Equestrian Helmets Market Size

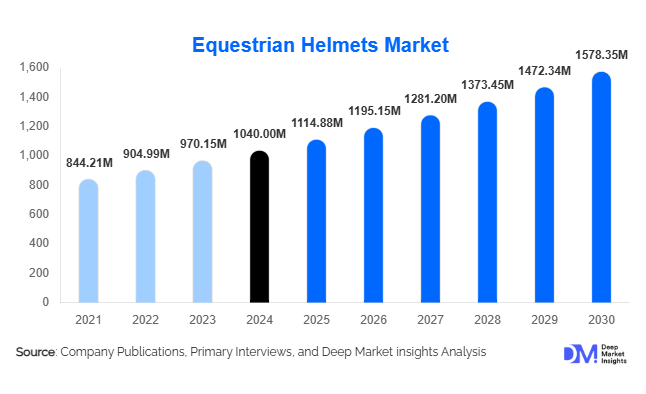

According to Deep Market Insights, the global equestrian helmets market size was valued at USD 1,040 million in 2024 and is projected to grow from USD 1,114.88 million in 2025 to reach USD 1,578.35 million by 2030, expanding at a CAGR of 7.2% during the forecast period (2025–2030). The equestrian helmets market growth is primarily driven by increasing participation in equestrian sports, rising awareness regarding rider safety, and advancements in helmet technology, such as lightweight composites, ergonomic designs, and smart helmet integrations.

Key Market Insights

- Safety-focused helmets dominate the market, reflecting global regulations and rider preference for certified protection in competitions and recreational riding.

- North America and Europe hold the largest shares of the market, with stringent safety standards and mature equestrian sports cultures driving adoption.

- Asia-Pacific is emerging as the fastest-growing region, fueled by rising participation in equestrian sports, increasing disposable incomes, and growing interest in premium and mid-range helmets.

- Online retail channels are rapidly expanding, enabling riders in regions with limited offline presence to access high-quality global brands.

- Technological adoption, including smart helmets with sensors, GPS tracking, and fall detection, is reshaping consumer expectations and driving product differentiation.

- Sustainability trends, such as eco-friendly materials and recycled composites, are influencing purchasing decisions among environmentally conscious riders.

Latest Market Trends

Smart and Connected Helmets

Emerging technologies are being integrated into equestrian helmets, including fall detection sensors, heart-rate monitors, and GPS tracking. These features not only enhance rider safety but also appeal to tech-savvy users and professional competitors. Smart helmets can provide insurers with actionable data, potentially reducing premiums and incentivizing adoption. Manufacturers are increasingly investing in research and development to introduce connected helmets that combine safety, performance, and comfort. This trend is particularly strong in North America and Europe, where early adoption of wearable tech is high.

Growth of Premium and Lightweight Materials

Premium materials such as carbon fiber and advanced composites are gaining popularity among professional and competitive riders. These materials offer high-impact resistance while remaining lightweight, enhancing comfort during long rides. Mid-range fiberglass and polycarbonate helmets continue to dominate recreational segments, balancing affordability with safety certification. Manufacturers are innovating with ventilation, ergonomic fit, and aesthetic customization, catering to both performance and style preferences.

Equestrian Helmets Market Drivers

Rising Awareness of Rider Safety

Global campaigns and regulatory requirements for helmet use in competitions and recreational riding are driving adoption. Awareness about the risk of traumatic brain injuries and the importance of certified helmets is increasing among riders across age groups, particularly in Europe and North America. Insurance policies for equestrian activities often mandate certified helmets, further boosting market demand.

Growth of Competitive and Recreational Equestrian Sports

Participation in competitive equestrian sports such as dressage, show jumping, and eventing has increased globally. Recreational riding is also expanding in emerging regions, such as the Asia-Pacific and Latin America. This dual growth in both professional and leisure segments directly fuels the demand for certified safety helmets.

Technological Innovations and Product Differentiation

Innovations in helmet materials, smart connectivity, and ergonomics are encouraging riders to upgrade their equipment. Helmets with improved ventilation, impact absorption, and customizable designs are becoming industry standards. Riders increasingly prefer high-quality products that combine safety with comfort, driving market expansion and premium product adoption.

Market Restraints

High Cost of Premium Helmets

The cost of carbon fiber and composite helmets can limit adoption among recreational riders in emerging markets. While professional riders and affluent consumers are willing to invest in premium products, the high price point remains a barrier for broader market penetration.

