Ethnic Wear Market Size

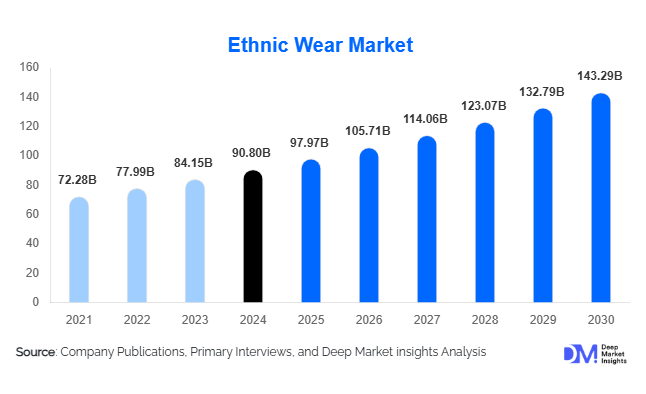

According to Deep Market Insights, the global ethnic wear market size was valued at USD 90.8 billion in 2024 and is projected to grow from USD 97.97 billion in 2025 to reach USD 143.29 billion by 2030, expanding at a CAGR of 7.9% during the forecast period (2025–2030). The ethnic wear market growth is primarily driven by the rising global appreciation for traditional craftsmanship, growing demand for cultural fashion fusion, and the expanding influence of ethnic-inspired apparel in mainstream fashion.

Key Market Insights

- Increasing global acceptance of ethnic-inspired fashion is driving cross-cultural apparel trends and hybrid wear collections that blend traditional and contemporary designs.

- Rising demand for sustainable and handcrafted clothing is fostering the use of organic fabrics, handloom textiles, and artisanal embroidery.

- Asia-Pacific dominates the ethnic wear market, led by India, China, and Southeast Asian nations, where traditional attire remains an integral part of daily and ceremonial life.

- The Middle East and Africa are emerging growth regions, supported by strong cultural roots, religious festivals, and rising luxury ethnic fashion demand.

- Global fashion brands are collaborating with local designers to enter regional ethnic markets and diversify their product portfolios.

- E-commerce platforms and digital fashion shows are amplifying the visibility and accessibility of ethnic wear for global consumers.

What are the latest trends in the ethnic wear market?

Fusion and Contemporary Ethnic Wear on the Rise

Fusion, combining ethnic silhouettes with Western styles a leading trend reshaping the ethnic wear market. From Indo-Western gowns to embroidered jackets and ethnic crop tops, designers are experimenting with styles that appeal to global youth. This trend bridges traditional craftsmanship with modern aesthetics, making ethnic wear more versatile for both festive and casual occasions.

Digital-First Retail Expansion

Online retail platforms are becoming central to the ethnic wear industry. Virtual try-ons, AI-driven size recommendations, and influencer-led marketing are fueling growth. E-commerce giants and niche ethnic wear startups are leveraging global shipping and social media reach to connect with diaspora consumers worldwide. Brands are increasingly hosting digital runway shows and virtual festivals to enhance consumer engagement.

What are the key drivers in the ethnic wear market?

Rising Global Cultural Exchange

The globalization of fashion has elevated ethnic wear to international prominence. Festivals, weddings, and multicultural events have spurred cross-border demand for traditional attire. The diaspora population across North America, Europe, and the Middle East continues to drive exports of ethnic apparel, especially from South Asia. Increased tourism and cross-cultural exposure are further amplifying interest in traditional designs and fabrics.

Growing Focus on Sustainable and Artisanal Fashion

Consumers are gravitating toward ethically made, handcrafted clothing that celebrates heritage. This shift supports local artisans, revives traditional weaving and embroidery techniques, and promotes the use of eco-friendly fabrics. Governments and NGOs in India, Bangladesh, and Africa are actively investing in handloom and craft clusters, positioning artisanal ethnic wear as both sustainable and culturally authentic.

What are the restraints for the global market?

High Production Costs and Supply Chain Fragmentation

Ethnic wear often involves labor-intensive craftsmanship, leading to higher production costs. Fragmented supply chains, seasonal demand patterns, and dependency on skilled artisans can result in inconsistent quality and limited scalability. This poses challenges for brands seeking to meet global demand while maintaining authenticity.

Counterfeit and Unorganized Sector Challenges

The presence of unregulated local manufacturers and counterfeit products dilutes brand value and impacts market standardization. In emerging markets, informal production networks dominate ethnic wear sales, limiting revenue transparency and creating pricing disparities that hinder the growth of organized retail players.

What are the key opportunities in the ethnic wear industry?

Luxury Ethnic Fashion Expansion

Growing disposable incomes and fashion consciousness are boosting demand for premium ethnic wear. Designers are launching luxury bridal wear, couture ethnic ensembles, and celebrity-endorsed lines tailored for affluent consumers. International fashion weeks are increasingly featuring ethnic couture, positioning it as a global luxury statement.

Men’s Ethnic and Occasion Wear Boom

Men’s ethnic wear is emerging as a major growth category, with rising interest in sherwanis, kurta sets, and fusion jackets for formal and festive occasions. Global brands are entering this space with contemporary designs, improved fits, and innovative fabrics. This trend is diversifying the market beyond traditional women’s wear dominance.

