the role of fancy yarn in the global home furnishing segment.

Market Restraints

High Production Costs and Process Complexity

The manufacturing of fancy yarn requires specialized machinery, multi-step processing, and skilled labor. These factors significantly raise production costs compared to conventional yarns. Additionally, ensuring consistent texture, color, and durability across large batches remains a technical challenge, especially in artisanal or small-scale setups. These complexities limit large-scale production and can constrain market penetration in price-sensitive regions.

Volatility in Raw Material Prices

Price fluctuations in raw materials such as cotton, wool, silk, and synthetic fibers affect overall production costs. Dependence on imports for specialty fibers also exposes manufacturers to currency risks and supply disruptions. Such instability may restrain the profitability of fancy yarn producers and hinder stable growth in emerging markets.

Fancy Yarn Market Opportunities

Emerging Demand from Technical and Functional Textiles

The growing technical textile industry presents significant opportunities for fancy yarn manufacturers. High-performance yarns with flame-retardant, moisture-wicking, and antimicrobial properties are being developed for sportswear, uniforms, and upholstery. Combining functional performance with aesthetic appeal opens new revenue streams in industrial and smart textile applications.

Customization and Small-Batch Production for Boutique Brands

With the rise of boutique fashion labels and D2C (direct-to-consumer) brands, demand for limited-edition, customized fancy yarns is growing. Small-batch spinning and artisanal blending offer designers exclusive textures and color patterns. Manufacturers adopting flexible production technologies and collaborative design models are positioned to capture this emerging niche of personalized textile production.

Product Type Insights

The fancy yarn market is categorized into boucle yarns, slub yarns, chenille yarns, metallic yarns, spiral yarns, and others. Boucle and chenille yarns dominate due to their extensive use in upholstery and winter wear, offering plush texture and warmth. Metallic yarns are gaining traction in fashion and decorative textiles for their shimmer and visual depth. Slub yarns are increasingly adopted in casual wear and denim fabrics, catering to modern fashion aesthetics emphasizing irregular textures and rustic finishes.

Application Insights

By application, the market is divided into apparel, home textiles, industrial fabrics, and others. The apparel segment leads, driven by strong adoption in knitwear, luxury garments, and accessories. Home textiles represent the second-largest segment, supported by rising consumer expenditure on interior décor. Industrial and functional uses of fancy yarn, particularly in composite materials and protective gear, are growing steadily, offering new diversification opportunities for manufacturers.

Distribution Channel Insights

Offline distribution channels, including textile showrooms, specialty stores, and manufacturer outlets, remain dominant due to the tactile nature of yarn selection. However, online sales platforms are expanding rapidly, with e-commerce portals and B2B textile marketplaces offering wider accessibility, variety, and price transparency. Digital catalogs and virtual texture simulation tools are helping bridge the sensory gap for online buyers, driving e-commerce penetration in the yarn trade.

| By Product Type | By Application | By Distribution Channel | By End-User Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

Europe

Europe remains the largest fancy yarn market, led by Italy, France, and Germany. The region’s advanced textile industry, emphasis on premium craftsmanship, and sustainability initiatives drive strong adoption. Italian mills are global leaders in high-quality chenille, boucle, and metallic yarns used in luxury fashion houses and interior décor brands. The region also leads in recycling and eco-textile innovation, promoting circularity in yarn production.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by expanding textile manufacturing bases in China, India, Japan, and South Korea. Low production costs, skilled labor, and strong export infrastructure support growth. Rising middle-class income levels and booming domestic fashion sectors are also boosting the consumption of fancy yarns in this region. China dominates exports, while India’s artisan-based spinning clusters are emerging as suppliers of hand-spun and eco-friendly yarns.

North America

North America exhibits moderate but steady growth, supported by consumer interest in sustainable and designer textiles. U.S. manufacturers are focusing on recycled synthetic yarns and luxury home décor applications. The rise of online crafting and knitting communities is also increasing retail-level demand for specialty yarns across the region.

Latin America

Latin America, led by Brazil and Mexico, is witnessing rising adoption of fancy yarns in the apparel and home furnishing sectors. Regional growth is supported by expanding local fashion industries and the increasing popularity of handwoven and artisanal textile products.

Middle East & Africa

MEA markets are gradually expanding, driven by growth in home décor and hospitality textiles. Countries like the UAE and South Africa are key importers of high-end fancy yarns for premium interior applications. Local textile clusters in Egypt and Turkey are also contributing to regional production and export growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Fancy Yarn Market

- Filpucci S.p.A.

- Donghia Inc.

- Schoeller Spinning Group

- Huvis Corporation

- Kraig Biocraft Laboratories Inc.

- Everest Textile Co. Ltd.

- Monteoliveto Yarns

- Indorama Ventures Public Co. Ltd.

- Nilit Ltd.

- Prachitra Textiles Pvt. Ltd.

Recent Developments

- In May 2025, Filpucci introduced a new range of biodegradable fancy yarns made from recycled wool and organic fibers, emphasizing traceability and low carbon emissions.

- In March 2025, Huvis Corporation launched an advanced line of metallic-effect polyester yarns designed for luxury fashion textiles and home décor applications.

- In January 2025, Schoeller Spinning Group announced the expansion of its sustainable yarn facility in Austria to enhance production capacity for recycled and organic fancy yarn blends.