Limited Awareness in Certain Regions

In parts of Asia, Africa, and Latin America, awareness regarding helmet safety is still limited. Many recreational riders continue to use non-certified helmets, which restrains market growth. Education and safety campaigns are required to improve adoption in these regions.

Equestrian Helmets Market Opportunities

Expansion into Emerging Markets

Emerging economies in Asia-Pacific and Latin America offer significant growth potential due to increasing equestrian club memberships, riding schools, and disposable income. Targeting mid-range helmets for recreational riders and training centers can unlock untapped demand. Countries such as China, India, and Brazil are poised for double-digit CAGR growth, making them strategic markets for both existing and new entrants.

Integration of Smart Technology

Smart helmets equipped with sensors for fall detection, GPS, and biometric monitoring present a new avenue for product differentiation. These helmets appeal to professional riders, training institutions, and tech-savvy younger audiences. Manufacturers integrating connected technology can establish a competitive edge, enhance safety, and drive premium adoption.

Regulatory and Certification Compliance

Increasing government and international federation mandates for certified helmets create a growing market for high-quality products. Helmets that meet ASTM, SEI, or EN standards are preferred globally, allowing manufacturers to command higher prices while ensuring rider safety. Educational campaigns highlighting the benefits of certified helmets can further accelerate market penetration.

Product Type Insights

Safety helmets dominate the market, representing 45% of global demand in 2024, due to mandatory regulations in competitions and high consumer preference for certified protection. Recreational helmets account for a significant portion of mid-range demand, while professional/competition helmets capture the premium segment. Trends indicate a steady shift toward lightweight, technologically enhanced, and customizable helmets in the professional category.

Application Insights

Competitive equestrian sports remain the primary application, accounting for 40% of demand, while recreational riding contributes 35%. Riding schools and training centers are the fastest-growing applications, particularly in emerging markets. The market is also witnessing demand from hobbyist riders, equestrian tourism programs, and equine therapy institutions, indicating potential diversification of end-use segments.

Distribution Channel Insights

Online retail platforms are rapidly expanding, capturing 30% of sales, due to ease of access, brand variety, and global reach. Offline retail, including specialty equestrian stores and sports equipment supermarkets, remains important for consumers seeking physical trials and personalized fitting. Manufacturers are increasingly leveraging e-commerce, D2C channels, and social media campaigns to reach a wider audience and educate consumers on helmet safety.

| By Product Type | By Material | By Rider Age | By Distribution Channel | By Price Range |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for 35% of the global market, with the U.S. leading demand due to a mature equestrian culture and strict safety standards. High disposable incomes and widespread awareness of rider safety support consistent adoption. Canada also contributes significantly, particularly in competitive sports and recreational riding.

Europe

Europe holds 30% of the market, with the U.K. and Germany as major contributors. Strict regulations, cultural affinity for equestrian sports, and preference for certified helmets drive demand. The fastest growth is observed in countries like Italy and Spain, where recreational riding is gaining popularity.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China, India, Japan, and Australia. Rising participation in equestrian clubs, higher disposable incomes, and increased adoption of mid-range and premium helmets are key drivers. China and India show double-digit growth potential due to emerging sports infrastructure and lifestyle adoption.

Latin America

Brazil, Argentina, and Mexico are leading markets, with increasing equestrian tourism and riding school establishments driving demand. While overall market share remains small, growth is steady among affluent consumers.

Middle East & Africa

Key markets include the UAE, South Africa, and Saudi Arabia. The Middle East is seeing growth driven by high-income riders, luxury preferences, and air connectivity with Europe. Africa contributes mainly through domestic competitions and recreational riding, supported by rising awareness of helmet safety.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Equestrian Helmets Market

- Charles Owen

- GPA Helmets

- KEP Italia

- Samshield

- Uvex Sports

- Troxel

- One K

- IRH Helmets

- HORZE

- Back on Track

- Harry Hall

- Riders Trend

- JK Equine

- Tipperary

- Wintec

Recent Developments

- In May 2025, GPA Helmets launched a new line of smart helmets with integrated fall detection and GPS tracking for professional riders.

- In April 2025, Charles Owen introduced a premium carbon fiber helmet series targeting competitive equestrian sports in Europe and North America.

- In February 2025, KEP Italia expanded its distribution network in the Asia-Pacific region, focusing on mid-range certified helmets for recreational riders.