Product Type Insights

Women’s ethnic wear continues to dominate the global market, encompassing sarees, salwar suits, lehengas, and fusion gowns. This segment benefits from evolving fashion trends, online retail penetration, and a steady stream of designer collections. Its leadership is primarily driven by the cultural significance of women’s ethnic wear, which plays a vital role in ceremonial, festive, and everyday social contexts. Men’s ethnic wear, including kurtas, pathanis, and indo-western suits, is witnessing rising popularity, especially during weddings, religious events, and festival seasons, supported by designer collaborations that modernize traditional styles. Children’s ethnic wear, influenced by family-oriented celebrations and social media trends, is gaining traction as parents increasingly purchase matching outfits for family events, combining comfort with style. Additionally, fusion wear for office and casual settings is expanding rapidly, appealing to consumers seeking versatility between traditional and modern aesthetics.

Application Insights

Wedding and festive wear remain the primary applications of ethnic clothing, capturing the largest market share. High demand during weddings, religious ceremonies, and cultural festivals drives this segment, highlighting the occasional and celebratory nature of ethnic wear. Daily ethnic wear is steadily growing in urban and semi-urban areas, propelled by comfort-oriented designs, breathable fabrics, and sustainable material adoption. Corporate and casual ethnic wear are also emerging, as modernized cuts and professional-appropriate designs encourage wider adoption. Influences from film, television, and social media are further enhancing consumer engagement and awareness, reinforcing ethnic wear’s integration into everyday fashion.

Distribution Channel Insights

Offline retail, including branded boutiques and department stores, remains essential for premium ethnic wear purchases, providing personalized fitting and high-touch customer experiences. However, online retail channels are driving the fastest growth, thanks to convenience, product diversity, and global accessibility. Platforms such as Myntra, Nykaa Fashion, Etsy, and D2C brand websites have expanded reach to international diaspora communities. Social commerce, influencer-led campaigns, and virtual showrooms are creating immersive shopping experiences, helping brands build loyalty while appealing to younger, tech-savvy demographics.

Demographic Insights

The 25–40 age group represents the largest consumer segment for ethnic wear, combining disposable income with a strong inclination toward cultural fashion for social, festive, and corporate occasions. Gen Z is shaping the growth of fusion and gender-fluid ethnic styles, seeking individual expression and versatility. Older consumers remain loyal to traditional attire for ceremonial events, while diaspora populations across North America, Europe, and the Middle East sustain consistent demand for authentic ethnic apparel, contributing significantly to global market growth.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global ethnic wear market, with India, Pakistan, and Bangladesh at the forefront. Growth is strongly driven by cultural significance, as ethnic wear is integral to daily life, religious practices, and ceremonial occasions. High demand during weddings and festivals like Diwali, Eid, and regional harvest celebrations boosts sales annually. The rising middle class, increasing disposable incomes, and thriving local artisan and handloom industries further support market expansion. Additionally, robust export activities and adoption of e-commerce platforms enable regional SMEs and designers to reach global consumers, consolidating Asia-Pacific’s dominant market share.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, is witnessing increasing demand for both traditional and fusion ethnic wear. Drivers include high disposable incomes, luxury fashion adoption, and strong cultural adherence to traditional attire during festivals and family events. African countries are experiencing a revival of indigenous textiles, with contemporary designers elevating local prints and embroidery into fashionable offerings. Expansion of luxury ethnic boutiques and growing online retail penetration in key hubs like Dubai and Doha further fuels market growth, making the region a strategic hotspot for global ethnic wear brands.

North America

North America’s ethnic wear market is primarily driven by its diverse multicultural population. Diaspora communities from South Asia, Africa, and the Middle East create consistent demand for authentic ethnic apparel, especially during cultural celebrations such as Diwali, Eid, and traditional weddings. Online retail channels and e-commerce platforms have made ethnic wear more accessible, while collaborations between local designers and mainstream fashion brands are increasing visibility. Rising interest in sustainable fabrics and artisanal products among consumers further supports market growth, making North America an important expansion region for ethnic wear companies.

Europe

Europe is emerging as a growing hub for ethnic wear, supported by niche fashion trends and an increasing focus on cultural and sustainable fashion. Countries like the U.K. and France host significant immigrant populations, while fashion-forward consumers seek ethnic-inspired clothing for festivals, cultural events, and heritage months. Drivers include interest in cultural preservation, demand for handcrafted apparel, and the growing integration of ethnic elements into contemporary European fashion. Online retail, designer collaborations, and awareness campaigns are enhancing adoption among younger and middle-aged consumers.

Latin America

Latin America’s ethnic wear market is gradually expanding, particularly in Mexico and Brazil. Growth is driven by collaborations between local artisans and international brands, along with consumer interest in colorful, handmade apparel that reflects indigenous cultural identity. Festivals and family-oriented celebrations also create seasonal demand spikes. While still nascent compared to Asia-Pacific or North America, increasing online retail penetration and social media influence are shaping ethnic wear adoption in the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Ethnic Wear Market

- Manyavar-Mohey

- FabIndia

- Biba Apparels

- Global Desi (House of Anita Dongre)

- Ritu Kumar

- Jaypore

- Soch

- Libas

- W for Woman

Recent Developments

- In August 2025, FabIndia launched its “Sustainable Threads” initiative, promoting handwoven organic cotton and plant-based dyes across global retail outlets.

- In June 2025, Manyavar announced expansion into North American and European markets through new online retail partnerships.

- In March 2025, Biba introduced an AI-powered virtual fitting room on its e-commerce platform to enhance online shopping experiences.