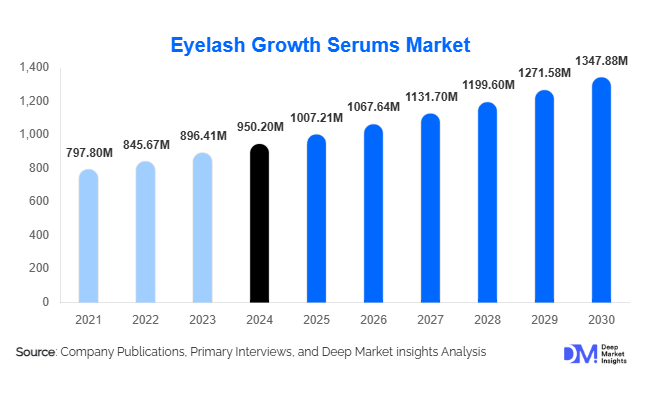

Eyelash Growth Serums Market Size

According to Deep Market Insights, the global eyelash growth serums market size was valued at USD 950.2 million in 2024 and is projected to grow from USD 1,007.21 million in 2025 to reach USD 1,347.88 million by 2030, expanding at a CAGR of 6.0% during the forecast period (2025–2030). Market growth is driven by the increasing consumer focus on non-invasive cosmetic enhancement, innovation in peptide and botanical formulations, and the expanding influence of digital beauty platforms that make premium serums accessible to global consumers.

Key Market Insights

- North America dominates the eyelash growth serums market, accounting for over 38% of global revenue in 2024, driven by high consumer awareness and strong retail distribution networks.

- Asia-Pacific is the fastest-growing region, propelled by rising disposable incomes, influencer-driven beauty trends, and increasing female workforce participation in markets such as China and India.

- Online and D2C channels are outpacing offline growth, with brands leveraging subscription models and social media to drive recurring revenue.

- Clean-label and botanical formulations are emerging as the top consumer preference, as users seek safe, natural alternatives to prostaglandin-based products.

- Innovation in peptide-based actives and dual-function serums (lash + brow, lash + primer) is transforming product positioning and premium pricing dynamics.

- Fragmented competition creates room for niche brands to capture market share through transparency, efficacy data, and ethical branding.

Latest Market Trends

Shift Toward Clean-Label and Botanical Serums

Consumers are increasingly demanding clean beauty products free from harmful additives such as parabens, prostaglandins, and synthetic dyes. Brands are responding with formulations featuring natural peptides, biotin, amino acids, and plant-derived actives like castor oil and green tea extracts. This shift aligns with broader sustainability trends in the cosmetics sector, where ingredient transparency and eco-friendly packaging are influencing purchase decisions. The growth of vegan, cruelty-free, and hypoallergenic product lines has also expanded the market’s reach to ethically conscious consumers.

Digital-First and Influencer-Driven Brand Growth

Social media platforms such as Instagram, TikTok, and YouTube have become major growth accelerators for eyelash serum brands. Influencer tutorials and user-generated reviews are driving rapid brand recognition, particularly among Gen Z and millennial consumers. Direct-to-consumer (D2C) models allow brands to bypass traditional retail channels, offer subscription refills, and collect valuable customer insights. Virtual try-ons and AR-enabled demonstrations are enhancing online engagement, fostering brand loyalty, and boosting repeat purchase rates.

Eyelash Growth Serums Market Drivers

Rising Consumer Demand for Non-Invasive Beauty Enhancements

Consumers are moving away from eyelash extensions and false lashes in favor of safe, non-invasive products that deliver long-term results. Eyelash serums appeal to this segment by promising visibly fuller, longer lashes through daily application. This trend aligns with the broader move toward minimalistic beauty and skincare-based cosmetics, particularly post-pandemic, when home-use products surged in popularity.

Innovation in Active Ingredients and Efficacy

Continuous R&D investments have led to more effective formulations that use peptides, biotin, keratin, and botanical complexes to strengthen hair follicles and improve lash density. Clinical testing and visible-before-and-after campaigns are increasing consumer trust. The evolution of hybrid serums that combine nourishment with visible lengthening benefits is expanding the customer base from cosmetic users to skincare enthusiasts.

E-commerce Expansion and Accessibility

The rapid proliferation of online beauty retail and global shipping has made premium eyelash serums available to consumers in both mature and emerging markets. Subscription models, bundled beauty kits, and influencer-led campaigns have fueled recurring purchases. The surge in digital marketplaces such as Amazon Beauty, Sephora Online, and brand-owned D2C platforms has lowered entry barriers for new brands and expanded overall market penetration.

Market Restraints

Regulatory and Safety Concerns

Prostaglandin analogs used in some high-performance serums have raised safety and regulatory scrutiny in certain regions. Side effects such as eye irritation and pigmentation changes have led to stricter compliance requirements, increasing formulation costs for manufacturers. This has also encouraged brands to invest in alternative actives that meet regional cosmetic safety standards.

High Competition and Price Pressure

The eyelash growth serums market is highly fragmented, with numerous emerging and private-label brands competing across digital and offline channels. This proliferation often drives heavy promotional discounting and squeezes margins. Established brands must continuously innovate or emphasize quality assurance to sustain their premium positioning amid low-cost competition.

