Energy Bar Market Size

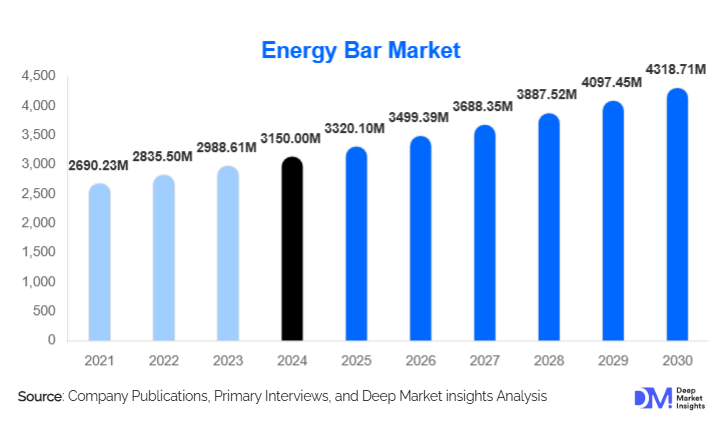

According to Deep Market Insights, the global energy bar market size was valued at USD 3,150 million in 2024 and is projected to grow from USD 3,320.1 million in 2025 to reach USD 4,318.71 million by 2030, expanding at a CAGR of 5.4% during the forecast period (2025–2030). The energy bar market growth is primarily driven by rising demand for convenient on-the-go nutrition, increasing health and fitness consciousness worldwide, and the rapid proliferation of plant-based and clean-label functional snack products.

Key Market Insights

- Conventional, non-organic energy bars dominate the market, accounting for nearly 75–80% of global revenue due to their accessibility, affordability, and widespread retail distribution.

- Protein bars remain the largest product category, representing approximately 40–45% of total market share in 2024, driven by strong adoption in sports and fitness communities.

- Plant-based energy bars lead ingredient-type demand, supported by growing consumer preference for vegan, clean-label, and allergen-friendly nutrition products.

- North America is the largest regional market, with robust retail penetration and a mature sports nutrition ecosystem.

- Asia-Pacific is the fastest-growing region, powered by rising disposable incomes, expanding gym culture, and rapid e-commerce adoption across India, China, and Southeast Asia.

- E-commerce and D2C models are transforming consumer access, enabling niche and premium brands to scale globally with personalized and subscription-based offerings.

What are the latest trends in the energy bar market?

Clean-Label and Functional Nutrition Bars Surge in Popularity

Energy bar manufacturers are increasingly formulating products with natural, organic, and minimally processed ingredients to meet rising consumer expectations for transparency and health optimization. Bars featuring functional additives, such as probiotics, adaptogens, nootropics, and superfoods, are gaining traction among wellness-driven consumers seeking both energy and targeted health benefits. This shift toward ingredient integrity is reshaping product innovation, with brands emphasizing non-GMO, gluten-free, vegan, and low-sugar claims to differentiate in crowded markets.

Plant-Based and Protein-Forward Bars Lead Innovation

As global demand for plant-based alternatives increases, manufacturers are expanding product lines utilizing pea protein, soy protein, nuts, and seeds as primary protein sources. These plant-forward formulations appeal to athletes, vegans, and eco-conscious consumers seeking sustainable protein options. Simultaneously, high-protein recovery bars remain a core trend, supported by the global rise of fitness centers, home workouts, and sports nutrition culture. Innovations include balanced macronutrient profiles, enhanced digestibility, and advanced protein blends tailored for endurance and post-training recovery.

What are the key drivers in the energy bar market?

Increasing Health and Fitness Consciousness

Growing awareness around nutrition, active lifestyles, and weight management is fueling global demand for energy bars as convenient, nutrient-dense snack alternatives. Rising rates of obesity and chronic lifestyle-related conditions are encouraging consumers to choose healthier snacks with balanced macros and functional benefits. Gyms, fitness apps, and sports nutrition influencers are amplifying the adoption of energy bars as part of daily nutrition routines.

Shift Toward On-the-Go and Convenient Nutrition

Urbanization and fast-paced lifestyles are driving demand for portable, ready-to-eat snack options. Energy bars offer a lightweight, shelf-stable, and quick source of fuel for students, working professionals, athletes, and travelers. This convenience factor positions energy bars as a growing substitute for traditional snacks, particularly in markets with increasing digital and office-based work cultures. Expansion of single-serve packaging and multipack formats further supports market adoption.

What are the restraints for the global market?

High Raw Material Costs and Ingredient Volatility

The cost of key inputs, such as nuts, plant proteins, whey protein, dried fruits, and specialty functional additives, can fluctuate significantly due to supply-chain disruptions, climate impacts, and global trade dynamics. These fluctuations increase production expenses for manufacturers and contribute to higher retail prices for consumers. Such cost pressures are especially challenging for small and mid-sized brands competing against large FMCG companies with stronger procurement capabilities.

Regulatory Scrutiny and Labeling Challenges

Energy bars often make performance, health, or nutritional claims, subjecting them to strict regional regulations on labeling, sugar content, additives, and nutrient thresholds. Compliance requirements, including testing, certification, and reformulation, can raise operational costs and delay product launches. Additionally, misleading claims or high sugar levels can negatively affect consumer trust and limit adoption in markets emphasizing clean-label and wellness-focused products.

What are the key opportunities in the energy bar industry?

Expansion into Emerging Markets

Rapid economic growth, rising health awareness, and evolving retail landscapes in India, China, Brazil, and Southeast Asia present significant opportunities for energy bar brands. Localized flavors, smaller pack sizes, and targeted e-commerce marketing strategies can help domestic and international players capture new consumer demographics. Expanding distribution in convenience stores, gyms, and hypermarkets will further deepen penetration in emerging regions.

Sustainable Packaging and Eco-Friendly Formulations

With increasing consumer focus on environmental responsibility, brands investing in recyclable, biodegradable, or compostable packaging have an opportunity to differentiate and gain loyalty. Eco-friendly production processes, regenerative agriculture sourcing, and carbon-neutral operations strengthen brand value. This sustainability shift is also encouraging the use of upcycled ingredients, such as fruit pulps, nut skins, and plant fibers, to reduce waste and promote circular nutrition.

Product Type Insights

Protein bars represent the largest and most influential product category in the market. They target athletes, gym-goers, and consumers seeking high-satiety snacks for muscle repair and sustained energy release. Meal replacement bars appeal to busy professionals and weight-management consumers, offering balanced nutrition in portable formats. Cereal and granola bars remain widely popular for everyday snacking, driven by mass-market affordability and family-friendly positioning. Functional and specialty bars incorporating probiotics, adaptogens, and superfoods are gaining momentum due to increasing demand for targeted health benefits.

Application Insights

Sports and endurance nutrition is the leading application segment, fueled by rising gym memberships, home fitness routines, and athletic performance needs. Weight management and meal replacement applications are growing rapidly, supported by demand for calorie-controlled, high-fiber, and low-sugar formulations. Everyday snacking is emerging as a major growth driver, as consumers shift toward healthier snack alternatives during work, travel, and study. Functional wellness applications, including cognitive support, immunity, and digestive health, represent an expanding niche powered by functional ingredient innovation.

Distribution Channel Insights

Supermarkets and hypermarkets account for the largest share of energy bar sales due to high product visibility and impulse purchases. Online platforms, including direct-to-consumer (D2C) websites and e-commerce marketplaces, are the fastest-growing channels, offering personalized nutrition plans, subscription boxes, and bulk packs. Specialty health-food stores and gyms maintain strong demand among fitness-oriented consumers. Convenience stores, airports, and vending machines further enhance market reach, especially for single-serve formats targeting on-the-go consumption.

Consumer Type Insights

Fitness enthusiasts and athletes form the core consumer base, relying on protein and performance bars for energy, recovery, and muscle support. Working professionals and students increasingly adopt energy bars as convenient meal supplements. Families and lifestyle consumers gravitate toward granola and cereal bars for everyday snacking. Health-conscious and wellness-focused individuals are driving growth in functional, plant-based, and organic energy bar segments.

Age Group Insights

Adults aged 25–45 represent the largest consumer segment, driven by active lifestyles, higher disposable incomes, and wellness goals. Young adults aged 18–24 increasingly purchase budget-friendly and plant-based bars influenced by fitness trends and social media. Consumers aged 46–65 show strong interest in low-sugar, high-fiber, and functional bars supporting joint health, immunity, and sustained energy. Seniors aged 65+, though a smaller demographic, prefer soft-textured, nutrient-rich bars designed for digestive ease and balanced nutrition.

| By Nature / Type | By Product Category / Format | By Ingredient / Source | By Distribution Channel | By Application / End Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains the largest regional market, led by the U.S., where energy bars are deeply integrated into sports nutrition, workplace snacking, and meal replacement habits. High demand for protein-rich and functional bars, along with mature retail infrastructure and strong brand presence, continues to support market expansion. Canada contributes significantly through rising interest in organic and clean-label snacks.

Europe

European markets, particularly Germany, the U.K., France, and the Nordics, show strong adoption of vegan, organic, and low-sugar bars. Germany’s conventional energy bar segment holds over 70% share, reflecting its well-established health-food culture. Europe’s regulatory emphasis on nutritional transparency drives innovation toward healthier, clean-label formulations with reduced additives.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with India and China leading in adoption fueled by rising fitness culture, increasing digital retail, and expanding middle-class consumption. E-commerce marketplaces are critical distribution platforms, enabling niche and imported brands to scale rapidly. Japan, Australia, and South Korea represent mature markets with strong preferences for functional, high-protein, and premium bars.

Latin America

Latin America is an emerging market with rising demand in Brazil, Argentina, and Mexico, driven by expanding retail networks and growing health awareness. Demand is strongest for multipacks and mid-range bars, with increasing interest in plant-based and high-fiber formulations.

Middle East & Africa

Urban centers in the Middle East, such as the UAE, Saudi Arabia, and Qatar, are witnessing rising demand for premium energy bars tied to growing fitness participation and high disposable incomes. Africa's market is developing gradually, with South Africa showing the highest demand for sports nutrition and functional snack products.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Energy Bar Market

- Mondelez International, Inc.

- General Mills, Inc.

- Kellanova

- Mars, Incorporated

- Post Holdings, Inc.

- Clif Bar & Company

- Quest Nutrition

- Glanbia plc

- GoMacro LLC

- PROBAR LLC

Recent Developments

- In March 2025, a leading U.S. manufacturer announced the launch of a new line of plant-based protein bars featuring adaptogens for stress reduction and cognitive support.

- In January 2025, several top global brands expanded sustainable packaging initiatives, introducing fully recyclable and biodegradable wrappers across their flagship product lines.

- In October 2024, multiple energy bar brands entered strategic partnerships with e-commerce subscription platforms to launch personalized nutrition kits and direct-to-consumer bundles.