Eyelash Growth Serums Market Opportunities

Expansion in Emerging Markets

Rapid urbanization and the rising middle-class population in Asia-Pacific and Latin America are opening new frontiers for market expansion. Growing beauty consciousness, increasing female workforce participation, and social media influence are stimulating demand for affordable premium products. Localization strategies such as region-specific marketing campaigns and tailored formulations offer strong entry opportunities for international brands.

Rise of Multifunctional and Hybrid Formulations

Consumers increasingly seek products that offer multiple benefits. Dual-purpose serums targeting both eyelashes and eyebrows, or combining conditioning and growth enhancement, are gaining traction. These innovations allow brands to command premium pricing and simplify consumer routines, catering to the growing “minimalist beauty” movement.

Sustainability and Ethical Branding

Brands that emphasize cruelty-free testing, recyclable packaging, and natural sourcing stand to gain significant market share. The sustainability trend extends beyond ingredients; consumers now value ethical production and transparent communication about product efficacy and sourcing. Certifications such as “Vegan,” “Dermatologist-Tested,” and “EcoCert” have become key differentiators for brands in mature markets.

Product Type Insights

Growth-focused serums dominate the market, accounting for approximately 40% of global revenue in 2024. These formulations primarily target lash length and density, aligning directly with consumer expectations of visible improvement. Volumizing and conditioning serums follow, driven by demand for lash health and repair. Multi-function serums, offering lash and brow benefits, are the fastest-growing sub-segment due to cross-functional usage and convenience-driven consumer behavior.

Ingredient Type Insights

Conventional and synthetic formulations lead the market with an estimated 55% share in 2024, owing to proven efficacy and strong brand reputation. However, organic and botanical serums are rapidly gaining share, driven by consumer skepticism toward synthetic prostaglandin analogs and a preference for natural peptides, plant oils, and vitamin complexes. This shift is encouraging established brands to reformulate or launch clean beauty sub-lines.

End-User & Distribution Channel Insights

Individual consumers represent the largest end-user segment, comprising roughly 85% of global sales in 2024. The professional segment beauty salons and dermatology clinics continue to expand as practitioners bundle serums with lash extension and aftercare treatments. Offline channels, particularly hypermarkets and beauty specialty stores, dominate with about 35% of total sales, while online sales are growing fastest, propelled by influencer marketing and brand-direct engagement. Subscription-based D2C models are creating stable recurring revenue streams for premium brands.

| By Product Type | By Ingredient Type | By End User | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounted for approximately 38.5% of global revenue in 2024, driven by mature retail infrastructure and consumer familiarity with premium beauty regimes. The U.S. leads the region with strong adoption of clinical-grade lash serums. The presence of major players such as L’Oréal and RevitaLash ensures continued innovation and market maturity. Canada follows with a rising demand for vegan and cruelty-free formulations.

Europe

Europe represents about 20–25% of the global share, with markets such as the U.K., Germany, France, and Italy leading in clean-label product adoption. Stringent cosmetic safety standards have encouraged innovation in peptide-based serums. Growth remains steady, supported by strong e-commerce penetration and consumer preference for certified, dermatologically tested formulations.

Asia-Pacific

The Asia-Pacific region is the fastest-growing market, expected to grow at over 7.5% CAGR through 2030. China, Japan, India, and South Korea are key demand centers, driven by beauty influencer culture and increased disposable income. Local brands are leveraging K-beauty and J-beauty innovations to enter the premium lash-care space. Online marketplaces such as Tmall and Lazada are facilitating access to international brands.

Latin America

Latin America is emerging with steady growth, led by Brazil and Mexico. Consumers are embracing Western beauty trends, with increasing penetration of mid-range serums. However, price sensitivity and import duties remain key barriers to premium segment growth. Local manufacturers are responding with affordable botanical-based alternatives.

Middle East & Africa

The MEA region accounts for a smaller share (10%) but exhibits strong demand in GCC countries such as Saudi Arabia and the UAE, where luxury cosmetics consumption is high. Rising female employment and beauty awareness are supporting market expansion. African nations like South Africa and Nigeria are witnessing growing distribution through beauty retailers and online marketplaces.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Eyelash Growth Serums Market

- L’Oréal S.A.

- LVMH SE

- Shiseido Company, Limited

- RevitaLash Cosmetics

- Skin Research Laboratories

- Pacifica Beauty LLC

- e.l.f. Cosmetics, Inc.

- Grande Cosmetics LLC

- JB Cosmetics Group

- RapidLash

- Topix Pharmaceuticals Inc.

- Neora

- Ardell International Inc.

- Replenix

- Peter Thomas Roth

Recent Developments

- In June 2025, RevitaLash Cosmetics launched its next-generation peptide-enriched serum designed to reduce irritation and improve lash density within six weeks of use.

- In April 2025, e.l.f. Cosmetics introduced an affordable, clean-label lash serum under its “e.l.f. SKIN” line, targeting the mass-market consumer segment.

- In February 2025, L’Oréal announced a strategic partnership with a biotechnology firm to develop sustainable, plant-based prostaglandin alternatives for eyelash and eyebrow care products.

- In December 2024, Shiseido expanded its lash serum distribution to Southeast Asia through a collaboration with leading regional e-commerce platforms, accelerating its footprint in emerging markets.